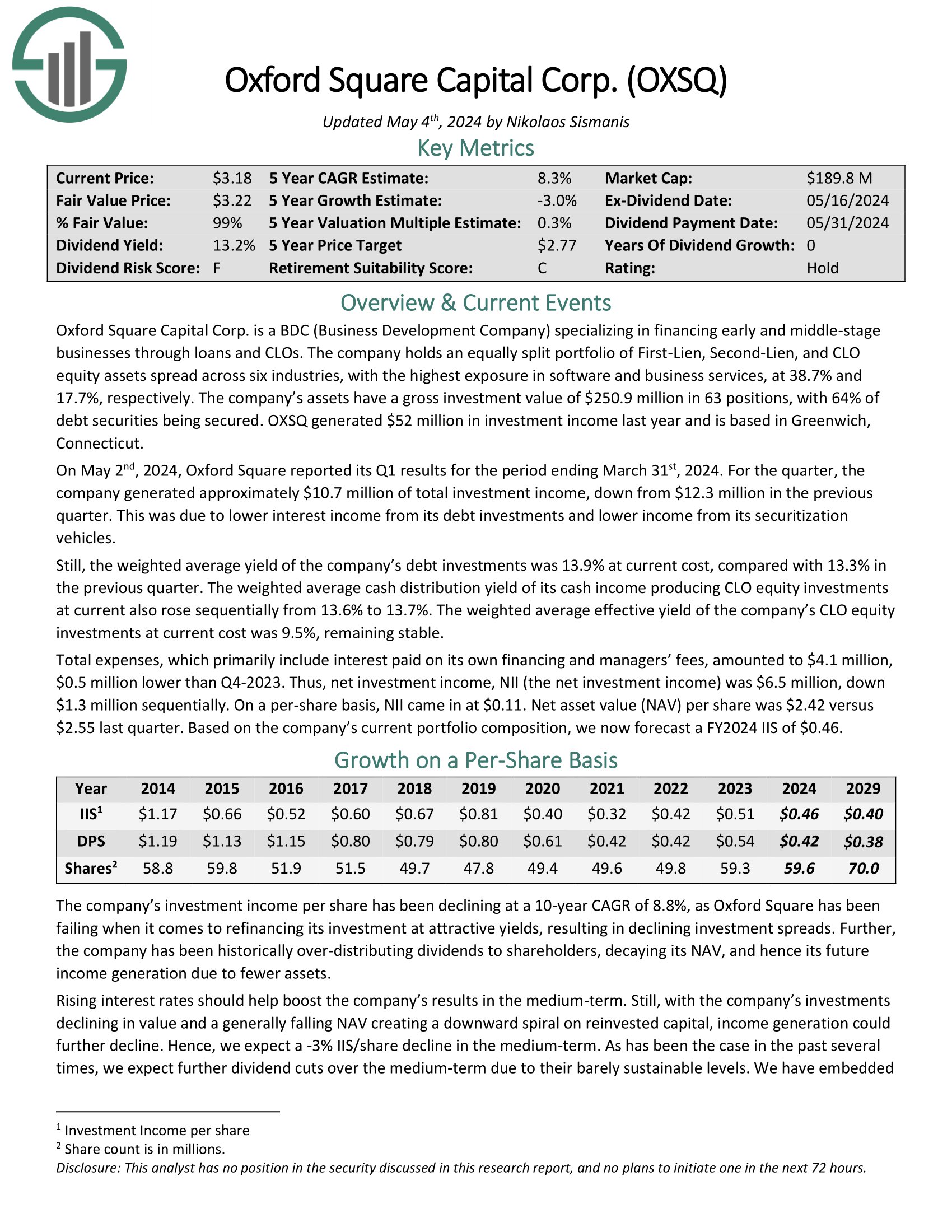

Oxford Square Capital Corp. is a BDC specializing in financing early and middle–stage businesses through loans and CLOs.

The company holds an equally split portfolio of First–Lien, Second–Lien, and CLO equity assets spread across multiple industries, with the highest exposure in software and business services.

Source: Investor Presentation

On May 2nd, 2024, Oxford Square reported its Q1 results for the period ending March 31st, 2024. For the quarter, the company generated approximately $10.7 million of total investment income, down from $12.3 million in the previous quarter.

