Updated on October 27th, 2025 by Bob CiuraSpreadsheet data updated daily

Income investors looking for quality dividend stocks typically buy large-cap stocks. This is understandable, as many companies with long histories of dividend increases have grown to dominate their respective industries.

But income investors should not automatically dismiss small-cap dividend stocks, as small-cap stocks have historically outperformed large-caps. Many small-cap dividend stocks have strong yields, in addition to their high growth potential.

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. stocks. Accordingly, the Russell 2000 Index can be an intriguing place to look for new investment opportunities.

You can download your free Excel list of Russell 2000 stocks, along with relevant financial metrics like dividend yields and P/E ratios, by clicking on the link below:

Small-cap dividend stocks, generally defined as having market capitalizations below $2 billion, are widely perceived to have better long-term growth potential than large-caps.

Investors can combine this outsized growth potential, with dividends and potential for capital gains through an expanding valuation multiple. As a result, the top small-cap dividend stocks presented here could generate superior returns over the next five years.

The top 10 small-cap stocks list below does not include BDCs, MLPs, or REITs. In addition, the list was filtered to only include stocks with Dividend Risk Scores of C or better in the Sure Analysis Research Database.

This article will list our top 10 small-cap dividend stocks right now, ranked by expected total returns over the next five years.

Table Of Contents

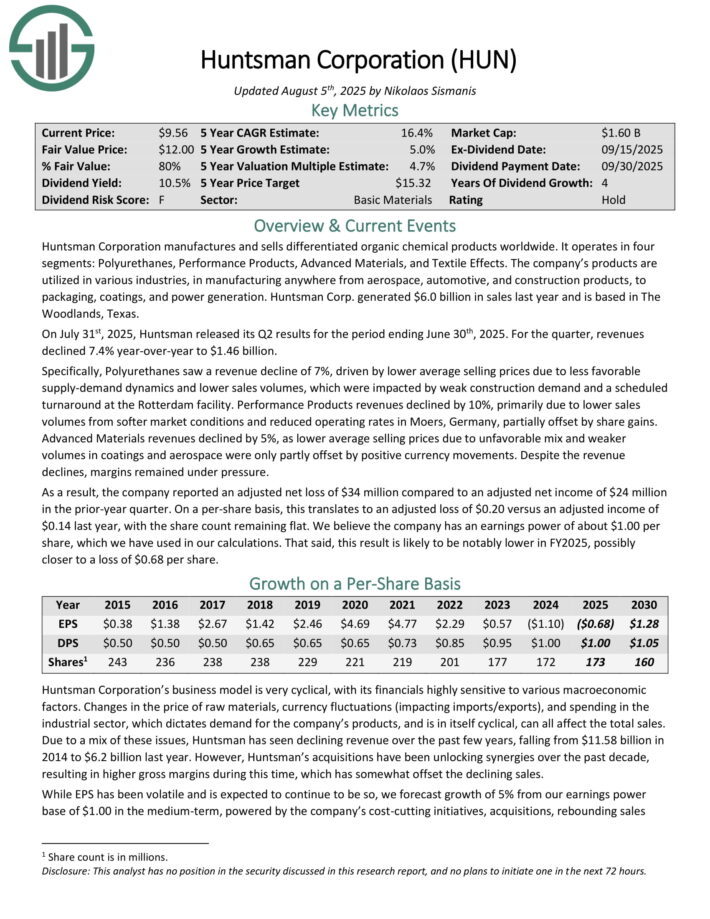

Small-Cap Dividend Stock #10: Huntsman Corp. (HUN)

5-year annual expected returns: 17.5%

Huntsman Corporation manufactures and sells differentiated organic chemical products worldwide. It operates in four segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects.

The company’s products are utilized in various industries, in manufacturing anywhere from aerospace, automotive, and construction products, to packaging, coatings, and power generation. Huntsman Corp. generated $6.0 billion in sales last year and is based in The Woodlands, Texas.

