Published on December 29th, 2025 by Bob Ciura

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually.

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

For this reason, we created a full list of 83 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Monthly dividend payouts along with high yields are certainly attractive on the surface. However, many monthly dividend stocks have turned in poor performance, marked by low (or even negative) total returns.

While past performance is not a guarantee of future results, it can be useful to look back to see which monthly dividend stocks performed the best.

Therefore, this article will discuss the 10 best-performing monthly dividend stocks over the past 10 years.

Table Of Contents

The best performing monthly dividend stocks are ranked below, according to their total annualized returns.

You can instantly jump to an individual section of the article by utilizing the links below:

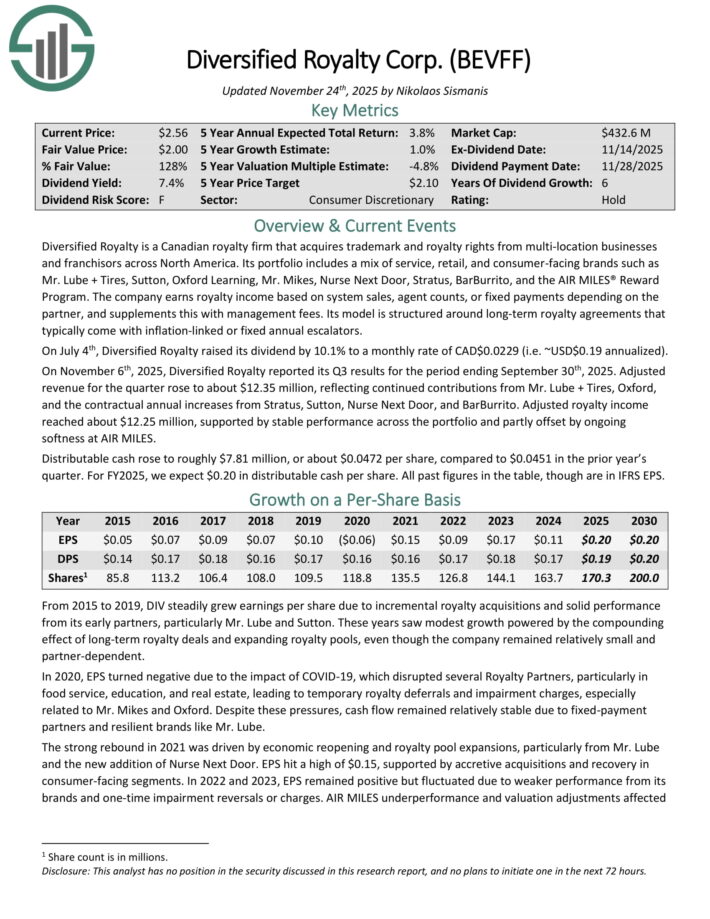

Best Performing Monthly Dividend Stock #10: Diversified Royalty Corp. (BEVFF)

Annualized 10-Year Total Returns: 13.9%

Diversified Royalty is a Canadian royalty firm that acquires trademark and royalty rights from multi-location businesses and franchisors across North America.

Its portfolio includes a mix of service, retail, and consumer-facing brands such as Mr. Lube + Tires, Sutton, Oxford Learning, Mr. Mikes, Nurse Next Door, Stratus, BarBurrito, and the AIR MILES Reward Program.

The company earns royalty income based on system sales, agent counts, or fixed payments depending on the partner, and supplements this with management fees. Its model is structured around long-term royalty agreements that typically come with inflation-linked or fixed annual escalators.

On July 4th, Diversified Royalty raised its dividend by 10.1% to a monthly rate of CAD$0.0229.

On November 6th, 2025, Diversified Royalty reported its Q3 results for the period ending September 30th, 2025. Adjusted revenue for the quarter rose to about $12.35 million, reflecting continued contributions from Mr. Lube + Tires, Oxford, and the contractual annual increases from Stratus, Sutton, Nurse Next Door, and BarBurrito.

Adjusted royalty income reached about $12.25 million, supported by stable performance across the portfolio and partly offset by ongoing softness at AIR MILES.

Distributable cash rose to roughly $7.81 million, or about $0.0472 per share, compared to $0.0451 in the prior year’s quarter.

