Updated on October 20th, 2025 by Bob Ciura

Insurance companies often produce a high level of profits each year, because they make money in two ways. First, insurance companies collect premium income on the policies they underwrite.

Second, they are able to make money by investing the large sums of accumulated premiums that have not been paid out as claims.

Due to this, insurance companies have been among the most rewarding to own over the past several decades. In fact, many of the Dividend Aristocrats and Dividend Achievers are in the insurance industry.

You can download our Excel spreadsheet list of over 60 insurance stocks (with important metrics that matter such as P/E ratios and dividend yields) for free by clicking the link below:

Our insurance stocks list is derived from the holdings of two exchange-traded funds:

SPDR S&P Insurance ETF (KIE)

iShares U.S. Insurance ETF (IAK)

The insurance industry has created many great fortunes. That’s because it’s slow changing and highly profitable, if the business is done well. Investing in insurance stocks is how Shelby Davis made $900 million from $50,000 starting in his late 30’s.

In recent years, the insurance industry (and other parts of the financial sector like banks) have struggled from low interest rates, which narrow the spread between what insurance companies can earn on their invested capital, versus what they pay out in claims.

In turn, higher interest rates would be a positive catalyst for insurance stocks, which would see their net investment income rise.

Still, there are a number of insurers that look attractively priced today that are poised to deliver strong total annual returns over the next five years.

This article will rank the top 5 insurance stocks now, in order of expected total annual returns.

Table Of Contents

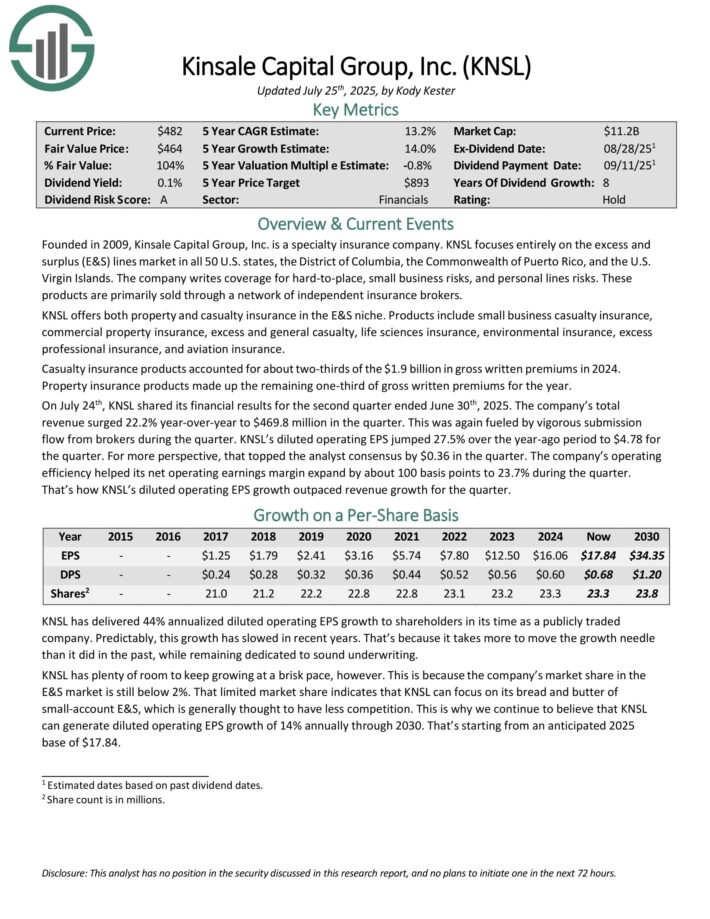

Best Insurance Stock #5: Kinsale Capital Group (KNSL)

5-year expected annual returns: 15.0%

Kinsale Capital Group is a specialty insurance company. KNSL focuses entirely on the excess and surplus (E&S) lines market in all 50 U.S. states, the District of Columbia, the Commonwealth of Puerto Rico, and the U.S. Virgin Islands.

The company writes coverage for hard-to-place, small business risks, and personal lines risks. These are primarily sold through a network of independent insurance brokers.

