Kenya’s financial landscape stands as one of the most dynamic in Africa, driven by rapid digitization, high mobile money adoption, and continued efforts toward financial inclusion. The country is globally recognized for the success of M-Pesa, which has transformed the way Kenyans send, receive, and store money since its launch in 2007. Today, mobile money platforms are used by over 90% of adults, enabling seamless payments, savings, and access to credit.

According to the FinAccess Household Survey 2024, 84.8% of Kenyan adults now have access to formal financial services, marking a significant milestone in inclusion. The Central Bank of Kenya’s Financial Sector Stability Report 2024 further notes the rising role of digital lending, with non-bank credit providers and mobile loan apps becoming key sources of short-term finance, though concerns remain over affordability, data privacy, and consumer protection.

This Kenya-focused study forms part of a broader Sub-Saharan Africa Financial Services and Usage Report, which examined evolving financial behaviors across multiple African markets. Powered by TuuCho; GeoPoll conducted the study via GeoPoll’s application and mobile web platform, reaching a total of 2,500 respondents, offering a comprehensive snapshot of how Kenyans access, use, and perceive financial services, from mobile wallets to traditional banking and emerging credit solutions. By situating Kenya’s findings within the regional context, the report highlights both the country’s leadership in digital finance innovation and the ongoing need to balance accessibility with responsible lending and financial literacy.

Demographic Overview

The survey gathered responses from a diverse group of young Kenyans, with most aged between 25 and 34 years (52%). Males accounted for 64% of respondents and females 36%, with a majority living in urban areas (73%) compared to rural areas (27%). In terms of income, most respondents fall within lower to mid-income brackets, reflecting the importance of affordable financial solutions. About 34% earn between KES 10,000 and 35,000 per month, while 31% earn below KES 10,000. A smaller but growing middle-income segment, representing 15%, earns between KES 35,000 and 50,000 monthly.

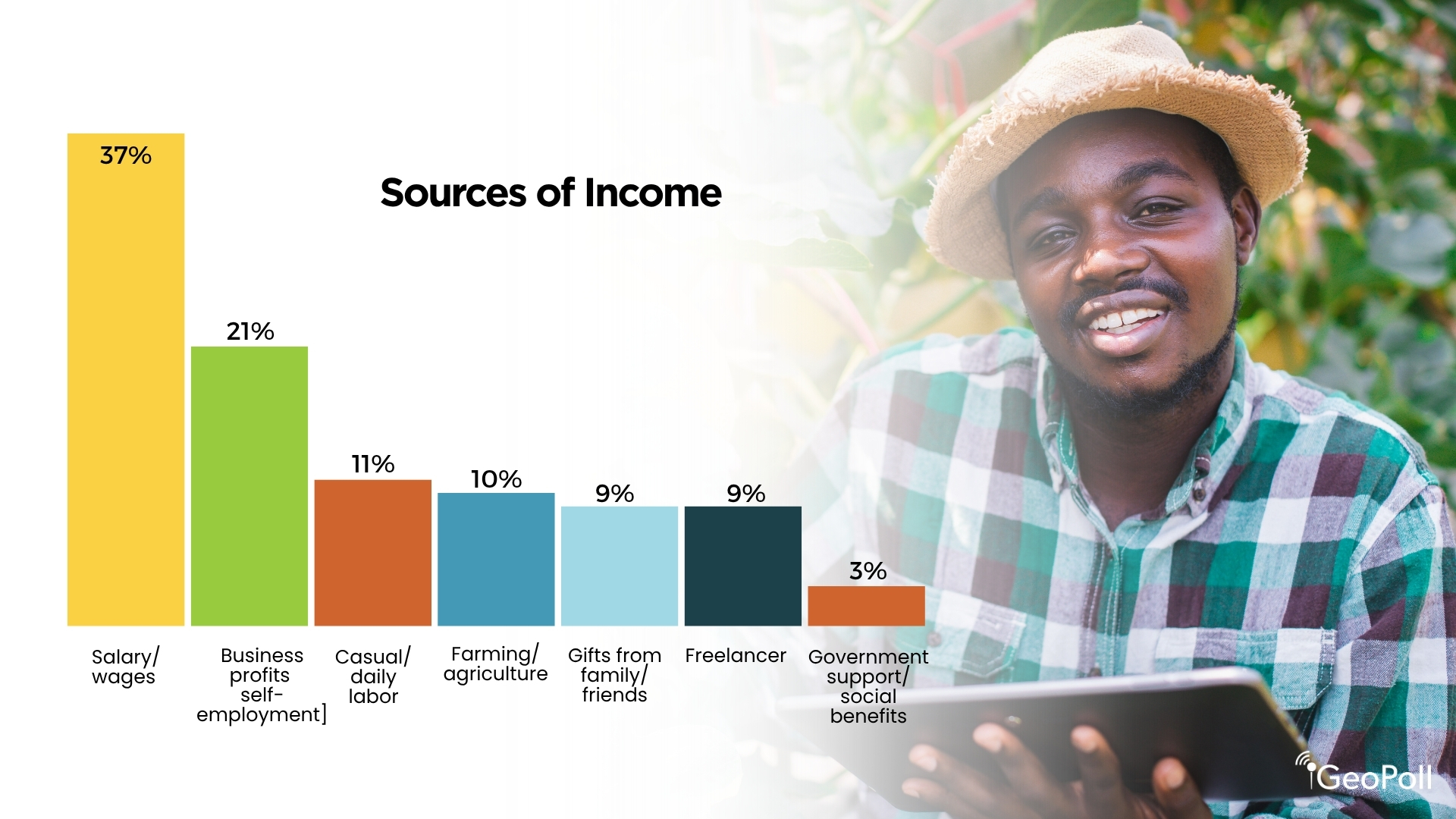

Sources of Income

The data indicates that most Kenyans derive their income from formal employment and small businesses, reflecting a mixed but evolving labor landscape. A significant 37% of respondents earn their primary income through salaries or wages from formal employment, showing the continued importance of structured jobs, particularly in urban centers. The second-largest source of income is business profits or self-employment, reported by 21% of respondents, highlighting Kenya’s strong entrepreneurial culture and the role of micro, small, and medium enterprises in sustaining livelihoods. Casual or daily labor ranks third at 11%, pointing to a sizeable portion of the population engaged in informal or short-term work.

