The African Nations Championship (CHAN) is a biennial football tournament organized by the Confederation of African Football (CAF), featuring national teams composed exclusively of players active in domestic leagues. The 2025 edition branded as CHAN 2024 due to its postponement, is being co-hosted by Kenya, Tanzania, and Uganda from 2nd to 30th August 2025.

Through this study, GeoPoll aimed to capture real-time public perception, viewership trends, and impact of the CHAN tournament across key African markets. The objectives include:

Awareness – Assess public knowledge and perception of the CHAN Tournament

Viewership & Engagement – Matches followship across TV, radio, and digital platforms and assess match attendance patterns in host cities.

Fan Sentiment & National Pride – Measure how fans perceive their national teams’ performances, and understand the emotional and cultural importance of CHAN in participating countries.

Sponsorship & Media Evaluation – Assess awareness and recall of sponsors and advertisers, and track brand visibility and fan engagement with commercial activations.

Awareness and Sources of Information

The survey findings showed a high level of awareness about the ongoing CHAN tournament across the host countries, with 88% of respondents indicating that they were familiar with the tournament. This could be a points that CHAN has successfully captured public attention and penetrated the sporting consciousness of fans across the region, or the patriotism and fanfare that came with the three countries hosting and participating in the tournament. The strong awareness levels provide a solid foundation for further analysis of viewership patterns, fan engagement, and the tournament’s broader socio-economic impact.

Primary Source of Information and news on CHAN

Among the respondents that affirmed that they were aware of CHAN 2025, a clear majority of respondents cited television (54%), reaffirming its role as the leading medium for sports coverage across the region. Social media followed as the second most influential channel (33%), with particularly high engagement in Uganda (39%) and Kenya (37%), compared to just 20% in Tanzania, highlighting the growing role of digital platforms in shaping fan conversations and real-time updates. Traditional media outlets such as radio (7%) and websites (4%) played smaller yet notable roles, while other sources including word of mouth, SMS, and newspapers (all below 1%) contributed minimally. Broadcast media continues to be strong, complemented by the rising influence of social platforms in reaching younger and more digitally connected audiences.

Following CHAN matches

A vast majority of respondents reported watching the ongoing CHAN tournaments. 93% indicated that they have followed the matches, which highlights the widespread interest and engagement with the competition among the surveyed audience.

