Published on November 6th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Universal Health Realty Income Trust (UHT) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Universal Health Realty Income Trust (UHT).

Business Overview

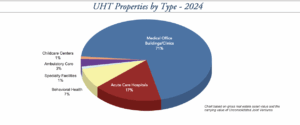

Universal Health Realty Income Trust is a real estate investment trust (REIT) focused on healthcare. Founded in 1986, the company specializes in owning and managing healthcare and human service-related facilities, including acute care hospitals, medical office buildings, rehabilitation and behavioral health hospitals, sub-acute care centers, and childcare facilities. Its targeted approach allows UHT to capitalize on the growing demand for healthcare infrastructure while maintaining a diversified portfolio of specialized properties.

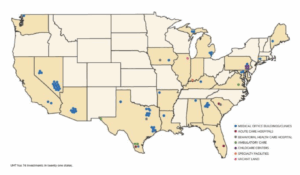

As of now, UHT’s portfolio includes 76 properties across 21 states, reflecting a broad geographic presence and market reach. The company has a market capitalization of $537 million, positioning it as a mid-sized player in the healthcare REIT sector. Through strategic property ownership and leases, UHT generates stable rental income while supporting healthcare providers across multiple care settings, combining real estate expertise with a focus on the expanding healthcare industry.

Source: Investor Relations

The company reported Q3 2025 net income of $4.0 million, or $0.29 per diluted share, unchanged from Q3 2024. Funds from operations (FFO), which excludes depreciation and amortization, rose to $12.2 million, or $0.88 per share, from $11.3 million, driven by a one-time settlement gain. For the nine months ended September 30, 2025, net income fell to $13.3 million, or $0.96 per share, from $14.6 million, while FFO remained steady at $35.9 million, or $2.59 per share.

The company paid a Q3 dividend of $0.74 per share and had $67.9 million available under its $425 million credit line. UHT also entered into a ground lease to develop the 80,000-square-foot Palm Beach Gardens Medical Plaza I in Florida, with construction scheduled to start in November 2025 at a cost of $34 million. A 10-year lease covers roughly 75% of the building’s space.

UHT invests in healthcare-related properties across 21 states, including hospitals, medical offices, and specialty facilities. While FFO is a key measure of REIT performance, results may be affected by factors such as changes in Medicaid funding, labor shortages, regulations, patient volumes, supply costs, and interest rates.

Growth Prospects

The company is well-positioned for growth due to favorable demographic trends in the U.S. As the population of over 70 million Baby Boomers continues to age, demand for healthcare services and facilities is expected to rise, creating long-term tailwinds for REITs specializing in healthcare properties. For investors, funds from operations (FFO) provides a more accurate measure of performance than traditional EPS, as it excludes non-cash expenses such as depreciation, which can distort earnings for real estate trusts.

The trust plans to grow by increasing rents on existing properties and selectively acquiring new healthcare assets. While issuing equity to fund acquisitions may modestly dilute per-share metrics, these strategies are expected to support steady growth. Over the intermediate term, Universal Health anticipates low-single-digit annualized growth of approximately 2.5%, reflecting the company’s historically consistent performance and its ability to capitalize on the expanding demand for healthcare infrastructure.

Competitive Advantages & Recession Performance

Universal Health Realty Income Trust has key competitive advantages, including a diversified portfolio of 76 healthcare properties across 21 states and long-term leases with specialized tenants. Its focus on hospitals, medical offices, rehabilitation and behavioral health centers, and childcare facilities creates stable rental income and high barriers to entry for competitors.

The trust has proven resilient during economic downturns, as demand for healthcare services remains largely non-discretionary. Using funds from operations (FFO) as a performance measure highlights consistent cash generation, supporting steady dividends and strategic growth even in recessionary periods.

Source: Investor Relations

Dividend Analysis

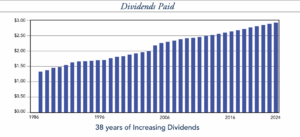

The company’s annual dividend is $2.96 per share. At its recent share price, the stock has a high yield of 7.6%.

Given the company’s 2025 earnings outlook, FFO is expected to be $3.67 per share. As a result, the company is expected to pay out roughly 81% its FFO to shareholders in dividends.

Source: Investor Relations

Final Thoughts

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].