Updated on March 26th, 2025 by Bob CiuraSpreadsheet data updated daily

The Dividend Aristocrats are a select group of 69 S&P 500 stocks with 25+ years of consecutive dividend increases.

The requirements to be a Dividend Aristocrat are:

Be in the S&P 500

Have 25+ consecutive years of dividend increases

Meet certain minimum size & liquidity requirements

There are currently 69 Dividend Aristocrats.

You can download an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

However, even Dividend Aristocrats can fall from grace. For example, Walgreens Boots Alliance (WBA) was removed from the Dividend Aristocrats list in 2024.

The company slashed its dividend due to a pronounced business downturn in the brick-and-mortar pharmacy retail industry, amid elevated competitive threats from online pharmacies.

This was after Walgreens Boots Alliance had maintained a 40+ year streak of consecutive dividend increases.

While dividend cuts from Dividend Aristocrats are unexpected, they have happened–and could happen again. To be clear, the following 3 Dividend Aristocrats are not currently in jeopardy of cutting their dividends.

Their dividend payouts are supported with sufficient underlying earnings (for now). If their earnings remain stable or continue to grow, they have at least a decent change of continuing their dividend growth.

But, the 3 Dividend Aristocrats below are facing fundamental challenges to varying degrees, which potentially threatens their dividend payouts.

This article will provide a detailed analysis on the three Dividend Aristocrats most in danger of a future dividend cut.

