Gold prices rise to fresh all time highs, more to come?

The US Dollar’s performance hinges on the severity of upcoming tariff announcements.

Next week’s focus: US tariffs, jobs data, and global central bank decisions.

Week in Review: Stagflation Fears Rise as Markets Await Trump ‘Liberation Day’ Tariffs

Wall Street stocks fell sharply on Friday, with big losses in Amazon (NASDAQ:), Microsoft (NASDAQ:), and other tech giants. This happened after U.S. data raised concerns about slow economic growth and rising inflation, as the Trump administration increased tariffs.

The Impact of Trumps Tariffs on US Stocks

Source: LSEG

In February, U.S. consumer spending grew, but less than expected, while a key measure of prices saw its biggest jump in over a year.

A University of Michigan survey revealed that for the next year hit their highest level in almost 2.5 years in March. They also believe inflation will stay high beyond next year.

This has added to fears that President Trump’s recent wave of tariff announcements since January will raise the cost of imported goods, push inflation higher, and stop the from lowering interest rates.

With Friday’s losses, the is down about 9% from its record high close on February 19. The is down around 14% from its record high close on December 16.

On the FX front, the failed to kick on following a positive start to the week and is on course to finish the week in the red. This saw a bounce for most denominated currency pairs such as and . The question now will be whether ‘liberation day’ will sink or save the US Dollar.

once again has been the major beneficiary from the uncertainty this week. Stagflation fears coupled with tariff uncertainty and geopolitical risk propelled the precious metal to fresh highs. This on the back of rising ETF demand and central bank buying begs the question, how far can the precious metal rise?

prices fell on Friday over concerns that U.S. tariff wars might trigger a global recession. However, prices still rose for the second week in a row as the U.S. increased pressure on OPEC members Venezuela and Iran.

As things stand is on course to finish the week around 1.13% up with technicals hinting at further gains in the week ahead. Of course this could be massively affected by tariff developments next week and one that I will be keeping an eye on.

On the crypto front, selling pressure has returned as market participants continue to de-risk as uncertainties rise. For a full breakdown on the current crypto landscape, please read GameStop (NYSE:) & (BTC/USD): corporate adoption grows, following strategy’s lead