The weighted average cash distribution yield of its cash income producing CLO equity investments at current also rose sequentially from 13.6% to 13.7%.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

Cheapest Monthly Dividend Stock #7: Apple Hospitality REIT (APLE)

Annual Valuation Return: 2.9%

Dividend Yield: 8.1%

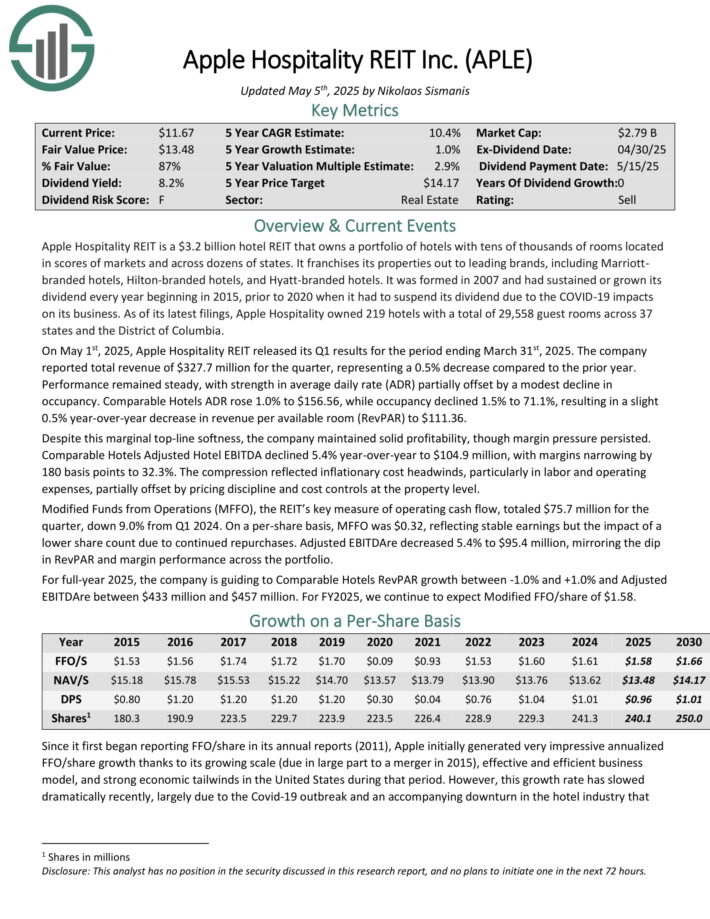

Apple Hospitality REIT is a hotel REIT that owns a portfolio of hotels with tens of thousands of rooms located in scores of markets and across dozens of states. It franchises its properties out to leading brands, including Marriott branded hotels, Hilton-branded hotels, and Hyatt-branded hotels.

As of its latest filings, Apple Hospitality owned 219 hotels with a total of 29,558 guest rooms across 37 states and the District of Columbia.

On May 1st, 2025, Apple Hospitality REIT released its Q1 results for the period ending March 31st, 2025. The company reported total revenue of $327.7 million for the quarter, representing a 0.5% decrease compared to the prior year.

Performance remained steady, with strength in average daily rate (ADR) partially offset by a modest decline in occupancy. Comparable Hotels ADR rose 1.0% to $156.56, while occupancy declined 1.5% to 71.1%, resulting in a slight 0.5% year-over-year decrease in revenue per available room (RevPAR) to $111.36.

Despite this marginal top-line softness, the company maintained solid profitability, though margin pressure persisted. Comparable Hotels Adjusted Hotel EBITDA declined 5.4% year-over-year to $104.9 million, with margins narrowing by 180 basis points to 32.3%.

Click here to download our most recent Sure Analysis report on APLE (preview of page 1 of 3 shown below):

Cheapest Monthly Dividend Stock #6: RioCan Real Estate Investment Trust (RIOCF)

Annual Valuation Return: 3.4%

Dividend Yield: 6.4%

RioCan Real Estate Investment Trust owns, manages, and develops retail-focused, mixed-use properties located in prime, high-density transit-oriented areas where Canadians shop, live, and work.

As of March 31st, 2025, the company wholly owned or co-owned stakes in 177 properties spanning an aggregate net leasable area of approximately 32 million square feet. Additionally, the company has a pipeline of approximately 21 million square feet zoned for future development.

