Updated on March 21st, 2025 by Bob Ciura

It isn’t surprising that we favor stocks that pay dividends, as studies have shown that owning income producing securities is an excellent way to build wealth while also protecting to the downside.

In bull markets, dividends can add to the gains from the stock while also purchasing additional shares. When prices decline, dividends can reduce the losses while being used to acquire more shares at a now lower price.

With this in mind, we created a full list of the Dividend Kings, a group of stocks with over 50 consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 55 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The Dividend Kings have rewarded shareholders with rising income for decades.

The following 10 stocks represent Dividend Kings that can continue to raise their dividends for decades to come.

The list includes 10 Dividend Kings with our highest Dividend Risk Score of ‘A’ in the Sure Analysis Research Database, that also have payout ratios below 70% to ensure a sustainable dividend payout.

The stocks are sorted by dividend payout ratio, from lowest to highest.

Table of Contents

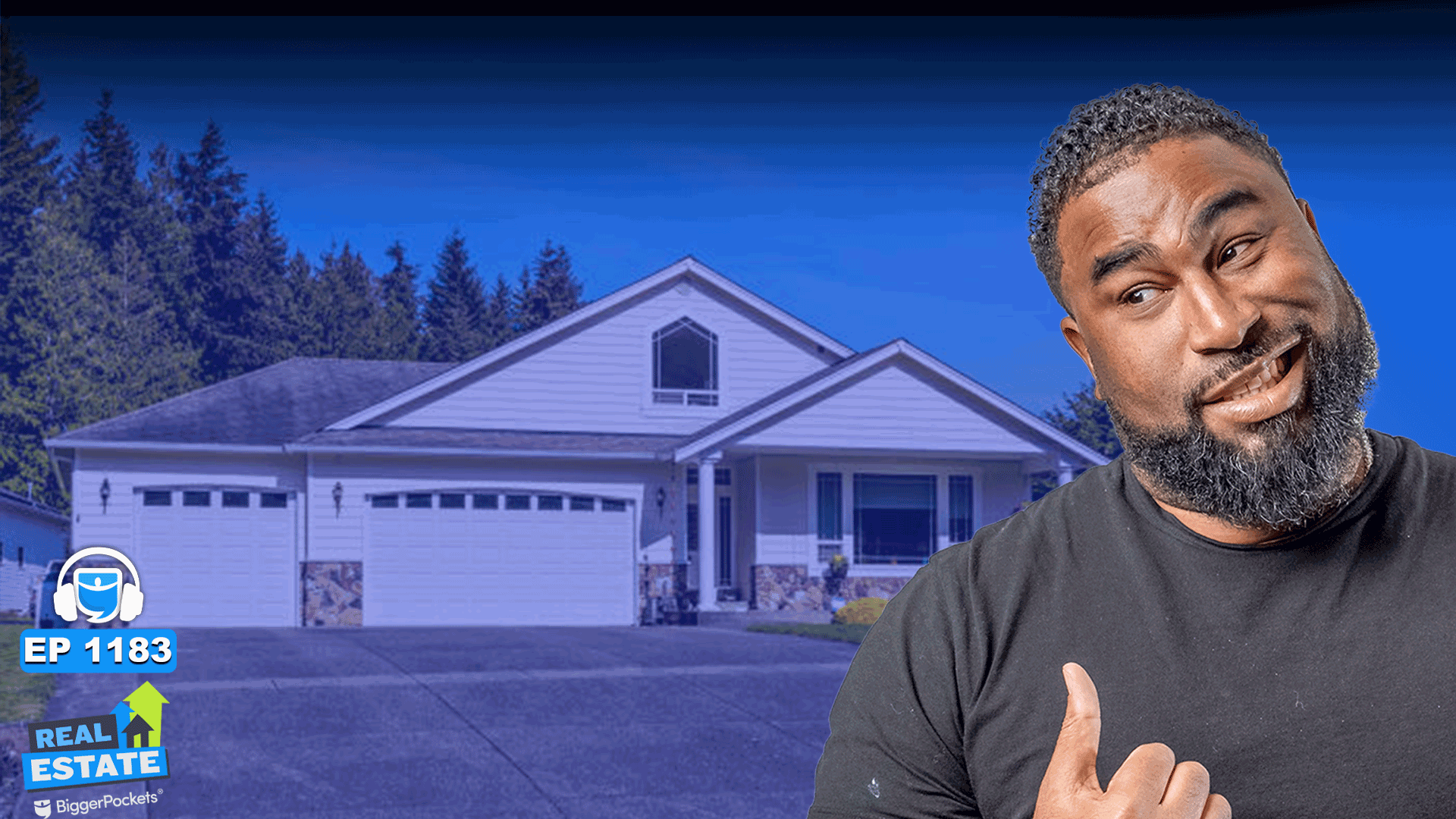

Dividend King To Hold Forever: Tootsie Roll Industries (TR)

