Updated on July 15th, 2025 by Nathan Parsh

Investors seeking stocks with a long history of dividend growth should consider the Dividend Kings. This elite group of stocks has the longest streaks of annual dividend increases. The Dividend Kings have each raised their dividends for at least 50 consecutive years.

To be a Dividend King, a company must have a robust business model with competitive advantages, as well as the ability to navigate economic recessions. It should be no surprise that we consider the Dividend Kings to be among the highest-quality dividend stocks in the entire stock market.

We compiled a comprehensive list of all 55 Dividend Kings, including key financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios. You can download the full list by clicking on the link below:

Altria raised its dividend by 4.1% in 2024, marking the company’s 55th consecutive year of dividend growth. The company enjoys numerous competitive advantages that have allowed it to raise its dividend for so long.

With a high dividend yield of 7.0%, Altria stock could be an attractive option for income investors.

Business Overview

Altria sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under various brands, including Marlboro, Skoal, and Copenhagen.

The company also has a 10% equity stake in Anheuser-Busch InBev (BUD) and a 45% stake in the cannabis company Cronos Group (CRON).

Related: 2025 Tobacco Stocks List | The 6 Best Now, Ranked In Order

Smokeable tobacco products still comprise the vast majority of Altria’s revenue and profit. The Marlboro brand continues to hold a leading market share in the U.S. market.

Source: Investor Presentation

Over the past several decades, this has served the company (and its shareholders) exceptionally well. Altria has increased its dividend for 55 consecutive years. While high dividend yields are common among tobacco stocks, no company has a longer dividend increase streak than Altria.

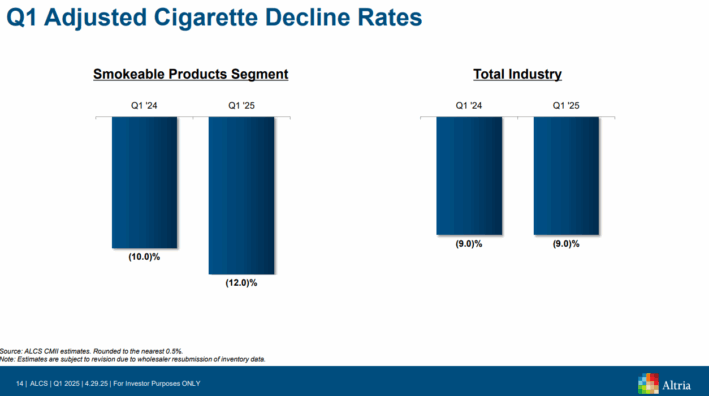

The company reported its Q1 2025 financial results on April 29th, 2025, with mixed results. The company reported an EPS of $1.23, representing a 6% increase from the prior year and surpassing estimates by $0.04. Revenue, net of excise taxes, totaled $4.52 billion, a 4.2% year-over-year decline and $96 million below expectations. Total net revenue was $5.26 billion, a 5.7% decline from Q1 2024.

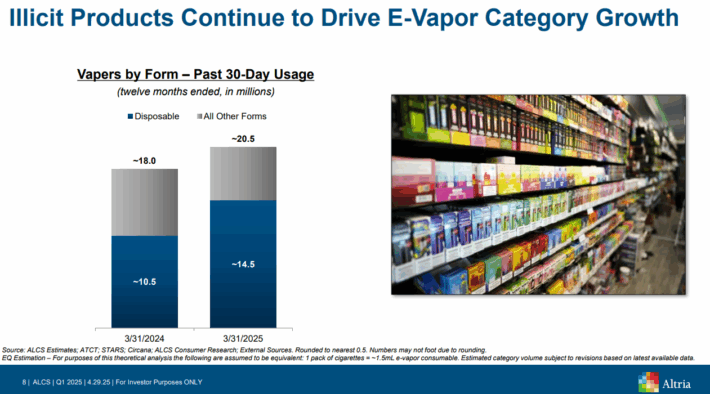

Reported diluted EPS declined by 48% year-over-year to $0.63, primarily due to an $873 million non-cash impairment charge related to the NJOY ACE e-vapor product following an importation ban due to a patent dispute. NJOY consumable volumes decreased by 23.9%, while device shipments dropped by 70%. This area of the business had been enjoying high rates of growth as NJOY had become the first brand to receive FDA authorization for menthol e-vapor products and made additional submissions for new product approvals.

Lower results were also impacted by a 13.7% decline in cigarette shipment volumes. Orla tobacco products experienced a 0.5% increase in net revenues, supported by an 18% rise in on-site sales—nicotine pouch shipments, despite a 3.1% decrease in retail share.

