Published on August 11th, 2025 by Bob CiuraSpreadsheet data updated daily

Real estate investment trusts – or REITs – give investors the opportunity to earn income from real estate, without any of the day-to-day hassles associated with being a traditional landlord.

REITs are popular for income investors, as they widely pay higher dividend yields than the average stock.

While the S&P 500 Index on average yields just 1.3% right now, it is relatively easy to find REITs with dividend yields of 5% or higher.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

The beauty of earning passive income is that it allows investors to generate income for doing almost nothing.

With this in mind, the following 10 REITs have high dividend yields and safe dividend payouts, allowing investors to earn passive income from real estate.

Table Of Contents

The table of contents below allows for easy navigation. The 10 REITs are sorted by dividend yield, in ascending order.

High Yield REIT For Passive Income: Equity Lifestyle Properties (ELS)

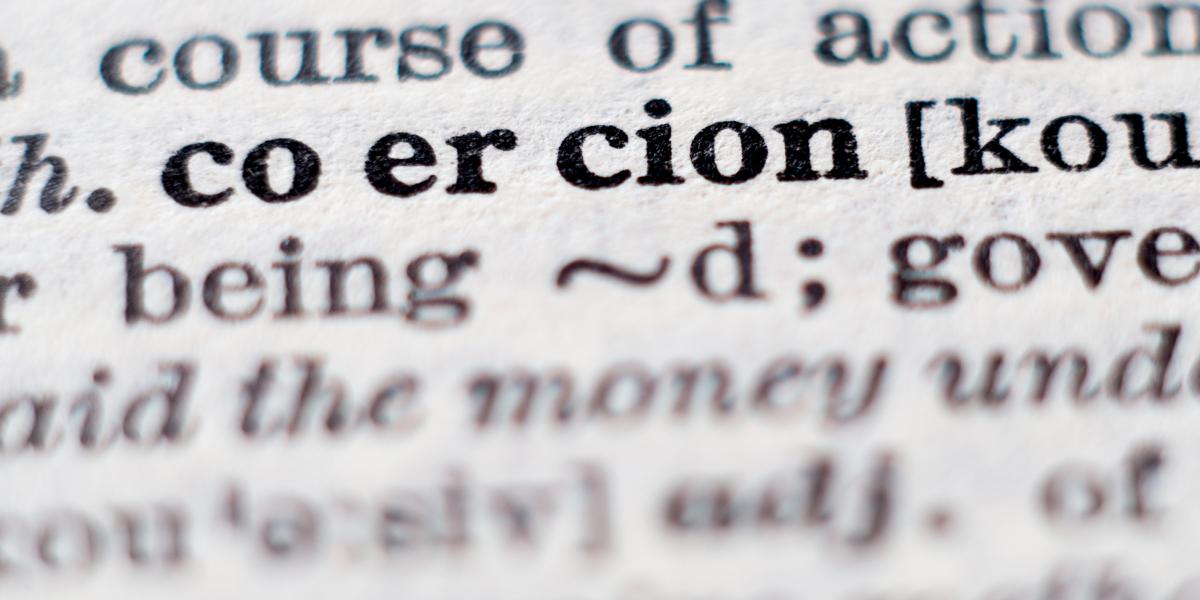

Equity LifeStyle Properties, Inc is a real estate investment trust which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home and recreational vehicle communities.

Equity LifeStyle Properties operates through the following segments: Property Operations; and Home Sales and Rentals Operations. The Property Operations segment owns and operates land lease properties. The Home Sales and Rentals Operations segment purchases, sells, and leases homes at the properties.

Equity LifeStyle Properties owns or has a controlling interest in more than 452 communities and resorts in 35 states and British Columbia, with more than 173,201 sites.

On July 21st, 2025, Equity LifeStyle Properties reported second-quarter. The company reported Q2 2025 revenue of $376.9 million, down 0.8% from $380.0 million in Q2 2024, with net income per common share steady at $0.42.

Normalized Funds from Operations (FFO) per share rose 4.7% to $0.69, and FFO per share was also $0.69, both meeting guidance midpoints. Core property operating revenues grew 3.5%, with manufactured home (MH) base rental income up 5.5% and RV/marina annual base rental income up 3.7%.