On July 31st, 2025, Huntsman released its Q2 results for the period ending June 30th, 2025. For the quarter, revenues declined 7.4% year-over-year to $1.46 billion. Specifically, Polyurethanes saw a revenue decline of 7%, driven by lower average selling prices due to less favorable supply-demand dynamics and lower sales volumes.

Performance Products revenues declined by 10%, primarily due to lower sales volumes from softer market conditions and reduced operating rates in Moers, Germany, partially offset by share gains.

Advanced Materials revenues declined by 5%, as lower average selling prices due to unfavorable mix and weaker volumes in coatings and aerospace were only partly offset by positive currency movements. Despite the revenue declines, margins remained under pressure.

As a result, the company reported an adjusted net loss of $34 million compared to an adjusted net income of $24 million in the prior-year quarter. On a per-share basis, this translates to an adjusted loss of $0.20 versus an adjusted income of $0.14 last year.

Click here to download our most recent Sure Analysis report on HUN (preview of page 1 of 3 shown below):

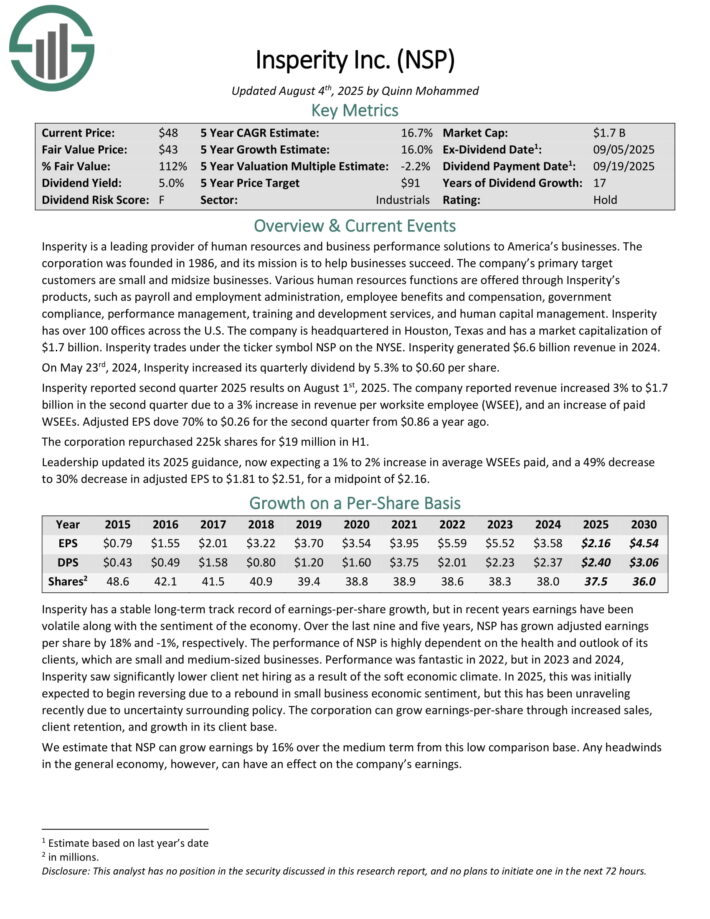

Small-Cap Dividend Stock #9: Insperity Inc. (NSP)

5-year annual expected returns: 17.8%

Insperity is a leading provider of human resources and business performance solutions to America’s businesses. The corporation was founded in 1986, and its mission is to help businesses succeed. The company’s primary target customers are small and midsize businesses.

Various human resources functions are offered through Insperity’s products, such as payroll and employment administration, employee benefits and compensation, government compliance, performance management, training and development services, and human capital management.

Insperity has over 100 offices across the U.S. Insperity generated $6.6 billion revenue in 2024.

Insperity reported second quarter 2025 results on August 1st, 2025. The company reported revenue increased 3% to $1.7 billion in the second quarter due to a 3% increase in revenue per worksite employee (WSEE), and an increase of paid WSEEs.