Click here to download our most recent Sure Analysis report on BEVFF (preview of page 1 of 3 shown below):

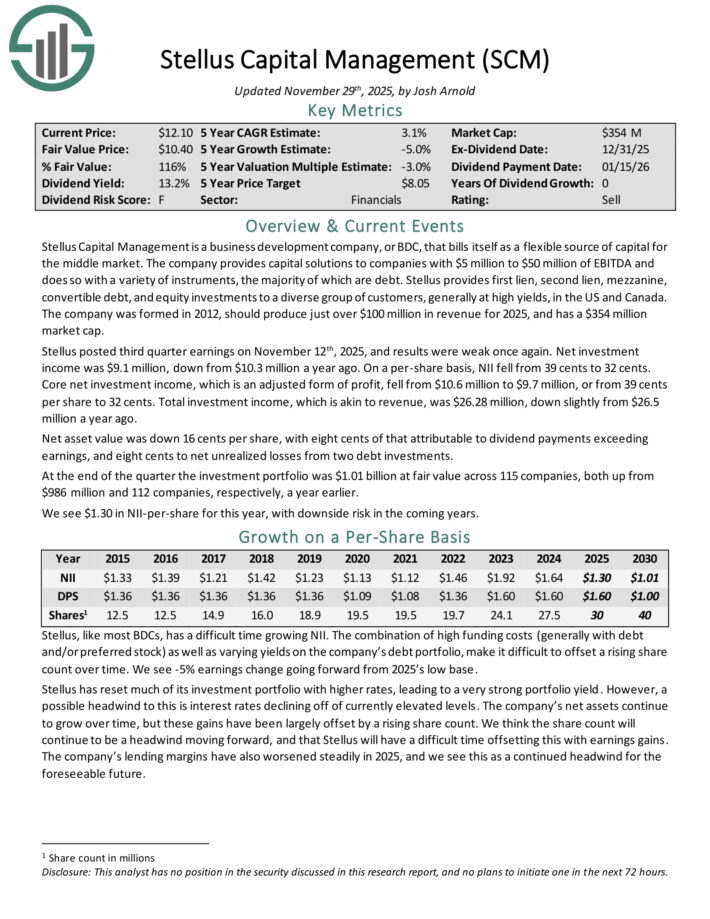

Best Performing Monthly Dividend Stock #9: Stellus Capital (SCM)

Annualized 10-Year Total Returns: 14.2%

Stellus Capital Management provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Stellus posted third quarter earnings on November 12th, 2025, and results were weak once again. Net investment income was $9.1 million, down from $10.3 million a year ago. On a per-share basis, NII fell from 39 cents to 32 cents.

Core net investment income, which is an adjusted form of profit, fell from $10.6 million to $9.7 million, or from 39 cents per share to 32 cents. Total investment income, which is akin to revenue, was $26.28 million, down slightly from $26.5 million a year ago.

Net asset value was down 16 cents per share, with eight cents of that attributable to dividend payments exceeding earnings, and eight cents to net unrealized losses from two debt investments.

At the end of the quarter the investment portfolio was $1.01 billion at fair value across 115 companies, both up from $986 million and 112 companies, respectively, a year earlier.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