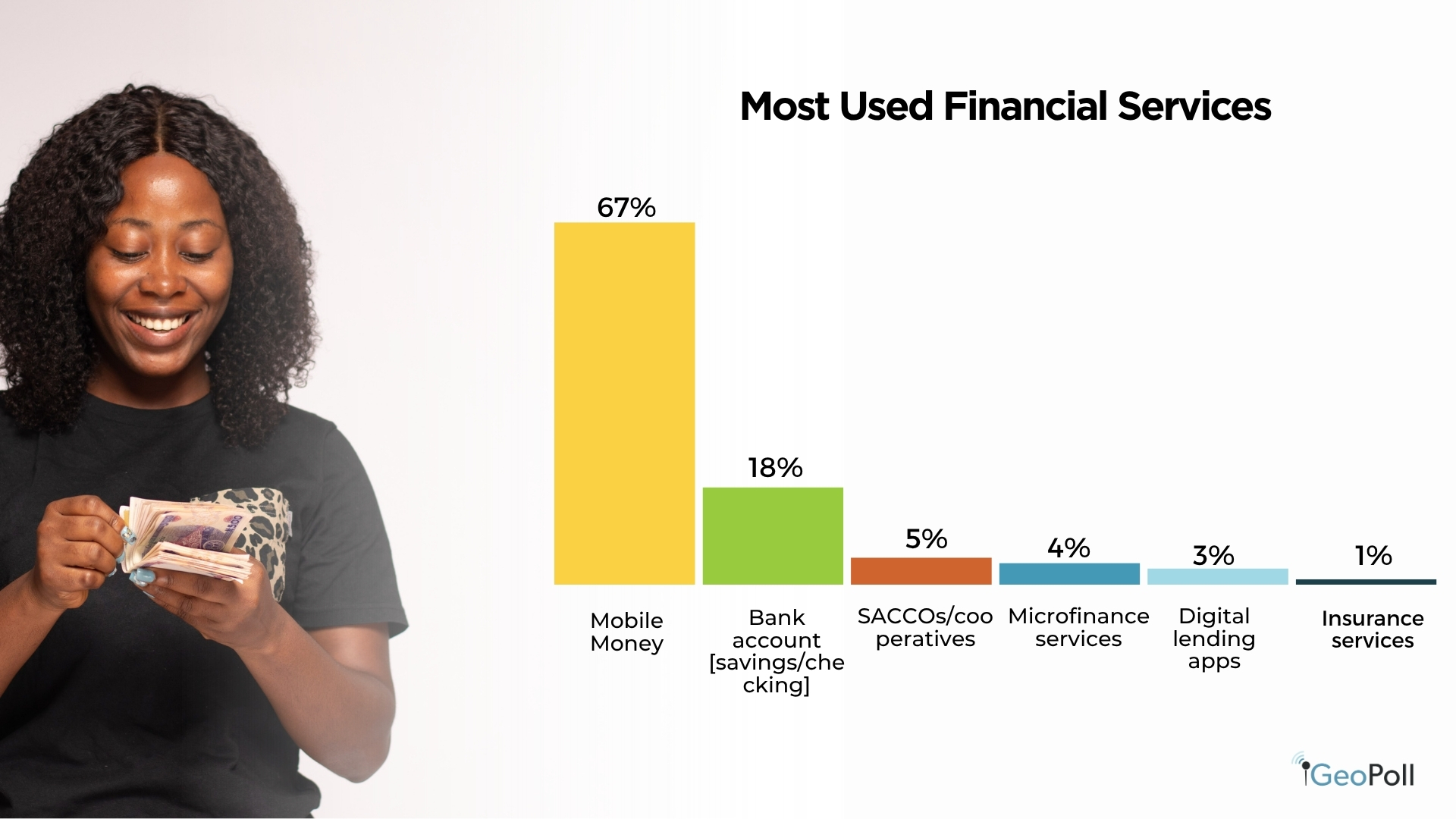

Financial Service Usage in Kenya

The findings reveal that mobile money platforms remain the dominant financial service in Kenya, reflecting their central role in everyday transactions and financial inclusion. About 67% of respondents reported using mobile money services such as M-Pesa, far surpassing all other financial channels. This demonstrates the continued integration of mobile finance into both personal and business activities across the country. The second most used service is bank accounts (including savings and checking), cited by 18% of respondents, showing that while traditional banking remains important, it lags behind mobile-based solutions in accessibility and usage. SACCOs and cooperatives follow distantly at 5%, indicating their niche but trusted role, particularly in rural and community-based financial systems. The comparatively low adoption of microfinance services (4%), digital lending apps (3%), and insurance services (1%) points to opportunities for growth in formal and digital finance beyond payments, especially in credit, savings, and risk protection products.

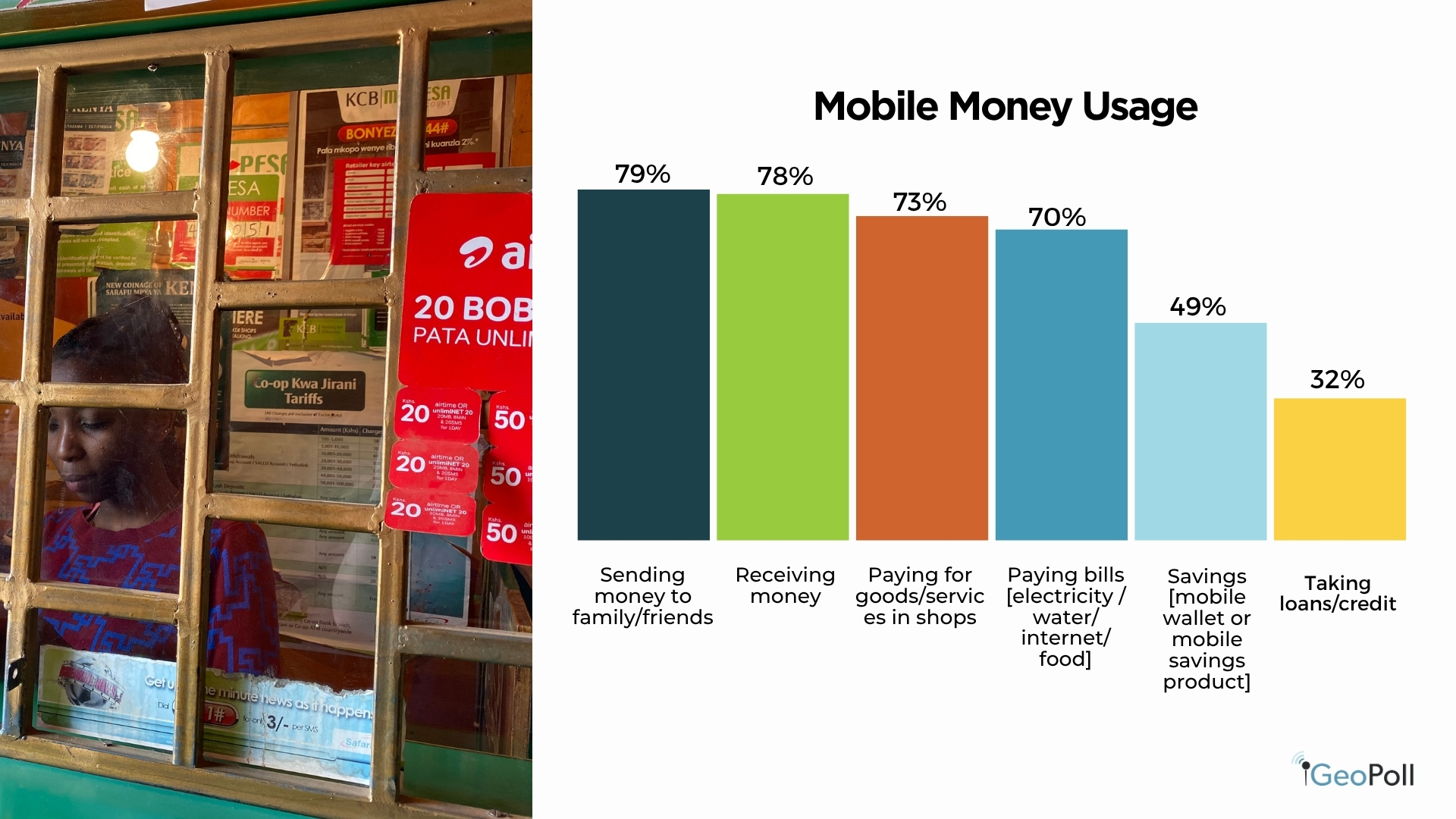

Mobile Money Usage in Kenya

Mobile money continues to define Kenya’s financial landscape, reaching near-universal adoption. According to the survey, an overwhelming 98% of respondents reported using mobile money services such as M-Pesa or Airtel Money, confirming its position as the country’s dominant financial tool. This near-total penetration reflects how mobile wallets have become deeply embedded in daily financial activity, bridging gaps in formal banking access and enabling real-time transactions for millions.

When asked about their main uses of mobile money, Kenyans demonstrated its versatility beyond simple transfers. The majority use it for sending (79%) and receiving money (78%), followed closely by paying for goods and services (73%) and settling bills (70%) such as electricity, water, and internet. Additionally, nearly half (49%) use mobile money for savings, while 32% rely on it for loans or credit, reflecting the expanding role of digital finance in meeting broader financial needs. This shows that mobile money has evolved from a payment platform into a multifunctional ecosystem supporting both transactional and financial management activities.