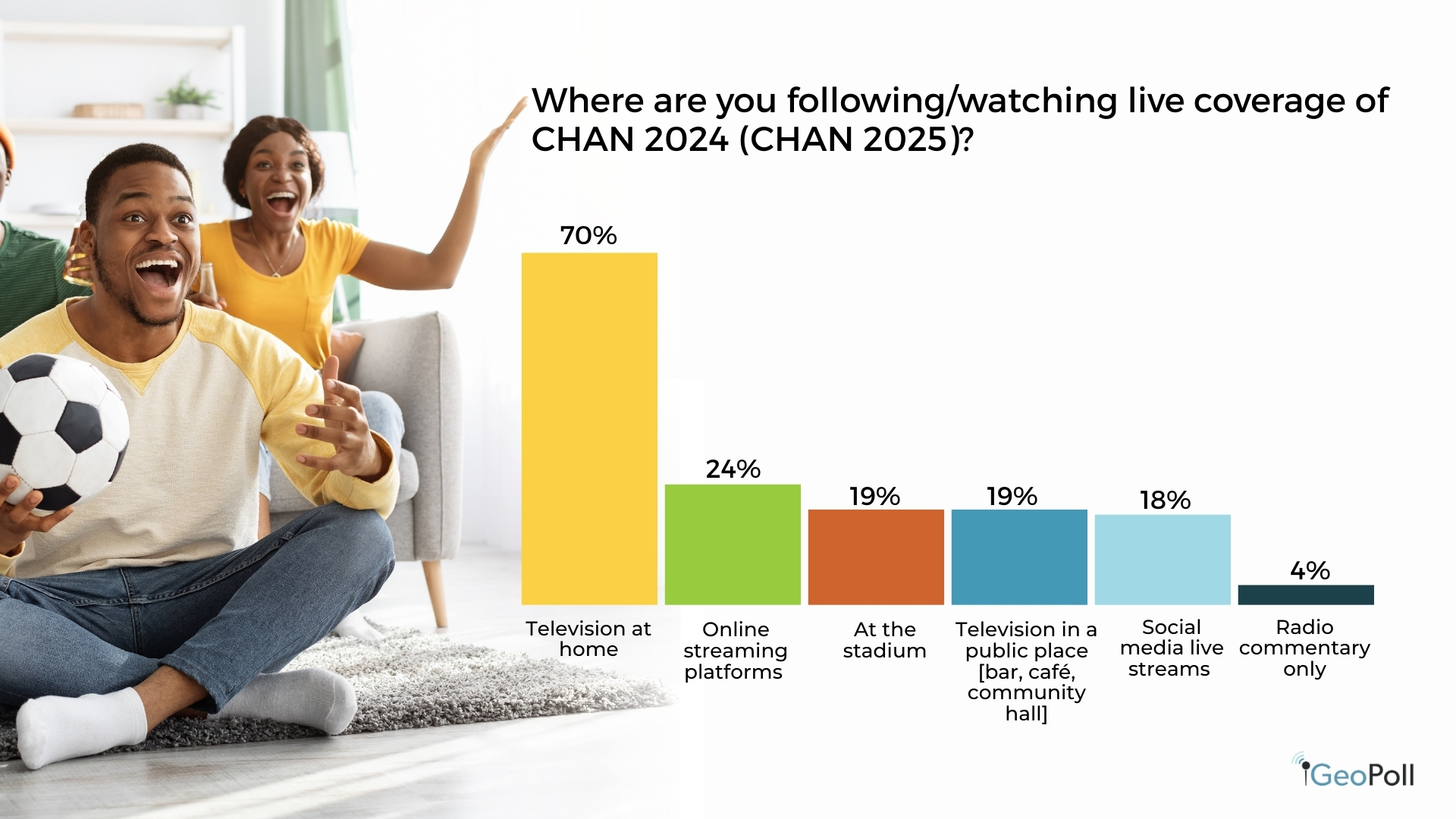

When asked where they follow live coverage of CHAN 2024, the majority of respondents (68%) said they watch on television at home, making it the most popular channel of engagement. Online streaming platforms ranked second at 23%, while 18% reported watching on television in public places such as bars or community halls. Similarly, 18% use social media live streams like Facebook, TikTok, or X. Attendance at the stadium was mentioned by 16% of respondents overall, with the highest mention in Kenya (20%), followed by Tanzania (19%) and Uganda (13%). while a smaller proportion (4%) rely solely on radio commentary.

Outstanding matches (So Far)

When asked about the matches that had been outstanding until the survey was conducted, the Kenya vs Morocco fixture dominated fan conversations, receiving 365 mentions (18%) and standing out as the most talked-about pairing. Other notable matches included Kenya vs Madagascar with 55 mentions (3%) and Uganda vs South Africa with 47 mentions (2%). Meanwhile, less attention was given to Kenya vs Zambia, which registered 11 mentions (1%), and Tanzania vs Morocco, which was mentioned only 4 times. This distribution highlights Kenya’s central role in driving fan interest across multiple matchups, while also showing that some fixtures captured relatively little attention from those surveyed.

Kenya vs Morocco – 365 mentions (18%)

Kenya vs Madagascar – 55 mentions (3%)

Uganda vs South Africa – 47 mentions (2%)

Kenya vs Zambia – 11 mentions (1%)

Tanzania vs Morocco – 4 mentions

This mentions were after the survey had started running. With data collection ending in 22nd August 2025