Tootsie Roll Industries, Inc. traces its roots to the late 1890’s when its namesake product, the Tootsie Roll, was first created.

Today, the company sells a wider variety of candy and gum products. Other well-known brands include DOTS, Junior Mints, Andes, Charms, Blow-Pops, Sugar Daddy, and Dubble Bubble.

Total revenue in 2024 was about $715.5M. Tootsie Roll reported Q4 2024 results on February 12th, 2025. Net sales were down 2% to $191.4 million for the quarter. Diluted EPS decreased 22% to $0.32 per share from $0.41 on a year-over-year basis on charges and lower sales volumes.

The momentum continued into 2023 because of higher sales volumes and raising prices, but margins were under pressure. Although volumes and revenue are declining in 2024, margins are higher because of lower freight costs and higher prices.

Click here to download our most recent Sure Analysis report on TR (preview of page 1 of 3 shown below):

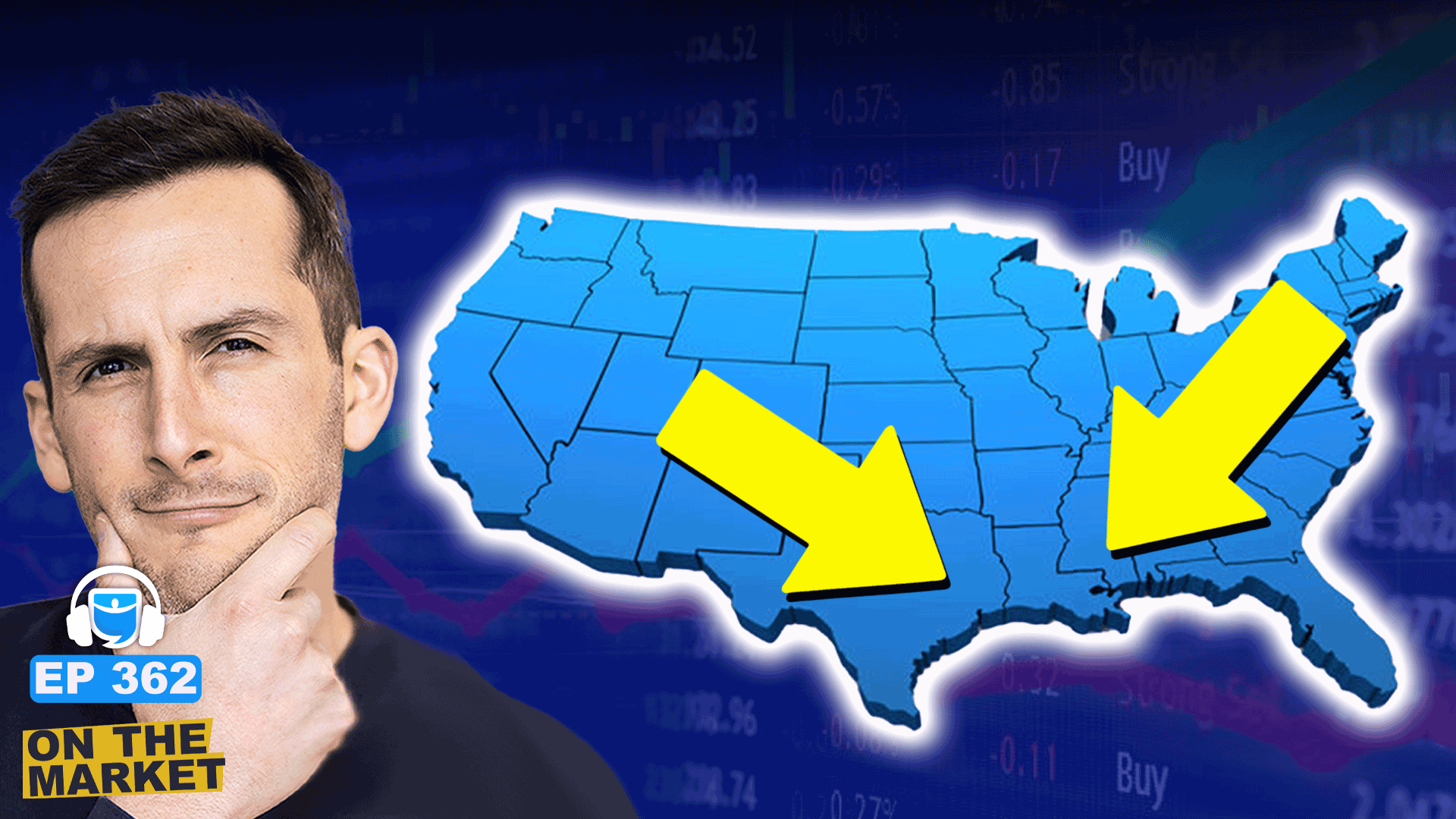

Dividend King To Hold Forever: MSA Safety Inc. (MSA)

MSA Safety Incorporated, formerly Mine Safety Appliances, was founded in 1914. Today, it develops and manufactures safety products.

Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military.

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air purifying respirators, and eye protection gear.

On February 12th, 2025, MSA released its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, revenue came in at $499.7 million, up 0.9% compared to Q4-2023. More specifically, the Americas segment’s sales were up 1%, while the International segment’s sales came in flat.

MSA’s adjusted operating margin rose by just 70 basis points to 24.0% compared to last year. Hence, adjusted earnings came in at $89.0 million, 9% higher from $82.0 million last year, despite the much softer increase in sales. Adjusted EPS also rose by 9% to $2.25. For the year, adjusted EPS came in at $7.70.