Core property operating expenses were flat, boosting core income from property operations (excluding property management) by 6.4%.

Click here to download our most recent Sure Analysis report on ELS (preview of page 1 of 3 shown below):

High Yield REIT For Passive Income: Prologis Inc. (PLD)

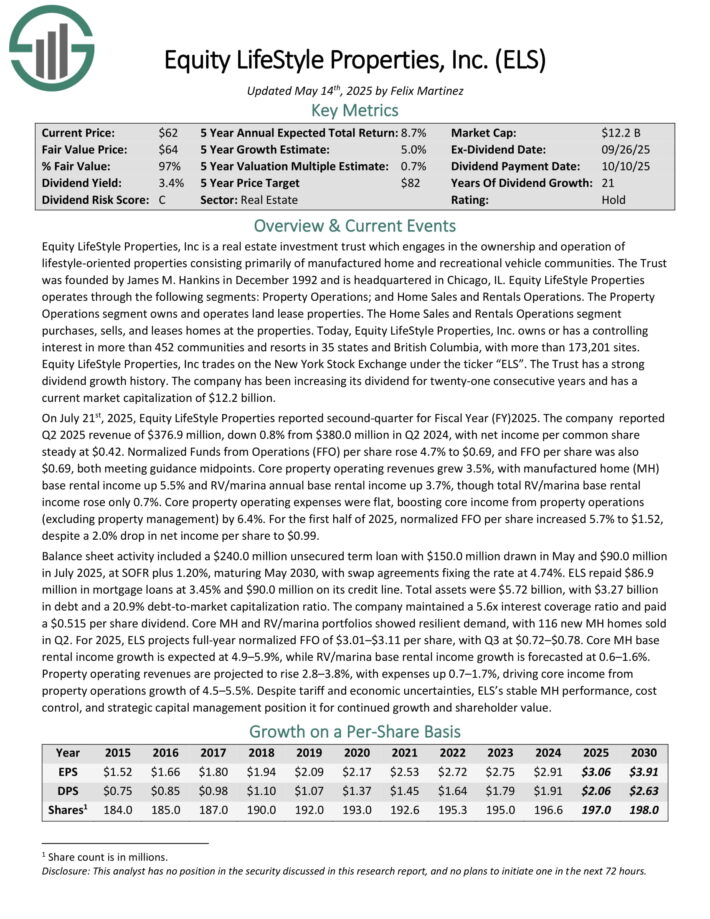

Prologis is the largest industrial U.S. REIT, owning about 1.3 billion square feet of real estate in 20 countries. It has a diversified rental collection base, comprising of more than 6,700 individual tenants.

On July 16th, 2025, Prologis posted its Q2 results for the period ending June 30th, 2025. For the period, rental revenue grew by 9.3% to just over $2.0 billion. Strategic capital revenues came in at $147 million. Total revenue increased by 8.8% year-over-year to $2.18 billion.

Core FFO/share rose by 9.0% to $1.46, supported by strong operational execution and disciplined capital deployment. Prologis’ debt as a percentage of its gross market cap remained healthy at 27.9%.

Its weighted average borrowing rate held steady at 3.2%. Finally, Prologis’ weighted average remaining lease term stood at 8.5 years.

The company maintained solid activity with 51.2 million square feet of lease commencements and $64 million in value creation from development stabilizations.

Management highlighted historically strong leasing pipelines and customer engagement, especially from larger tenants, pointing to strengthening demand.

Click here to download our most recent Sure Analysis report on PLD (preview of page 1 of 3 shown below):

High Yield REIT For Passive Income: Camden Property Trust (CPT)