RIOCF’s annualized contractual gross rent is mostly derived from retail properties (85.1%). Office properties chip in another 10.5%, and residential rental properties contribute the remaining 4.4% to RIOCF’s annualized rent.

The company’s strategy is to focus primarily on necessity-based retail. These include grocery stores and pharmacies (20.0% of annualized rent) and are buoyed by exceptionally strong tenants like Walmart and Costco.

Essential goods and services made up 24.0% of annualized rent and included tenants like the Bank of Montreal, TD Bank, and Royal Bank of Canada. Value retailers contributed 13.0% of annualized rent and include Dollarama, as well as TJX Companies’ HomeSense and Winners brands.

On May 5th, RIOCF released its first-quarter earnings report for the period ended March 31st, 2025. The company’s revenue fell by 8.5% year-over-year to $255.4 million in the quarter (adjusting for average CAD to USD conversion rates in Q1 2024 and Q1 2025).

Click here to download our most recent Sure Analysis report on RIOCF (preview of page 1 of 3 shown below):

Cheapest Monthly Dividend Stock #5: Ellington Credit Co. (EARN)

Annual Valuation Return: 3.7%

Dividend Yield: 16.8%

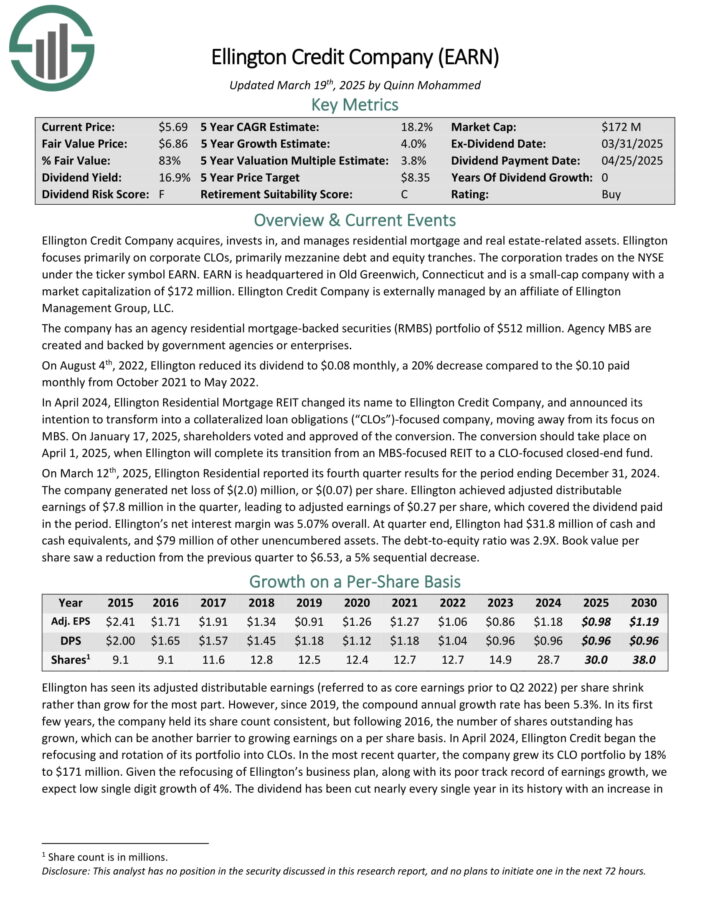

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

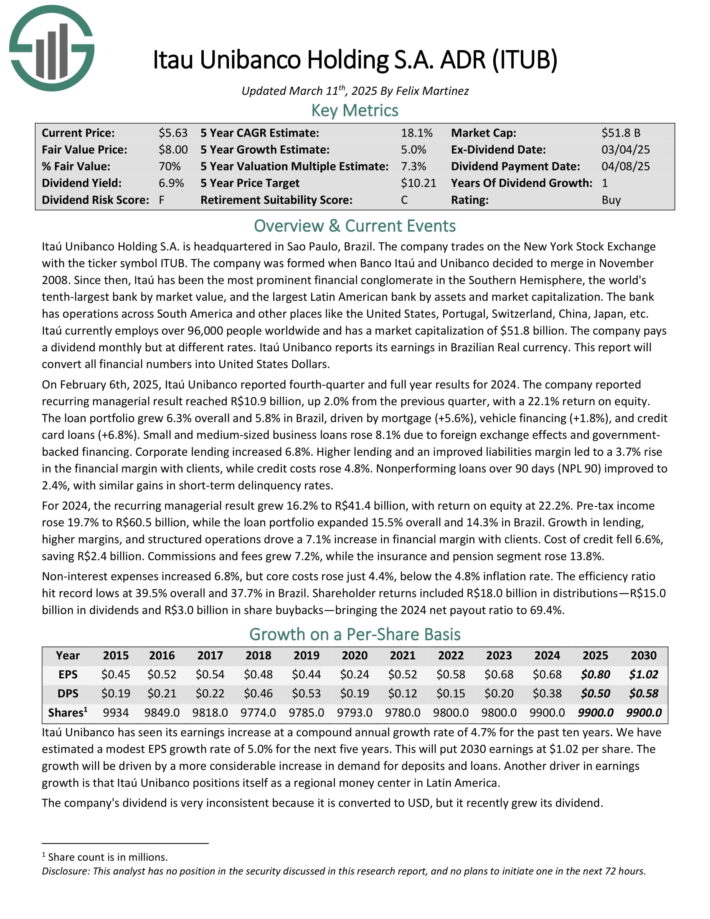

Cheapest Monthly Dividend Stock #4: Itau Unibanco Holding S.A. (ITUB)

Annual Valuation Return: 3.8%

Dividend Yield: 7.5%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On February 6th, 2025, Itaú Unibanco reported fourth-quarter and full year results for 2024. The company reported recurring managerial result reached R$10.9 billion, up 2.0% from the previous quarter, with a 22.1% return on equity.

The loan portfolio grew 6.3% overall and 5.8% in Brazil, driven by mortgage (+5.6%), vehicle financing (+1.8%), and credit card loans (+6.8%).

Small and medium-sized business loans rose 8.1% due to foreign exchange effects and government backed financing. Corporate lending increased 6.8%.

Higher lending and an improved liabilities margin led to a 3.7% rise in the financial margin with clients, while credit costs rose 4.8%. Nonperforming loans over 90 days (NPL 90) improved to 2.4%, with similar gains in short-term delinquency rates.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