MSA’s management expects low-single digit full-year organic sales growth in 2025.

Click here to download our most recent Sure Analysis report on MSA (preview of page 1 of 3 shown below):

Dividend King To Hold Forever: Parker-Hannifin Corp. (PH)

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $16 billion.

Parker-Hannifin has paid a dividend for 72 years and has increased the dividend for 67 consecutive years.

Source: Investor Presentation

In late January, Parker-Hannifin reported (1/30/25) results for the second quarter of 2025. Organic sales grew 1% over the prior year’s quarter, as 14% growth in aerospace was almost offset by declines in North American Business and International Business.

Adjusted earnings-per-share grew 6%, from $6.16 to $6.53, thanks to strong sales and a wider profit margin in aerospace.

Parker-Hannifin exceeded the analysts’ consensus by $0.30. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 38 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

Dividend King To Hold Forever: S&P Global Inc. (SPGI)

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P posted fourth quarter and full-year earnings on February 11th, 2025, and results were much better than expected on both the top and bottom lines.

Adjusted earnings-per-share came to $3.77, which was a staggering 30 cents ahead of estimates. Earnings rose from $3.13 a year ago.

Revenue was up 14% year-over-year to $3.59 billion, beating estimates by $90 million. The company posted revenue growth in all of its operating segments, in addition to strong operating margin expansion.

Operating expenses rose slightly from $2.26 billion to $2.33 billion year-over-year. That led to operating profit of $1.68 billion, sharply higher from $1.39 billion a year ago.

With dividend growth above 10%, SPGI is one of the rock solid dividend stocks.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