Adjusted EPS dove 70% to $0.26 for the second quarter from $0.86 a year ago. The corporation repurchased 225k shares for $19 million in H1.

Click here to download our most recent Sure Analysis report on NSP (preview of page 1 of 3 shown below):

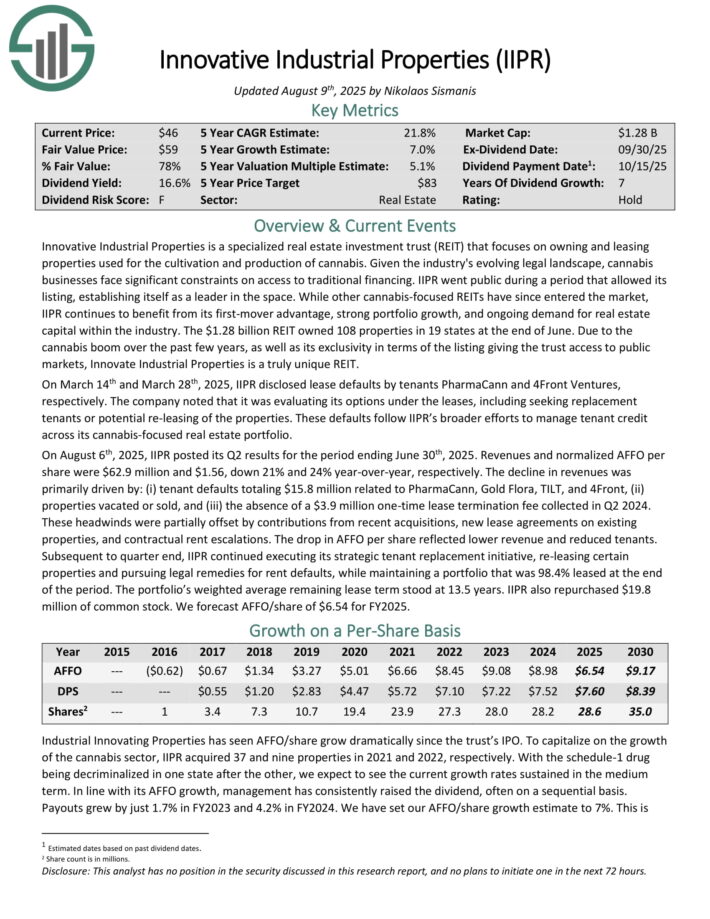

Small-Cap Dividend Stock #8: Innovative Industrial Properties (IIPR)

5-year annual expected returns: 18.0%

Innovative Industrial Properties, Inc. is a single-use “specialty REIT” that exclusively focuses on owning properties used for the cultivation and production of cannabis.

Approximately 92% of IIPR’s properties are industrial, with retail comprising 2% and blended properties the remaining 6%.

On August 6th, 2025, IIPR posted its Q2 results for the period ending June 30th, 2025. Revenues and normalized AFFO per share were $62.9 million and $1.56, down 21% and 24% year-over-year, respectively. The decline in revenues was primarily driven by tenant defaults totaling $15.8 million related to PharmaCann, Gold Flora, TILT, and 4Front.

These headwinds were partially offset by contributions from recent acquisitions, new lease agreements on existing properties, and contractual rent escalations. The drop in AFFO per share reflected lower revenue and reduced tenants.

Subsequent to quarter end, IIPR continued executing its strategic tenant replacement initiative, re-leasing certain properties and pursuing legal remedies for rent defaults, while maintaining a portfolio that was 98.4% leased at the end of the period. The portfolio’s weighted average remaining lease term stood at 13.5 years.