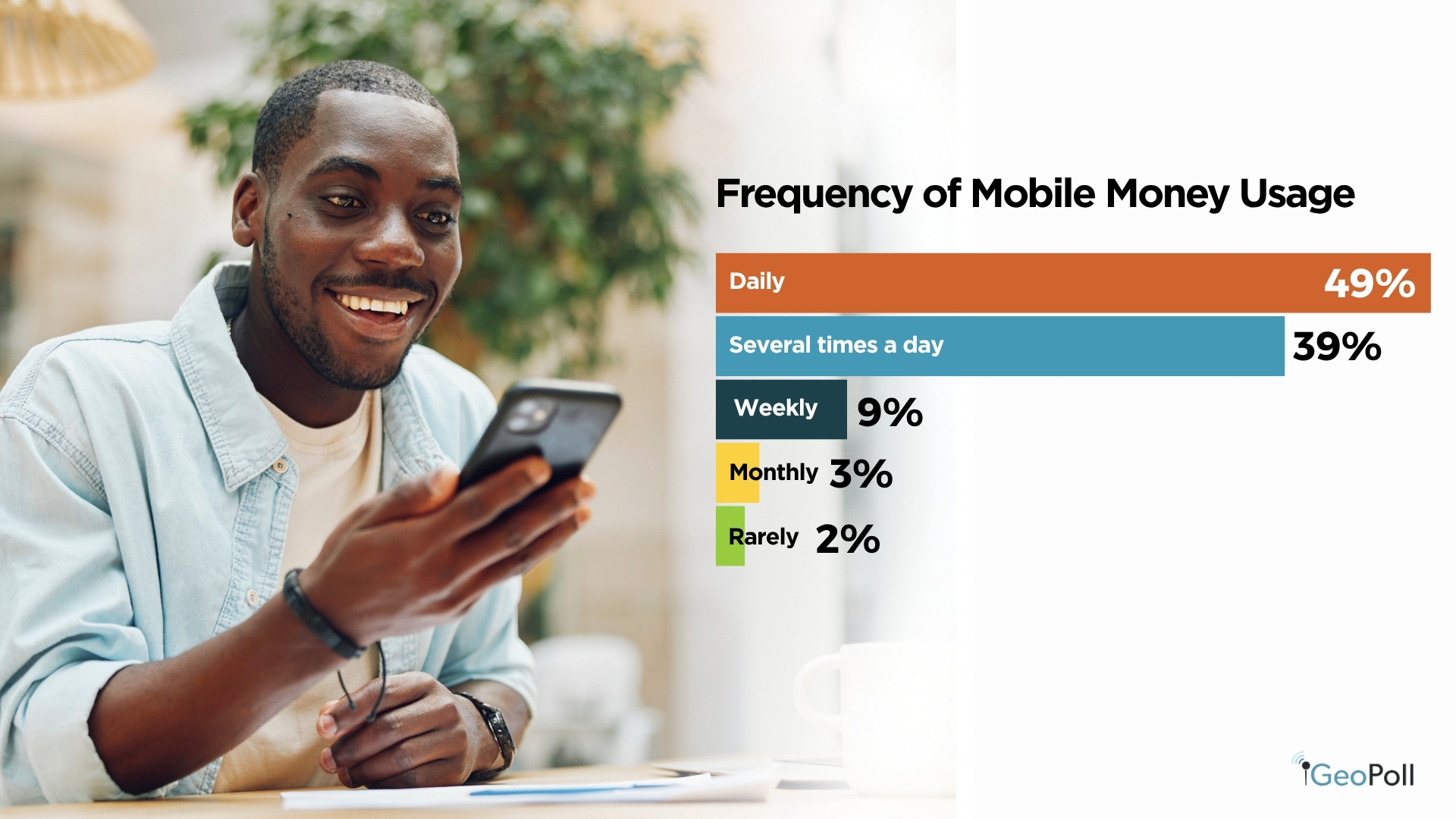

In terms of frequency of use, engagement is remarkably high, 49% of respondents use mobile money daily, while another 39% transact several times a day. Only a small minority use it weekly or less often. These patterns demonstrate how integral mobile money has become to everyday life in Kenya, facilitating everything from routine purchases to income management. The findings highlight a mature and highly active digital finance environment, where convenience, trust, and accessibility drive sustained adoption and frequent usage.

Bank Account Ownership and Usage in Kenya

Banking access in Kenya remains significant, though not as widespread or actively used as mobile money. The findings show that 83% of respondents have a bank account, while 17% do not. Among account holders, 40% maintain a savings account, 23% have a current or checking account, and 21% hold both types. This indicates that most users prioritize savings-based products, aligning with Kenya’s growing culture of financial prudence and long-term planning. However, the relatively high share of individuals without bank accounts highlights the continued importance of alternative financial systems such as mobile money and SACCOs.

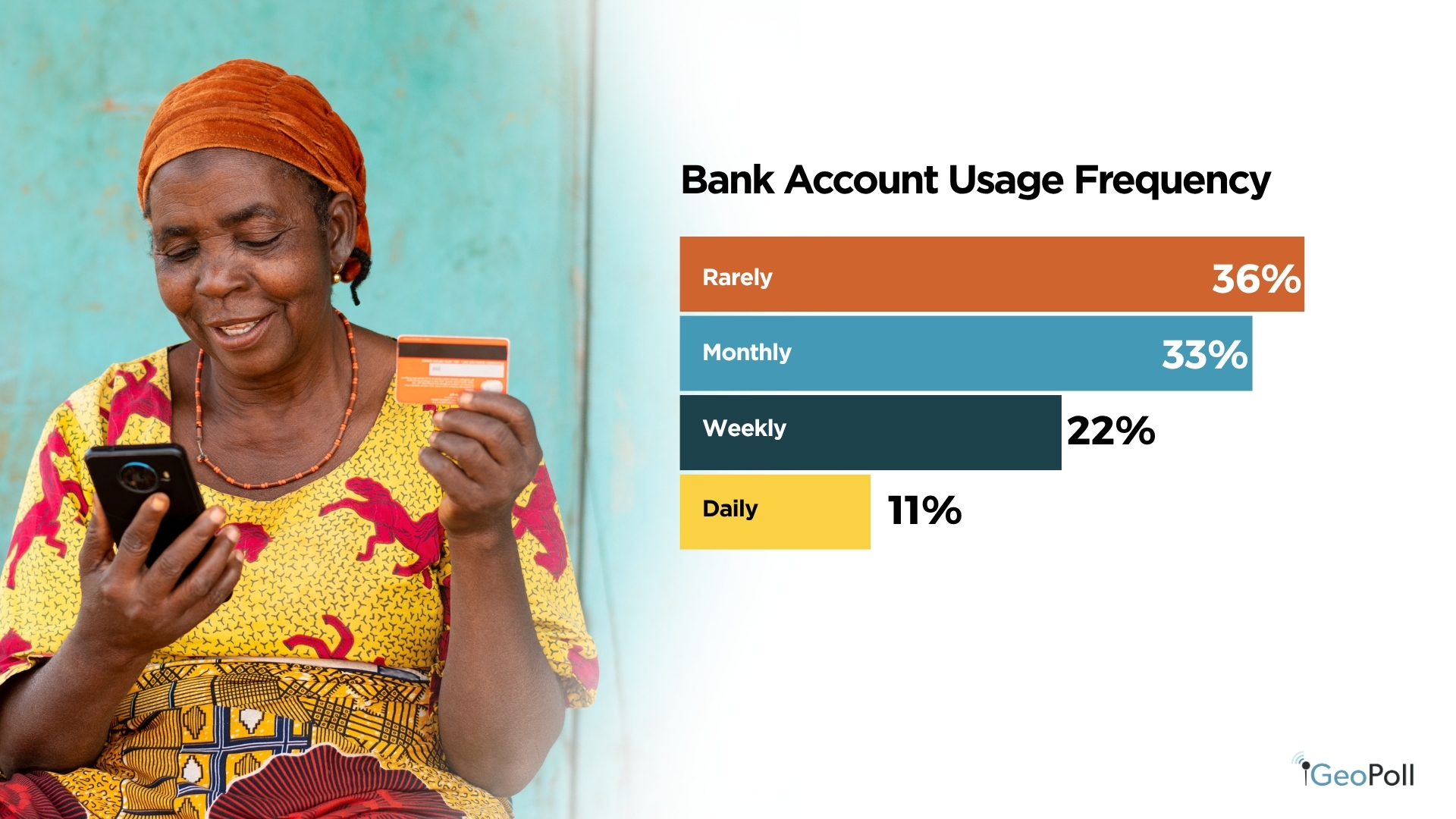

In terms of frequency of bank use, activity levels are moderate to low. About 36% of respondents use their bank accounts rarely, while another 33% engage with them monthly. Only 22% access their accounts weekly, and 11% use them daily. This suggests that while many Kenyans maintain formal banking relationships, everyday transactions are far more likely to occur through mobile platforms, which offer greater convenience and accessibility for routine financial needs.

When asked about their main reasons for using bank accounts, respondents cited receiving income (35%) and saving money (35%) as the top purposes. Smaller proportions reported using banks to pay bills or school fees (8%), conduct business transactions (6%), or access credit or loans (4%). These findings show that banks remain trusted for secure deposits and salary handling, but are less integrated into the daily financial activities that mobile money now dominates. The data points to a hybrid financial environment where formal banking serves as a foundation for savings and income management, while digital tools drive everyday financial interactions.