KNSL offers both property and casualty insurance in the E&S niche. Products include small business casualty insurance, commercial property insurance, excess and general casualty, life sciences insurance, environmental insurance, excess professional insurance, and aviation insurance.

Casualty insurance products accounted for about two-thirds of the $1.9 billion in gross written premiums in 2024. Property insurance products made up the remaining one-third of gross written premiums for the year.

On July 24th, KNSL shared its financial results for the second quarter ended June 30th, 2025. The company’s total revenue surged 22.2% year-over-year to $469.8 million in the quarter. This was again fueled by vigorous submission flow from brokers during the quarter.

Diluted operating EPS jumped 27.5% over the year-ago period to $4.78 for the quarter.

Click here to download our most recent Sure Analysis report on KNSL (preview of page 1 of 3 shown below):

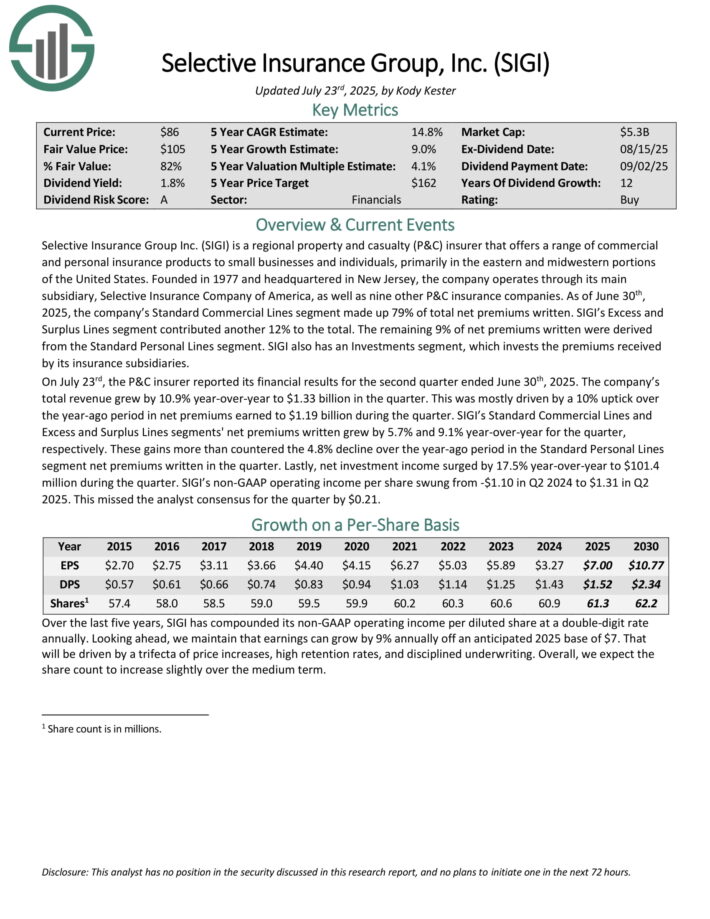

Best Insurance Stock #4: Selective Insurance Group (SIGI)

5-year expected annual returns: 16.1%

Selective Insurance Group is a regional property and casualty (P&C) insurer that offers a range of commercial and personal insurance products to small businesses and individuals, primarily in the eastern and mid-western portions of the United States.

As of June 30th, 2025, the company’s Standard Commercial Lines segment made up 79% of total net premiums written. SIGI’s Excess and Surplus Lines segment contributed another 12% to the total. The remaining 9% of net premiums written were derived from the Standard Personal Lines segment.

SIGI also has an Investments segment, which invests the premiums received by its insurance subsidiaries.

On July 23rd, the P&C insurer reported its financial results for the second quarter ended June 30th, 2025. The company’s total revenue grew by 10.9% year-over-year to $1.33 billion in the quarter. This was mostly driven by a 10% uptick over the year-ago period in net premiums earned to $1.19 billion during the quarter.

SIGI’s Standard Commercial Lines and Excess and Surplus Lines segments’ net premiums written grew by 5.7% and 9.1% year-over-year for the quarter, respectively.

