Despite a brief return to normalcy in 2022, equity factor strategies have experienced performance challenges relative to cap-weighted indexes since the COVID-19-induced market crash of 2020. While there are many explanations for these challenges, our focus here is on another question:

Is it possible to retain the benefits and economically sound basis of a factor approach to equity investing while more closely aligning a factor portfolio’s performance with a cap-weighted benchmark?

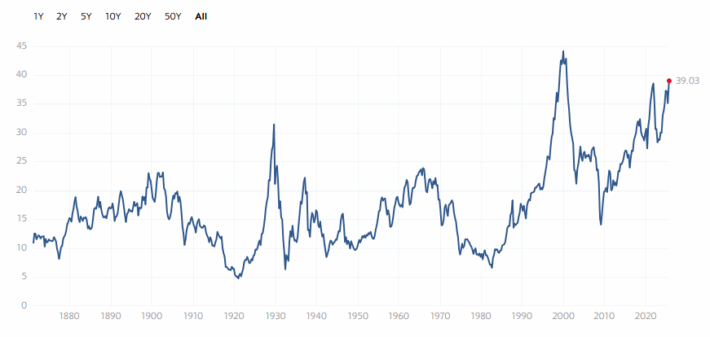

Before we answer that, let us briefly review the drawbacks of cap-weighted indexes. In cap-weighted indexes, companies with higher market caps receive a higher weighting in the index. Smaller companies, on the other hand, which presumably have the most room to grow, receive a lower weighting. The risk inherent in investing in cap-weighted index strategies is threefold. One, they may experience losses as companies with the largest weights “mean revert” to lower price levels. Second, by underweighting smaller companies, cap-weighted strategies may prevent investors from meaningfully benefiting from companies with the most growth potential. Finally, cap-weighted index strategies are relatively concentrated in a small subset of the largest stocks. This lack of diversification runs against a cornerstone of modern investing and leaves investors vulnerable to significant downside risk if one or more of the largest companies in the index experience large drawdowns.

In contrast, a properly constructed equity factor strategy will be driven by risk factors that have been shown to reward investors over the longer term. These factors — Value, Momentum, Size, Profitability, Investment, and Low Volatility — have been empirically validated over several decades by various researchers and possess a clear and intuitive economic rationale. Multi-factor portfolios that have exposure to all six factors are typically more diversified and lower volatility investment vehicles compared with cap-weighted indexes and the products that emulate their behavior. While the latter characteristics have served factor portfolios well, as we have seen, in some market environments, equity factor portfolios may underperform cap-weighted strategies. The question is: Is there a way to retain the benefits of factor investing while staying more aligned with the performance of cap-weighted indexes?

What Is to Be Done?

As we show below, a binary choice between factor investing and cap-weighted-like performance is not necessary. While tilting towards cap-weighted benchmarks in a wholesale manner will likely not benefit investors in the long run, there is a middle way: continue investing in a factor strategy but apply tracking error constraints to reduce the performance gap between cap-weighted and “unconstrained” factor portfolios over a given period. As our analysis demonstrates, applying the latter adjustments to a factor portfolio has both pros and cons, both in the short and long term.

How Do Tracking Error Constrained Factor Portfolios Behave?

The chart below shows the recent performance differences between a standard six factor portfolio –where each factor has equal weight — and tracking error (TE) constrained variants of it. When we apply TE constraints, the table indicates the performance gap between the factor portfolios and the cap-weighted index shrinks considerably. The cost that these portfolios pay, however, is around 100 basis points (bps) of additional volatility and a deterioration of downside protection, as measured by maximum drawdown.

Factor Portfolios with Tracking Error Constraints,31 December 2022 to 30 June 2023

The sector composition of the TE-controlled portfolios in the following table shows that the strong underexposure to the Technology sector falls significantly relative to the standard multi-factor portfolio. This may not come as much of a surprise. After all, larger technology companies have been one of the primary drivers of the outperformance of cap-weighted vehicles relative to equity factor strategies.

Sector Allocations as of 30 June 2023

Over a longer measurement horizon, the following chart demonstrates that controlling for TE detracts from long-term risk-adjusted performance by increasing volatility and reducing returns. The information ratios and the probability of outperforming the cap-weighted index over various horizons also deteriorate slightly.

Long-Term Risk Adjusted Performance,30 June 1971 to 31 December 2022

Conclusion

Tracking error risk control is an effective way to manage the out-of-sample tracking error of multi-factor indices, and it can also help reduce sector deviations of multi-factor indices. We don’t have to throw out the baby with the bathwater.

However, over the long term, aligning a factor portfolio’s performance with a cap-weighted index may be detrimental to both absolute and risk-adjusted returns. Moreover, simple cap-weighted approaches to equity investing lack the economic and conceptual foundations to justify their use. While they may outperform in certain market environments, they do not possess the formula for superior long-term risk-adjusted performance.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/ Wengen Ling

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.