Altria focused on returning cash to shareholders, repurchasing 5.7 million shares for $326 million. As of the end of the quarter, Altria had $1 billion remaining on its share repurchase authorization. The company also distributed $1.7 billion in dividends during the quarter.

Growth Prospects

Altria’s future growth is uncertain due to changing consumer habits.

As a major tobacco company, Altria has to deal with the reality of declining smoking rates in the United States. Each year, there are fewer cigarette smokers in the U.S and, therefore, fewer customers for tobacco giants like Altria.

In its most recent quarterly results, the company reported that its smokeable products segment recorded a decline in domestic cigarette shipment volume of nearly 14% compared to last year when adjusted for trade inventory movement. This is not an issue particular to just Altria as the industry itself continues to see declining volumes.

Source: Investor Presentation

Historically, tobacco manufacturers have compensated for falling smoking volumes with pricing increases. This tactic has been successful in offsetting lost revenue, and Altria will continue to raise prices in the years to come.

But ultimately, tobacco companies must adapt to the new environment, and Altria is preparing for a post-cigarette world by investing heavily in the development of non-combustible products.

Altria has invested heavily in non-combustible products, such as its $1.8 billion investment in Cronos. E-vapor and cannabis could be two major long-term growth catalysts going forward.

Altria also acquired the Swiss company Burger Söhne Group to commercialize its own! Oral nicotine pouches. Oral tobacco is a growth area for Altria, as consumers who have quit smoking increasingly shift to oral tobacco products.

Source: Investor Presentation

Not all transactions have paid off for the company, as Altria’s investments in Juul and Cronos have resulted in billions of dollars in losses since inception.

Through cost reductions and share repurchases, the company will also be able to generate earnings-per-share growth. Overall, we expect a compound annual growth rate of ~0.8% in Altria’s earnings per share over the next five years.

Competitive Advantages & Recession Performance

Altria benefits from several competitive advantages, which have enabled the company to generate steady growth over many years. First and foremost, Altria has tremendous brand loyalty. The retail market share for the flagship Marlboro cigarette brand has remained high for many years. This affords the company the ability to raise prices every year without losing customers.

Second, tobacco manufacturers operate an advantageous business model that does not require intensive capital outlays. Thanks to economies of scale in production and distribution, the tobacco industry is not a capital-intensive business. This is why Altria generates strong free cash flow each year, even as revenue has stagnated due to falling smoking rates.

Such strong free cash flow leaves ample funds available for shareholder returns, debt repayment, and investment in future growth initiatives.

Another benefit of Altria’s business model is its high resistance to recessions. Cigarettes and alcohol sales hold up very well during recessions, which keeps Altria’s profitability and dividend growth intact. The company performed strongly during the previous major economic downturn, the Great Recession of 2008-2009:

2008 earnings-per-share: $1.66

2009 earnings-per-share: $1.76

2010 earnings-per-share: $1.87

Altria grew its adjusted earnings per share each year during the Great Recession. This demonstrates the company’s ability to generate steady earnings growth, even in a more challenging broader economic environment.

Given Altria’s exposure to recession-resistant products, it should withstand the next downturn very well.

Valuation & Expected Returns

Based on the expected 2025 earnings-per-share of $5.38, Altria stock trades for a price-to-earnings ratio of 10.8, compared with our fair value estimate of 10.0.

As a result, Altria stock appears to be slightly overvalued, which could lead to negative returns due to a compression of valuation multiples. If Altria’s P/E ratio decreases from 10.8 to 10.0 over the next five years, shareholder returns would decrease by 1.5% per year.

In addition, we expect 0.8% annual earnings-per-share growth through 2030, which will further boost shareholder returns.

Lastly, Altria has a high dividend yield of 7.0%, making the stock very attractive for investors who focus primarily on income. The dividend appears to be safe, as the company maintains a payout ratio of 76% of its expected adjusted earnings per share for 2025.

Taken together, Altria stock has total expected returns of more than 6.4% per year over the next five years. With a high expected rate of return below 10% per year, we rate Altria stock a hold.

Final Thoughts

When it comes to dividend stocks, Altria is about as steady as they come. It has increased its dividend each year for over five decades, an impressive performance.

The company faces uncertainty due to the continued decline in smoking rates. Nevertheless, Altria has planned for the changing consumer landscape by investing in new products, such as heated tobacco, e-vapor, and cannabis. These adjacent categories are expected to fuel continued growth for years to come.

Altria stock also appears to be undervalued, meaning right now is an opportune time to buy shares. The high dividend yield of 7.0% is relatively secure. Overall, the stock seems very attractive for income investors.

Related: How to Live Off Dividends In Retirement

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].