Who will win

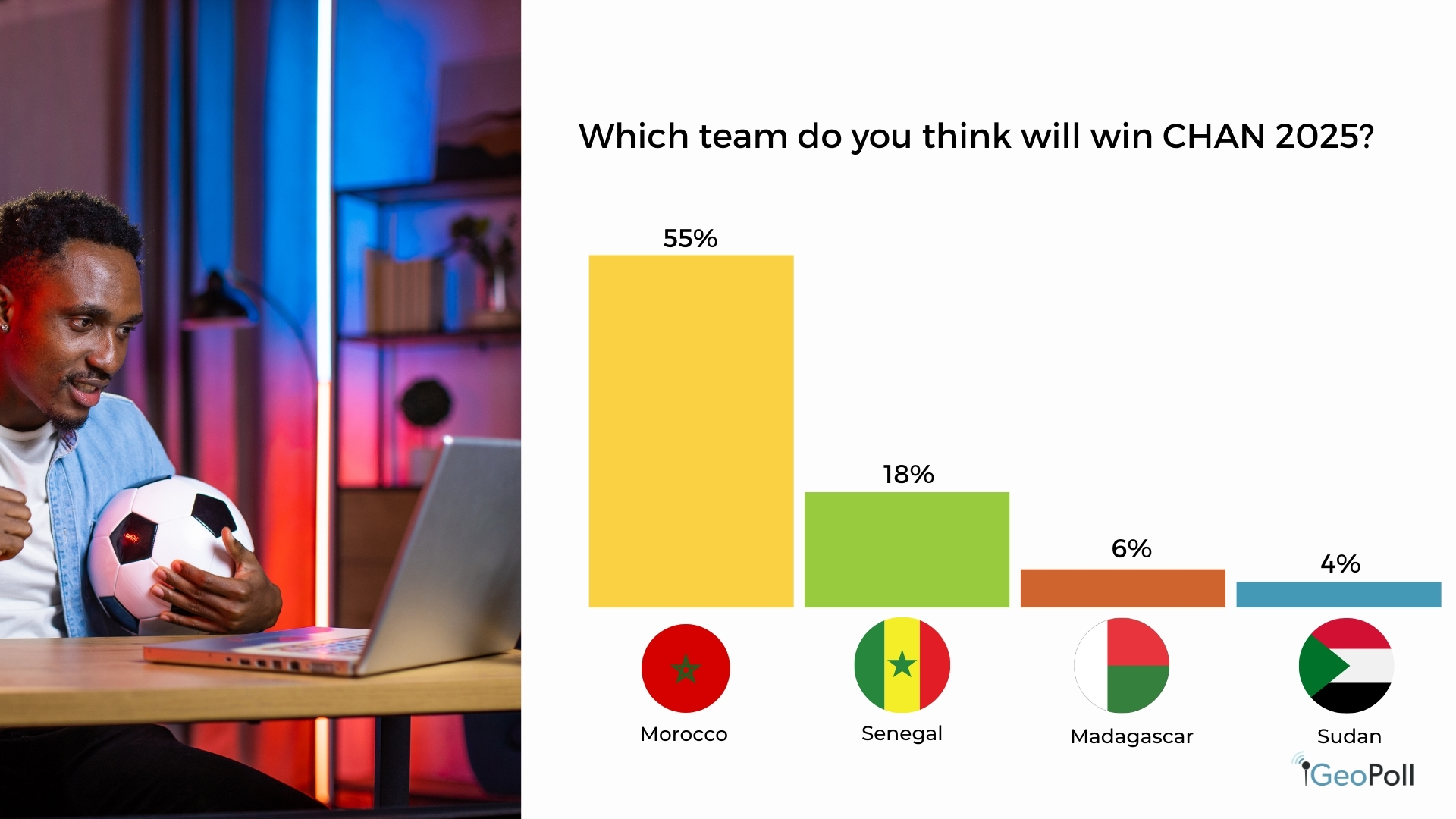

Among the remaining teams, Morocco leads strongly with 55% of the mentions, positioning it as the most favored contender for CHAN 2025. Senegal garnered 18%, reflecting moderate expectations of success, while Madagascar (6%) and Sudan (4%) attracted smaller levels of support, suggesting they are seen as outside challengers in the tournament.