The week ahead: Tariffs, tariffs and more tariffs

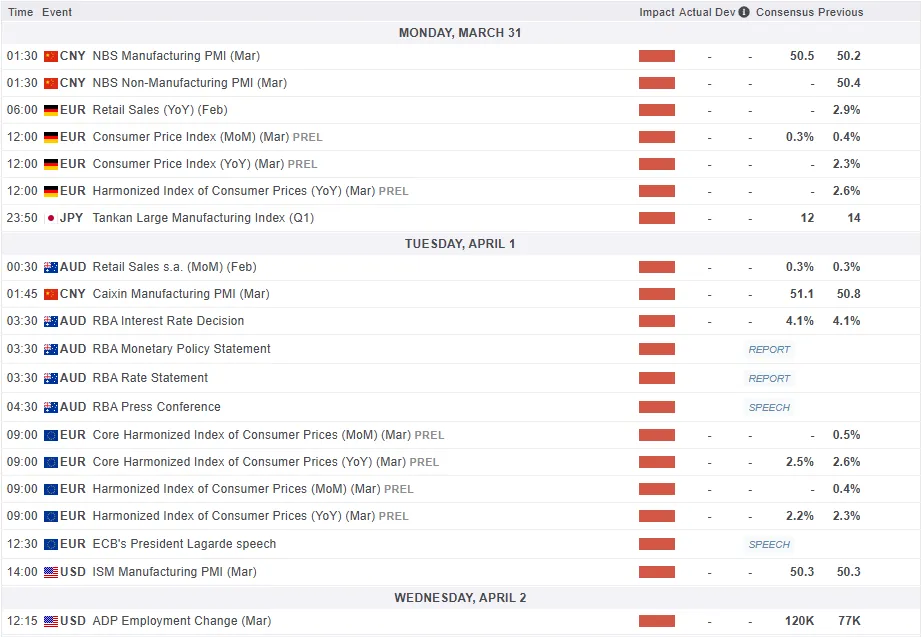

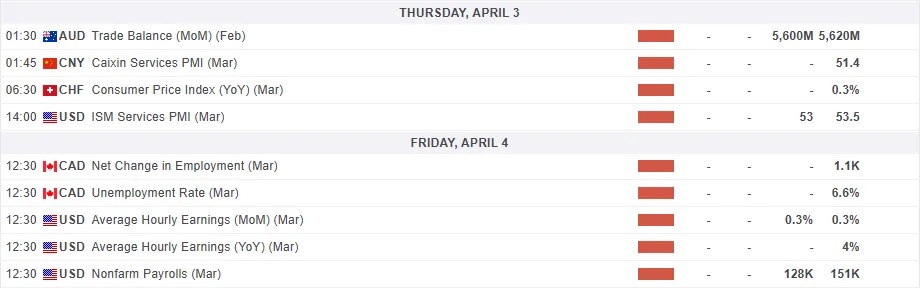

The upcoming week will focus on U.S. President Donald Trump’s plans for new tariffs. Alongside this, markets will also watch U.S. jobs data, an Australian central bank meeting, and a key eurozone inflation report.

Asia Pacific Markets

The main focus this week in the Asia Pacific region will be tariff developments even though we have a slew of data releases.

Next week, in China the focus will be on new tariffs. President Trump’s “Liberation Day” announcement and the U.S. investigation into China’s imports under the Phase One Trade Agreement are key events. The investigation deadline is April 1, with results expected then or shortly after. While China isn’t the main target of new tariffs, the investigation could lead to further actions.

Trump’s TikTok ban moratorium ends on April 5, making next week important for this issue. He has hinted at reducing China tariffs to secure a TikTok deal, something which the Chinese so far do not seem likely to entertain..

On the data side, China’s official PMI (Monday) is expected to rise slightly to 50.4 from 50.2, while the (Wednesday) may dip to 50.6 from 50.8. If correct, this could indicate tougher times for Chinese exporters.

In Japan, industrial production is expected to bounce back, likely due to increased auto production as manufacturers ramped up before new tariffs. However, the Tankan survey for large manufacturers is expected to drop due to tariff concerns, while the non-manufacturing survey may improve thanks to strong wage growth.

High food prices, especially for rice, are weighing on consumer spending. Retail sales and household spending for February are expected to show a decline.

The is expected to keep interest rates unchanged on April 1. Even though February’s inflation was weaker than expected, overall inflation for the first quarter likely rose slightly. High inflation and tariff risks are expected to stop the RBA from making consecutive rate cuts and thus a hold seems the likely outcome.

Europe + UK + US

In developed markets, the US, Europe and UK tariffs will dominate the headlines. As we have seen in recent weeks, tariffs have even overshadowed data releases and this is something which could continue next week.

The upcoming week will be busy. The 25% tariffs on foreign steel and aluminum now include autos, and on April 2nd, “Liberation Day,” more tariffs will be announced on countries accused of “cheating” America. This could mean combined tariffs, like 50% on European autos (25% EU + 25% auto tariff).

These tariffs may raise prices for US consumers, reduce spending power, and hurt corporate profits, fueling fears of stagflation, which could harm jobs and asset prices. Fed Chair Powell speaks Friday, but he’s likely to stay neutral, focusing on future economic data to guide decisions.

I expect ISM business surveys to show negative reactions due to tariff concerns and market drops. The jobs report will be key, as we will get insights and gauge if hiring slowed further amid uncertainty and government layoffs.

In the Euro Area, the main focus will be Eurozone inflation for March which is expected to stay above 2%, with core inflation above 2.5%. Lower energy prices might slightly ease headline inflation, but upcoming inflation reports will draw more attention due to potential tariffs.

The UK catches a breather after a busy week which included the UK budget. A budget which could be described as ‘kicking the can down the road’ with spending set to increase in the short-term.

Chart of the Week – US Dollar Index (DXY)

This week’s focus remains on the US Dollar Index as it looks to developments next week for guidance.

The DXY has pushed above the key resistance level at 104.00 with a weekly candle close and gains early in the week. However, a poor finish to the week on Thursday and Friday saw the index lose around 0.6%, leaving it in the red for the week and hovering at the 104.00 support handle.

The 14-period RSI did not even get to retest the neutral 50 level, declining from around the 47 mark which is a sign of strong bearish momentum still in play.

The next developments for the DXY will hinge on how tariffs shake up next week and how market participants perceive the developments.

If tariffs are less severe than anticipated, the DXY could rally and finally make its way toward the 200-day MA just shy of the 105.00 handle and beyond.

Aggressive tariffs and reciprocal tariffs could ratchet up tensions and weigh on the US Dollar and potentially send the index toward fresh lows below the 103.00 handle.

US Dollar Index (DXY) Daily Chart – March 28, 2025

Source; TradingView

Key Levels to Consider:

Support

Resistance

Original Post