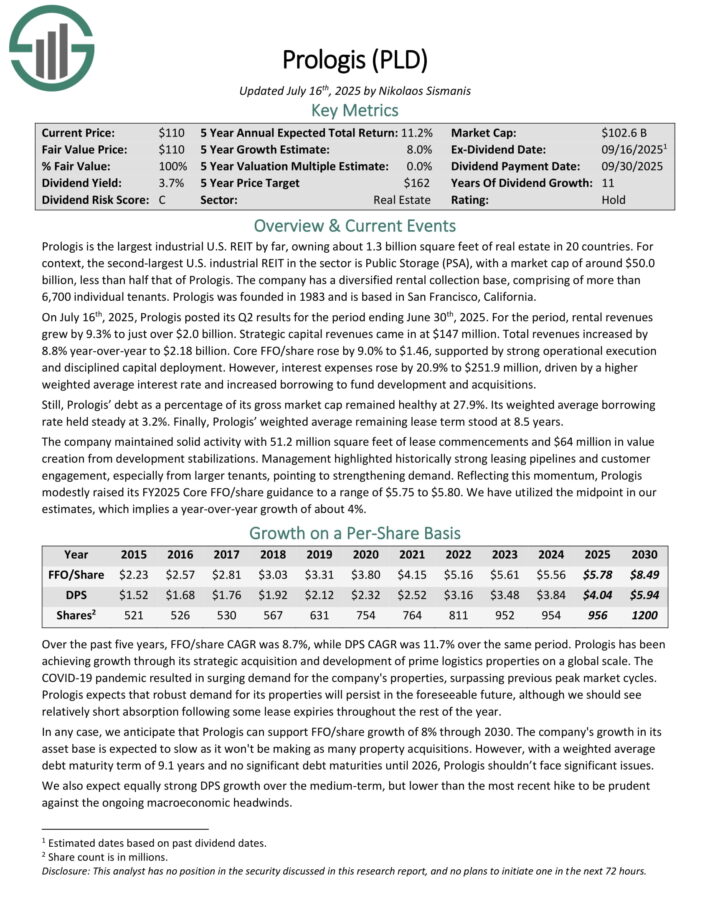

Founded in 1993 and headquartered in Houston, Texas, Camden Property Trust is one of the largest publicly traded multifamily real estate companies in the U.S.

The REIT owns, manages and develops multifamily apartment communities. It currently owns 172 properties that contain over 58,000 apartments.

On July 31st, 2025, Camden Property reported its Q2 results. For the quarter, the company reported property revenue of $396.5 million, up slightly from $387.2 million in Q2 2024.

While same-property revenues rose 1.0%, same-store occupancy increased 30 basis points to 95.6%. Same-property expenses grew by 2.4% during the period, while same-property net operating income (NOI) grew 0.2%.

Funds from Operations (FFO) totaled $184.2 million, or $1.67 per share, compared to $187.7 million, or $1.71 per share, in Q2 2024.

Camden has a competitive advantage in its position as one of the largest multifamily REITs in the U.S. Its scale and expertise allow it to leverage its experience across a wide portfolio of properties and actively pursue developments.

The company’s FFO payout ratio has hovered in the 60% to 70% range for the last decade. CPT has increased its dividend for 14 consecutive years.

Click here to download our most recent Sure Analysis report on Camden Property Trust (CPT) (preview of page 1 of 3 shown below):