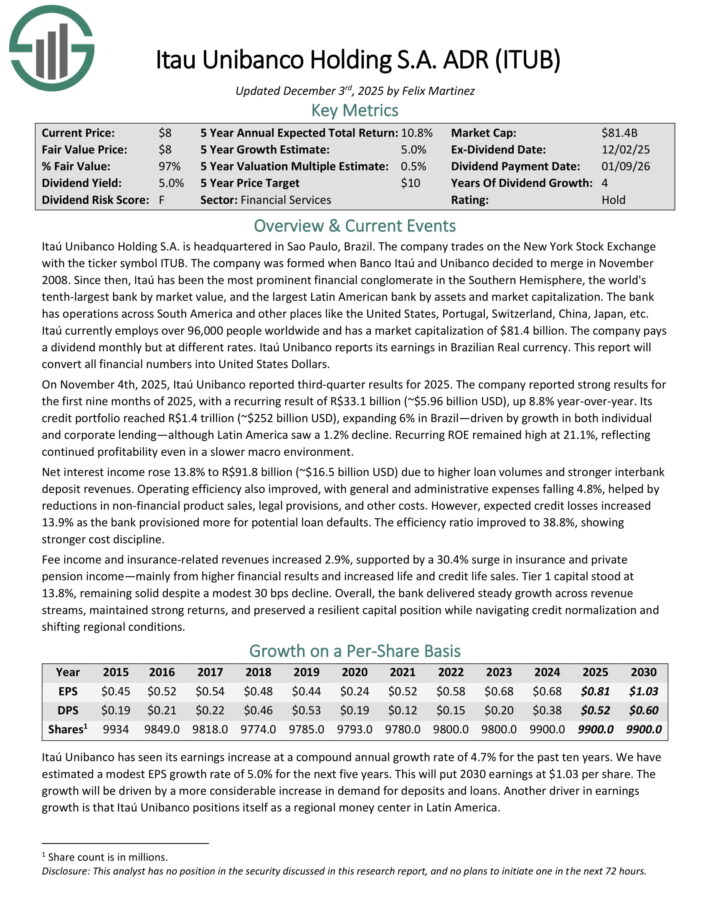

Best Performing Monthly Dividend Stock #8: Itau Unibanco (ITUB)

Annualized 10-Year Total Returns: 14.9%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. It is the world’s tenth-largest bank by market value, and the largest Latin American bank by assets and market capitalization.

The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

Itaú currently employs over 96,000 people worldwide and has a market capitalization of $81.4 billion.

On November 4th, 2025, Itaú Unibanco reported third-quarter results for 2025. The company reported strong results for the first nine months of 2025, with a recurring result of R$33.1 billion (~$5.96 billion USD), up 8.8% year-over-year.

Its credit portfolio reached R$1.4 trillion (~$252 billion USD), expanding 6% in Brazil—driven by growth in both individual and corporate lending—although Latin America saw a 1.2% decline.

Recurring ROE remained high at 21.1%, reflecting continued profitability even in a slower macro environment.

Net interest income rose 13.8% to R$91.8 billion (~$16.5 billion USD) due to higher loan volumes and stronger interbank deposit revenues.

Operating efficiency also improved, with general and administrative expenses falling 4.8%, helped by reductions in non-financial product sales, legal provisions, and other costs.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

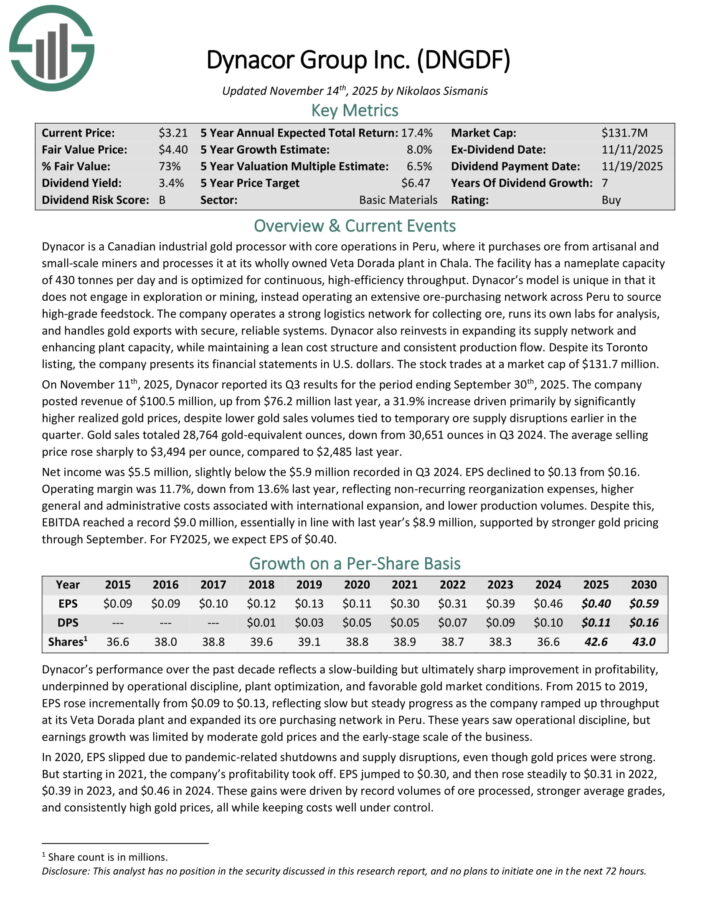

Best Performing Monthly Dividend Stock #7: Dynacor Group (DNGDF)

Annualized 10-Year Total Returns: 15.3%

Dynacor is a Canadian industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tonnes per day and is optimized for continuous, high-efficiency throughput.

Dynacor’s model is unique in that it does not engage in exploration or mining, instead operating an extensive ore purchasing network across Peru to source high-grade feedstock.

