Key Takeaways

Bitcoin gained 13% in April despite a broader market selloff.

Ethereum’s dominance in smart contract fees significantly decreased as users migrated to other networks.

Share this article

Bitcoin showed flashes of independence from equities in April, renewing hopes that it’s evolving into a true macro hedge. However, VanEck’s recent data tell a different story.

In a monthly recap published on Monday, analysts at VanEck say that the flagship crypto asset still trades closely with traditional markets, as it quickly re-synced with major indices after a brief divergence.

Bitcoin briefly showed signs of decoupling from US equities during the week ending April 6, when former President Trump announced new tariff measures that rattled global markets. While equities and gold declined, Bitcoin climbed from $81,500 to over $84,500 at week’s end, hinting at a potential shift toward independent price action.

This divergence fueled hopes that Bitcoin might break away from traditional risk asset behavior and push toward new highs. However, the momentum did not last long, and the asset soon resumed trading in line with equity markets.

Offering more context in this area, VanEck—drawing on data from VanEck Research and Artemis XYZ—notes that Bitcoin has not meaningfully decoupled from the stock market.

Although the 30-day moving average correlation between BTC and the S&P 500 briefly dipped below 0.25 in early April, it quickly rebounded to around 0.55 by the end of the month.

Still, Bitcoin outperformed the major stock indices during the month. It gained 13%, while the Nasdaq Composite fell 1% and the S&P 500 posted only a slight increase.

Perhaps most notably, Bitcoin’s volatility declined by 4% in April, even as volatility in equity markets doubled amid rising geopolitical and trade tensions.

Structural tailwinds are building

According to VanEck, despite the fact that Bitcoin still behaves like a risk asset in the short term, structural tailwinds, including aggressive corporate BTC accumulation, may be setting the stage for long-term divergence.

Analysts suggest that as individuals, corporations, and central banks increasingly view Bitcoin as a sovereign, uncorrelated store-of-value, its long-term behavior could break free from that of traditional risk assets.

Russia and Venezuela, which have already begun embracing Bitcoin’s utility in international trade, are early examples of this transformation, according to analysts.

Corporate-level Bitcoin accumulation was active in April. To recap, Strategy added 25,400 BTC to its holdings, while Metaplanet and Semler Scientific also made significant purchases.

A key highlight of the month was the launch of a new venture, XXI (Twenty One), formed by Softbank, Tether, and Cantor Fitzgerald, with the goal of acquiring over $3 billion worth of Bitcoin.

This signals Bitcoin’s growing role on corporate balance sheets, as institutional exposure shifts from speculative bets to long-term strategic positioning.

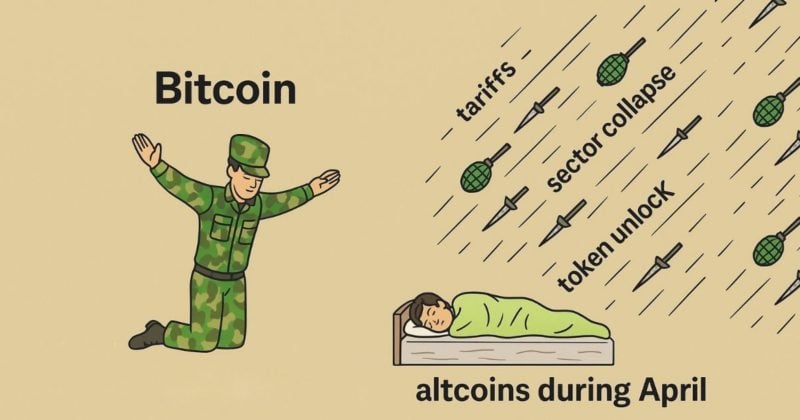

Crypto stumbles as Bitcoin holds steady

Bitcoin dodged the tariff fallout, but altcoins were not lucky.

Layer 1 networks led the decline, with Ethereum, Solana, and Sui all posting heavy drawdowns from their January highs, falling between 66% and 68%, according to VanEck. The MarketVector Smart Contract Leaders Index (MVSCLE) dropped 5% in April and is now down 34% year-to-date.

The slump followed a global equity selloff triggered by new trade tariffs, compounded by unlock fatigue and heavy losses in speculative sectors like DeFi AI, DeSci, and AI Agents. Meme coin trading volume also collapsed by 93% between January and March.

Yet some chains managed to buck the trend, including Sui, Solana, and Stacks, according to VanEck.

Solana rose 16%, lifted by network upgrades and growing institutional treasury interest. Ethereum, meanwhile, slipped another 3%, underperforming its peers as fee erosion and layer 2 competition continued.

Solana’s April was quiet but constructive. The network released SIMD-0207, a compute upgrade that sets the stage for future throughput gains. The Solana Foundation also began phasing out underperforming validators reliant on delegation, aiming to prioritize those offering ecosystem value.

With roughly 18% of staked SOL managed through the Foundation, validator dynamics remain a key part of the chain’s governance. While some question meme coin sustainability, Solana’s unmatched throughput continued to dominate trading activity. In April, meme coins accounted for 95% of all DEX activity on the chain, excluding SOL and stablecoins.

Sui’s strength goes beyond its price. In April, its daily DEX volumes jumped 45%, placing it among the most active chains. It entered the top 10 in smart contract platform revenue and posted the highest stablecoin turnover ratio at 716%. Core developer Mysten Labs earned praise for product velocity and responsiveness in an increasingly crowded layer 1 sector.

Ethereum, by contrast, faces mounting pressure. Its share of layer 1 fee revenue slid to around 14%, down from 74% two years ago. Developers proposed major changes, including a shift to RISC-V architecture for faster zk-proofs, a 100x gas limit increase via EIP-9698, and parallel transaction execution under EIP-9580.

But Ethereum’s layer 2s continued to siphon users and activity. Flashbots’ deployment on Base and Optimism cut confirmation times to 200 milliseconds, while Arbitrum introduced gas payments in non-ETH tokens, further undermining ETH’s role. The core dilemma remains: Layer 2s rely on Ethereum’s security while eroding its fee base.

Meanwhile, Tron and Hyperliquid took the top spots in average daily blockchain revenue, earning more than both Solana and Ethereum.

Tron’s dominance in stablecoin transfers and Hyperliquid’s niche in perpetual trading helped them generate $1.7 million and $1.4 million daily, respectively, according to VanEck.

Speculative energy continued to fade. Meme coins, which once drove volumes across chains, saw trading activity and sentiment plunge. The MarketVector Meme Coin Index has fallen 48% year-to-date, though meme coins still made up 35% of Solana’s DEX activity in April.

Share this article