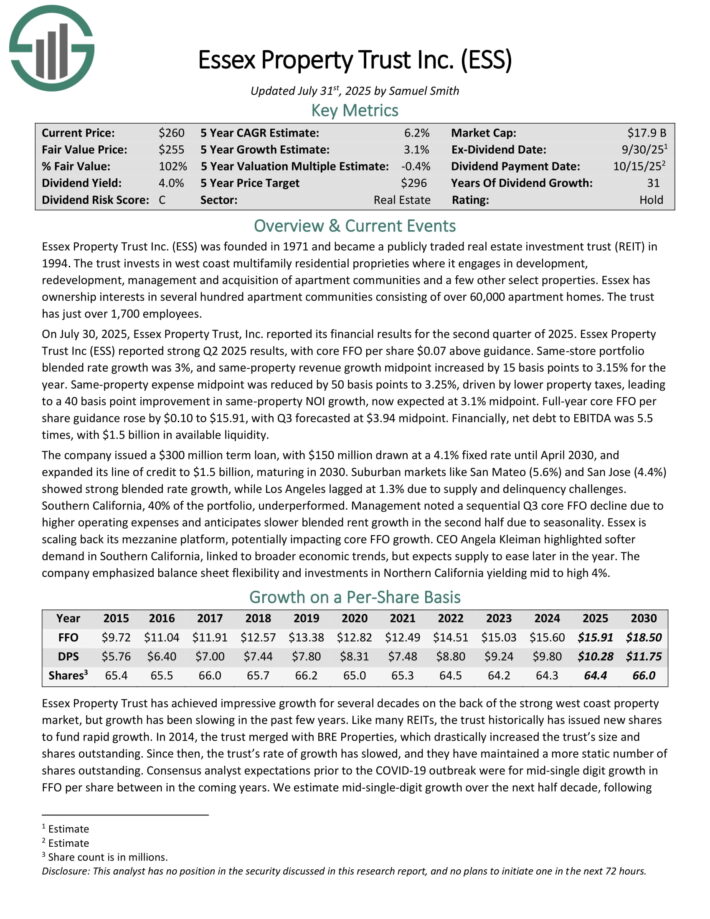

High Yield REIT For Passive Income: Essex Property Trust (ESS)

Essex Property Trust was founded in 1971. The trust invests in West Coast multi-family residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties.

Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Essex is concentrated on the West Coast of the U.S., including cities like Seattle and San Francisco.

On July 30, 2025, Essex Property Trust, Inc. reported its financial results for the second quarter of 2025. Essex Property Trust Inc (ESS) reported strong Q2 2025 results, with core FFO per share $0.07 above guidance.

Same-store portfolio blended rate growth was 3%, and same-property revenue growth midpoint increased by 15 basis points to 3.15% for the year.

Same-property expense midpoint was reduced by 50 basis points to 3.25%, driven by lower property taxes, leading to a 40 basis point improvement in same-property NOI growth, now expected at 3.1% midpoint. Full-year core FFO per share guidance rose by $0.10 to $15.91, with Q3 forecasted at $3.94 midpoint.

Financially, net debt to EBITDA was 5.5 times, with $1.5 billion in available liquidity.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

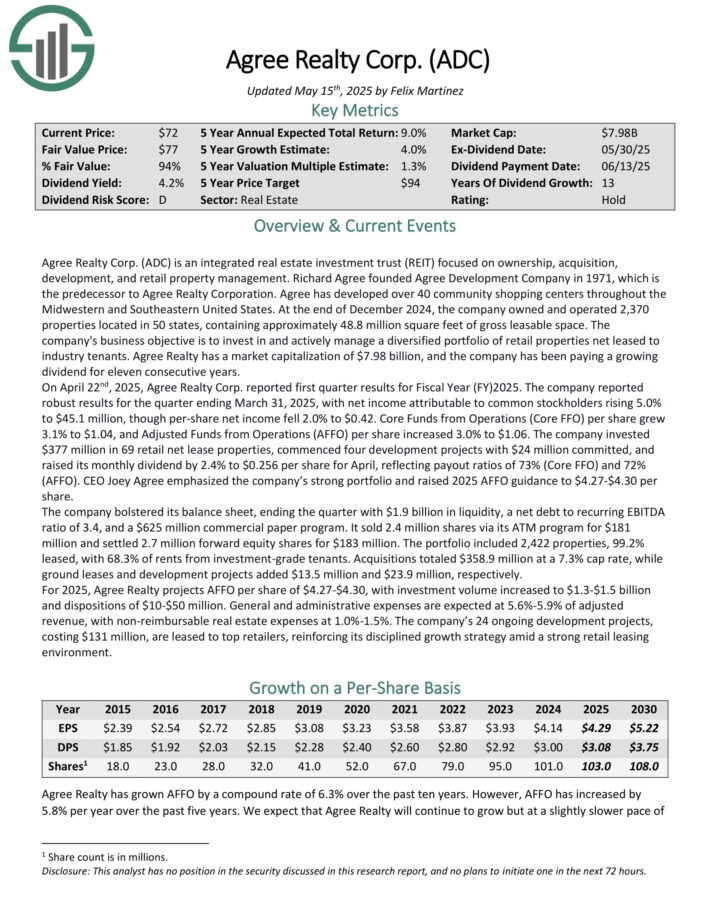

Top REIT #6: Agree Realty (ADC)

Agree Realty is an integrated real estate investment trust (REIT) focused on ownership, acquisition, development, and retail property management.