The company operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems.

Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow.

On November 11th, 2025, Dynacor reported its Q3 results. The company posted revenue of $100.5 million, up from $76.2 million last year, a 31.9% increase driven primarily by significantly higher realized gold prices, despite lower gold sales volumes tied to temporary ore supply disruptions earlier in the quarter.

Gold sales totaled 28,764 gold-equivalent ounces, down from 30,651 ounces in Q3 2024. The average selling price rose sharply to $3,494 per ounce, compared to $2,485 last year.

Net income was $5.5 million, slightly below the $5.9 million recorded in Q3 2024. EPS declined to $0.13 from $0.16. Operating margin was 11.7%, down from 13.6% last year, reflecting non-recurring reorganization expenses, higher general and administrative costs associated with international expansion, and lower production volumes.

Click here to download our most recent Sure Analysis report on DNGDF (preview of page 1 of 3 shown below):

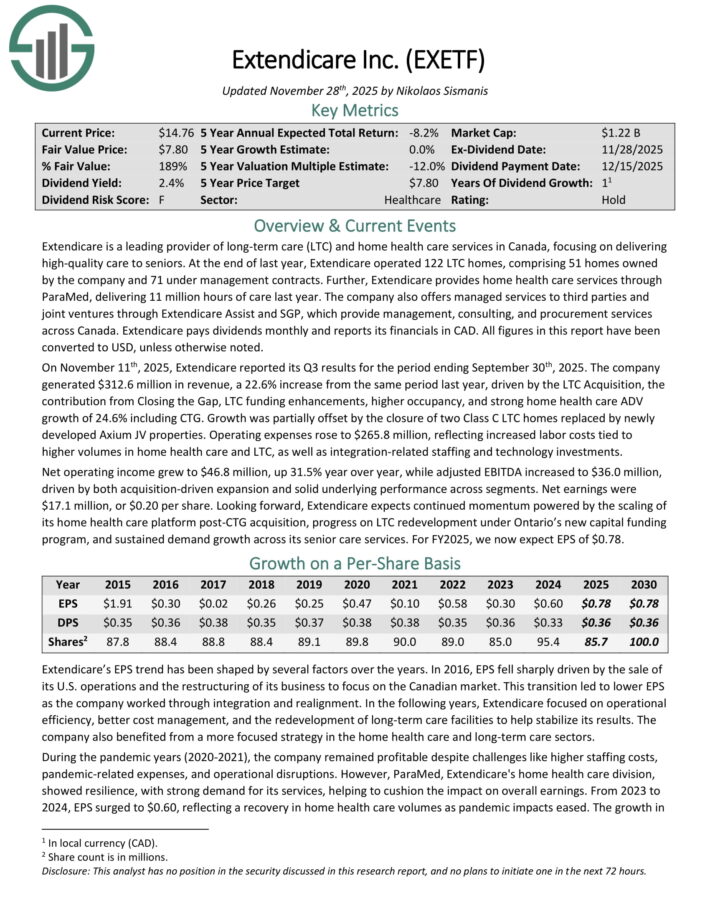

Best Performing Monthly Dividend Stock #6: Extendicare, Inc. (EXETF)

Annualized 10-Year Total Returns: 15.4%

Extendicare is a leading provider of long-term care (LTC) and home health care services in Canada, focusing on delivering high-quality care to seniors.

At the end of last year, Extendicare operated 122 LTC homes, comprising 51 homes owned by the company and 71 under management contracts.

Further, Extendicare provides home health care services through ParaMed, delivering 11 million hours of care last year. The company also offers managed services to third parties and joint ventures through Extendicare Assist and SGP, which provide management, consulting, and procurement services across Canada.

On November 11th, 2025, Extendicare reported its Q3 results for the period ending September 30th, 2025. The company generated $312.6 million in revenue, a 22.6% increase from the same period last year, driven by the LTC Acquisition, the contribution from Closing the Gap, LTC funding enhancements, higher occupancy, and strong home health care ADV growth of 24.6% including CTG.

Growth was partially offset by the closure of two Class C LTC homes replaced by newly developed Axium JV properties.

Operating expenses rose to $265.8 million, reflecting increased labor costs tied to higher volumes in home health care and LTC, as well as integration-related staffing and technology investments.

Net operating income grew to $46.8 million, up 31.5% year over year, while adjusted EBITDA increased to $36.0 million, driven by both acquisition-driven expansion and solid underlying performance across segments. Net earnings were $17.1 million, or $0.20 per share.

