Shares of Beyond Meat, Inc. (NASDAQ: BYND) were down over 3% on Friday. The stock has dropped 27% year-to-date. The plant-based meat company delivered disappointing results once again in the second quarter of 2025 with a double-digit decline in revenue and continued losses. BYND believes its challenges are transient and can be overcome by the steps it is taking but in the current scenario, this may not be easy.

Revenue declines and continued losses

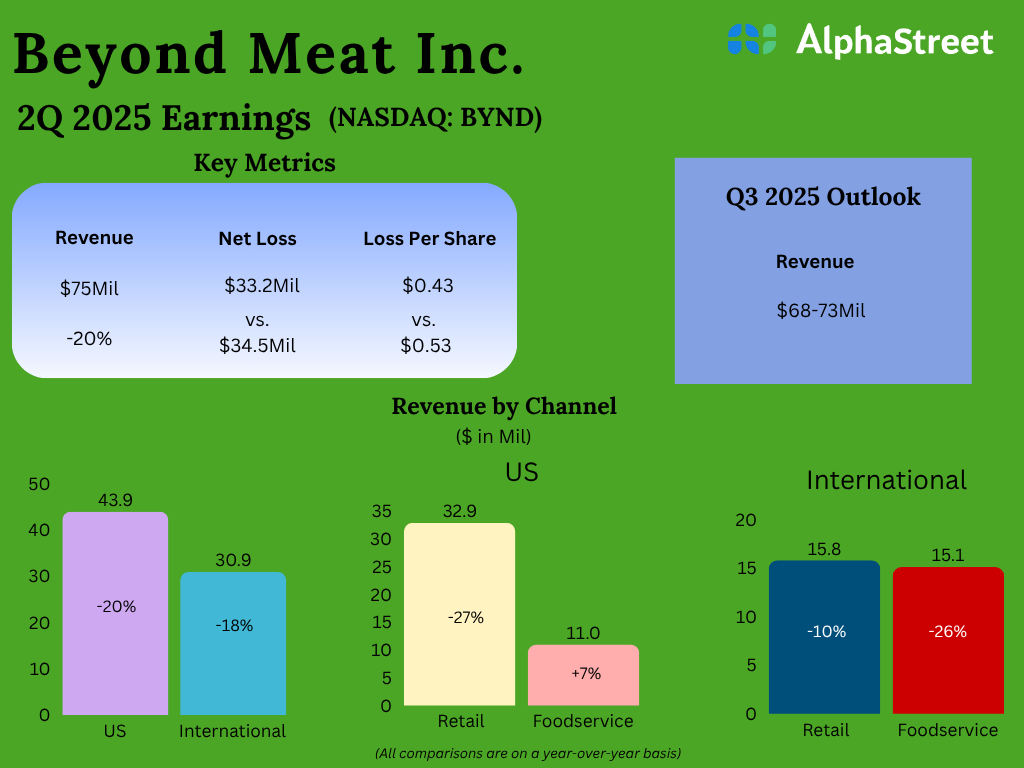

In the second quarter of 2025, Beyond Meat’s revenues decreased 20% from the year-ago period to $75 million. This was mainly caused by a 19% drop in volumes, driven largely by weak category demand.

Beyond Meat’s products are costly and this does not work in its favor in a difficult economic environment. In addition, there continues to be more demand for animal meats due to the comparatively lower cost as well as perceived health benefits.

The company’s profitability remains pressured. In Q2, it delivered a net loss of $0.43 per share, although this was narrower than the loss of $0.53 per share reported in the previous year. Gross margin was 11.5%, down from 14.7% last year, hurt mainly by higher cost of goods sold per pound.

Weak business performance

In Q2, Beyond Meat saw revenues and volumes decline across all its channels, with the exception of US foodservice. The highest declines were in the US retail and international foodservice channels, both of which saw double-digit decreases in revenues and volumes.

Volumes in the US retail channel fell 24%, due to weak category demand and the relocation of plant-based meat products to the frozen aisle from the refrigerated aisle by many retailers. International foodservice channel volumes decreased 22%, due to lower sales of burger products caused by pauses and discontinuation in certain markets. The company expects the headwinds in its international foodservice channel to continue for the foreseeable future.

In the international retail channel, volumes were down 13%, due to lower sales of the company’s products in Canada and the EU. Volumes in the US foodservice channel were up 2%, mainly due to higher sales of its ground beef and dinner sausage products.

Bleak outlook

Beyond Meat did not provide guidance for the full year of 2025 as it continues to face high volatility and uncertainty in its operating environment. As such, the company only provided an outlook for the third quarter of 2025, where it expects net revenues to range between $68-73 million. This outlook implies a decline on both a sequential and YoY basis. The Q3 guidance reflects continued demand softness for plant-based meats and anticipated impacts from recent distribution losses at certain QSR customers.

Countermeasures

Beyond Meat is taking several steps to transform its business. These include intensifying its expense reduction and as part of these efforts, the company is reducing its workforce by 6%. It is also working on expanding gross margins through the optimization of its portfolio by exiting and reshaping product lines, making additional investments in facilities, and reducing supply chain costs. BYND is also working on expanding the distribution of its core products and expects to bring on new US retail distribution.

In light of these continued challenges, it remains to be seen how long it will take for these measures to take effect and whether they will yield the benefits the company anticipates.