Table of Contents

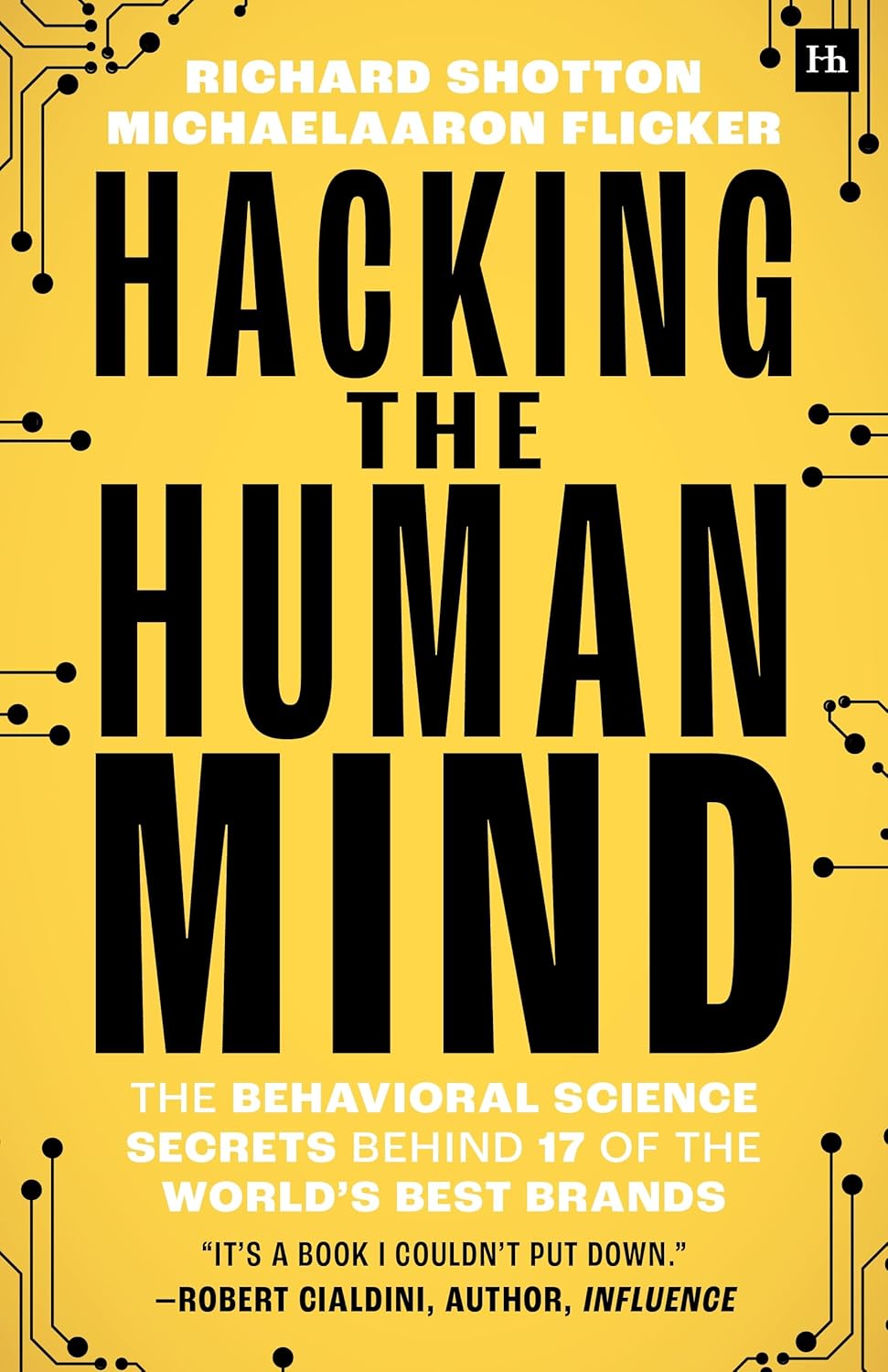

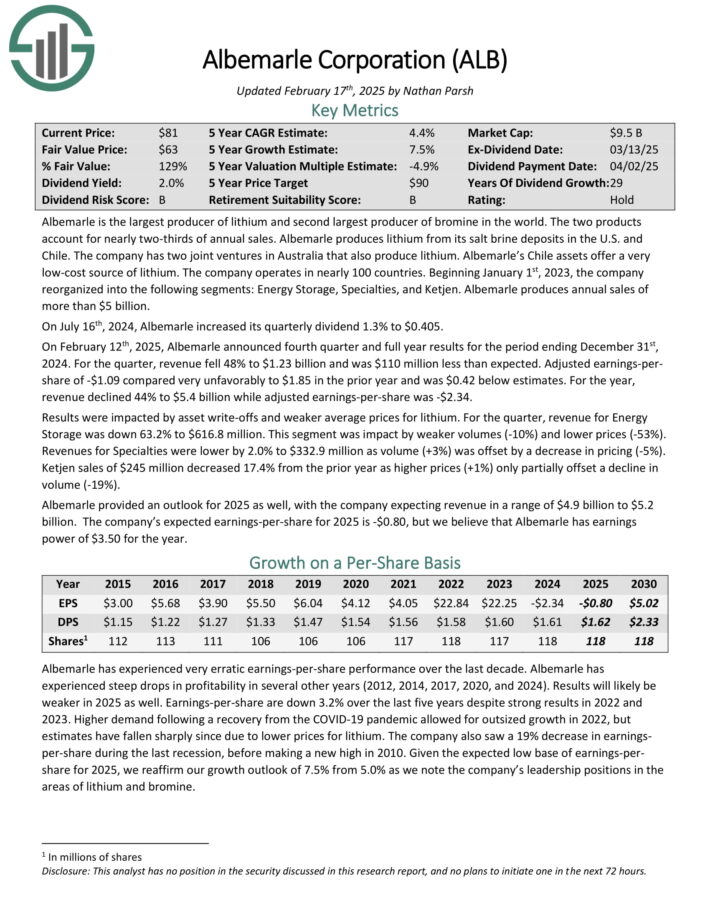

Red Flag Dividend Aristocrat For 2025: Albemarle Corporation (ALB)

Dividend Risk Score: B

Dividend Yield: 2.1%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium. The company operates in nearly 100 countries.

Albemarle, like any commodity producer, is beholden to the underlying commodity price for growth and profitability. Unfortunately, the steep drop in lithium prices has caused a massive decline in Albemarle’s financial performance in recent quarters.

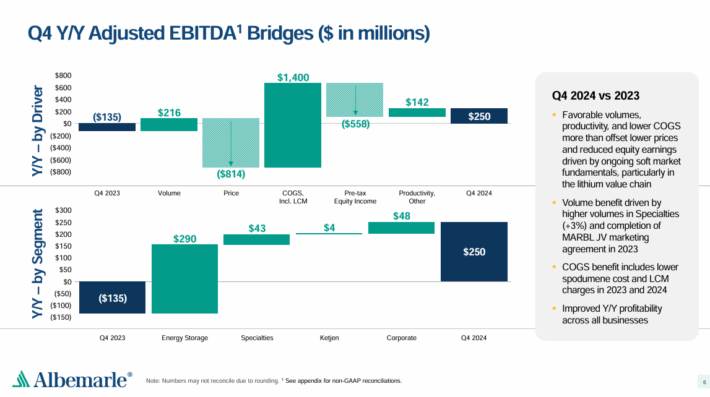

On February 12th, 2025, Albemarle announced fourth quarter and full year results. For the quarter, revenue fell 48% to $1.23 billion and was $110 million less than expected.

Source: Investor Presentation

Adjusted earnings-per-share of -$1.09 compared very unfavorably to $1.85 in the prior year and was $0.42 below estimates.

For the year, revenue declined 44% to $5.4 billion while adjusted earnings-per-share was -$2.34.

Results were impacted by asset write-offs and weaker average prices for lithium. For the quarter, revenue for Energy Storage was down 63.2% to $616.8 million.

This segment was impact by weaker volumes (-10%) and lower prices (-53%). Revenues for Specialties were lower by 2.0% to $332.9 million as volume (+3%) was offset by a decrease in pricing (-5%).

Results are not expected to meaningfully improve in 2025. Albemarle expects 2025 full-year revenue in a range of $4.9 billion to $5.2 billion. The company is expected to produce earnings-per-share of -$0.80 in 2025.

Continued declines in sales, along with net losses, could threaten Albemarle’s dividend payout. This is especially true if lithium prices continue to drop.