Click here to download our most recent Sure Analysis report on EXETF (preview of page 1 of 3 shown below):

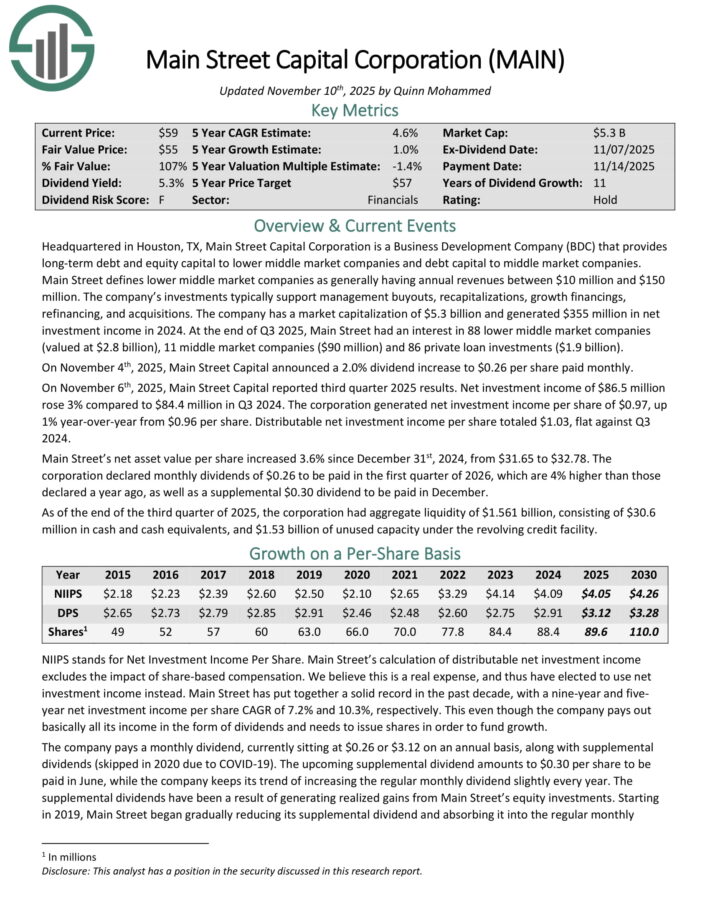

Best Performing Monthly Dividend Stock #5: Main Street Capital (MAIN)

Annualized 10-Year Total Returns: 15.7%

Main Street Capital Corporation is a Business Development Company (BDC) that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies.

Main Street defines lower middle market companies as generally having annual revenues between $10 million and $150 million.

The company’s investments typically support management buyouts, recapitalizations, growth financings, refinancing, and acquisitions. The company has a market capitalization of $5.3 billion and generated $355 million in net investment income in 2024.

At the end of Q3 2025, Main Street had an interest in 88 lower middle market companies (valued at $2.8 billion), 11 middle market companies ($90 million) and 86 private loan investments ($1.9 billion).

The corporation had aggregate liquidity of $1.561 billion, consisting of $30.6 million in cash and cash equivalents, and $1.53 billion of unused capacity under the revolving credit facility.

On November 4th, 2025, Main Street Capital announced a 2.0% dividend increase to $0.26 per share paid monthly.

On November 6th, 2025, Main Street Capital reported third quarter 2025 results. Net investment income of $86.5 million rose 3% compared to $84.4 million in Q3 2024.

The corporation generated net investment income per share of $0.97, up 1% year-over-year from $0.96 per share. Distributable net investment income per share totaled $1.03, flat against Q3 2024.

Main Street’s net asset value per share increased 3.6% since December 31st, 2024, from $31.65 to $32.78.

The corporation declared monthly dividends of $0.26 to be paid in the first quarter of 2026, which are 4% higher than those declared a year ago, as well as a supplemental $0.30 dividend to be paid in December.

