In October of 2025, the RAND Corporation published a report titled “Stabilizing the U.S.–China Rivalry“. Within weeks, the study disappeared from RAND’s website. No explanation. No revision notice. No reupload. For a prominent think tank, whose research pipeline is structured to avoid public missteps, withdrawal of a report is uncommon, and silence more so. The unusual disappearance of this report raises questions about internal disagreement within U.S. strategy-making circles.

RAND headquarters

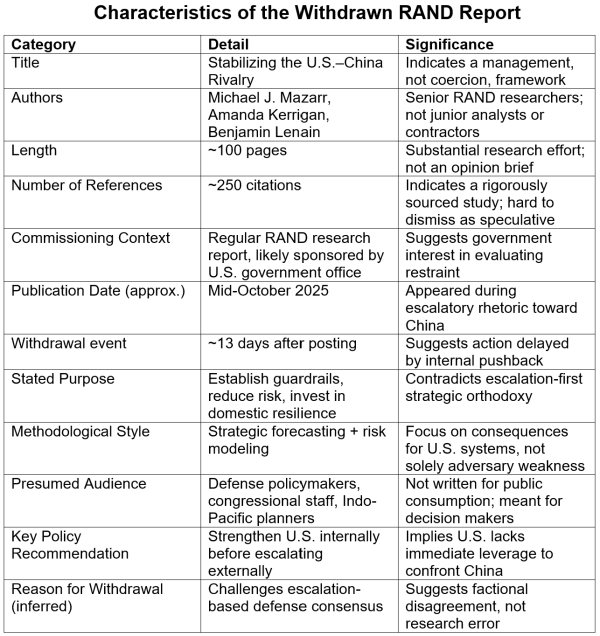

The timeline itself suggests a struggle. The study appeared on RAND’s website in mid-October 2025 and was not removed until nearly two weeks later. This is far too slow for a routine correction and far too fast for a scheduled revision. Such a delay is characteristic of an internal contest: the report was vetted, approved, published, and allowed to circulate — until opposition within the policy structure hardened sufficiently to demand its removal. The RAND report was not suppressed because it was mistaken, but because its implications became intolerable after they were recognized. The structural characteristics of the withdrawn report are shown below.

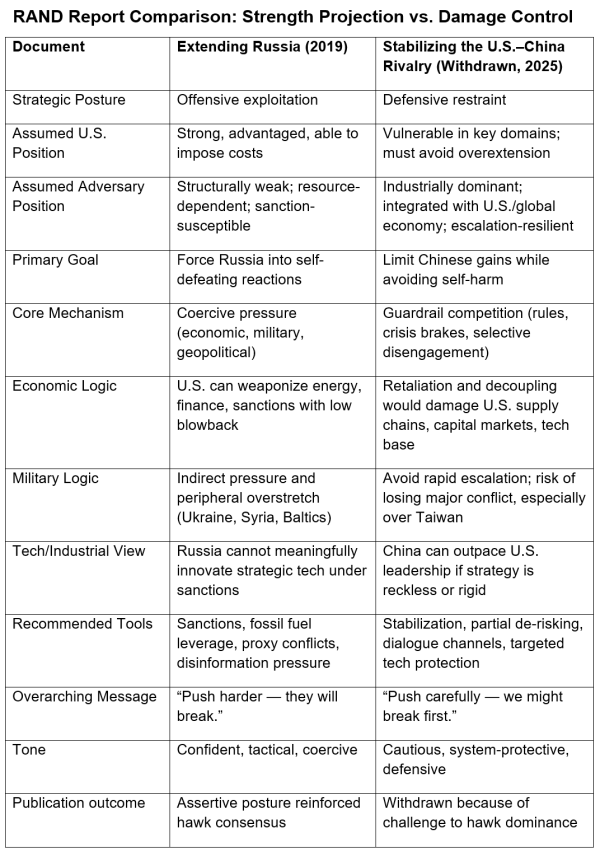

To understand why this document was retracted, it is useful to examine it alongside another historically important RAND study: “Extending Russia: Competing from Advantageous Ground” (2019). The contrast between the two offers a rare, unfiltered glimpse into an evolving, and contested, U.S. strategic worldview.

Russia as a Target of Pressure

“Extending Russia” was explicitly about Washington’s ability to impose costs on Moscow. The study recommended strategies to “extend” Russian vulnerabilities—essentially stressing the state until it faces difficult internal trade-offs. Tools included:

energy leverage

financial sanctions

information pressure

peripheral military competition.