Agree has developed over 40 community shopping centers throughout the Midwestern and Southeastern United States.

On April 22nd, 2025, Agree Realty Corp. reported first quarter results for Fiscal Year (FY)2025. The company reported robust results for the quarter ending March 31, 2025, with net income attributable to common stockholders rising 5.0% to $45.1 million, though per-share net income fell 2.0% to $0.42.

Core Funds from Operations (Core FFO) per share grew 3.1% to $1.04, and Adjusted Funds from Operations (AFFO) per share increased 3.0% to $1.06.

The company invested $377 million in 69 retail net lease properties, commenced four development projects with $24 million committed, and raised its monthly dividend by 2.4% to $0.256 per share for April, reflecting payout ratios of 73% (Core FFO) and 72% (AFFO).

The company bolstered its balance sheet, ending the quarter with $1.9 billion in liquidity, a net debt to recurring EBITDA ratio of 3.4, and a $625 million commercial paper program.

The portfolio included 2,422 properties, 99.2% leased, with 68.3% of rents from investment-grade tenants. Acquisitions totaled $358.9 million at a 7.3% cap rate, while ground leases and development projects added $13.5 million and $23.9 million, respectively.

For 2025, Agree Realty projects AFFO per share of $4.27-$4.30, with investment volume increased to $1.3-$1.5 billion and dispositions of $10-$50 million.

Click here to download our most recent Sure Analysis report on ADC (preview of page 1 of 3 shown below):