Lastly, net investment income surged by 17.5% year-over-year to $101.4 million during the quarter.

Click here to download our most recent Sure Analysis report on SIGI (preview of page 1 of 3 shown below):

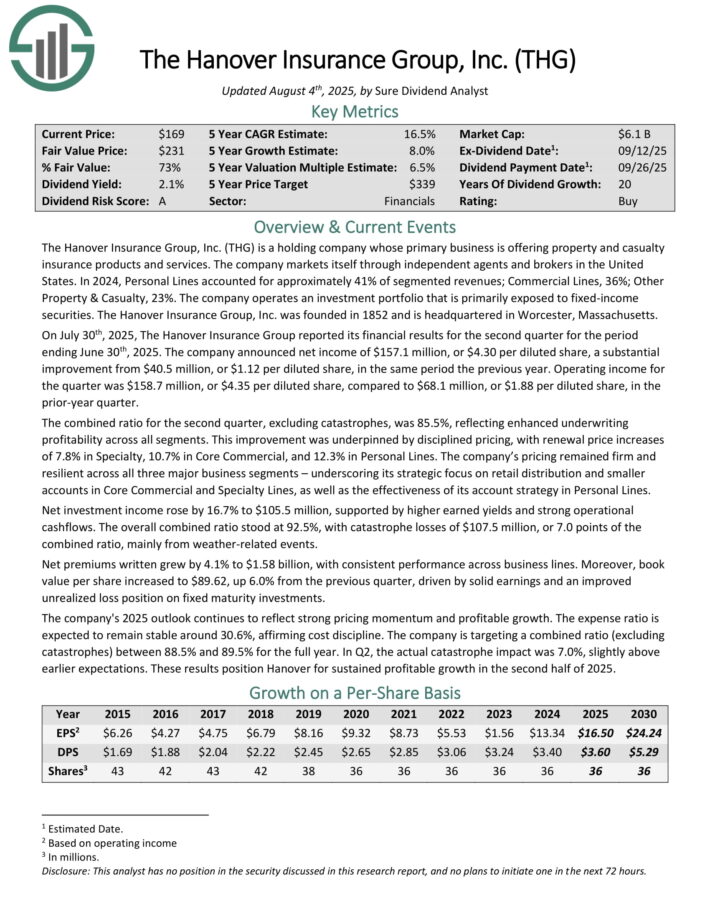

Best Insurance Stock #3: The Hanover Insurance Group (THG)

5-year expected annual returns: 11.3%

The Hanover Insurance Group is a holding company whose primary business is offering property and casualty insurance products and services.

The company markets itself through independent agents and brokers in the United States. In 2024, Personal Lines accounted for approximately 41% of segmented revenues; Commercial Lines, 36%; Other Property & Casualty, 23%. The company operates an investment portfolio that is primarily exposed to fixed-income securities.

On July 30th, 2025, The Hanover Insurance Group reported its financial results for the second quarter for the period ending June 30th, 2025.

The company announced net income of $157.1 million, or $4.30 per diluted share, a substantial improvement from $40.5 million, or $1.12 per diluted share, in the same period the previous year.

Operating income for the quarter was $158.7 million, or $4.35 per diluted share, compared to $68.1 million, or $1.88 per diluted share, in the prior-year quarter.

The combined ratio for the second quarter, excluding catastrophes, was 85.5%, reflecting enhanced underwriting profitability across all segments.

Click here to download our most recent Sure Analysis report on THG (preview of page 1 of 3 shown below):

Best Insurance Stock #2: First American Financial (FAF)

5-year expected annual returns: 17.0%

First American Financial Corporation provides insurance through two segments: title insurance and related services and specialty insurance.

Title insurance and related services include real estate insurance, property closing services, escrow, risk mitigation, real estate data products and related real estate transaction services.

The title insurance sector provides insurance to residential and commercial customers. In 2024, First American Financial generated $6.1 billion in revenue.

On July 23rd, 2025, First American reported second quarter results. The company generated revenue of $1.8 billion, which was a 14% increase compared to the prior year quarter. Adjusted net income soared 20% to $1.53 per share from $1.27 in second quarter 2024.