Click here to download our most recent Sure Analysis report on ALB (preview of page 1 of 3 shown below):

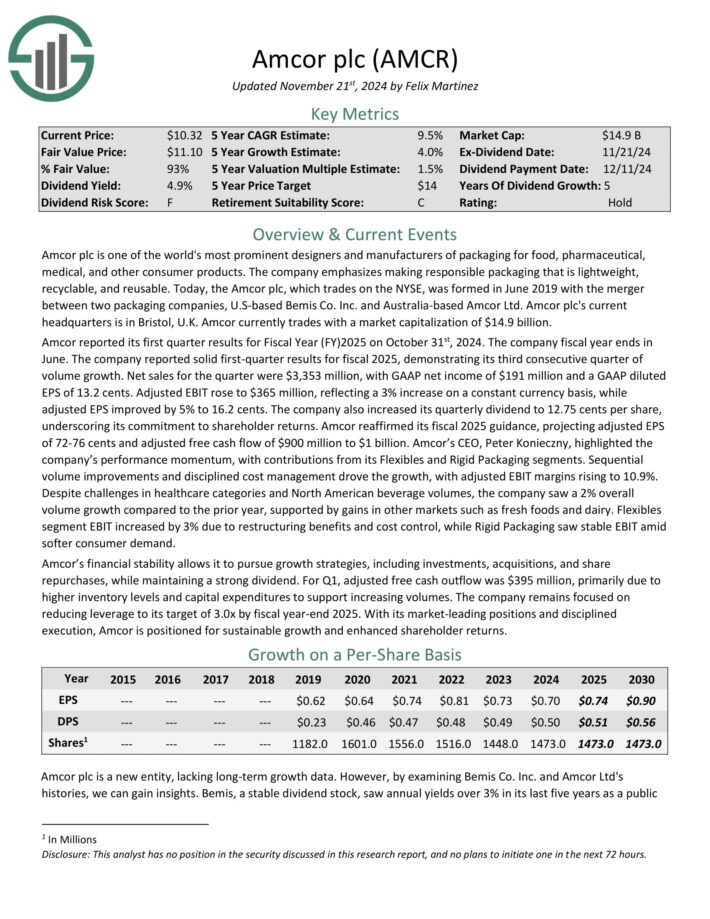

Red Flag Dividend Aristocrat For 2025: Amcor plc (AMCR)

Dividend Risk Score: F

Dividend Yield: 5.0%

Amcor plc is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company emphasizes making responsible packaging that is lightweight, recyclable, and reusable.

Today, the Amcor plc, which trades on the NYSE, was formed in June 2019 with the merger between two packaging companies, U.S-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s current headquarters is in Bristol, U.K.

The current dividend yield is attractive compared to the broader market, but the payout ratio is high at nearly 70% expected for 2025.

As a packaging manufacturer, Amcor is particularly exposed to the global economy. It would be difficult for the company to maintain its dividend in a steep recession as a result. AMCR stock receives our lowest Dividend Risk Score of ‘F’.

Click here to download our most recent Sure Analysis report on AMCR (preview of page 1 of 3 shown below):

Red Flag Dividend Aristocrat For 2025: Franklin Resources (BEN)

Dividend Risk Score: C

Dividend Yield: 6.1%

Franklin Resources is an investment management company. It was founded in 1947. Today, Franklin Resources manages the Franklin and Templeton families of mutual funds.

On January 31st, 2025, Franklin Resources reported net income of $163.6 million, or $0.29 per diluted share, for the first fiscal quarter ending December 31, 2024.

This marked a significant improvement from the previous quarter’s net loss of $84.7 million, though EPS remained lower than the $251.3 million net income recorded in the same quarter last year.

Source: Investor presentation

The past few years have been difficult for Franklin Resources. Franklin Resources was slow to adapt to the changing environment in the asset management industry.

The explosive growth in exchange-traded funds and indexing investing surprised traditional mutual funds.

ETFs have become very popular with investors due in large part to their lower fees than traditional mutual funds. In response, the asset management industry has had to cut fees and commissions or risk losing client assets.

Earnings-per-share are expected to decline in 2025 as a result. The company still maintains a manageable payout ratio of 51% expected for 2025, but if EPS continues to decline, the dividend payout could be in danger down the road.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

Final Thoughts

The Dividend Aristocrats are among the best dividend growth stocks in the market.

And while most Dividend Aristocrats will continue to raise their dividends each year, there could be some that end up cutting their payouts.

While it is rare, investors have seen multiple Dividend Aristocrats cut their dividends over the past several years, including Walgreens Boots Alliance, 3M Company (MMM), V.F. Corp. (VFC), and AT&T Inc. (T).

While the three Dividend Aristocrats presented here have been successful raising their dividends each year to this point, they all face varying levels of challenges to their underlying businesses.

For this reason, income investors should view the 3 red flag Dividend Aristocrats in this article cautiously going forward.

Additional Reading

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].