Published on June 30th, 2025 by Bob Ciura

Palantir Technologies (PLTR) is one of the market’s premier growth stocks. In just the past three years, Palantir stock has produced returns of more than 1,200%.

As the company’s revenue growth has exploded and it has become profitable, it is natural for investors to wonder if a dividend payment might be on the horizon.

Whether a company pays a dividend depends on many factors. Thousands of publicly-traded companies pay dividends to shareholders, and some have maintained long histories of raising their dividends yearly.

For example, the Dividend Aristocrats are a select group of 69 stocks in the S&P 500 that have raised their dividends for 25+ years in a row.

You can download an Excel spreadsheet of all Dividend Aristocrats (with metrics that matter, such as price-to-earnings ratios and dividend yields) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

On the other hand, other companies don’t pay a dividend right now and might not for a very long time (or ever).

Investors interested in the company may want to know if Palantir will ever pay a dividend to shareholders. This article will attempt to answer that question.

Business Overview

Palantir had its initial public offering on September 30, 2020. The stock opened up at $10 before finishing the day at $9.50. However, the stock has performed quite well in the past five years, and now trades above $130 per share.

Currently, Palantir has a market capitalization above $300 billion, making it a mega-cap stock.

Palantir was founded in 2003, in part by well-known venture capitalist Peter Thiel. Thiel has been the brains, money or both behind some of the technology sectors most successful endeavors, including Meta Brands (META) and PayPal (PYPL).

Palantir is one of the leading providers of software platforms for the intelligence community. The company has four main platforms.

The Palantir Gotham platform can identify patterns hidden in datasets, which range from signals intelligence sources to reports with confidential informants. Gotham is used by counter-terrorism analysts within the U.S. Intelligence Community and U.S. Department of Defense.

Palantir Foundry creates a central operating system for a company’s data which allows users to integrate and analyze data needed in one centrally located place.

AIP allows customers to automate virtually all areas of their businesses. Its Workflow Builder can construct AI apps, actions, and agents.

Lastly, Apollo houses software deployment tools. Solutions include SaaS, security, compliance, and more.

Growth Prospects

The company’s platforms can be used to address a wide variety of industries, ranging from defense to health care to food to energy. This doesn’t limit Palantir ability to attract customers to just a few areas of the economy.

With a deep pool of potential customers, Palantir is no niche business.

The need for businesses and organizations to be able to safely secure its data in a central location is also a necessity and Palantir is able to scale their platform to meet their needs.

Palantir has translated these growth prospects into results.

On May 5th, the company reported first-quarter financial results. For the quarter, revenue of $883.85 million beat analyst expectations by $21.72 million. Adjusted earnings-per-share of $0.13 was in-line with estimates.

U.S. revenue increased 55% year-over-year, including 71% year-over-year growth in U.S. commercial revenue.

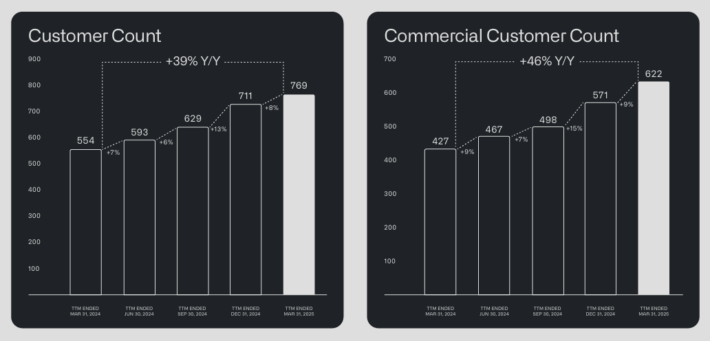

Source: Investor Presentation

The company has also been busy winning new business since going public. Palantir closed on 139 deals in the first quarter worth at least $1 million, 51 of which were worth at least $5 million.

Palantir is also beginning to find more of an international presence. The company can continue to grow its business by expanding its area of operations.