Click here to download our most recent Sure Analysis report on IIPR (preview of page 1 of 3 shown below):

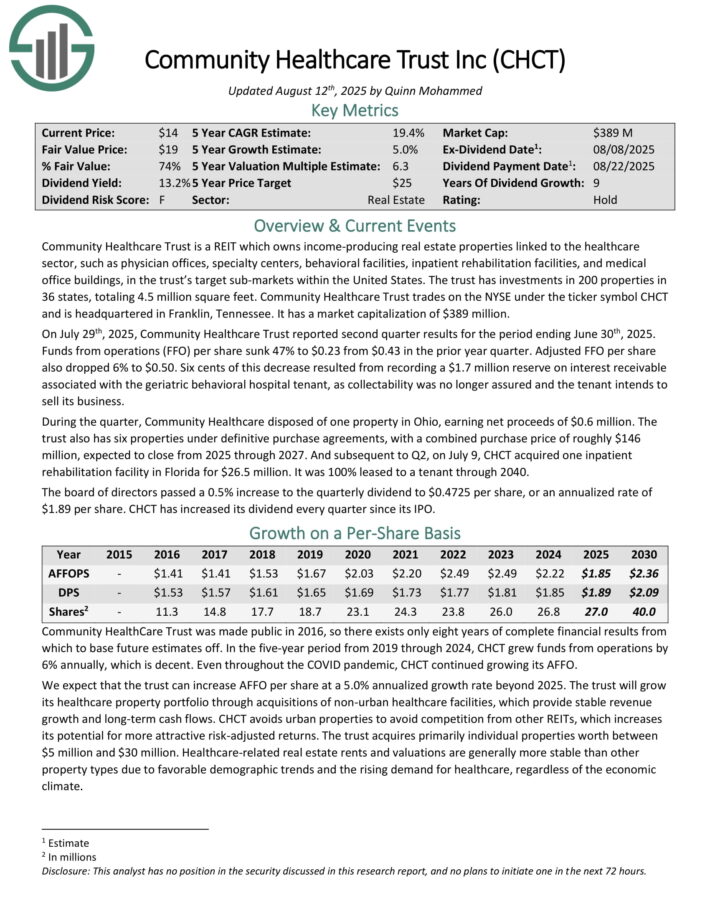

Small-Cap Dividend Stock #7: Community Healthcare Trust (CHCT)

5-year annual expected returns: 18.1%

Community Healthcare Trust owns income-producing real estate properties linked to the healthcare sector, such as physician offices, specialty centers, behavioral facilities, inpatient rehabilitation facilities, and medical office buildings, in the trust’s target sub-markets within the United States.

The trust has investments in 200 properties in 36 states, totaling 4.5 million square feet.

On July 29th, 2025, Community Healthcare Trust reported second quarter results for the period ending June 30th, 2025.

Funds from operations per share sank 47% to $0.23 from $0.43 in the prior year quarter. Adjusted FFO per share also dropped 6% to $0.50.

Six cents of this decrease resulted from recording a $1.7 million reserve on interest receivable associated with the geriatric behavioral hospital tenant, as collectability was no longer assured and the tenant intends to sell its business.

During the quarter, Community Healthcare disposed of one property in Ohio, earning net proceeds of $0.6 million. The trust also has six properties under definitive purchase agreements, with a combined purchase price of roughly $146 million, expected to close from 2025 through 2027.

And subsequent to Q2, on July 9, CHCT acquired one inpatient rehabilitation facility in Florida for $26.5 million. It was 100% leased to a tenant through 2040.