Top Banks (% of Mentions)

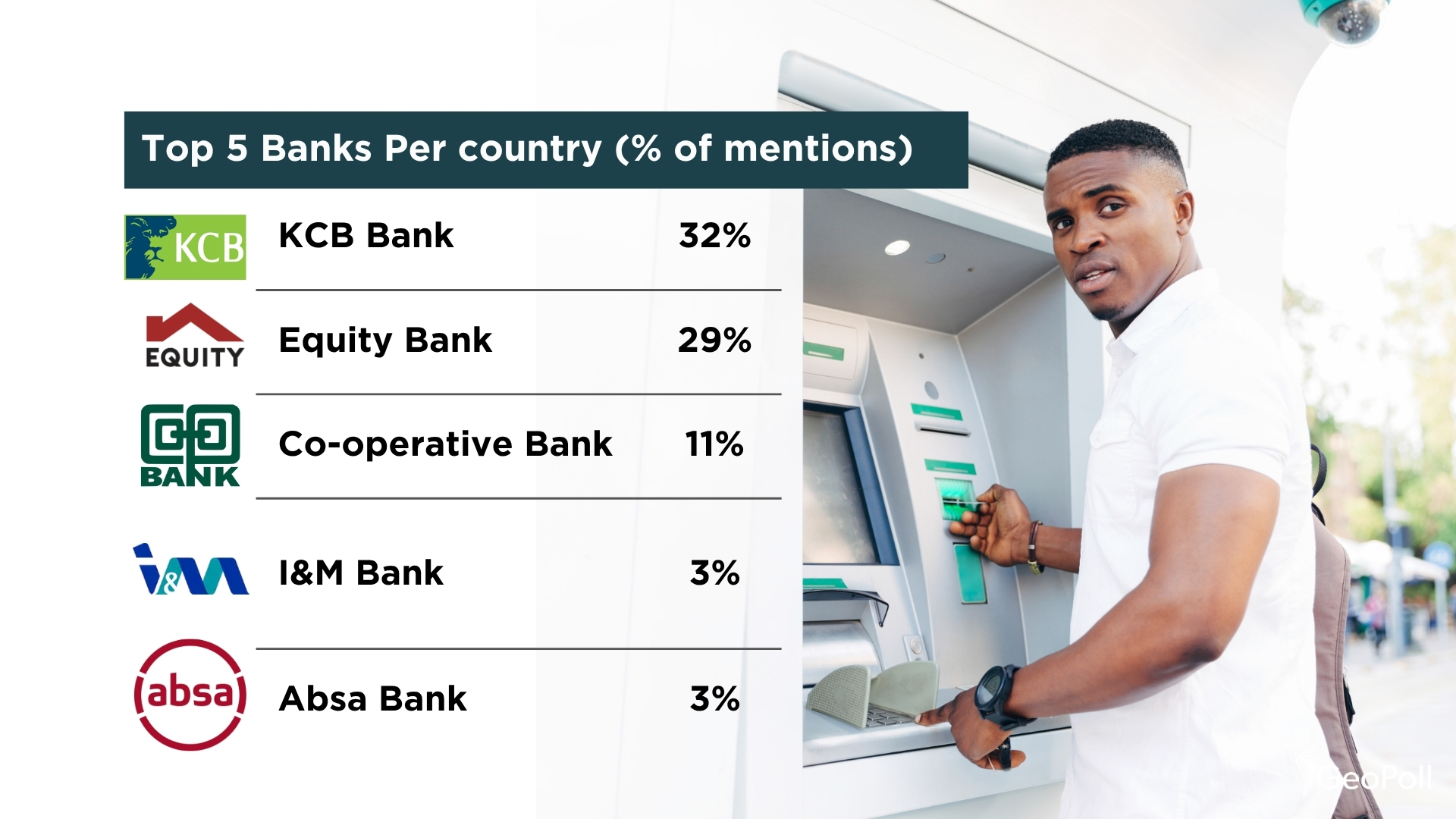

Among the respondents, the top five preferred banks in Kenya are KCB Bank (32%), Equity Bank (29%), Co-operative Bank (11%), I&M Bank (3%), and Absa Bank (3%). The results show a strong preference for Kenyan-owned institutions, with KCB, Equity, and Co-operative Bank collectively commanding over 70% of respondents. Their dominance highlights the strength of homegrown banks that have built extensive networks and deep community trust, while I&M and Absa represent smaller but established players within the country’s diversified banking sector.

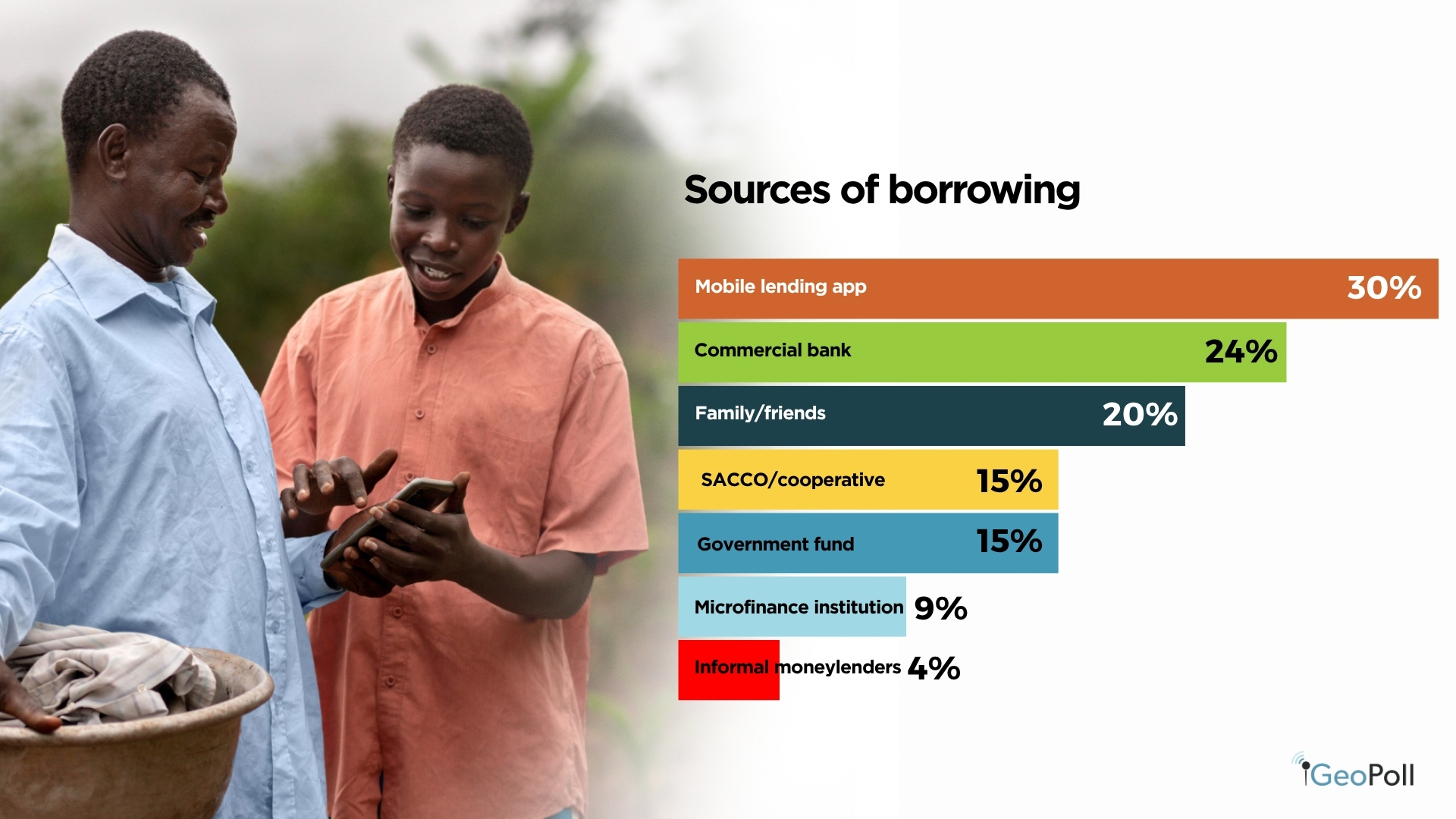

Borrowing Trends and Loan Sources in Kenya

The findings reveal a nearly even split in borrowing activity among Kenyan respondents. About 47% reported having taken a loan in the past 12 months, while 53% had not. This balance suggests that credit access is relatively widespread but still moderated by income levels, financial literacy, or risk aversion.