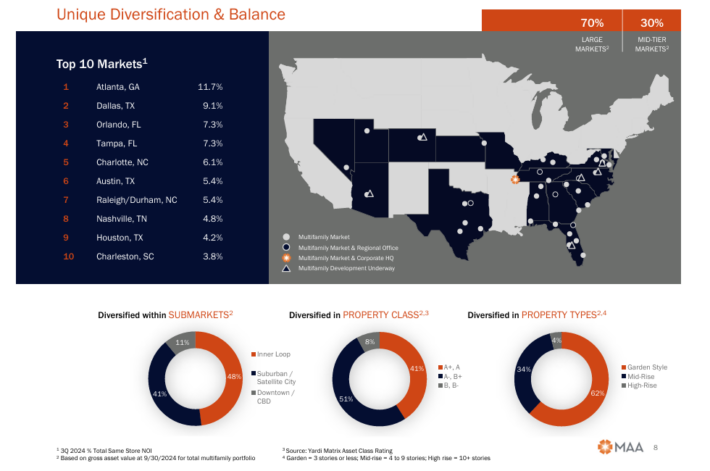

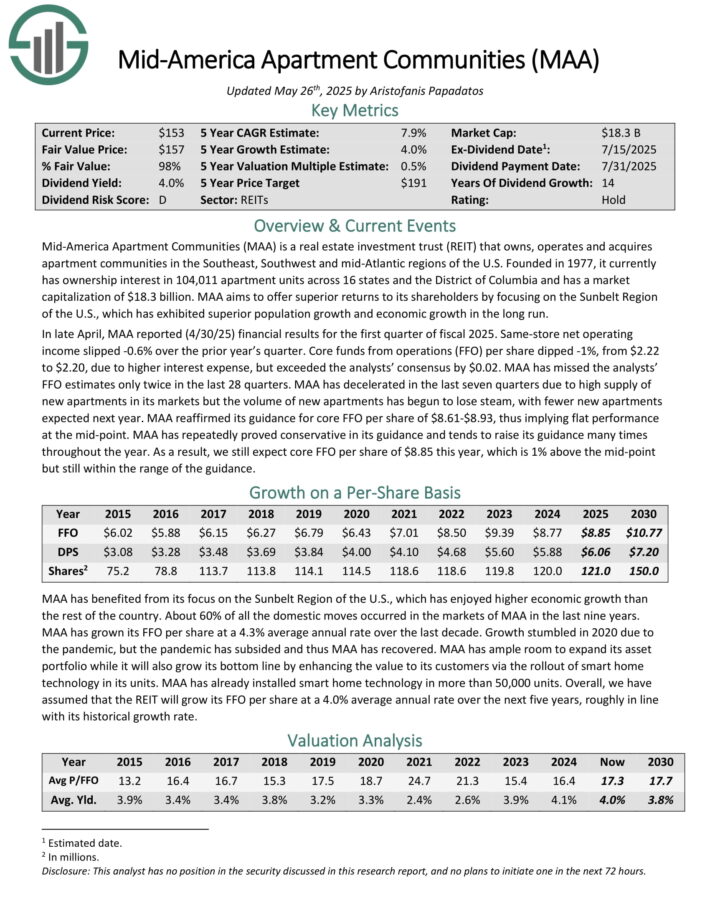

Top REIT #5: Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities is a REIT that owns, operates and acquires apartment communities in the Southeast, Southwest and mid-Atlantic regions of the U.S.

It currently has ownership interest in ~102,000 apartment units across 16 states and the District of Columbia.

MAA is focused on the Sunbelt Region of the U.S., which has exhibited superior population growth and economic growth in the long run.

Source: Investor Presentation

In late April, MAA reported (4/30/25) financial results for the first quarter of fiscal 2025. Same-store net operating income slipped -0.6% over the prior year’s quarter. Core funds from operations (FFO) per share dipped -1%, from $2.22 to $2.20, due to higher interest expense, but exceeded the analysts’ consensus by $0.02.

MAA has missed the analysts’ FFO estimates only twice in the last 28 quarters. MAA has decelerated in the last seven quarters due to high supply of new apartments in its markets but the volume of new apartments has begun to lose steam, with fewer new apartments expected next year.

MAA reaffirmed its guidance for core FFO per share of $8.61-$8.93.

Click here to download our most recent Sure Analysis report on Mid-America Apartment Communities (MAA) (preview of page 1 of 3 shown below):

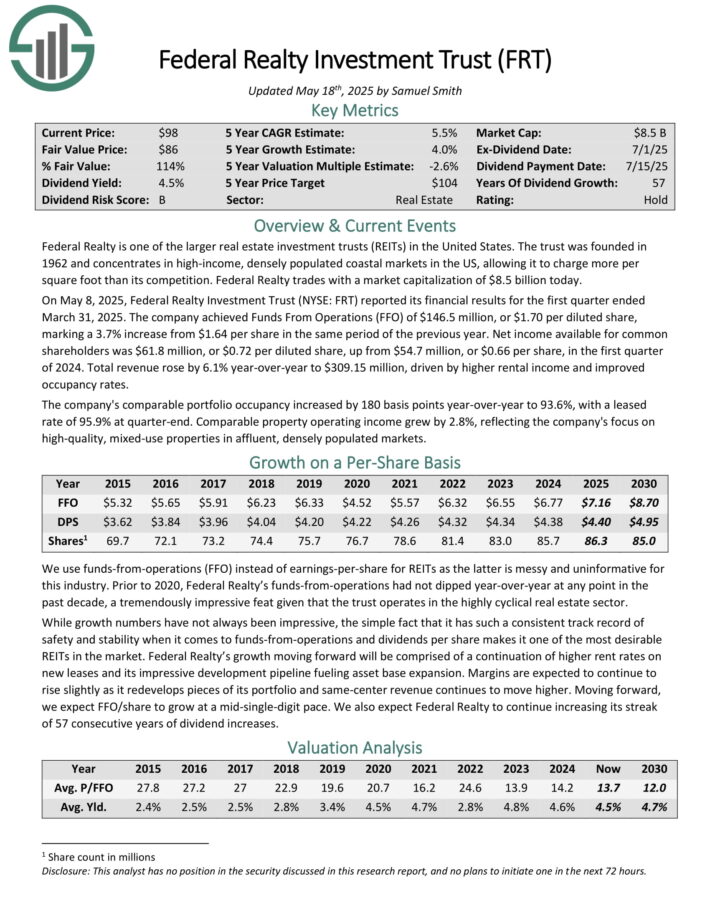

Top REIT #4: Federal Realty Investment Trust (FRT)

Federal Realty was founded in 1962. It concentrates in high-income, densely populated coastal markets in the US, allowing it to charge more per square foot than its competition.

