Asian Market Wrap

Asian stock markets dipped after reaching a nearly four-year high on Tuesday, as investors awaited corporate earnings and monitored US tariff talks.

MSCI’s broad Asia-Pacific index (excluding Japan) hit its highest level since October 2021 earlier in the day but later fell by 0.4%. The index has gained almost 16% this year.

Japanese markets reopened after Monday’s holiday, following weekend elections where the ruling coalition lost in the upper house. Despite the setback, Prime Minister Shigeru Ishiba pledged to stay in office.

Japanese stocks briefly rose at the open but turned lower by the afternoon, as the election results were already factored in and not as bad as expected.

The gained 1% on Monday, recovering some recent losses, but slightly weakened on Tuesday to 147.73 per .

European Open

European markets are expected to remain cautious, with attention on earnings from companies like SAP and UniCredit. Futures for the and dropped 0.5%, while fell 0.3%.

As the August 1 tariff deadline approaches, investors are hoping strong earnings from major US and European companies will support the markets. They’ll closely examine quarterly results to see how trade uncertainty has affected profits and consumer demand.

A key focus will be on how much the ’s 9% rise in the April-June quarter has impacted profits in Europe’s export-driven economy. So far this year, the euro has risen 13% as investors moved away from US assets due to President Trump’s unpredictable trade policies.

SAP previously estimated that every 1 cent increase in the euro could reduce its annual revenue by 30 million euros. The euro is now at 1.1688, up from 1.1329 in April.

Earnings from luxury brand LVMH and drugmaker Roche are also in the spotlight this week.

Source: LSEG

Meanwhile, tariffs remain a key issue. The EU is considering measures to counter US trade pressure, such as targeting US services or limiting access to public contracts. President Trump has threatened 30% tariffs on European imports if no deal is reached by August 1.

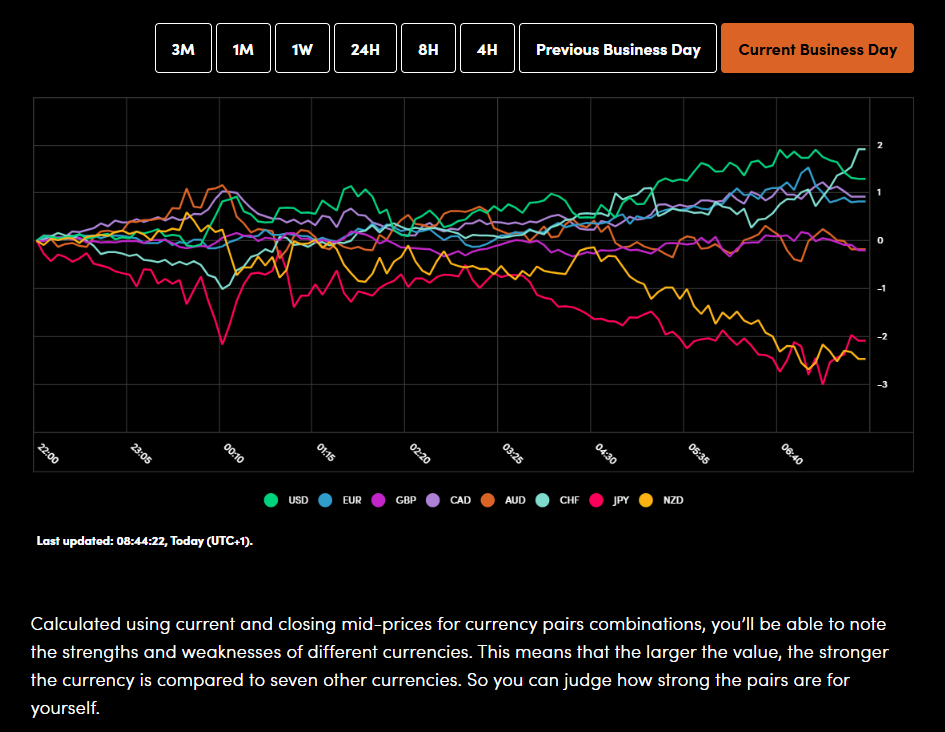

On the FX front, the US dollar stayed mostly unchanged on Tuesday after a small drop earlier in the week. Investors are keeping an eye on trade deal talks ahead of the August 1 deadline, which could lead to high tariffs if no agreements are made.

The dollar held steady after falling on Monday due to a stronger yen and lower US Treasury yields. The dropped slightly to 1.3474, while the euro slipped to 1.1689. Attention is also on the European Central Bank’s upcoming rate decision, where no changes are expected.

The , which measures the dollar against other currencies, rose slightly to 97.882 after a 0.6% drop on Monday.

Currency Power Balance

Source: OANDA Labs

Investors are also concerned about the Federal Reserve’s independence, as President Trump has criticized Fed Chair Jerome Powell and pressured him to .

prices rose yesterday finding resistance back at the $3400/oz handle. Overnight and this morning we are seeing bulls a bit more cautious as trade deal uncertainty rears its ugly head once more, boosting haven appeal.

continue their slide today, testing the 100-day MA. There are a host of factors affecting Oil prices at the moment with a clear direction not presenting itself just yet. For more on oil prices, read WTI Oil Slips as 200-day MA Caps Upside Potential

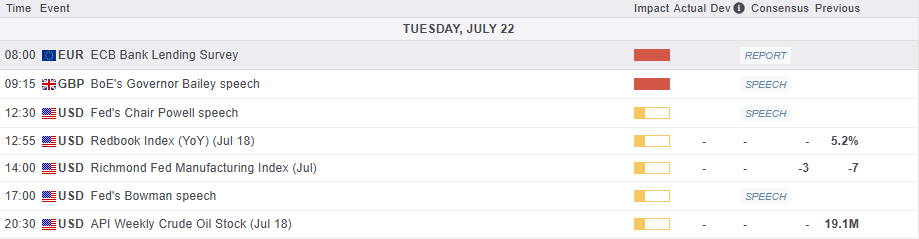

Economic Data Releases and Final Thoughts

Looking at the economic calendar, it is a quiet day in terms of data releases.

Trade negotiations and earnings are set to spend another day dominating the overall market narrative and driving sentiment.

Earnings due today include Coca-Cola (NYSE:), Raytheon (NYSE:), Lockheed Martin (NYSE:) and General Motors (NYSE:).

Later in the day we will get a speech from Fed policymaker Bowman. However, with the Fed having entered its blackout period, its unlikely that he will touch too much on the Feds monetary policy stance.

This will be followed with API weekly crude oil numbers which could stoke some volatility in Oil prices.

MarketPulse Economic Calendar

Chart of the Day – FTSE 100 Index

From a technical standpoint, the is hovering just above the psychological 9000 handle.

There is a possibility of a pullback though just looking at price action and the wicks off the last two days on the daily timeframe.

However, positive earnings developments and trade deal news could propel the FTSE beyond the 9000 handle. The question is whether the index will be able to hold onto any gains above the 9000 handle.

Immediate support rests at 8956 before the 8925 and 8900 handles come into focus.

Immediate resistance rests at 9029 before the 9048 handle which is the all-time high comes into focus.

FTSE 100 Daily Chart, July 22. 2025

Source: TradingView.com

Original Post