Click here to download our most recent Sure Analysis report on CHCT (preview of page 1 of 3 shown below):

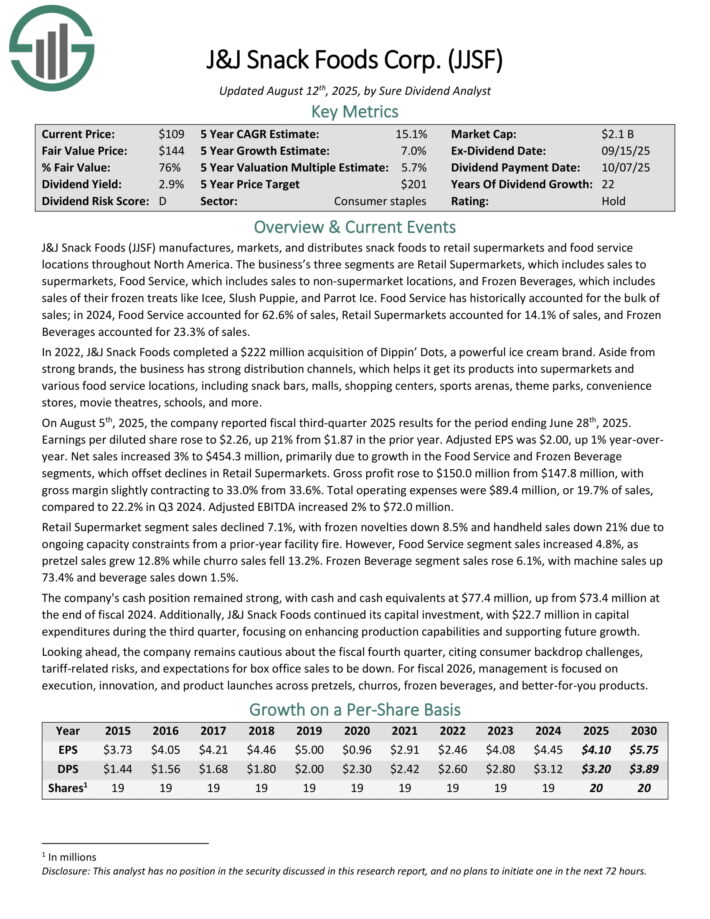

Small-Cap Dividend Stock #6: J&J Snack Foods Corp. (JJSF)

5-year annual expected returns: 19.3%

J&J Snack Foods (JJSF) manufactures, markets, and distributes snack foods to retail supermarkets and food service locations throughout North America.

The business’s three segments are Retail Supermarkets, which includes sales to supermarkets, Food Service, which includes sales to non-supermarket locations, and Frozen Beverages, which includes sales of their frozen treats like Icee, Slush Puppie, and Parrot Ice.

Food Service has historically accounted for the bulk of sales; in 2024, Food Service accounted for 62.6% of sales, Retail Supermarkets accounted for 14.1% of sales, and Frozen Beverages accounted for 23.3% of sales.

On August 5th, 2025, the company reported fiscal third-quarter 2025 results for the period ending June 28th, 2025. Earnings per diluted share rose to $2.26, up 21% from $1.87 in the prior year. Adjusted EPS was $2.00, up 1% year-over-year.

Net sales increased 3% to $454.3 million, primarily due to growth in the Food Service and Frozen Beverage segments, which offset declines in Retail Supermarkets. Gross profit rose to $150.0 million from $147.8 million, with gross margin slightly contracting to 33.0% from 33.6%. Total operating expenses were $89.4 million, or 19.7% of sales, compared to 22.2% in Q3 2024. Adjusted EBITDA increased 2% to $72.0 million.

Retail Supermarket segment sales declined 7.1%, with frozen novelties down 8.5% and handheld sales down 21% due to ongoing capacity constraints from a prior-year facility fire. However, Food Service segment sales increased 4.8%, as pretzel sales grew 12.8% while churro sales fell 13.2%. Frozen Beverage segment sales rose 6.1%, with machine sales up 73.4% and beverage sales down 1.5%.

