The Tanzanian financial sector is evolving rapidly, mirroring broader regional trends highlighted in the GeoPoll Financial Landscape in Africa 2025 report. With the continued growth of digital solutions and increasing smartphone penetration, financial access in Tanzania is expanding beyond traditional banking.

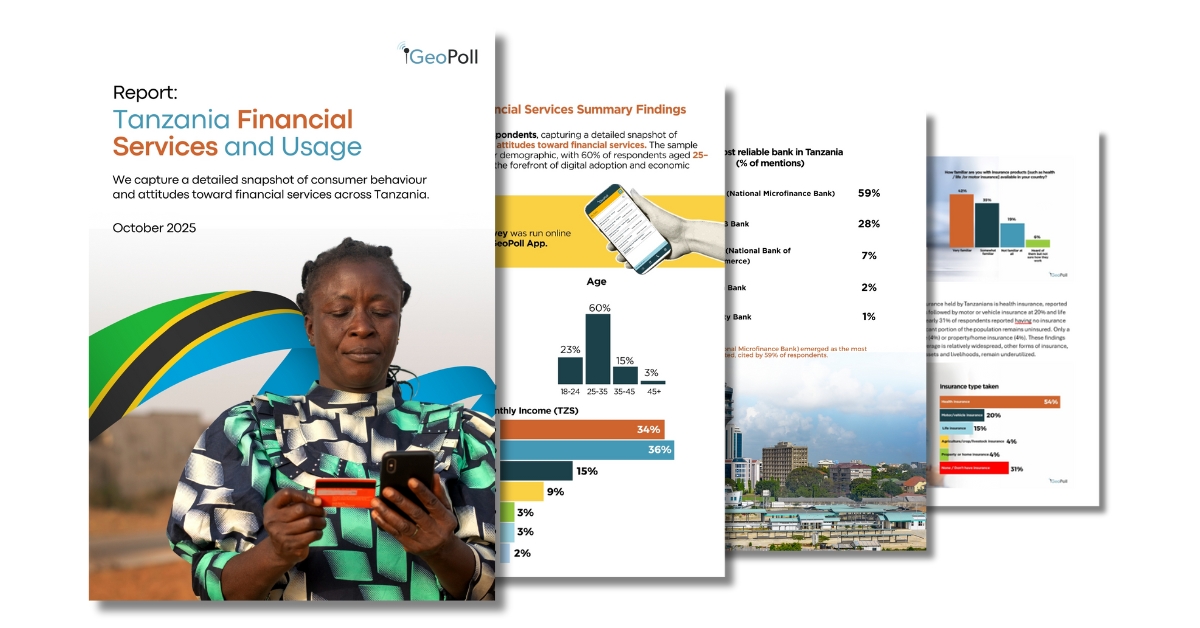

GeoPoll’s latest country-specific study, Tanzania Financial Services and Usage 2025, delves deeper into how consumers are navigating this transformation, from mobile money and banking to insurance, loans, and financial planning, offering an in-depth look at the behaviors and challenges shaping the nation’s financial future.

Expanding Access Through Mobile Money

With 94 percent of Tanzanians using mobile money platforms such as M-Pesa, Tigo Pesa, and Airtel Money, digital finance has become the foundation of financial inclusion. The report reveals that mobile transactions dominate daily financial life, enabling millions to send and receive funds, pay bills, and save, even without formal bank accounts.

Banking and Credit Behavior

While 76 percent of Tanzanians now have a bank account, usage remains infrequent, as most rely on mobile channels for convenience. NMB Bank and CRDB Bank lead in trust and customer preference.Meanwhile, 46 percent of respondents took a loan in the past year, with mobile lending apps emerging as the top credit source, underscoring the shift toward instant, tech-driven borrowing solutions.

Insurance and Financial Confidence

Insurance awareness is growing, but affordability remains a barrier. High premiums (37 percent) and limited understanding keep many uninsured. Still, health insurance leads uptake, showing potential for greater inclusion with better communication and pricing.

Key Takeaway

Tanzanians are eager adopters of digital finance but face persistent hurdles around high fees, network issues, and accessibility. To strengthen inclusion, stakeholders must focus on affordable, customer-centric, and transparent solutions that empower everyday users.

Get the Full Report

These are just a few of the findings from our new report: Tanzania Financial Services and Usage

The comprehensive, 21-page report covers:

Income Sources – Formal employment (43%) and self-employment (28%) are the main income streams, while 13% depend on farming or agriculture.

Mobile Money Usage – Used by 94% of Tanzanians, mainly for sending (78%), receiving (73%), and paying bills (60%). Over 60% use it daily or several times a day.

Banking Trends – 52% have savings accounts; NMB (59%) and CRDB (28%) are the most trusted banks. Mobile apps (41%) are preferred over USSD for digital banking.

Loans and Borrowing – 46% took a loan in the past year; mobile lending apps (27%) and banks (24%) are the top sources. Most borrow for business (26%) or emergencies (24%).

Insurance – 45% have insurance, mainly health (54%). Barriers include high premiums (37%) and limited understanding (23%).

Financial Challenges – High fees (36%) and network downtime (37%) are the main pain points for mobile and fintech users.

Affordability and Life Impact – 71% delayed major life plans due to financial constraints, and 70% switched to cheaper products to cope with rising costs.

At GeoPoll, we offer mobile-first, rapid-turnaround consumer insights via our Tuucho Panel across Africa. Whether you’re testing new concepts, exploring market expansion, or fine-tuning your distribution strategy, our tools help you make smarter, faster decisions. Contact us today to get started.