dropped sharply after Middle East tensions escalated with Israeli strikes on Iran.

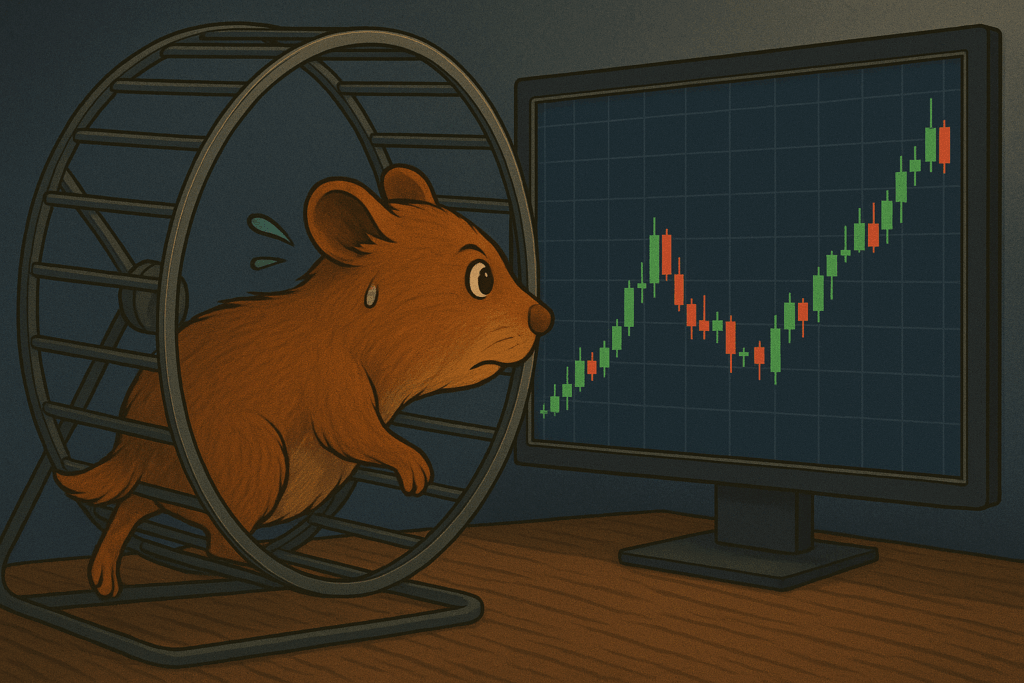

$1.2 billion in leveraged crypto positions liquidated as altcoins posted even steeper losses.

If $103,000 support holds, Bitcoin may stabilize and attempt a recovery next week.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The fresh rise in Middle East tensions has hit cryptocurrency markets hard. After Israeli airstrikes on Tehran and military sites near Tabriz, dropped as much as 5 percent to $102,000. Altcoins saw even bigger losses, with $1.2 billion worth of leveraged futures positions wiped out. After these liquidations, Bitcoin bounced back slightly and moved toward $105,000 from its key support level.

Geopolitical Risks Deepen Correction

Bitcoin started falling from the $110,000 level as rising tensions shook global markets during the week. The sell-off deepened after the Israeli airstrike, pushing investors to safe-haven assets. This showed once again that Bitcoin acts like a risky asset during short-term uncertainty.

At the same time, surged to $3,400 after a week-long rally, and climbed to $76 on supply concerns. Bitcoin, however, dropped sharply during the crisis, weakening the idea of it being a form of digital gold. As cryptocurrencies are highly volatile, they remain risky assets. The heavy use of leverage makes Bitcoin even more vulnerable during times of crisis.

Bitcoin Steadies After Leveraged Selloff

Coinglass data shows that $1.16 billion worth of crypto positions were liquidated in the past 24 hours, including $450 million in Bitcoin alone. The expiry of $3.7 billion in Bitcoin options on Deribit also added to the market’s volatility. The maximum pain level for Bitcoin options was set at $107,000. Since Bitcoin closed well below this level, it favored selling positions.

Despite the recent three-day drop, Bitcoin had gained nearly 10 percent last week and was approaching its record highs. For now, the decline seems limited. If geopolitical tensions ease, Bitcoin may recover quickly.

On the daily Bitcoin chart, recent selling stopped around the $103,000 level. This area marks the lower boundary of Bitcoin’s consolidation over the past month. Buyers stepped in at this point during the latest decline, which helped limit further losses. If Bitcoin holds above $103,000 through the weekend, it may continue to trade sideways and attempt to move back toward the $111,000 record level next week.

Geopolitical events will remain a key factor. If Iran’s response is limited, market anxiety may ease, encouraging investors to see the pullback as a buying opportunity. But if Iran responds more strongly, the sell-off may continue and weigh further on the crypto markets.

Technical Outlook for Bitcoin

Bitcoin remains under selling pressure. The key support to watch is $103,000, which marks the lower boundary of its one-month trading range. If Bitcoin closes below this level on the daily chart, the decline may deepen and pull the price down toward the $97,000 to $98,000 zone.

However, if buyers hold $103,000 again, attention will shift back to the recent peak at $111,950. A break above this level may open the way for a move toward the $114,000 to $125,000 range.

Bitcoin has seen steady institutional demand thanks to strong internal factors. But as recent events show, global risks can easily overshadow positive news for Bitcoin, which still trades like a risky asset. This latest drop highlights that Bitcoin does not fully act like a traditional safe haven yet.

While demand rises for physical assets like gold, cryptocurrencies continue to move in line with other risk assets. Still, Bitcoin’s limited supply, transparent structure, and growing institutional interest help limit the size of declines and make the market less volatile than it used to be.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.