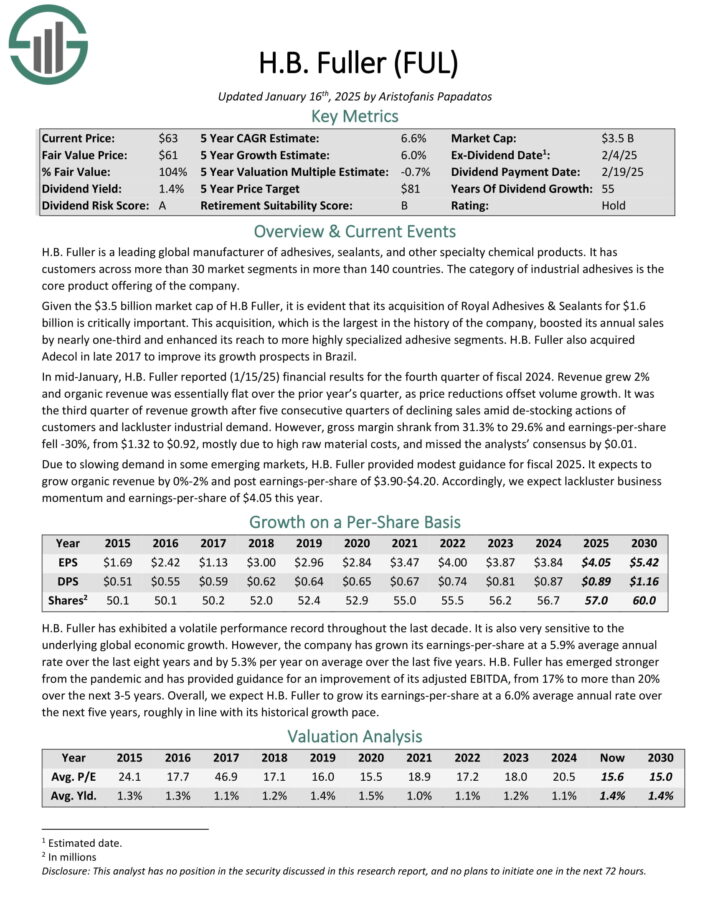

Dividend King To Hold Forever: H.B. Fuller Company (FUL)

H.B. Fuller is a leading global manufacturer of adhesives, sealants, and other specialty chemical products.

It has customers across more than 30 market segments in more than 140 countries. The category of industrial adhesives is the core product offering.

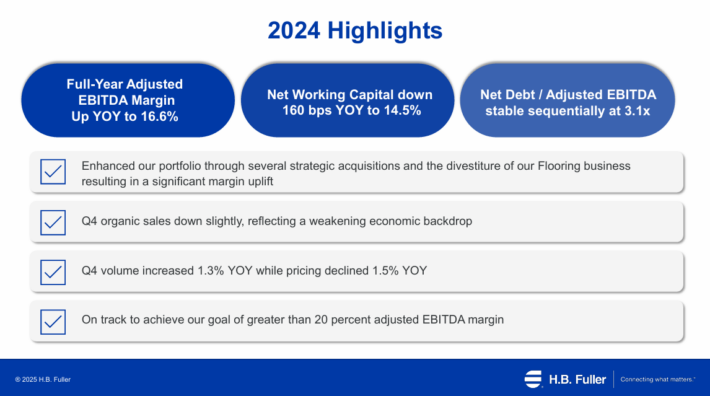

In mid-January, H.B. Fuller reported (1/15/25) financial results for the fourth quarter of fiscal 2024. Revenue grew 2% and organic revenue was essentially flat year-over-year, as price reductions offset volume growth.

Highlights for the full year can be seen in the image below:

Source: Investor Presentation

It was the third quarter of revenue growth after five consecutive quarters of declining sales amid de-stocking actions of customers and lackluster industrial demand.

However, gross margin shrank from 31.3% to 29.6% and earnings-per-share fell -30%, from $1.32 to $0.92, mostly due to high raw material costs, and missed the analysts’ consensus by $0.01.

Due to slowing demand in some emerging markets, H.B. Fuller provided modest guidance for fiscal 2025. It expects to grow organic revenue by 0%-2% and post earnings-per-share of $3.90-$4.20.

Click here to download our most recent Sure Analysis report on FUL (preview of page 1 of 3 shown below):

Dividend King To Hold Forever: Dover Corp. (DOV)

Dover Corporation is a diversified global industrial manufacturer with annual revenues approaching $8 billion.

Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

On January 30th, 2025, Dover announced fourth quarter and full year results the period ending December 31st, 2024. For the quarter, revenue grew 1% to $1.93 billion, though this was $20 million less than expected.

Adjusted earnings-per-share of $2.20 compared unfavorably to $2.45 in the prior year, but was $0.12 ahead of estimates.

For the year, revenue was higher by 1% to $7.75 billion while adjusted earnings-per-share of $8.29 compared to $8.80 in 2023.

For the quarter, organic revenue grew 0.3% year-over-year while bookings grew 7%. Engineered Products had organic growth of 2% as gains in vehicle aftermarket and fluid dispensing were offset by shipment timings in aerospace and defense.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

Dividend King To Hold Forever: Tennant Co. (TNC)

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers.