Click here to download our most recent Sure Analysis report on JJSF (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #5: Horizon Technology Finance (HRZN)

5-year annual expected returns: 19.4%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

On August 7th, 2025, Horizon announced its Q2 results for the period ending June 30th, 2025. For the quarter, total investment income fell 4.5% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Net investment income per share (IIS) fell to $0.28, down from $0.36 compared to Q2-2024. Net asset value (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of the end of the quarter was $0.94 per share, indicating a considerable cash cushion. Management assured investors of the dividend’s stability by declaring three forward monthly dividends at a rate of $0.11.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

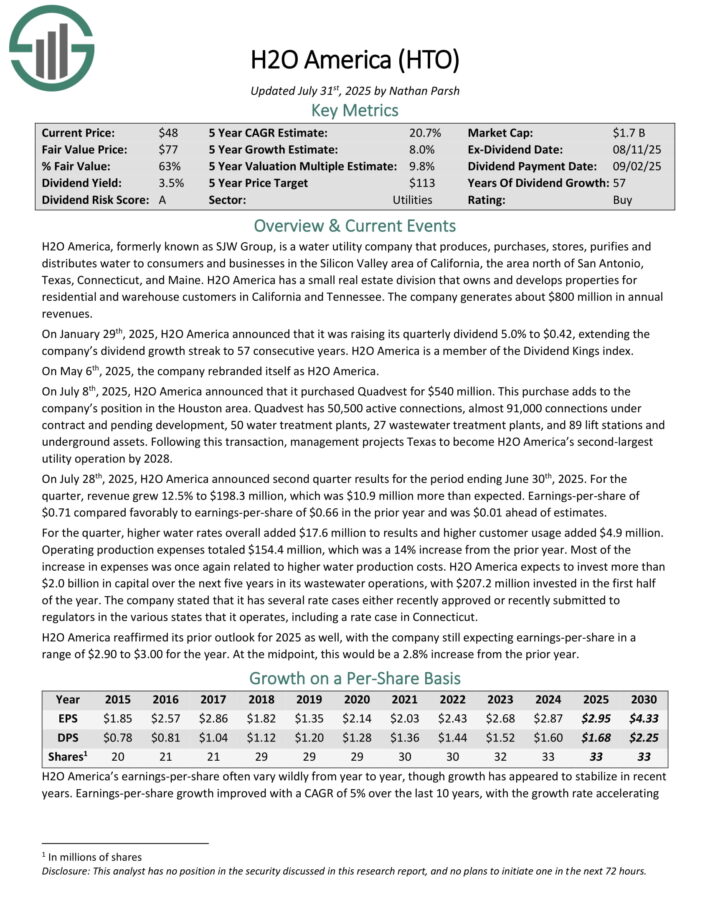

Small-Cap Dividend Stock #4: H2O America (HTO)

5-year annual expected returns: 19.4%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