Organization of CHAN

When asked about the organization of CHAN 2025, respondents voiced overwhelmingly positive feedback: 53% described the tournament as extremely well organized, while another 42% rated it as fairly organized. Only 3% felt it was poorly organized and an additional 3% were uncertain. These results underscore widespread appreciation for the collaborative efforts of the co-hosts, reflecting strong confidence in the planning and execution of matches throughout the region.

Still, a few operational hiccups emerged amid the widespread praise. Notably, in Kenya, ticket sales for the highly anticipated Harambee Stars quarter-final against Madagascar crashed early on, with the ticketing platform overwhelmed by bot activity—a glitch that forced organizers to halt sales temporarily.

We also see that in Nairobi, authorities implemented significant road closures and traffic diversions to manage congestion and ensure security around match venues. Similarly, in Kampala and Entebbe, police issued comprehensive advisories warning of heavy traffic, widespread diversions, and vehicle restrictions enforced along major routes leading to Mandela National Stadium.

Brands and Sponsorship of CHAN

Brand visibility surrounding CHAN 2025 seems robust, with 70% of respondents noting that they’ve seen brands sponsoring the tournament. In contrast, 16% indicated they hadn’t noticed any sponsors, while another 16% were uncertain. This high level of brand recall implies that sponsorship activations are effectively reaching audiences, although there is still a significant portion of fans who may not fully engage with or recognize sponsor messaging.

Betting on CHAN games

When asked about their betting behavior during CHAN 2025, the largest group of respondents (39%) reported that they hadn’t placed any bets at all. However, betting activity was still quite noticeable, as around a quarter (26%) admitted to having made multiple bets, while 17% had bet once or twice. Additionally, 19% indicated that they had considered betting but ultimately chose not to participate. These results underscore that while a significant portion of fans opted to abstain from betting, nearly half of the audience engaged directly with it, showcasing the growing impact of sports wagering on fan involvement during the tournament.

Betting Device

Among respondents who placed bets on CHAN 2025 matches, the overwhelming majority (71%) used mobile phones as their preferred platform. A smaller share (24%) reported using other unspecified devices, while very few relied on traditional or less accessible methods such as slot machines (2%), betting slips (2%), or cybercafé machines (1%).