Click here to download our most recent Sure Analysis report on MAIN (preview of page 1 of 3 shown below):

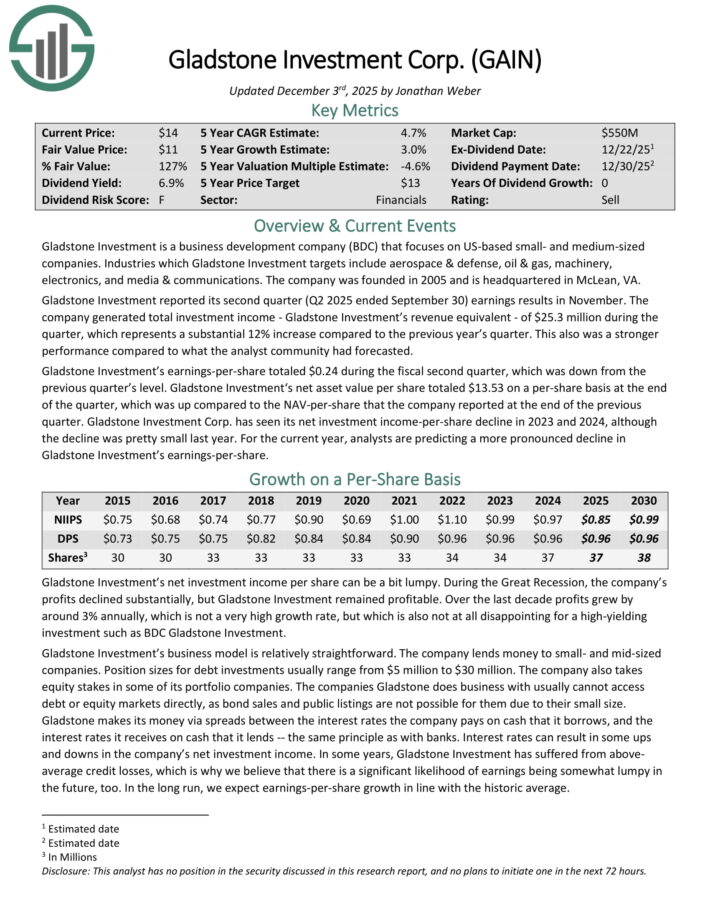

Best Performing Monthly Dividend Stock #4: Gladstone Investment (GAIN)

Annualized 10-Year Total Returns: 16.9%

Gladstone Investment is a business development company (BDC) that focuses on US-based small- and medium-sized companies.

Industries which Gladstone Investment targets include aerospace & defense, oil & gas, machinery, electronics, and media & communications. The company was founded in 2005 and is headquartered in McLean, VA.

Gladstone Investment reported its second quarter (Q2 2025 ended September 30) earnings results in November. The company generated total investment income of $25.3 million during the quarter, which represented a 12% increase year-over-year.

Gladstone Investment’s earnings-per-share totaled $0.24 during the fiscal second quarter, which was down from the previous quarter’s level.

Gladstone Investment‘s net asset value per share totaled $13.53 on a per-share basis at the end of the quarter, which was up compared to the NAV-per-share that the company reported at the end of the previous quarter.

Click here to download our most recent Sure Analysis report on GAIN (preview of page 1 of 3 shown below):

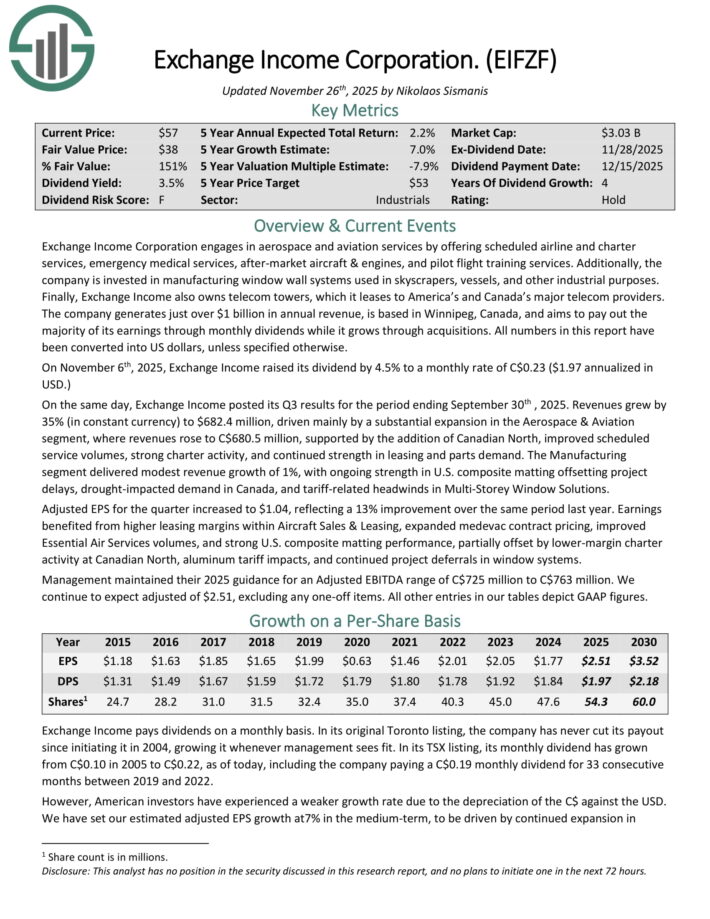

Best Performing Monthly Dividend Stock #3: Exchange Income Corp. (EIFZF)

