The U.S. stock market has experienced significant volatility in recent months. After a sharp decline in early April, triggered by the announcement of sweeping tariffs by the Trump administration, markets rebounded following a 90-day pause on tariffs, including those against China. This recovery was bolstered by strong corporate earnings and resilient economic data.

Despite this rebound, concerns remain. Moody’s recent downgrade of the U.S. credit rating has raised questions about the country’s debt levels, leading to increased demand for safe-haven assets like gold. Additionally, rising Treasury yields have contributed to market nervousness.

In this context, investors are seeking opportunities in undervalued stocks that may offer above-average returns if bulls resume their charge higher. In this article, we’ll examine three such stocks that appear to be mispriced by the market, despite the recent bullish surge.

1. Open Text

One stock that remains undervalued based on its fair value estimate is Open Text Corporation (NASDAQ:), which shows more than 50% growth potential.

Source: InvestingPro

Very often, such values are attributed to companies that are moving in a permanent downtrend, which increases the percentages as the price goes lower and lower. In this case, however, the price has been moving northward for more than a month while defending long-term lows.

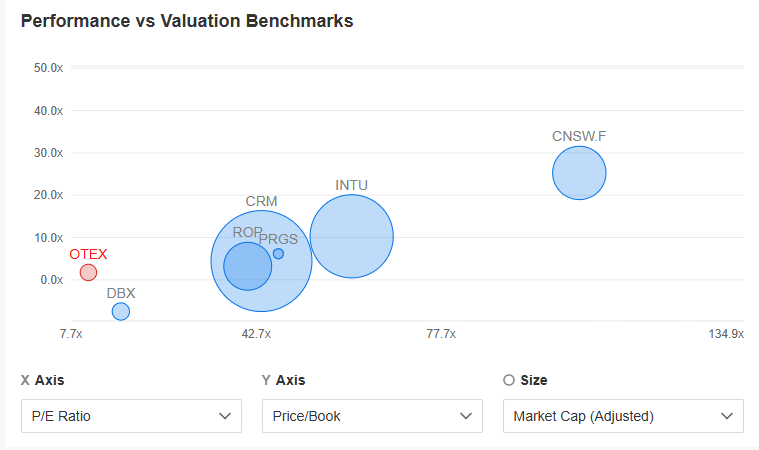

The attractiveness of the valuation is also highlighted by the price/earnings and price/book value ratios, where the former is currently one of the lowest in the entire strategy at 11.1x. It looks equally attractive doing a comparison to sector competitors, placing the company in the lower left corner on the P/E and P/B ratio axis.

Source: InvestingPro

Such large upside estimates are often tied to companies stuck in a persistent downtrend, which inflates valuation gaps as share prices fall. In this case, however, Open Text has been trending upward for over a month while holding key long-term support levels.

Its valuation appeal is further supported by attractive ratios—especially the price-to-earnings (P/E) ratio of just 11.1x, one of the lowest in the strategy. A comparison with sector peers places Open Text in the lower-left quadrant of the P/E and price-to-book value axes, signaling strong relative value.

Source: InvestingPro

2. Adobe Systems – Rising Earnings Support Optimism

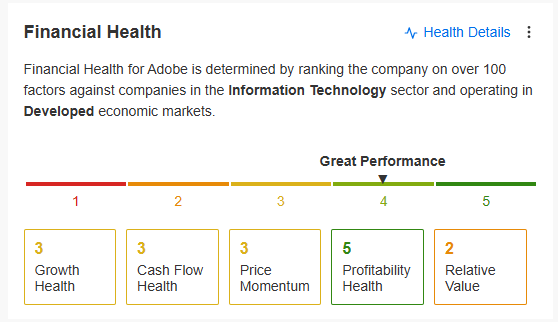

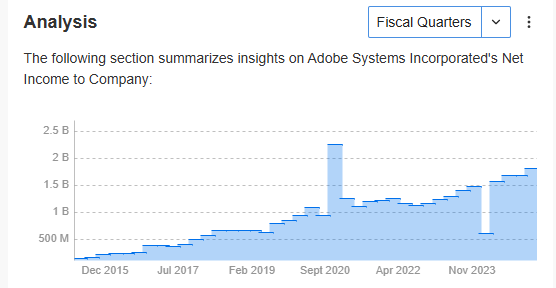

While Adobe Systems (NASDAQ:) doesn’t show as dramatic a fair value gap as Open Text—approximately 25%—it still reflects meaningful upside potential. What drives this optimism is the company’s robust fundamentals and strong financial health.

Source: InvestingPro

Adobe’s consistent net profit growth over recent years (with just one exception last year) is another bright spot. The next earnings release on June 12 could offer an opportunity to reinforce this upward trajectory.

3. Merck & Co. – In Search of a Trend Reversal

Merck & Co. (NYSE:), a major U.S. healthcare company, shows about 46% upside potential on paper. However, the technical setup remains the key factor—so far, there’s been no clear signal of a trend reversal.

Currently, sellers have pushed the price down to a support level near $74 per share. A bullish breakout above $85 would be the first sign of reversal, potentially setting the stage for a challenge of the next major resistance around $100.

Bottom Line

While the market’s bullish momentum continues, identifying undervalued stocks remains a prudent strategy. By focusing on companies with strong fundamentals and growth potential, investors can position themselves to capitalize on future gains. The three stocks discussed exemplify opportunities that may still be mispriced, offering a chance to enhance portfolio performance even in a rising market.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with a proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.