Updated on July 8th, 2025 by Nathan Parsh

Only the best companies can increase dividends through multiple recessions.

The Dividend Kings are a group of stocks that have increased their dividends for at least 50 consecutive years. Accomplishing this task is no small feat. The fact that only 55 companies meet the requirement to become a Dividend King is evidence of this.

You can see all 55 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Johnson & Johnson (JNJ) has increased its dividend for 63 consecutive years, one of the longest dividend growth streaks in the stock market.

This healthcare giant is one of the most popular dividend growth stocks due to its excellent recession-resistant business model and strong dividend track record.

Johnson & Johnson stock remains an excellent holding for long-term dividend growth.

Business Overview

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. Johnson & Johnson is a mega-cap stock with a market capitalization of $376 billion. The company generates annual sales of $89 billion.

Johnson & Johnson operates a diversified business model, enabling it to appeal to a broad range of customers within the healthcare sector. J&J now operates two segments: pharmaceuticals and medical devices, following the spin-off of its consumer health businesses.

Growth Prospects

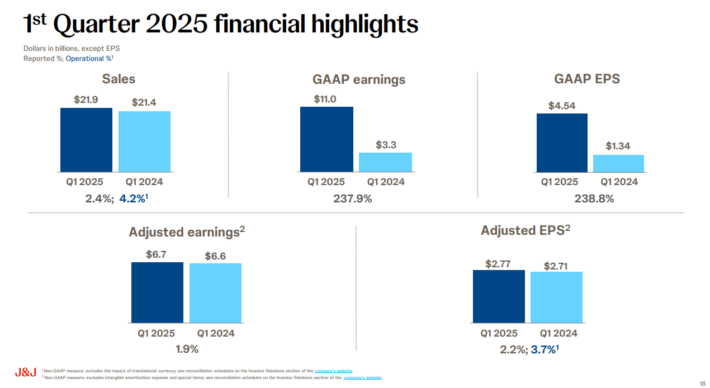

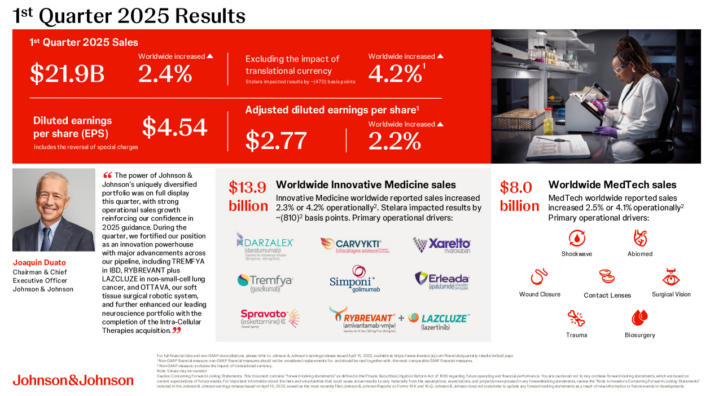

Johnson & Johnson reported first-quarter results on April 15th, 2025.

Source: Investor Presentation

For the period, revenue grew 2.4% to $21.9 billion while adjusted earnings-per-share of $2.77 improved from $2.71 in the prior year. Both results topped the market’s expectations.

Regionally, U.S. sales increased by 5.9%, while international markets declined by 1.8%, resulting in a 2.4% growth in total worldwide sales. Adjusting for currency exchange, revenue grew 4.2% worldwide.

The Innovative Medicine segment reported 4.2% currency-neutral growth, driven by products in oncology, cardiovascular, and metabolism. MedTech had a 4.1% increase, with growth driven by cardiovascular and vision products. Despite some slowdowns in specific product categories, both segments contributed to the company’s positive performance.

Johnson & Johnson revised its full-year 2025 guidance to reflect better operational performance. The company anticipates adjusted operational EPS to be in the range of $10.50 to $10.70, down from the previously reported range of $10.75 to $10.95. Sales for 2025 are expected to grow between 3.0% and 3.9%, demonstrating confidence in sustained growth despite short-term earnings pressures.

Source: Investor Presentation

We expect Johnson & Johnson to generate 6% annual earnings-per-share growth over the next five years. The pharmaceutical segment will continue to be the company’s main growth driver, as it has for several years.

Competitive Advantages & Recession Performance

Johnson & Johnson has multiple advantages over its competitors.

Johnson & Johnson’s size and scale are unmatched in its industry. It also has a AAA credit rating from Standard & Poor’s and Moody’s Investors Service, which is higher than the U.S. government’s.

Microsoft Corporation (MSFT) is the only other company with an AAA credit rating.

The company’s size and scale, along with its credit rating, provide Johnson & Johnson with the financial flexibility to make acquisitions that fuel further growth.

Johnson & Johnson also invests heavily in research and development to bring new products to market. This investment has resulted in the company’s extensive portfolio of brands that lead their respective categories.

These competitive advantages allowed Johnson & Johnson to weather multiple recessions. Listed below are the company’s earnings-per-share results before, during, and after the last major recession:

2006 earnings-per-share: $3.76

2007 earnings-per-share: $4.15 (9.4% increase)

2008 earnings-per-share: $4.57 (10.1% increase)

2009 earnings-per-share: $4.63 (1.3% increase)

2010 earnings-per-share: $4.76 (2.8% increase)

Johnson & Johnson had EPS growth of almost 12% from 2007 through 2009, an impressive accomplishment given the circumstances of the Great Recession.

The company’s dividend also continued to grow. With six decades of dividend growth, Johnson & Johnson is likely to continue increasing its dividend well into the future.

Johnson & Johnson’s competitive advantages and recession performance make the stock an excellent defensive stock.

Valuation & Expected Returns

With a current share price of $157 and expected earnings per share of $10.60 for the year, Johnson & Johnson has a price-to-earnings ratio of 14.8.

We view the stock as slightly undervalued, with a fair value P/E estimate of 17. Expansion of the P/E multiple from 14.8 to 17 would increase annual returns by 2.8% over the next five years.

Total returns will also consist of earnings growth and dividends.

Given the company’s competitive advantages and recent business performance, we feel that a 6% average annual EPS growth rate is achievable over the next five years.

Finally, Johnson & Johnson stock has a current dividend yield of 3.3%. Therefore, total annual returns are expected to be 11.6% annually through 2030.

Final Thoughts

Few Dividend Kings are as well-known or popular among dividend growth investors as Johnson & Johnson.

For good reason, Johnson & Johnson’s diversified business model has enabled the company to endure several recessions while still increasing its dividends for the past 63 years. This growth streak is nearly unmatched.

Additionally, the stock is trading at a very attractive valuation, in our opinion. Overall, projected returns earn the stock a buy recommendation.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].