In the Federal Reserve’s battle between fighting inflation and limiting unemployment, the latter side carried the day Wednesday and could also have an edge heading into 2026 if labor market weakness becomes more evident through an apparent overcounting of jobs numbers.

In the immediate term, worries over the employment situation meant a vote, albeit divided by a 9-3 margin, to lower the central bank’s key interest rate by a quarter percentage point. Down the road, there are indications that policymakers will be more inclined to cut further if the labor market stays soft.

At his Wednesday news conference, Chair Jerome Powell mentioned several times that there likely has been negative job growth in recent months, a condition that would argue for easier monetary policy.

“Gradual cooling in the labor market has continued,” Powell said. “Surveys of households and businesses both show declining supply and demand for workers. So, I think you can say that the labor market has continued to cool gradually, just a touch more gradually than we thought.”

At issue is a monthly estimate the Bureau of Labor Statistics performs of how the labor market is affected by businesses closing and opening. The estimate, known as the birth-death model, takes a guess at the jobs gained by openings and lost by closings.

Powell said the model has probably overstated jobs by about 60,000 per month since April. With job growth averaging just shy of 40,000 in that period, an overstatement that size would equate to payroll losses of about 20,000 per month.

Powell urges caution

The chair called the discrepancy “something of a systematic overcount” that likely will see big revisions to job growth numbers.

In September, the BLS released a preliminary benchmark estimate that job growth was overstated by 911,000 in the 12-month period preceding March 2025. A final count is scheduled to come out in February.

In “a world where job creation is negative, I just think we need to watch that situation very carefully and be in a position where we’re not pushing down job creation with our policy,” Powell said.

Balancing support for the labor market with keeping inflation under control will be central to policymaking as the Fed enters 2026.

Officials at this week’s Federal Open Market Committee meeting expressed a broad divergence of opinion on where rates should head. Six of the 19 participants said they opposed the latest rate cut — two of them were among the 12 who vote — and seven indicated they don’t see the need for any reductions next year, according to the “dot plot” of individual expectations.

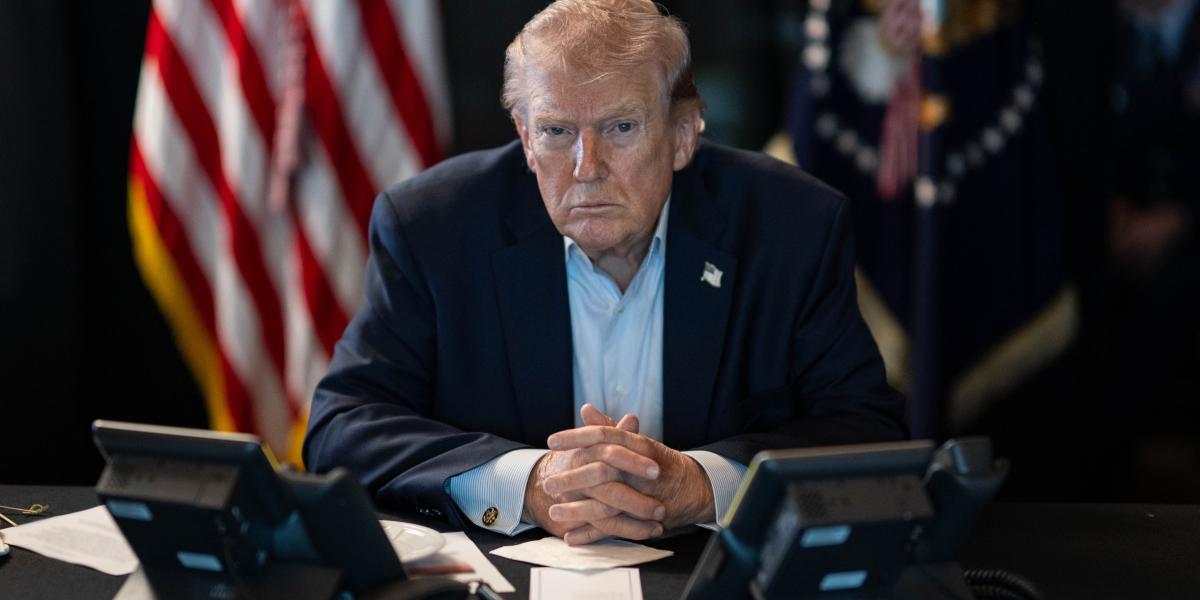

On the other side are those who think there is at least some room for further easing. That would point to greater concerns about the labor market, even as inflation holds above the Fed’s 2% target. However, Powell said much of the inflation overshoot is coming from President Donald Trump’s tariffs, whose impact is expected to wane as the months go on.

Market sees more cuts

Should the view hold that inflation is subsiding and the labor market is stumbling, the Fed would then be expected to tilt toward an easing bias, particularly with Powell leaving his position as chair in May.

“With the Fed’s most influential members keeping a keen eye on the unemployment rate, we think that as long as labor demand wanes and [the] unemployment rate increases, the path will be cleared for additional cuts, despite the vocal opposition from the hawks,” Natixis economist Christopher Hodge said in a note.

“Because we see the unemployment rate rising through Q1 2026, we think the Fed will continuing cutting to arrest further softening in the labor market,” Hodge added, noting that “we think a cut in January is more likely than not.”

Stocks rallied Wednesday and Thursday amid hopes that the rhetoric out of the FOMC was not as hawkish as feared.

Still, futures market pricing is indicating the next cut won’t come until at least April. Traders also are putting odds on two reductions in 2026, which is more aggressive than the dot-plot indication of one, with even a 41% probability of three moves, according to the CME Group’s FedWatch measure.