Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) stayed green on Friday. The stock has gained 15% in the past three months. The gaming company is slated to report its earnings results for the second quarter of 2026 on Thursday, November 6, after market close. Here’s a look at what to expect from the earnings report:

Revenue

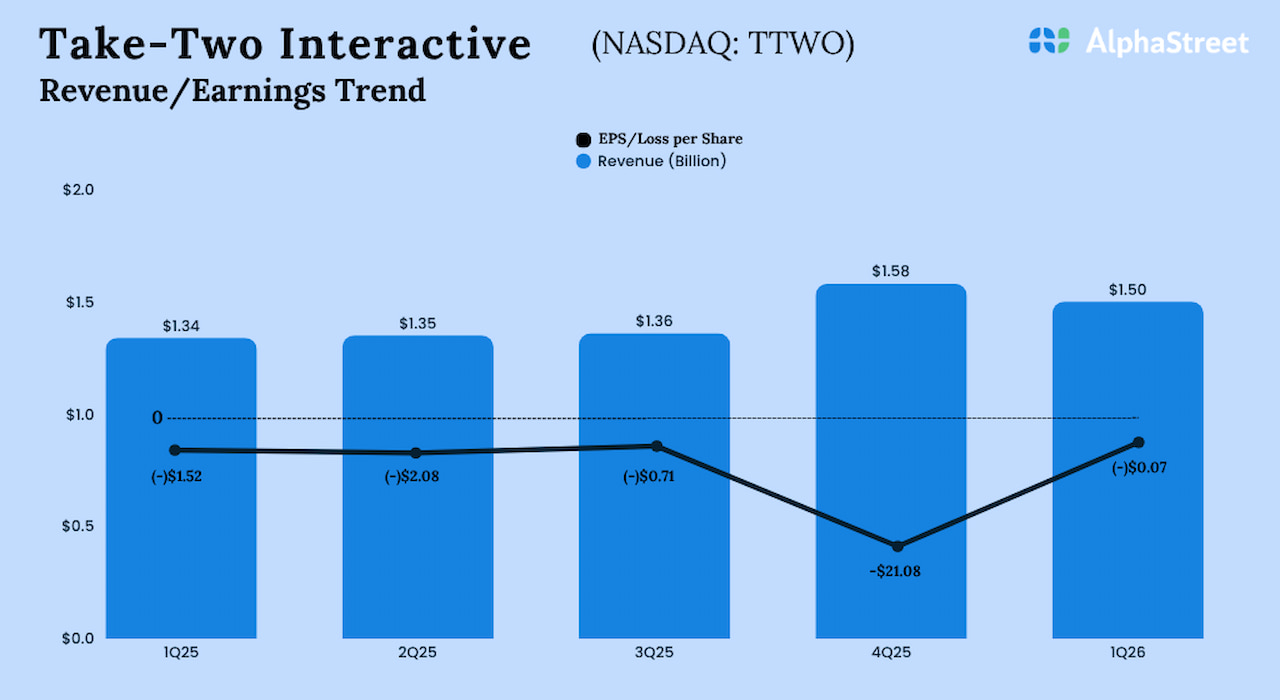

Take-Two has guided for net revenues to range between $1.65-1.70 billion in the second quarter of 2026. This compares to revenues of $1.35 billion reported in the second quarter of 2025. In the first quarter of 2026, net revenues increased 12% year-over-year to $1.50 billion.

The company has guided for net bookings to range between $1.70-1.75 billion in Q2 2026. Analysts’ estimates point to $1.74 billion, which imply an increase of over 17% from the same period a year ago. In Q1 2026, net bookings grew 17% YoY to $1.42 billion.

Earnings

TTWO has guided for net loss per share to range between $0.75-0.60 in Q2 2026. Analysts are estimating a loss of $0.64 per share. This compares to a net loss of $2.08 per share reported in Q2 2025. In Q1 2026, net loss was $0.07 per share.

Points to note

Take-Two is expected to benefit from continued demand for its core franchises and strength in its mobile business. Grand Theft Auto and NBA 2K continue to perform well with growth in engagement and recurrent consumer spending. In Q1, new player accounts for GTA Online grew over 50% YoY. NBA 2K25 has seen significant growth in engagement and recurrent consumer spending. The company is also seeing healthy engagement with its other sports titles such as WWE 2K25.

The second quarter saw the release of Mafia: The Old Country, NBA 2K26, and Borderlands 4. TTWO expects the largest contributions to net bookings in the quarter to come from NBA 2K, Borderlands 4, the Grand Theft Auto series, Toon Blast, Match Factory, Empires & Puzzles, Color Block Jam, the Red Dead Redemption series, Words With Friends, and Mafia: The Old Country.

The company projects recurrent consumer spending to increase by approx. 1% in Q2, assuming a low single-digit increase for NBA 2K, a slight growth in mobile, and a decline for Grand Theft Auto Online. Last quarter, recurrent consumer spending increased 14%.

Take-Two expects operating expenses to range between $1.02-1.03 billion for Q2 2026. The company expects Opex to increase by around 7% YoY, mainly due to marketing for its new releases during the period.

The post A few points to note as Take-Two Interactive (TTWO) gears up for Q2 2026 earnings first appeared on AlphaStreet.