On May 8, 2025, Federal Realty Investment Trust reported its financial results for the first quarter. The company achieved Funds From Operations (FFO) of $146.5 million, or $1.70 per diluted share, marking a 3.7% increase from $1.64 per share in the same period of the previous year.

Net income available for common shareholders was $61.8 million, or $0.72 per diluted share, up from $54.7 million, or $0.66 per share, in the first quarter of 2024. Total revenue rose by 6.1% year-over-year to $309.15 million, driven by higher rental income and improved occupancy rates.

The company’s comparable portfolio occupancy increased by 180 basis points year-over-year to 93.6%, with a leased rate of 95.9% at quarter-end.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

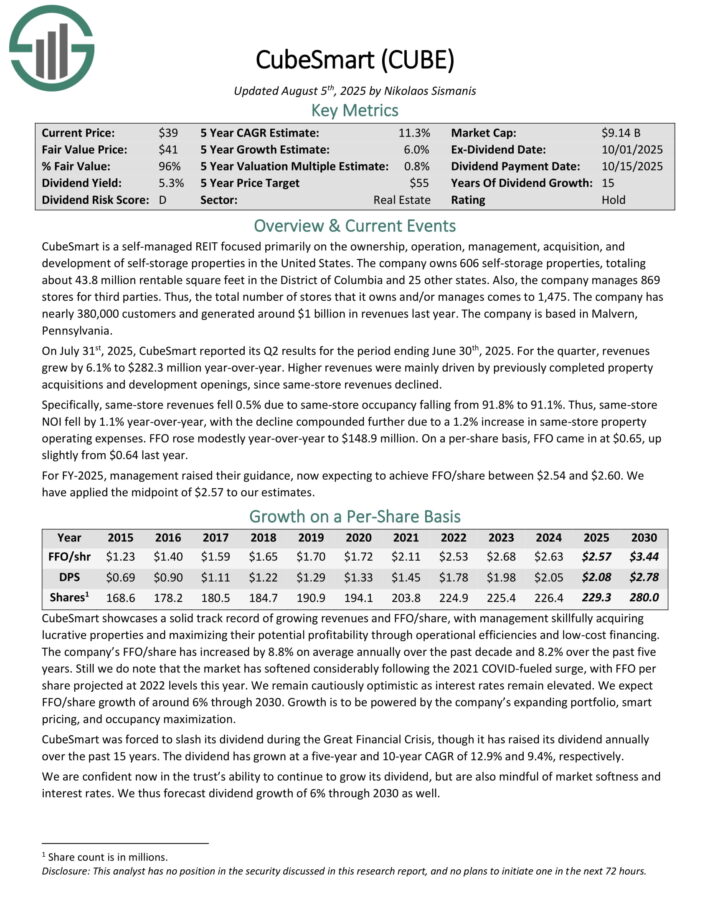

Top REIT #3: CubeSmart (CUBE)

CubeSmart is a self-managed REIT focused primarily on the ownership, operation, management, acquisition, and development of self-storage properties in the United States.

It owns 606 self-storage properties, totaling about 43.8 million rentable square feet in the District of Columbia and 25 other states. Also, the company manages 869 stores for third parties. Thus, the total number of stores that it owns and/or manages comes to 1,475.

The company has nearly 380,000 customers and generated around $1 billion in revenue last year.

On July 31st, 2025, CubeSmart reported its Q2 results for the period ending June 30th, 2025. For the quarter, revenues grew by 6.1% to $282.3 million year-over-year.

Higher revenues were mainly driven by previously completed property acquisitions and development openings, since same-store revenues declined.

Specifically, same-store revenues fell 0.5% due to same-store occupancy falling from 91.8% to 91.1%. Thus, same-store NOI fell by 1.1% year-over-year, with the decline compounded further due to a 1.2% increase in same-store property operating expenses.

FFO rose modestly year-over-year to $148.9 million. On a per-share basis, FFO came in at $0.65, up slightly from $0.64 last year.

Click here to download our most recent Sure Analysis report on CUBE (preview of page 1 of 3 shown below):

Top REIT #2: Realty Income Corp. (O)

Realty Income is a retail real estate focused REIT that owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income’s diversified portfolio comprises 15,627 commercial properties across eight countries, with 79.9% in retail, 14.4% in industrial, 3.2% in gaming, and 2.5% in other sectors.