When asked about their sources of borrowing, mobile lending apps emerged as the most common option, used by 30% of respondents. Their popularity reflects the convenience and speed of digital credit solutions like M-Shwari, Tala, and Branch. Commercial banks followed at 24%, indicating that traditional financial institutions remain an important source of formal credit, particularly for salaried individuals. Other notable borrowing sources include family or friends (20%), SACCOs or cooperatives (15%), and government funds (15%), showing a blend of formal and informal mechanisms in Kenya’s credit landscape. A smaller share borrowed from microfinance institutions (15%) and informal moneylenders (9%), suggesting that while access to credit is broad, affordability and regulation remain ongoing challenges.

Regarding the main reasons for borrowing, emergencies (27%) topped the list, followed by business purposes (23%) and school or education fees (12%). These patterns highlight that borrowing in Kenya is largely driven by short-term needs and income-support activities, rather than asset acquisition or long-term investments. Fewer respondents cited borrowing for food (7%), household expenses (5%), or asset purchases (4%), reinforcing that loans are often used as financial buffers rather than tools for wealth creation.

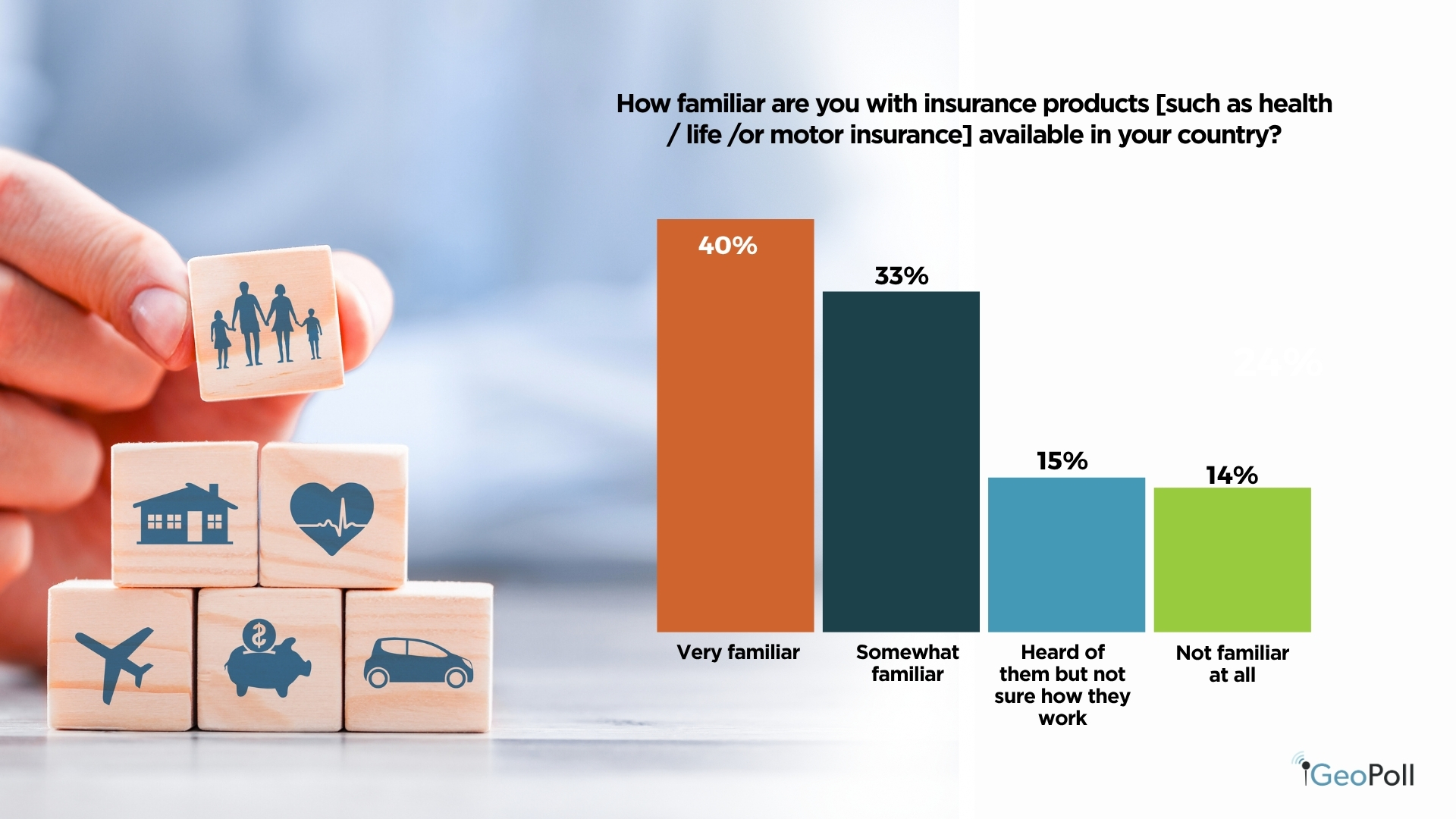

Familiarity with Insurance Products

Most Kenyans demonstrate a solid awareness of insurance, with about 40% saying they are very familiar with different insurance products and providers. Another 33% are somewhat familiar, showing moderate understanding. However, around 28% have only heard of insurance or are not familiar at all, indicating that while awareness is widespread, deeper understanding remains limited across portions of the population.