In July, First American approved a new $300 million share repurchase authorization, good for 4.8% of its float.

Click here to download our most recent Sure Analysis report on FAF (preview of page 1 of 3 shown below):

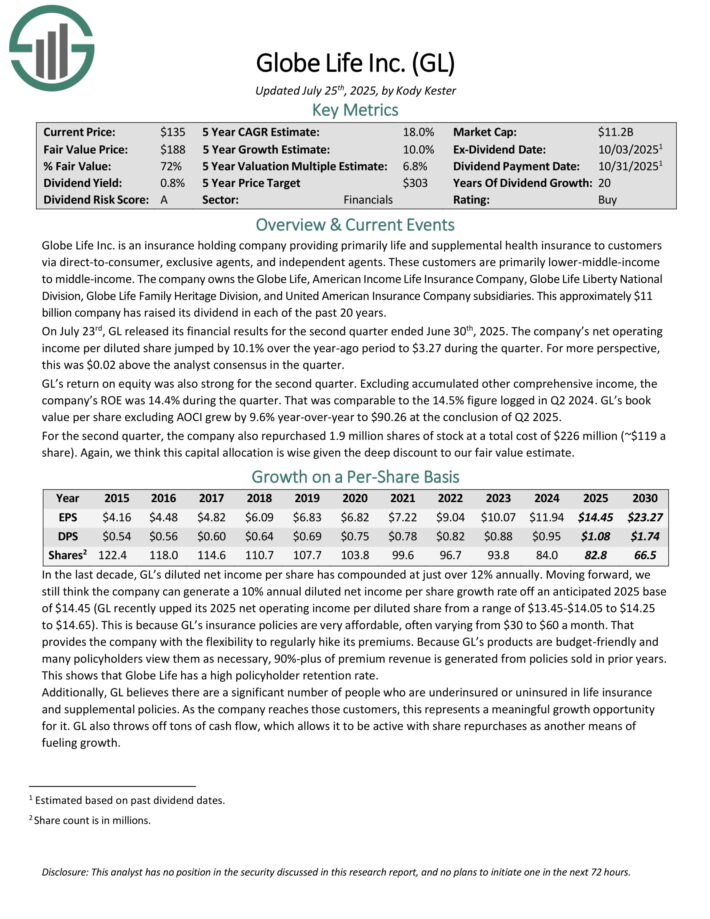

Best Insurance Stock #1: Globe Life (GL)

5-year expected annual returns: 18.1%

Globe Life is an insurance holding company providing primarily life and supplemental health insurance via direct to consumer, exclusive agents, and independent agents. Founded in 1979, Globe Life has raised its dividend every year for the past 20 years.

On July 23rd, GL released its financial results for the second quarter ended June 30th, 2025. The company’s net operating income per diluted share jumped by 10.1% over the year-ago period to $3.27 during the quarter. For more perspective, this was $0.02 above the analyst consensus in the quarter.

GL’s return on equity was also strong for the second quarter. Excluding accumulated other comprehensive income, the company’s ROE was 14.4% during the quarter. That was comparable to the 14.5% figure logged in Q2 2024. GL’s book value per share excluding AOCI grew by 9.6% year-over-year to $90.26 at the conclusion of Q2 2025.

For the second quarter, the company also repurchased 1.9 million shares of stock at a total cost of $226 million (~$119 a share).

Click here to download our most recent Sure Analysis report on GL (preview of page 1 of 3 shown below):

Final Thoughts

Insurance is often considered to be a boring industry, but investors looking for solid annual returns and dividend income should consider insurance stocks.

Many insurance stocks have increased dividends for at least a decade. Some have done so for multiple decades.

Not only has nearly every company on this list exhibited a pattern of steady dividend growth for many years, all have an above-market average dividend yield as well.

As a result, many insurance stocks are appealing for income investors.

Investors looking for exposure to this industry could see strong returns from these top 5 insurance stocks.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 56 stocks with 50+ years of consecutive dividend increases.

The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].