Competitive Advantages

Palantir has several advantages that sets it apart from the competition. First, Palantir’s sophisticated platform can help companies optimize their business and find ways to remove costs from the system. This can help improve operating performance while reducing expenses.

The company’s products are also in high demand among military customers. While somewhat controversial amongst certain investors, the company’s platforms have been proven to work in these areas which makes them a popular choice amongst the intelligence and defense communities.

Once trust has been gained, there could be switching costs associated with these agencies choosing another vendor.

Palantir also has the benefit of growing customers while also reducing in reliance on just a few customers.

Source: Investor Presentation

Palantir generated GAAP net income of $214 million along with GAAP earnings-per-share of $0.08, meaning the company has reached profitability.

The company also raised guidance, now expecting 2025 revenue of $3.89 billion to $3.902 billion. Palantir also expects free cash flow of $1.6 billion to $1.8 billion.

Meanwhile, the company has the advantage of significant cash reserves. As of the end of its most recent quarter, Palantir had a total of $5.43 billion of cash and cash equivalents, and marketable securities on its balance sheet.

Current assets total $6.28 billion, compared with current liabilities of $976.4 million, indicating very strong liquidity. Very few young public companies have such a vast sum of liquid assets available, without significant long-term debt.

Such a strong balance sheet increases the chance that the company could pay a dividend at some point.

Lastly, Palantir is still run by the same leadership as when the company was founded. Thiel remains chairman and his handpicked CEO Alex Karp has been in place since 2004.

Will Palantir Ever Pay A Dividend?

Palantir is a rare company that has shown strong revenue and earnings growth since its IPO, along with an abundance of cash on its balance sheet.

Companies looking to pay a dividend need to be profitable with strong balance sheets in order to distribute a dividend.

On the surface, Palantir meets these requirements, meaning it could theoretically pay a dividend. However, there are other considerations for companies still in their growth stage, such as Palantir.

Primarily, growth companies need to reinvest cash flow back into their businesses, to stay on the growth track. Indeed, Palantir continues to invest the vast majority of its proceeds back into the business.

Operating expenses rose 22% in the first quarter, year-over-year. This was due to the company increasing its sales and market, research and development and general and administrative budgets to a more reasonable level for a growing and expanding company.

With high expenses comes a low level of profits, which impacts any possible dividend desire Palantir may have. Even though the company was profitable in its first quarter, Palantir is only expected to earn $0.37 per share this year.

Earnings-per-share are expected to grow by 16% next year to $0.43. This leaves relatively little room to pay a dividend.

For example, ff the company wanted to allocate half of next year’s earnings-per-share to a dividend, then shareholders might receive a quarterly dividend of roughly $0.05. This equates to a yield of just 0.1% at the current price, which likely wouldn’t have much appeal for income investors.

At the same time, investors aren’t flocking to Palantir because of its ability to throw off income. The young company is already profitable and seeing an incredible growth rate. Any use of capital to pay a paltry dividend would be capital that couldn’t be spent elsewhere.

Palantir is much better off preserving capital to reinvest in its business. The cash on the balance sheet can always be used to make an acquisition or help grow the business in some other way.

Therefore, we believe it could be at least five to 10 years before Palantir is in a position where initiating a dividend makes sense.

Final Thoughts

After a slow start, there is no doubting Palantir has been an excellent investment following its IPO. The stock has rocketed higher in just the past few years, producing a lifetime of returns in a relatively short time.

The company produced GAAP profits in its first quarter and showed that revenue growth remains very high. Palantir also has a lot of growth in front of it and has multiple competitive advantages that should propel it higher.

Investors looking for a growth stock, and don’t mind the controversies regarding the company’s platforms, could do well owning shares of Palantir. What they likely won’t see is a dividend anytime soon.

For shareholders of Palantir, they are probably more excited about the total return possibilities than a small dividend.

Additional Reading

See the articles below for an analysis of whether other stocks that currently don’t pay dividends will one day pay a dividend:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].