Geographically, 84.6% of annualized base rent originates from the United States, 12.6% from the United Kingdom, and 2.8% from continental Europe.

On May 5, 2025, Realty Income Corporation reported its financial results for the first quarter ended March 31, 2025. The company achieved total revenue of $1.38 billion, surpassing analyst expectations of $1.27 billion.

Net income available to common stockholders was $249.8 million, or $0.28 per diluted share, compared to $129.7 million, or $0.16 per share, in the same period of the previous year.

Funds from Operations (FFO) per share increased to $1.05 from $0.94, while Adjusted Funds from Operations (AFFO) per share rose to $1.06 from $1.03, reflecting a 2.9% year-over-year growth.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

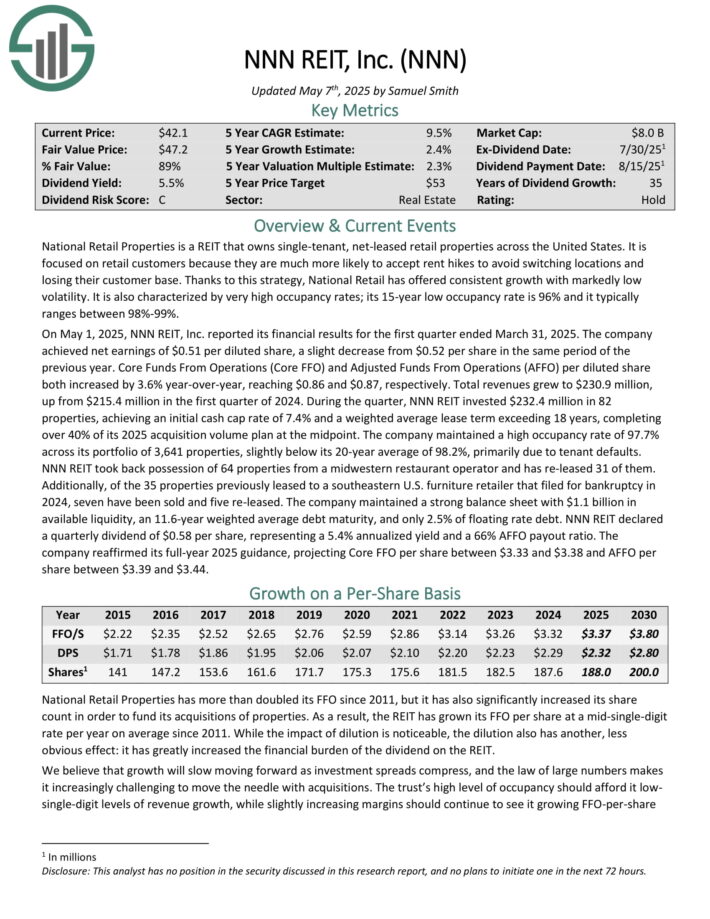

Top REIT #1: NNN REIT Inc. (NNN)

National Retail Properties is a REIT that owns single-tenant, net-leased retail properties across the United States. It is focused on retail customers because they are much more likely to accept rent hikes to avoid switching locations and losing their customer base.

On May 1, 2025, NNN REIT, Inc. reported its financial results for the first quarter ended March 31, 2025. The company achieved net earnings of $0.51 per diluted share, a slight decrease from $0.52 per share in the same period of the previous year.

Core Funds From Operations (Core FFO) and Adjusted Funds From Operations (AFFO) per diluted share both increased by 3.6% year-over-year, reaching $0.86 and $0.87, respectively. Total revenues grew to $230.9 million, up from $215.4 million in the first quarter of 2024.

During the quarter, NNN REIT invested $232.4 million in 82 properties, achieving an initial cash cap rate of 7.4% and a weighted average lease term exceeding 18 years, completing over 40% of its 2025 acquisition volume plan at the midpoint.

The company maintained a high occupancy rate of 97.7% across its portfolio of 3,641 properties, slightly below its 20-year average of 98.2%, primarily due to tenant defaults.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

Additional Reading

You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].