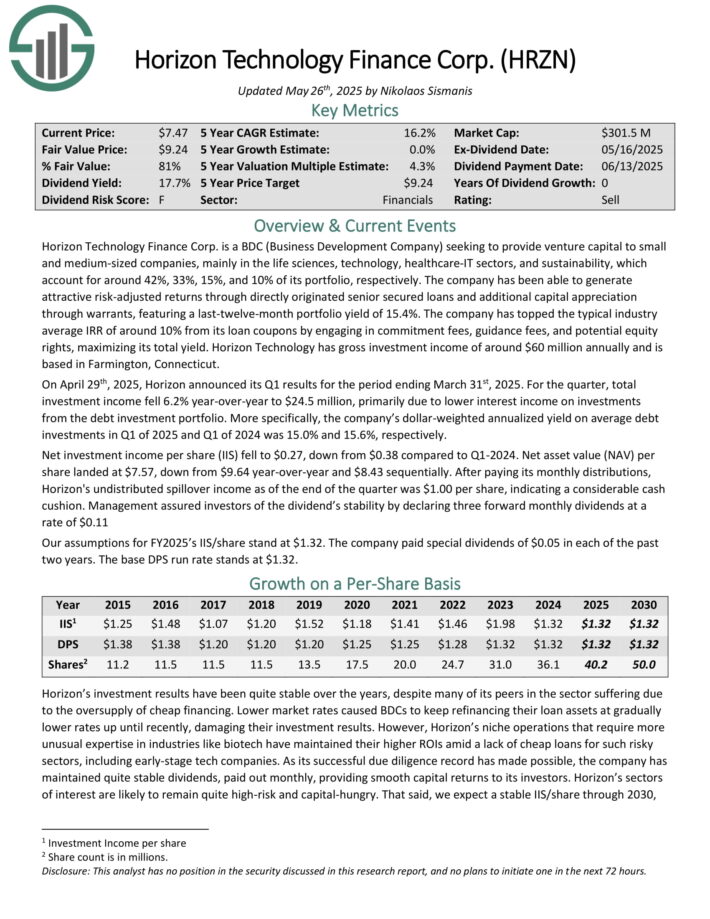

Cheapest Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

Annual Valuation Return: 4.3%

Dividend Yield: 17.6%

Horizon Technology Finance Corp. is a BDC (Business Development Company) seeking to provide venture capital to small and medium-sized companies, mainly in the life sciences, technology, healthcare-IT sectors, and sustainability, which account for around 42%, 33%, 15%, and 10% of its portfolio, respectively.

The company has been able to generate attractive risk-adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants, featuring a last-twelve-month portfolio yield of 15.4%.

The company has topped the typical industry average IRR of around 10% from its loan coupons by engaging in commitment fees, guidance fees, and potential equity rights, maximizing its total yield. Horizon Technology has gross investment income of around $60 million annually and is based in Farmington, Connecticut.

On April 29th, 2025, Horizon announced its Q1 results for the period ending March 31st, 2025. For the quarter, total investment income fell 6.2% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q1 of 2025 and Q1 of 2024 was 15.0% and 15.6%, respectively.

Net investment income per share (IIS) fell to $0.27, down from $0.38 compared to Q1-2024. Net asset value (NAV) per share landed at $7.57, down from $9.64 year-over-year and $8.43 sequentially.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

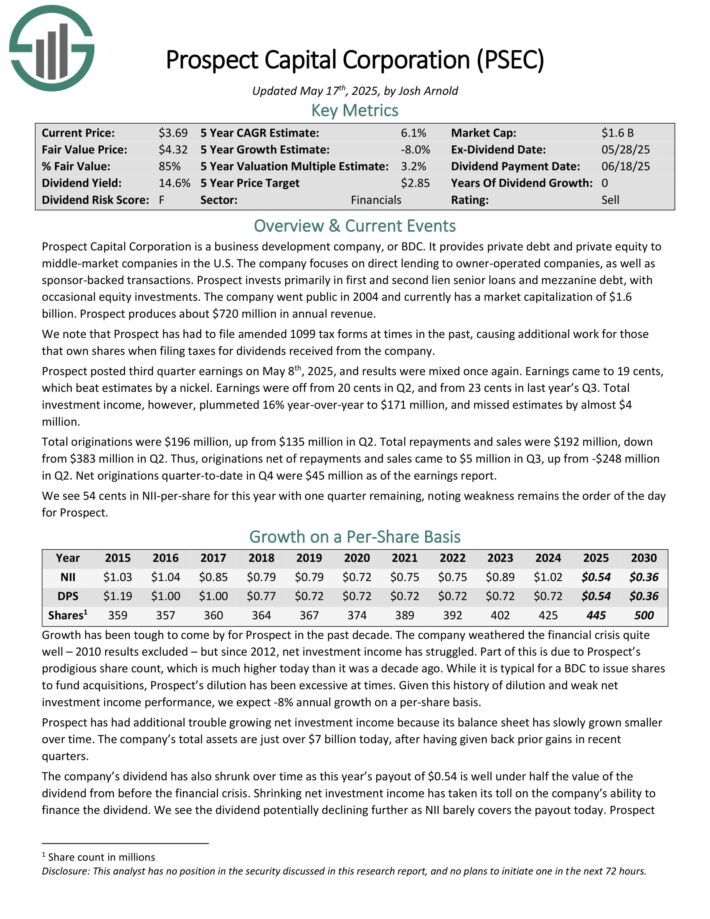

Cheapest Monthly Dividend Stock #2: Prospect Capital (PSEC)

Annual Valuation Return: 5.9%

Dividend Yield: 16.7%

Prospect Capital Corporation is a business development company, or BDC. It provides private debt and private equity to middle-market companies in the U.S. The company focuses on direct lending to owner-operated companies, as well as sponsor-backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted third quarter earnings on May 8th, 2025, and results were mixed once again. Earnings came to 19 cents, which beat estimates by a nickel. Earnings were off from 20 cents in Q2, and from 23 cents in last year’s Q3.

Total investment income, however, plummeted 16% year-over-year to $171 million, and missed estimates by almost $4million.