The underlying assumption was straightforward: the U.S. possesses structural power, Russia does not. As a result, coercive measures appear low-risk and high-return. The report offers a plan for managing an adversary from a position of strategic confidence. Some foreign policy analysts have considered this report to be a blueprint for the assertive U.S. posture that preceded the Ukraine war.

China Policy as Management of Systemic Constraint

By contrast, “Stabilizing the U.S.–China Rivalry” adopts a cautionary tone unusual in U.S. strategic literature. Rather than identifying Chinese weaknesses to exploit, its central concern is avoiding actions that might weaken the United States itself. Where the Russia report encourages escalation to impose costs, the China study warns that escalation may produce asymmetric blowback affecting:

Global supply chains

Industrial capacity

Technology platforms

Capital markets

In short, costs cannot be imposed on China without risking significant retaliatory actions against the U.S. economy and defense base. (This was demonstrated recently when China responded to increased U.S. import tariffs by restricting the export of essential rare-earth materials.) The study’s recommendations center on restraint, crisis-management channels, selective “de-risking,” and internal capability rebuilding. This contrasts markedly with the confrontational approach presented in the “Extending Russia” report, and this strategic shift was likely seen as a direct challenge by Washington’s China hawks.

Why the RAND Report Withdrawal Matters

RAND reports do not pass easily into public view. Prior to publication they undergo internal peer review; methodological review; sponsor liaison and approval; and editorial and classification screening. A report cleared through these steps represents a professionally accepted line of analysis, not a personal opinion. When such a document is withdrawn after clearance, the likely cause is not faulty research, but political pressure.

The China report’s framing challenged the prevailing policy assumptions of the China hawks. U.S. defense contractors, naval lobbying circles, and military planners benefit from a narrative of unrestrained U.S. capability and open-ended escalation. A report suggesting that U.S. power is limited, particularly vis-à-vis a peer industrial economy, undermines the logic of increasing defense appropriations and escalation-oriented military planning. In other words, the report’s realism made it politically untimely.

A Strategic Debate, Not a Conspiracy

The withdrawal of the report should not be read as an incident of simple censorship. It signals something more important: a deepening institutional debate over how to position the United States in a geopolitical environment where the coercive instruments that were applied against Russia may be counterproductive against China. The China study represents a realist faction arguing that the U.S. must invest in industrial, technological, and financial resilience before pursuing aggressive competition. Its warning is less about China’s strength than America’s vulnerabilities. These include dependency on foreign manufacturing inputs; exposure to retaliatory capital controls; eroding technological monopolies; and fragile defense supply chains. The report stated the politically inconvenient truth: policy must converge with economic arithmetic.

Report Withdrawal as a Setback for the China Hawks

The quiet removal of “Stabilizing the U.S.–China Rivalry” did not simply protect a policy consensus; it exposed its fragility. The hawkish approach to China—based on the assumption that escalation will successfully impose coercive leverage—now faces practical constraints that are increasingly difficult to deny. The RAND report’s realism was unacceptable not because it was provocative, but because it was evidence-based at a moment when the dominant position is ideological.

For China hawks, escalation is a tool for restoring deterrence through fear. Yet “Stabilizing the Rivalry” presented a scenario in which escalation erodes deterrence by exposing American vulnerabilities. In that framework, the China hawk position begins to resemble what economists call a moral hazard: an actor takes on greater risk because it expects another party—here the broader U.S. economy—to absorb the costs.

This tension reveals why a defensive strategy is politically unwelcome. It requires acknowledging that the United States cannot “manage” China primarily through military signaling, sanctions, export controls, or alliance pressure. Those instruments still matter, but in the RAND analysis they function as supplements to industrial and technological renewal, not as substitutes. The hawkish model reverses that order by treating industrial weakness as an incidental issue rather than a key problem to solve.

In practical terms, the RAND report withdrawal signals a deteriorating political position for China hawks, not because their agenda lacks influence, but because its strategic justification is becoming harder to defend without suppressing research that contradicts it. The inability to allow a vetted, internally approved study from a prominent think tank to remain public demonstrates the growing incongruity between hawkish anti-China sentiment and economic constraints on China policy.

Conclusion

If the U.S. continues to debate China policy without confronting its industrial dependencies, the disagreement will not be between hawks and realists but between narrative and arithmetic. RAND’s withdrawn report was not an ideological provocation but a forecasting exercise arriving at a forbidden conclusion: the U.S. cannot pursue hegemonic competition without first rebuilding its economic capacity to compete. Refusing to say so does not reduce the cost of escalation with China. It only postpones the reckoning.