Amount spent on betting

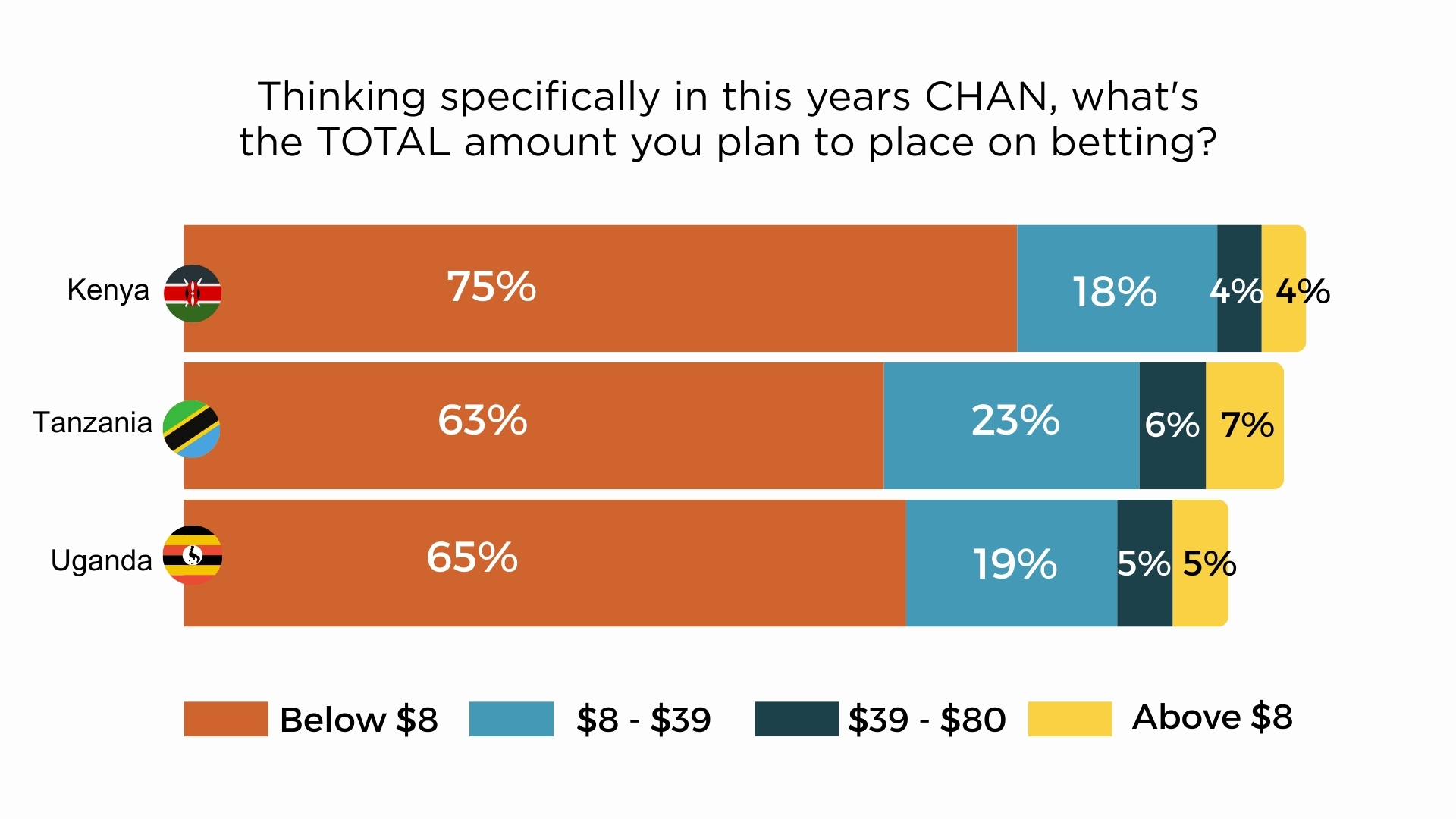

Kenya

Among Kenyan respondents, the vast majority (75%) plan to spend less than KES 1,000 ($8) on betting during CHAN 2025. A smaller portion (18%) expect to spend between KES 1,000 ($8) and 5,000($39), while very few indicated higher stakes, with 4% planning to spend above KES 10,000 ($80) and another 4% intending to wager between KES 5,000($39) and 10,000 ($80).

Tanzania

Among Tanzanian respondents, the majority (63%) planned to wager below TZS 20,000 ($8) on CHAN 2025 matches. About 23% intended to bet between TZS 20,000 ($8) and TZS 100,000 ($39), while smaller proportions expected to spend higher amounts: 7% planned to spend above TZS 200,000 ($80), and 6% between TZS 100,000 ($39) and TZS 200,000 ($80).

Uganda

Among Ugandan respondents, 65% planned to spend below UGX 28,000 ($8) on betting during CHAN 2025. Around 19% indicated they would place bets between UGX 28,000 ($8) and UGX 140,000 ($39), while smaller groups leaned toward higher stakes. About 5% aimed to spend between UGX 140,000 ($39) and UGX 280,000 ($80), another 5% expected to spend above UGX 280,000 ($80).

While betting participation is notable, most fans engage with relatively low amounts, reflecting cautious spending habits and perhaps a preference for casual rather than high-risk betting.

Methodology/About this Survey

This survey was powered by GeoPoll’s AI platform; Tuucho run via the GeoPoll mobile application between the 21st and 22nd August 2025 in CHAN’S host countries; Kenya, Tanzania and Uganda. The sample size was 2,500, composed of random users between 18 and 50. Since the survey was randomly distributed to an affluent audience the results are slightly skewed towards younger respondents.

Please get in touch with us to get more details about our capabilities and explore more topics in Africa, Asia, and Latin America.