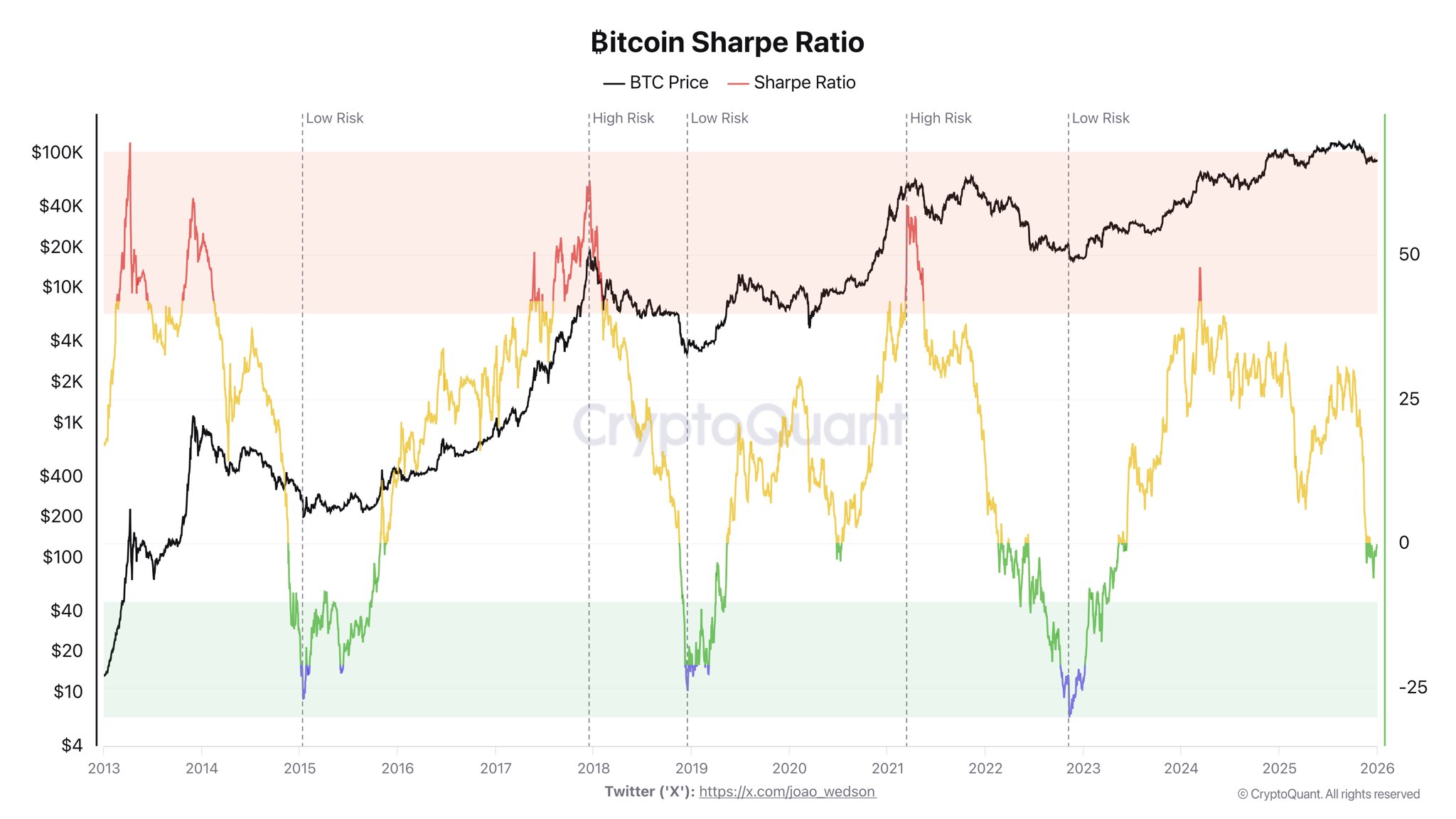

With Bitcoin‘s waning price action extending and its value still below the $90,000 mark, many key metrics and indicators are starting to enter into negative territory in this new year. One of the major metrics that has turned negative as the year begins is the BTC Sharpe Ratio, which measures the risk level of the flagship cryptocurrency asset.

A Rare Bitcoin Risk-Low Opportunity Has Emerged

Ongoing volatility has hampered Bitcoin’s price action despite several attempts at an upward move, keeping the asset stuck below the $100,000 mark. Although the Bitcoin market appears vulnerable at first glance, a closer examination of risk-adjusted returns reveals a more complex picture.

Darkfost, a market expert and author at CryptoQuant, has delved into BTC’s risk performance via the Sharpe Ratio, revealing a major shift in the market. According to Darkfost, it is a tool for evaluating risk based on the volatility and returns of an asset. By comparing these two variables, analysts are able to determine periods when exposure is more or less risky.

Following his analysis of the Sharpe Ratio, the expert has disclosed that the metric has flipped into a negative territory after falling to -0.5, a move that typically unfolds during periods of market stress or transition. As seen in the chart shared by Darkfost, the metric is now approaching a historical low-risk zone.

Typically, when the Sharpe ratio falls to low levels, it is accompanied by high-risk periods. However, this implies that returns have been low for Bitcoin, which is volatile by nature. In other words, investors have experienced a series of losses while volatility stays elevated.

This shift may be a sign of weakness in Bitcoin market dynamics. However, it brings Bitcoin closer to areas that have historically been associated with lower downside risk and longer-term opportunities.

Darkfost highlighted that the best opportunities on Bitcoin typically appear after losses have already been realized and the correction has been intensified by volatility. The trend leads to significant drawdowns and negative returns.

For this reason, a negative Sharpe ratio, such as the current drop to -0.5, may indicate a favorable Bitcoin opportunity. In the past, the best purchasing opportunities have appeared whenever this ratio has reached the extremely low-risk zone indicated on the chart.

Are Long-Term Holders Now Buying More BTC?

A report from Axel Adler Jr., a researcher and author, shows that Bitcoin long-term holders are demonstrating resilience despite current price fluctuations. Adler’s analysis focuses on the BTC LTH Distribution Pressure metric, which has undergone a key shift that could shape the market’s trajectory.

Data tells that the LTH Distribution Pressure Index has fallen to -1.628, which implies that the metric has transitioned into the Accumulation zone. The shift points to minimal selling pressure from BTC’s long-term holders, indicating renewed confidence among the cohort in the asset’s prospects.

Currently, the average daily LTH spending for Bitcoin is at 221 BTC, marking one of the lowest levels in months. Darkfost also indicated the Spent Output Profit Ratio (SOPR), which is positioned at 1.13, confirming that BTC holders remain in profit levels. With the key metrics positioned at these critical levels, the market structure seems favorable.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.