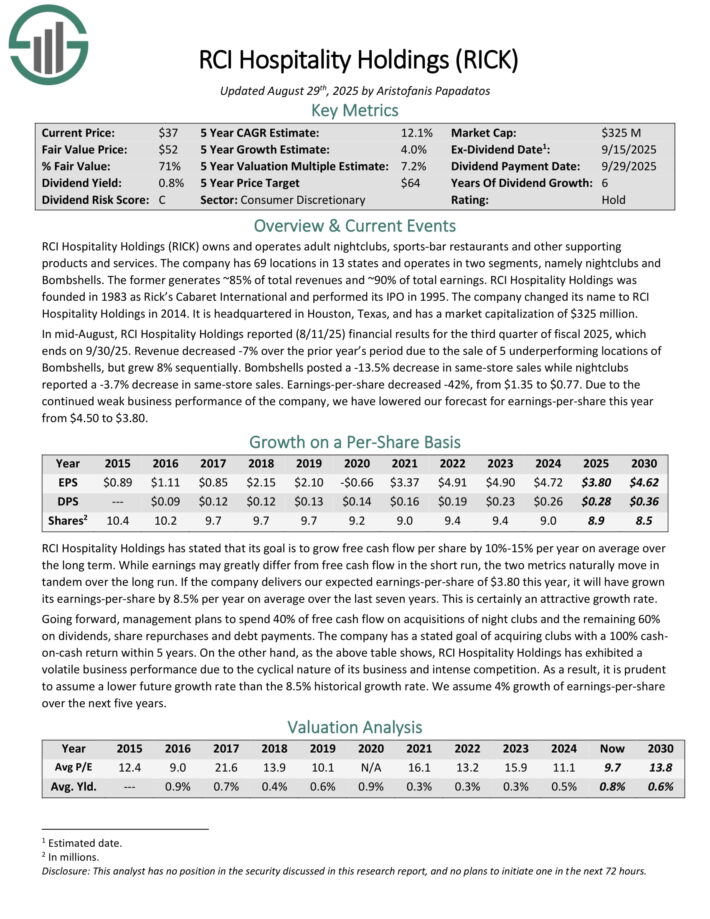

Small-Cap Dividend Stock #3: RCI Hospitality Holdings (RICK)

5-year annual expected returns: 19.6%

RCI Hospitality Holdings owns and operates adult nightclubs, sports-bar restaurants and other supporting products and services.

The company has 69 locations in 13 states and operates in two segments, namely nightclubs and Bombshells. The former generates ~85% of total revenues and ~90% of total earnings.

RCI Hospitality Holdings was founded in 1983 as Rick’s Cabaret International and performed its IPO in 1995. The company changed its name to RCI Hospitality Holdings in 2014. It is headquartered in Houston, Texas.

In mid-August, RCI Hospitality Holdings reported (8/11/25) financial results for the third quarter of fiscal 2025, which ends on 9/30/25. Revenue decreased -7% over the prior year’s period due to the sale of 5 under-performing locations of Bombshells, but grew 8% sequentially.

Bombshells posted a -13.5% decrease in same-store sales while nightclubs reported a -3.7% decrease in same-store sales. Earnings-per-share decreased -42%, from $1.35 to $0.77..

Click here to download our most recent Sure Analysis report on RICK (preview of page 1 of 3 shown below):

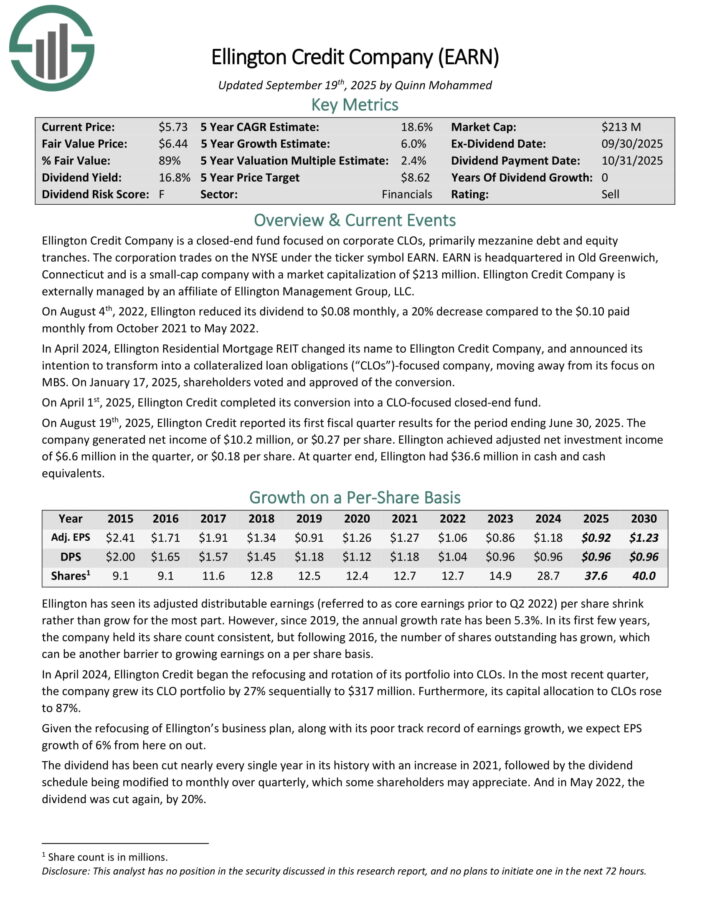

Small-Cap Dividend Stock #2: Ellington Credit Co. (EARN)