In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its fourth quarter earnings results on February 19. Revenues of $328 million during the quarter increased 6% year-over-year.

Tennant Company generated adjusted earnings-per-share of $1.52 during the fourth quarter, which was less than what the analyst community had forecasted, and which was down compared to the previous year.

Management is forecasting that adjusted earnings-per-share will fall into a range of $5.70 to $6.20 in 2025.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

Dividend King To Hold Forever: W.W. Grainger Inc. (GWW)

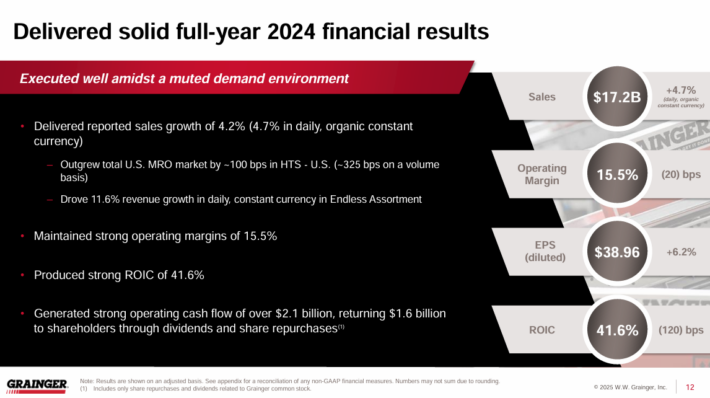

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

Grainger has more than 4.5 million active customers, with more than 30 million products offered globally.

On January 31st, 2025, W.W. Grainger posted its Q4 and full-year results. For the quarter, revenues were $4.23 billion, up 5.9% on a reported basis and up 4.7% on a daily, constant currency basis compared to last year.

Results were driven by solid performance across the board. The High-Touch Solutions segment achieved sales growth of 4.0% due to volume growth in all geographies.

Source: Investor Presentation

In the Endless Assortment segment, sales were up 15.1%. Revenue growth for the segment was driven by core B2B customers across the segment as well as enterprise customer growth at MonotaRO.

Net income equaled $475 million, up 20.2% compared to Q4-2023. Net income was boosted by a 110 basis point expansion in the operating margin to 15.0%.

Earnings-per-share came in at $9.74, 22.8% higher year-over-year, and were further aided by stock buybacks. For the year, EPS reached a record $38.71.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

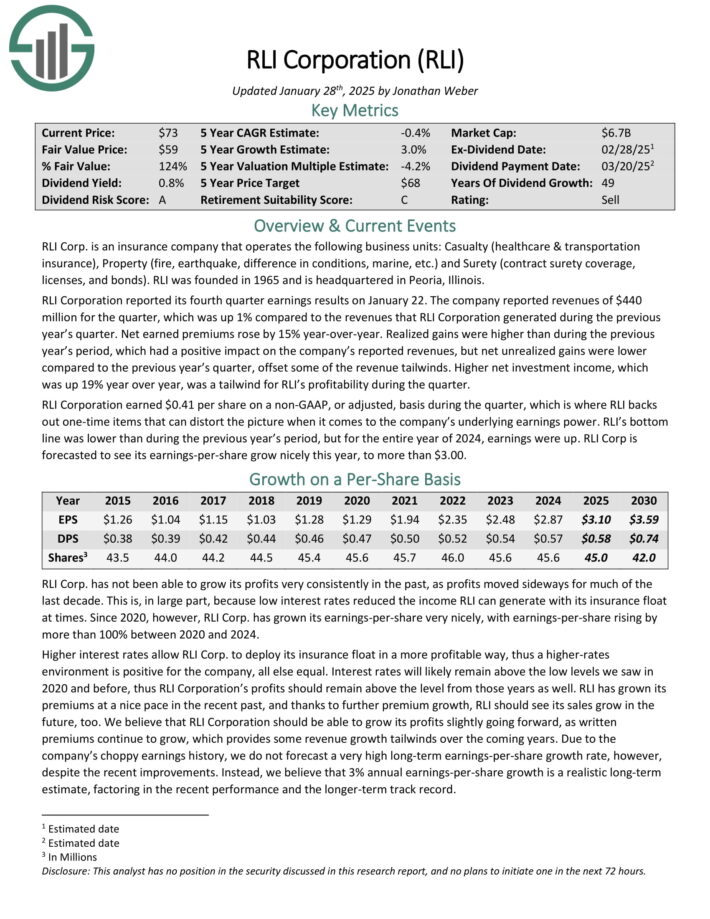

Dividend King To Hold Forever: RLI Corp. (RLI)

RLI Corp. is an insurance company that operates the following business units: Casualty (healthcare & transportation insurance), Property (fire, earthquake, difference in conditions, marine, etc.) and Surety (contract surety coverage, licenses, and bonds).