Total originations were $196 million, up from $135 million in Q2. Total repayments and sales were $192 million, down from $383 million in Q2.

Originations net of repayments and sales came to $5 million in Q3, up from -$248 million in Q2. Net originations quarter-to-date in Q4 were $45 million as of the earnings report.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

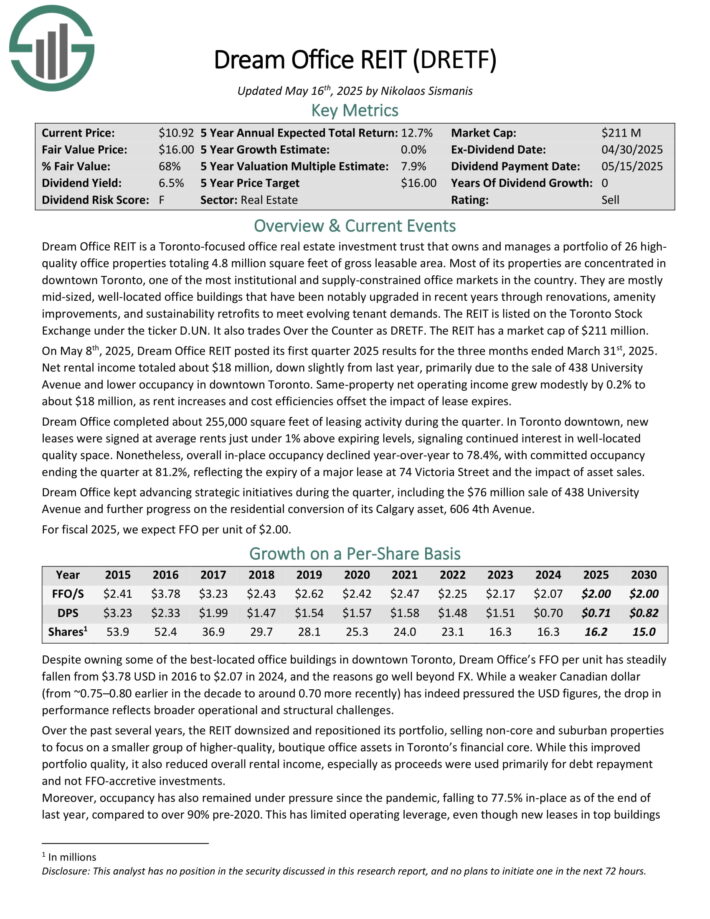

Cheapest Monthly Dividend Stock #1: Dream Office REIT (DRETF)

Annual Valuation Return: 8.3%

Dividend Yield: 6.6%

Dream Office REIT is a Toronto-focused office real estate investment trust that owns and manages a portfolio of 26 high-quality office properties totaling 4.8 million square feet of gross leasable area. Most of its properties are concentrated in downtown Toronto, one of the most institutional and supply-constrained office markets in the country.

They are mostly mid-sized, well-located office buildings that have been notably upgraded in recent years through renovations, amenity improvements, and sustainability retrofits to meet evolving tenant demands.

On May 8th, 2025, Dream Office REIT posted its first quarter 2025 results for the three months ended March 31st, 2025. Net rental income totaled about $18 million, down slightly from last year, primarily due to the sale of 438 University Avenue and lower occupancy in downtown Toronto. Same-property net operating income grew modestly by 0.2% to about $18 million, as rent increases and cost efficiencies offset the impact of lease expires.

Dream Office completed about 255,000 square feet of leasing activity during the quarter. In Toronto downtown, new leases were signed at average rents just under 1% above expiring levels, signaling continued interest in well-located quality space.

Click here to download our most recent Sure Analysis report on DRETF (preview of page 1 of 3 shown below):

Final Thoughts

Although monthly dividend stocks may appear appealing for generating a steady income stream, it’s crucial to bear in mind that not all dividend stocks are created equal.

Each stock carries its own set of risks, and the greater the risk, the more probable it is that shares will appear undervalued.

Investors should scrutinize the cheap valuation of monthly dividend stocks. Nevertheless, our list can serve as an excellent starting point for investors seeking potential opportunities for undervalued investments in the realm of monthly dividend stocks.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.