5-year annual expected returns: 20.2%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

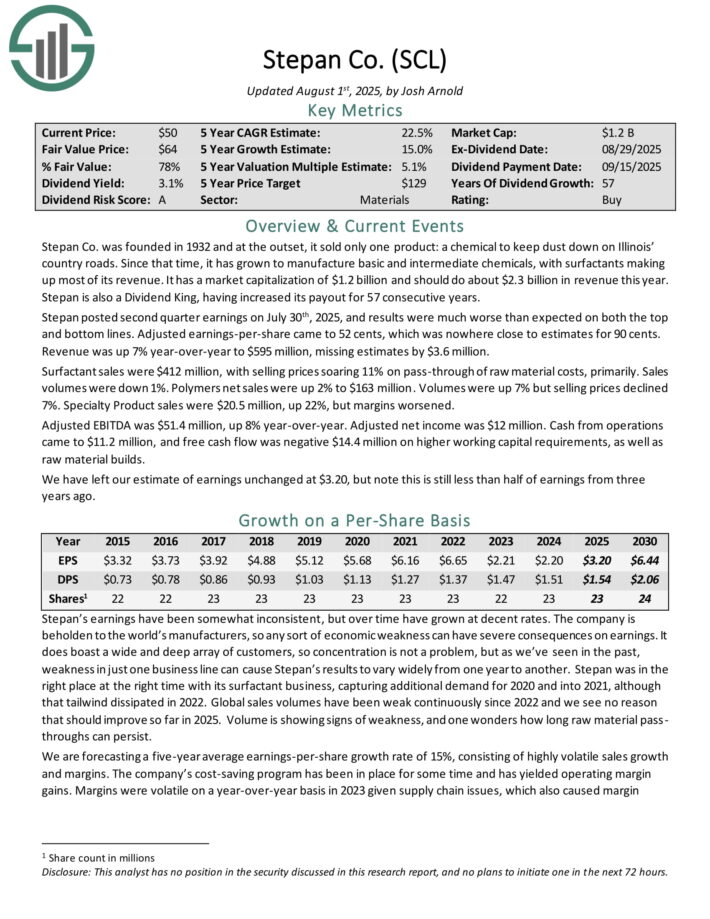

Small-Cap Dividend Stock #1: Stepan Co. (SCL)

5-year annual expected returns: 24.5%

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to just a handful of industries.

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted second quarter earnings on July 30th, 2025, and results were much worse than expected on both the top and bottom lines. Adjusted earnings-per-share came to 52 cents, which was nowhere close to estimates for 90 cents. Revenue was up 7% year-over-year to $595 million, missing estimates by $3.6 million.

Surfactant sales were $412 million, with selling prices soaring 11% on pass-through of raw material costs, primarily. Sales volumes were down 1%. Polymers net sales were up 2% to $163 million. Volumes were up 7% but selling prices declined 7%. Specialty Product sales were $20.5 million, up 22%, but margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted net income was $12 million. Cash from operations came to $11.2 million, and free cash flow was negative $14.4 million on higher working capital requirements, as well as raw material builds.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

Small-cap dividend stocks could generate stronger growth than their large-cap peers, due to their smaller sizes. In addition, many small-cap stocks pay dividends to shareholders.

The 10 small-cap dividend stocks on this list all pay dividends, have a positive growth outlook, and could generate solid total returns.

In addition to small cap dividend stocks, Sure Dividend maintains similar databases on the following useful universes of stocks:

The Dividend Aristocrats List: 66 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases.

High Dividend Stocks: Stocks with 5%+ dividend yields.

Monthly Dividend Stocks: our database currently contains more than 30 stocks that pay dividends every month.

Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].