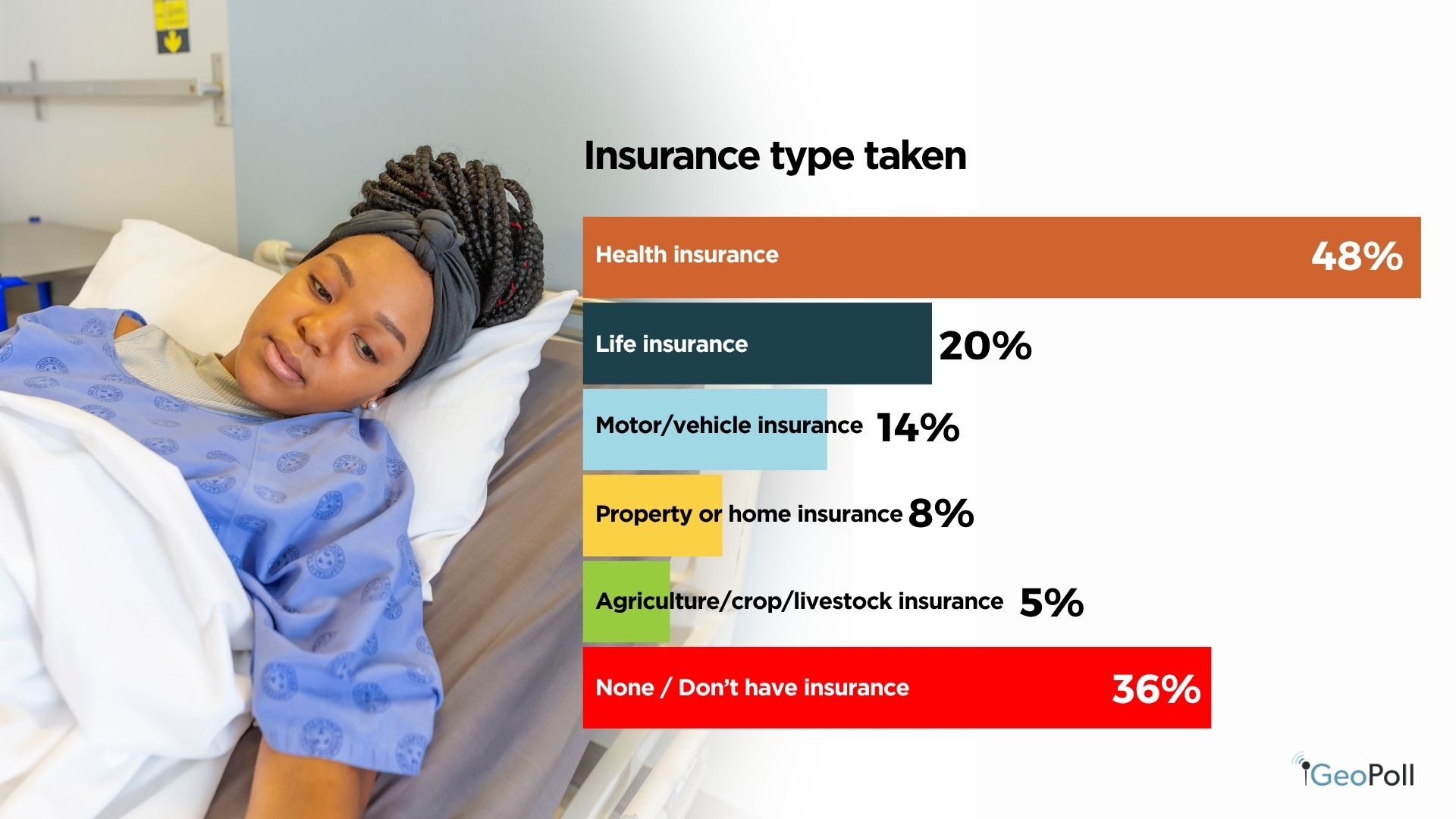

Insurance Uptake and Coverage Types

Nearly half of respondents, 48%, reported having taken an insurance policy, while 53% said they have not. Among those insured, health insurance dominates at 48%, followed by life insurance at 17% and motor insurance at 14%. Around 36% of respondents currently have no insurance coverage, revealing significant opportunity for growth in other categories such as property, agricultural, and home insurance.

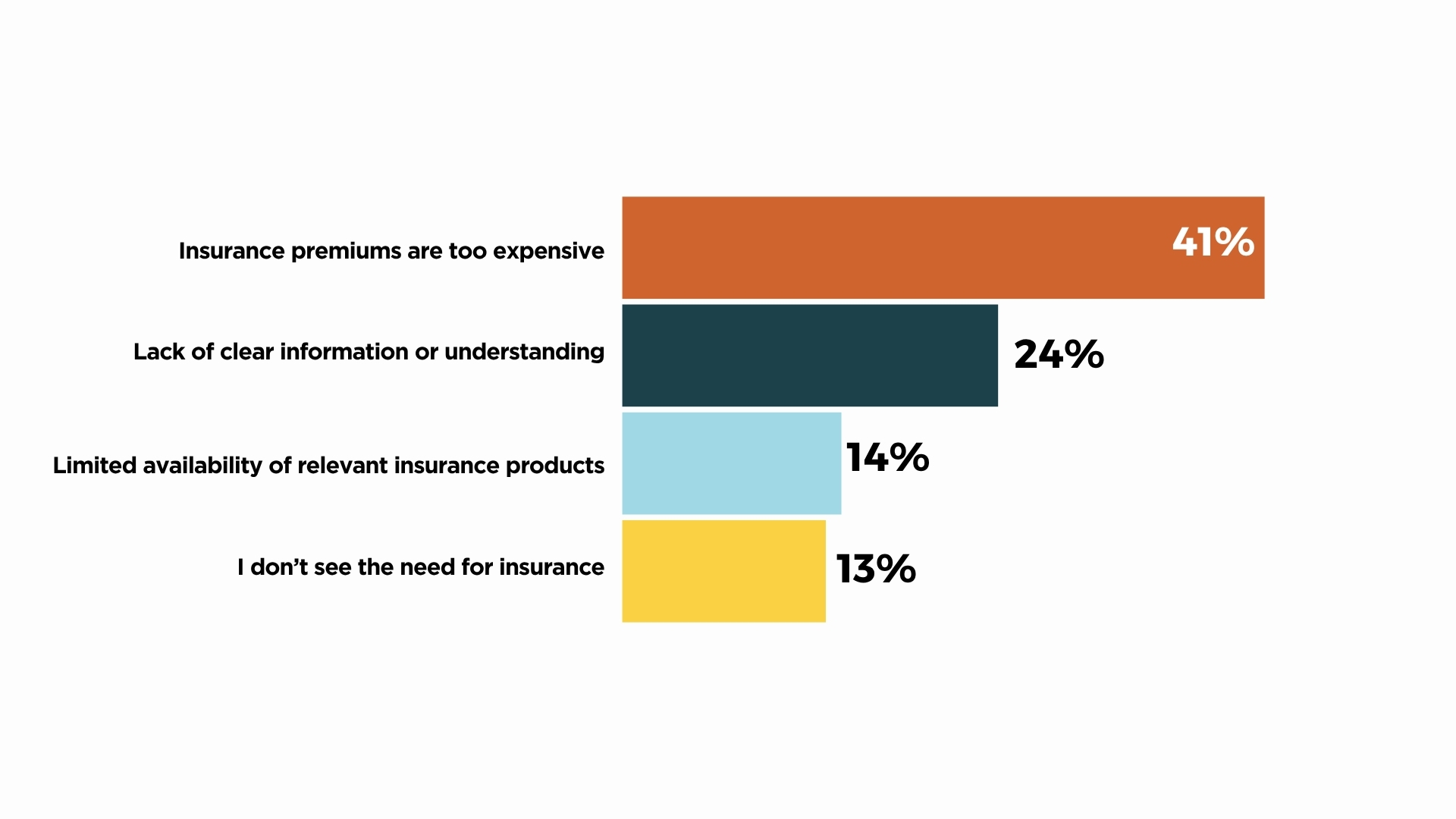

Barriers to Insurance Uptake

The main challenge limiting insurance adoption is affordability, with about 41% citing high premiums as the biggest deterrent. Another 24% pointed to lack of clear information or understanding, while 14% mentioned limited product availability. Roughly 13% said they do not see the need for insurance. These findings highlight the need for more affordable, transparent, and accessible insurance options tailored to Kenyan consumers.