Annualized 10-Year Total Returns: 18.5%

Exchange Income Corporation engages in aerospace and aviation services by offering scheduled airline and charter services, emergency medical services, after-market aircraft & engines, and pilot flight training services.

Additionally, the company is invested in manufacturing window wall systems used in skyscrapers, vessels, and other industrial purposes.

Finally, Exchange Income also owns telecom towers, which it leases to America’s and Canada’s major telecom providers. The company generates just over $1 billion in annual revenue.

On November 6th, 2025, Exchange Income raised its dividend by 4.5% to a monthly rate of C$0.23 ($1.97 annualized in USD.) On the same day, Exchange Income posted its Q3 results for the period ending September 30th , 2025.

Revenue grew by 35% (in constant currency) to $682.4 million, driven mainly by a substantial expansion in the Aerospace & Aviation segment, where revenues rose to C$680.5 million, supported by the addition of Canadian North, improved scheduled service volumes, strong charter activity, and continued strength in leasing and parts demand.

Adjusted EPS for the quarter increased to $1.04, reflecting a 13% improvement over the same period last year.

Earnings benefited from higher leasing margins within Aircraft Sales & Leasing, expanded medevac contract pricing, improved Essential Air Services volumes, and strong U.S. composite matting performance.

Click here to download our most recent Sure Analysis report on EIFZF (preview of page 1 of 3 shown below):

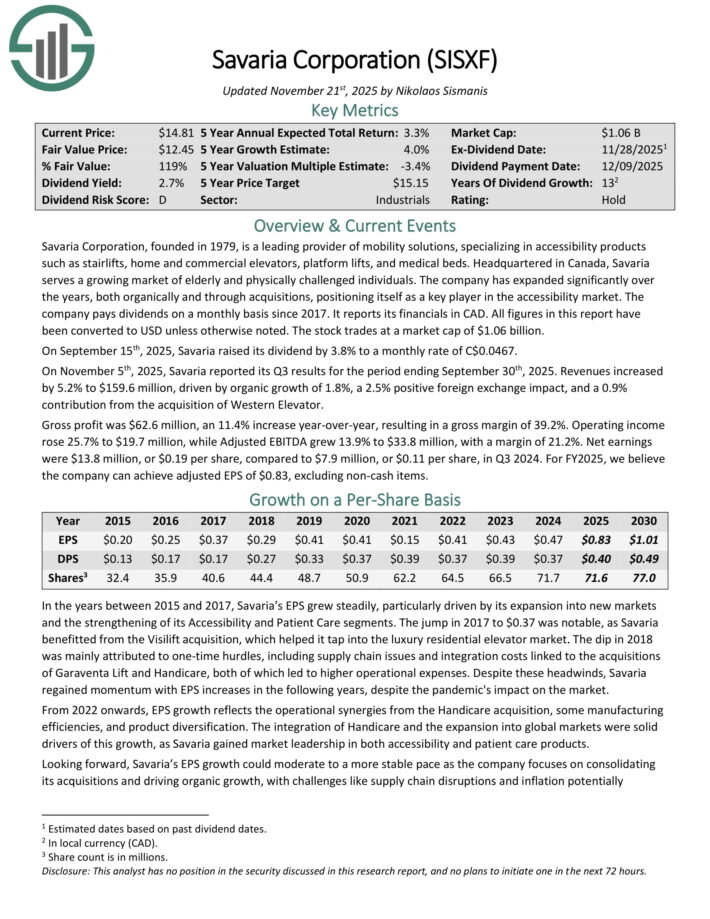

Best Performing Monthly Dividend Stock #2: Savaria Corp. (SISXF)

Annualized 10-Year Total Returns: 19.5%

Savaria Corporation is a leading provider of mobility solutions, specializing in accessibility products such as stairlifts, home and commercial elevators, platform lifts, and medical beds.