Source: Investor Presentation

RLI Corporation reported its fourth quarter earnings results on January 22. The company reported revenues of $440 million for the quarter, which was up 1% year-over-year. Net earned premiums rose by 15% year-over-year.

Realized gains were higher than during the previous year’s period, which had a positive impact on the company’s reported revenues, but net unrealized gains were lower compared to the previous year’s quarter, offset some of the revenue tailwinds.

Higher net investment income, which was up 19% year over year, was a tailwind for RLI’s profitability during the quarter.

RLI Corporation earned $0.41 per share on a non-GAAP, or adjusted, basis during the quarter.

Click here to download our most recent Sure Analysis report on RLI (preview of page 1 of 3 shown below):

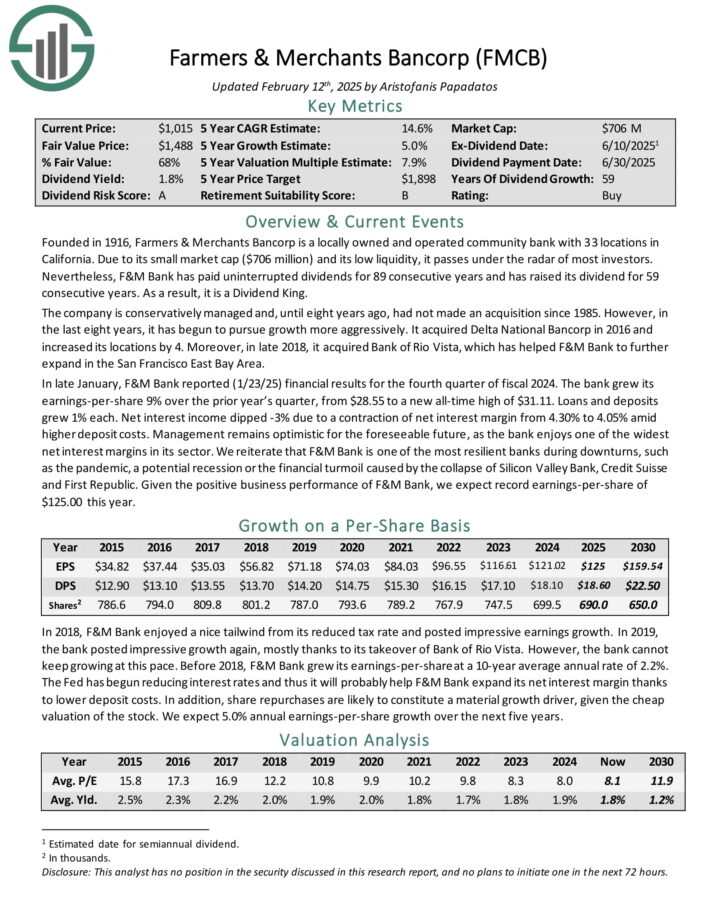

Dividend King To Hold Forever: Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In late January, F&M Bank reported (1/23/25) financial results for the fourth quarter of fiscal 2024. The bank grew its earnings-per-share 9% over the prior year’s quarter, from $28.55 to a new all-time high of $31.11. Loans and deposits grew 1% each.

Net interest income dipped -3% due to a contraction of net interest margin from 4.30% to 4.05% amid higher deposit costs. Management remains optimistic for the foreseeable future, as the bank enjoys one of the widest net interest margins in its sector.

We reiterate that F&M Bank is one of the most resilient banks during downturns, such as the pandemic, a potential recession or the financial turmoil caused by the collapse of Silicon Valley Bank, Credit Suisse and First Republic.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stocks to hold forever.

Sure Dividend maintains similar databases on the following useful universes of stocks:

There is nothing magical about investing in the Dividend Kings. They are simply a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Purchasing businesses with these characteristics–at fair or better prices–and holding them forever, will likely result in strong long-term investment performance.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].