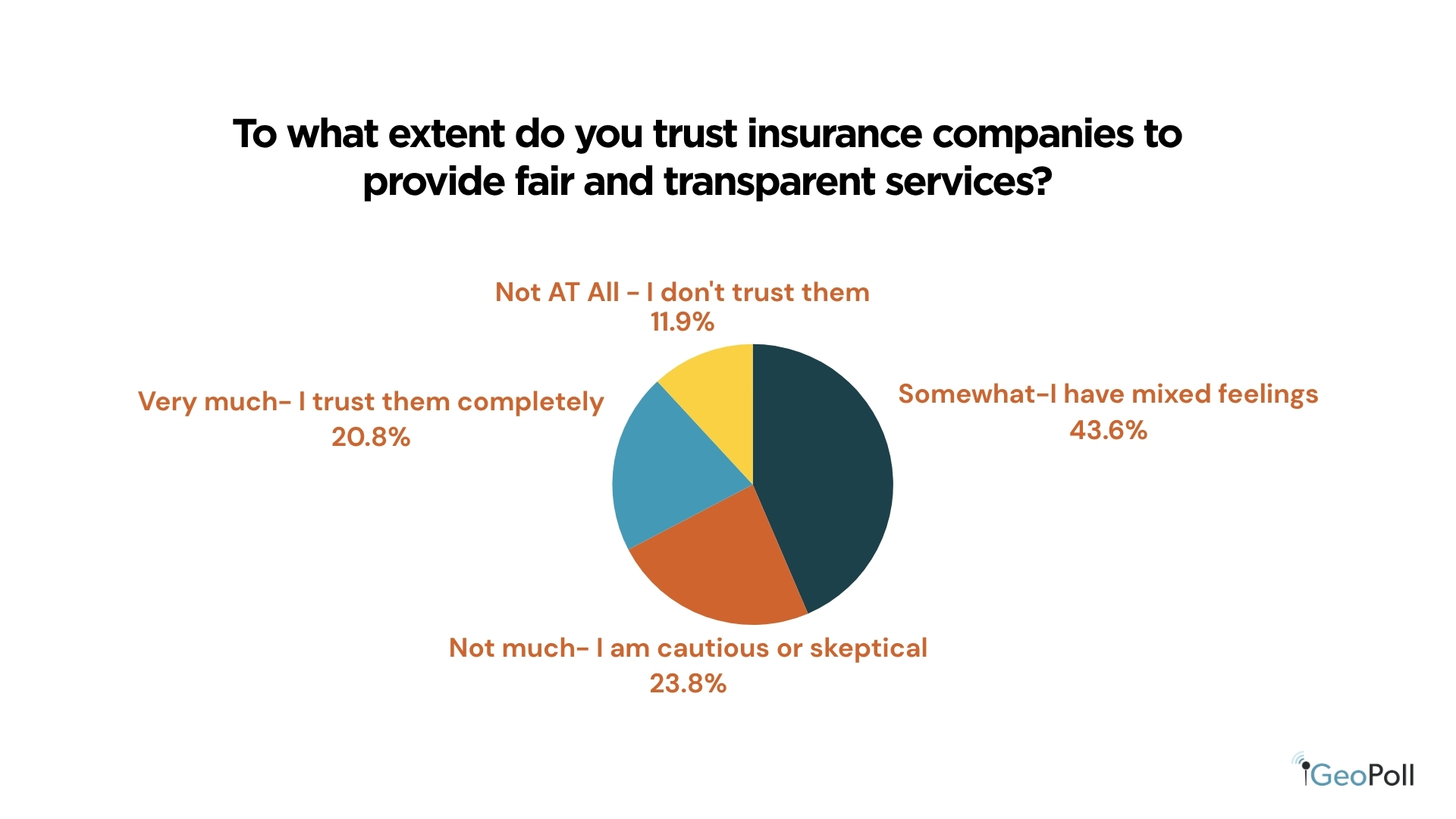

Trust in Insurance Companies

Trust levels in insurance companies are moderate. About 44% of Kenyans have mixed feelings, 24% are cautious or skeptical, and 21% fully trust insurers. Only 12% say they do not trust them at all. These results show that while awareness is growing, confidence remains limited, highlighting the need for insurers to improve transparency and build stronger customer relationships.

Challenges, Barriers, and Satisfaction with Financial Services

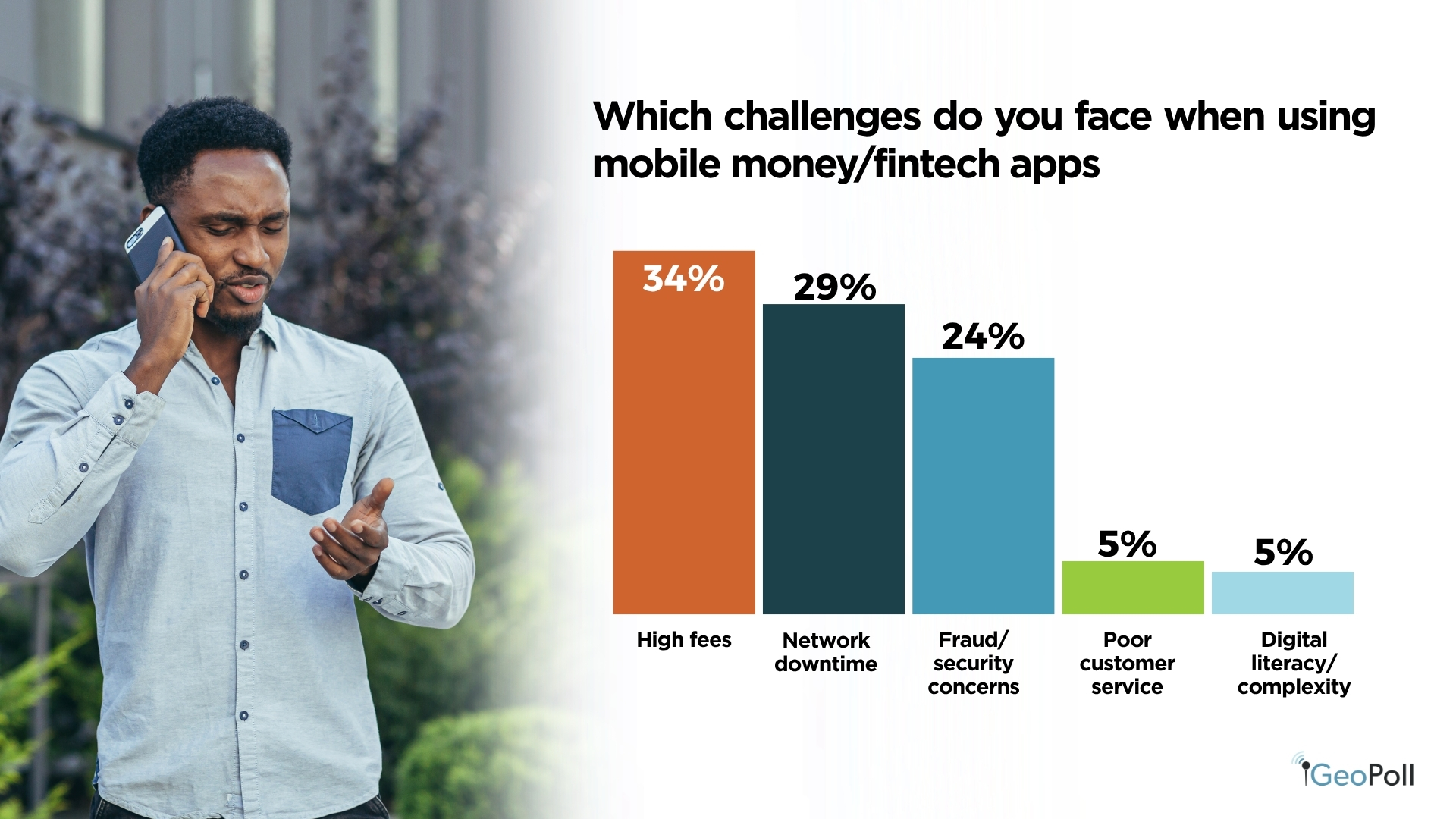

High fees remain a major concern across both mobile money and formal financial services, with 34% of respondents citing them as the main challenge in fintech use and 46% identifying them as the biggest barrier to accessing formal financial systems. Other significant issues include network downtime at 28% and fraud or security concerns at 25%, while customer service and digital literacy challenges were reported by fewer users.

Despite these challenges, overall satisfaction with financial services is fairly positive. About 41% of respondents reported being satisfied and 14% very satisfied, while 38% were neutral. Only a small proportion, roughly 8%, expressed dissatisfaction. This suggests that although costs and service reliability are key pain points, most users acknowledge some level of satisfaction with available financial services.