Headquartered in Canada, Savaria serves a growing market of elderly and physically challenged individuals. The company has expanded significantly over the years, both organically and through acquisitions, positioning itself as a key player in the accessibility market.

On September 15th, 2025, Savaria raised its dividend by 3.8% to a monthly rate of C$0.0467. On November 5th, 2025, Savaria reported its Q3 results for the period ending September 30th, 2025.

Revenues increased by 5.2% to $159.6 million, driven by organic growth of 1.8%, a 2.5% positive foreign exchange impact, and a 0.9% contribution from the acquisition of Western Elevator.

Gross profit was $62.6 million, an 11.4% increase year-over-year, resulting in a gross margin of 39.2%. Operating income rose 25.7% to $19.7 million, while Adjusted EBITDA grew 13.9% to $33.8 million, with a margin of 21.2%. Net earnings were $13.8 million, or $0.19 per share, compared to $7.9 million, or $0.11 per share, in Q3 2024.

Click here to download our most recent Sure Analysis report on SISXF (preview of page 1 of 3 shown below):

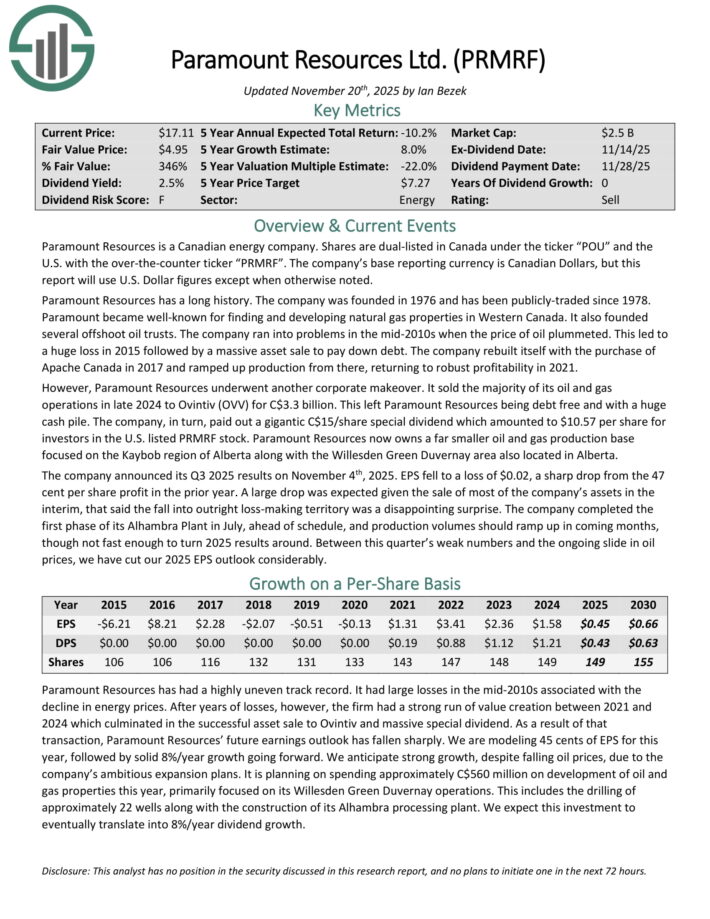

Best Performing Monthly Dividend Stock #1: Paramount Resources (PRMRF)

Annualized 10-Year Total Returns: 24.4%

Paramount Resources is a Canadian energy company. Paramount Resources has a long history. The company was founded in 1976 and has been publicly-traded since 1978.

Paramount Resources now owns a far smaller oil and gas production base focused on the Kaybob region of Alberta along with the Willesden Green Duvernay area also located in Alberta.

The company announced its Q3 2025 results on November 4th, 2025. EPS fell to a loss of $0.02, a sharp drop from the 47 cent per share profit in the prior year.

A large drop was expected given the sale of most of the company’s assets in the interim, that said the fall into outright loss-making territory was a disappointing surprise.

The company completed the first phase of its Alhambra Plant in July, ahead of schedule, and production volumes should ramp up in coming months.

It is planning on spending approximately C$560 million on development of oil and gas properties this year, primarily focused on its Willesden Green Duvernay operations.

This includes the drilling of approximately 22 wells along with the construction of its Alhambra processing plant.

Click here to download our most recent Sure Analysis report on PRMRF (preview of page 1 of 3 shown below):

Further Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Monthly Dividend Stock Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].