With the government shutdown limiting broader economic news, investor focus is turning to upcoming Q3 earnings.

Which undervalued stocks could present buying opportunities?

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

US stock markets are bouncing back after last week’s sharp drop following news that China restricted exports of rare earth metals. Investors seem to hope this is part of ongoing talks with the US, which reduces the chance of a bigger drop in the short term. With the US government shutdown keeping broader economic news quiet, attention is shifting to quarterly earnings, especially as major financial companies report their results.

Today’s analysis looks at three potentially undervalued companies set to release Q3 2025 results in the coming weeks.

Comcast Corp Closer to Long-Term Lows

made the list not just for its high fair value of 58% but also for its technical setup. The stock has been in a downtrend for almost a year and is approaching its 2022 low around $29 per share.

If the stock holds this level and reports strong quarterly results, it could be a good chance to consider a buy. The low P/E ratio of 4.8x and recent net income far above the average of past years make it even more appealing.

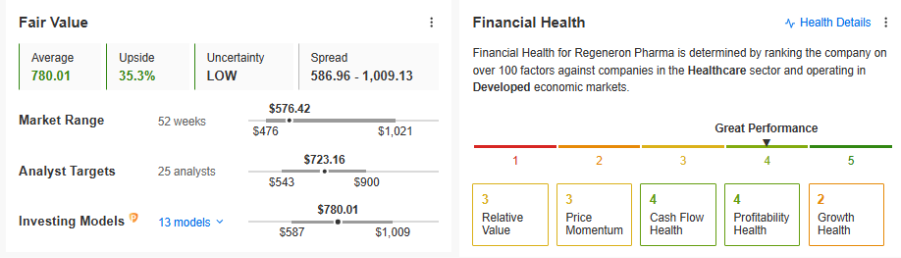

Regeneron Pharmaceuticals’ Strong Fundamentals

is a biotech and medical device company focused on innovative treatments. The company is working with partners on gene therapy research, which is a key focus for the future. Its fair value potential is 35.5%, and it has a strong financial health score.

Source: InvestingPro

Source: InvestingPro

In June, the stock hit the bottom of a downtrend under a year old, around $480 per share, which could lead to a rebound. A move above $600 per share would be key for a potential upward trend.

Analysts’ Confidence in Arch Capital

is highlighted today for its 27% fair value and strong financial health, similar to Regeneron. Analysts are also optimistic ahead of its quarterly results at the end of October, with earnings per share expectations rising significantly.

Source: InvestingPro

On the chart, the stock has been trading sideways between $83 and $97 per share. A break above this range would be a strong technical signal that buyers are regaining control.

Final Words

Investors may find opportunities by watching these stocks closely as Q3 earnings unfold. Staying informed and tracking key levels can help position for potential gains.

****InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.