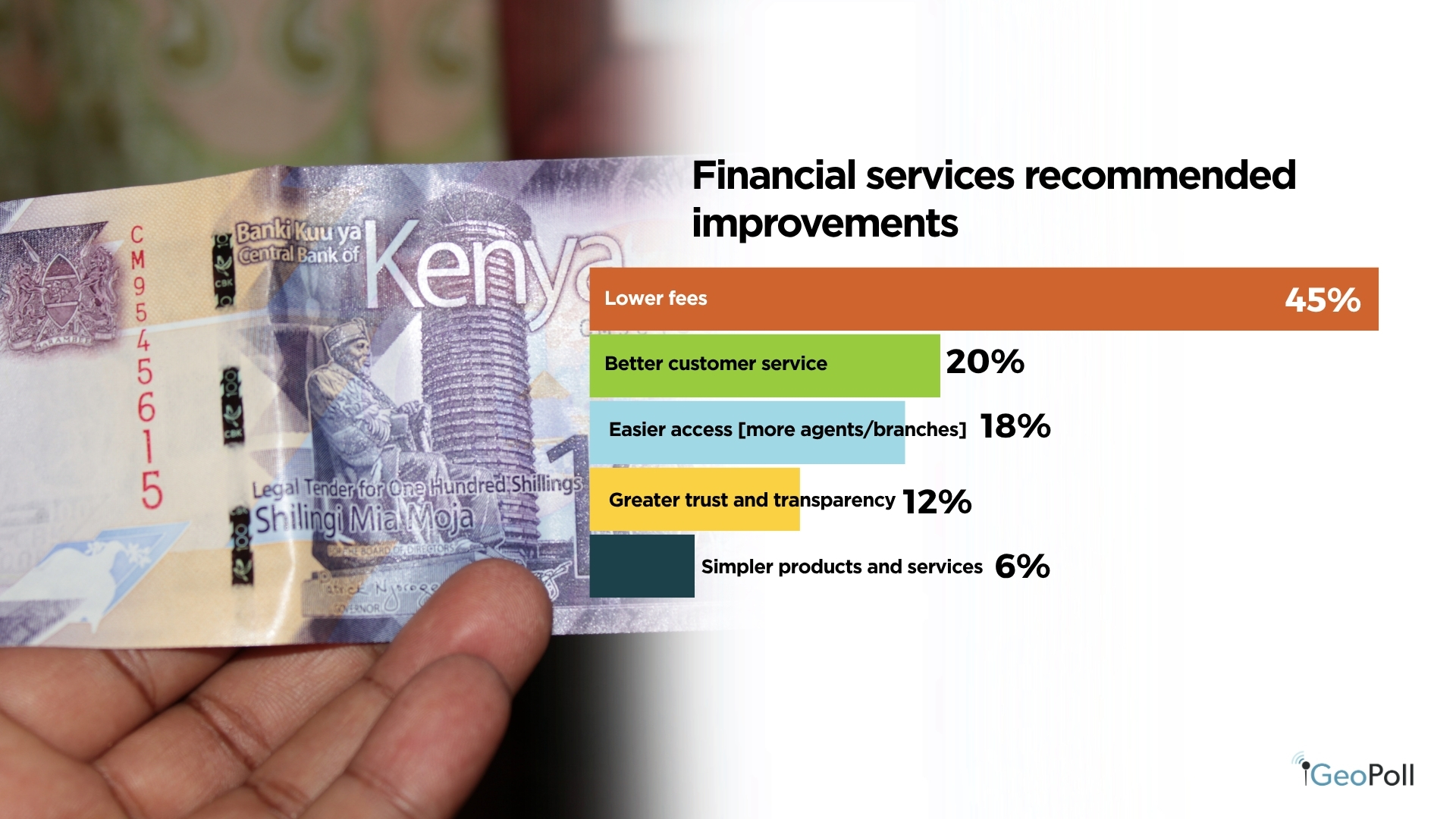

When asked about improvements that would encourage more frequent use, nearly 45% of respondents called for lower fees. Better customer service and easier access to branches or agents were also seen as important by 20% and 19%, respectively. These insights highlight a clear demand for affordability, convenience, and improved service delivery to enhance engagement with financial products in Kenya.

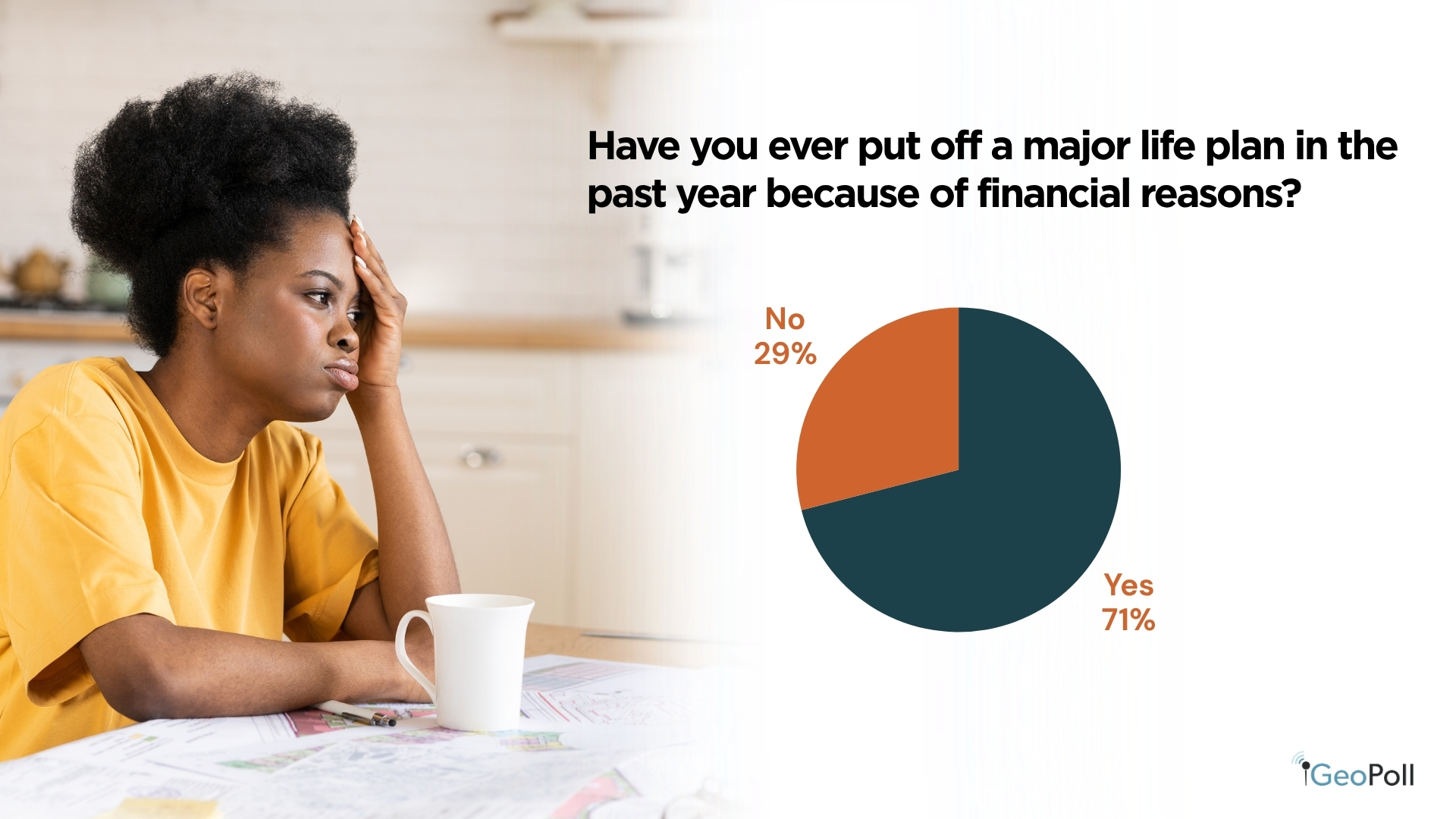

Financial Constraints and Major Life Decisions

A large majority of respondents, 71%, reported postponing major life plans such as marriage, education, or starting a business due to financial reasons. Only 29% said they had not delayed any major plans. This indicates that financial challenges remain a significant barrier to personal progress for many Kenyans, affecting long-term goals and overall economic well-being.

Consumer Spending Adjustments

A significant 79% of respondents reported changing a product and opting for a cheaper alternative, while only 22% said they had not. This shows that most Kenyans are making cost-conscious decisions, likely influenced by economic pressures and the rising cost of living, as they prioritize affordability over brand or quality preferences.

Conclusion

Kenya’s financial landscape continues to set the pace for digital innovation in Africa, yet clear gaps remain between access, affordability, and depth of use. With 84.8% of adults now financially included and mobile money reaching 98% penetration, Kenya has achieved remarkable progress in expanding access to financial tools. However, challenges persist: 41% of respondents cite high fees as the main barrier to insurance and financial service uptake, while 44% express only moderate trust in insurance providers.

Financial strain remains widespread, with 71% of Kenyans delaying major life decisions due to money constraints and 79% opting for cheaper products to cope with rising costs. Despite these pressures, 55% of users report being satisfied or very satisfied with available financial services, evidence of a population that remains resilient, adaptive, and optimistic. Moving forward, Kenya’s financial ecosystem must prioritize affordability, transparency, and responsible innovation to ensure that its digital success story translates into sustainable financial well-being for all.

Methodology/About this Survey

This Exclusive Survey was powered by GeoPoll’s AI platform; Tuucho run via the GeoPoll mobile application and Mobile web in Kenya, the sample size was 2,500, composed of random users between 18 and 50. Since the survey was randomly distributed to an affluent audience the results are slightly skewed towards younger respondents.

These insights highlight not only the evolving nature of Kenya’s financial landscape, but also the power of GeoPoll in uncovering meaningful, data-driven narratives across diverse populations. Through its robust mobile-based survey technology and extensive reach across emerging markets, GeoPoll delivers fast, reliable, and actionable financial data that helps organizations, policymakers, and researchers understand consumer behavior, financial inclusion, and economic trends in real time. As digital finance continues to transform access and usage across Africa, GeoPoll remains at the forefront, bridging the gap between people and insights, and enabling smarter decisions through a deeper understanding of financial realities.

Please get in touch with us to get more details about our capabilities, explore more on various topics in Africa, Asia, and Latin America.