“The banking sector, in particular, stands to benefit from a positive Union budget for FY26 and the Reserve Bank of India’s recent easing of loan requirements after three years. This move signals strengthening financial sector stocks,” he says.

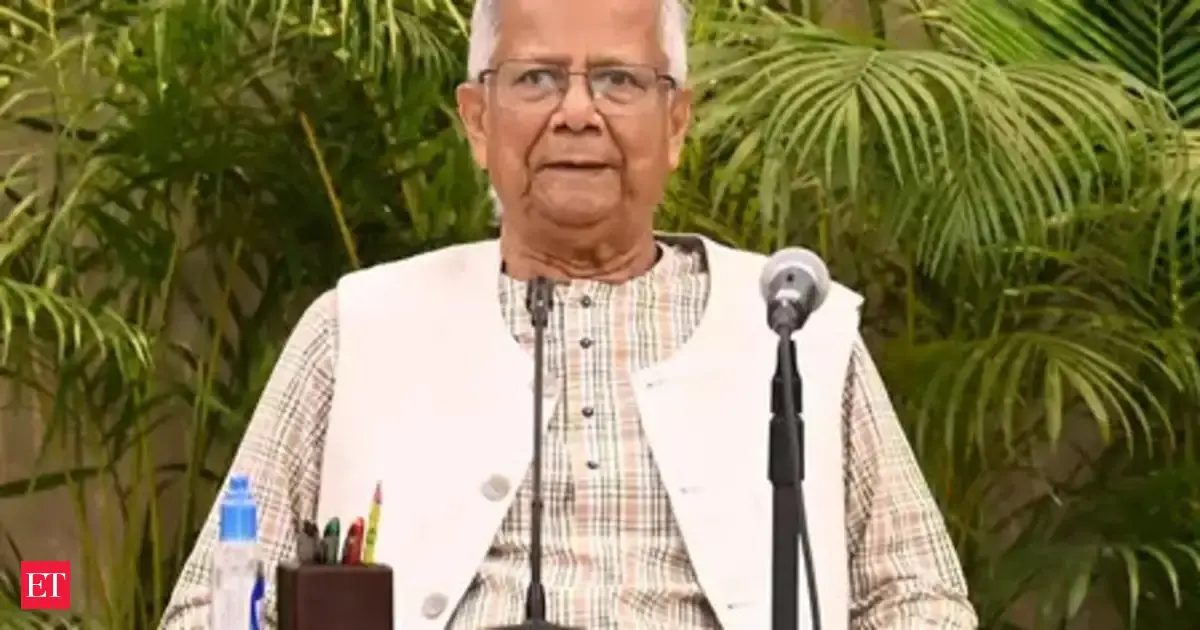

Edited excerpts from a chat:

What is your outlook on equity markets for the next 12–18 months, considering global uncertainties and domestic growth trends? Is this the time to buy the fear?

The outlook for Indian equity markets over the next 12-18 months appears generally optimistic, driven by strong domestic growth, government-led infrastructure investments, and robust corporate earnings, particularly in sectors such as technology, financials, and consumer goods. However, global factors such as rising US interest rates, potential recession risks, and volatile commodity prices could impact market sentiment and liquidity. While India’s economy is expected to remain resilient, challenges may arise from the RBI’s inflation management efforts and tightening global liquidity. Additionally, geopolitical uncertainties and domestic political stability will play a crucial role in shaping investor sentiment.

Overall, despite the strong growth potential in Indian markets, a well-diversified strategy, focusing on strong sectors while effectively managing risks, will be essential for navigating any volatility ahead.

With interest rate cycles shifting globally, how do you see Indian markets reacting in the near term?

Policymakers in the US are anticipating two rate cuts in 2025, with economic growth projected at 1.7% and inflation at 2.7%. Additionally, the Fed plans to slow the pace of balance sheet reduction by adjusting the monthly redemption cap on Treasury securities by the month of April.A higher lending rate could impact sectors like banking, while IT and pharma may benefit from a stronger USD. Overall the effects on India’s currency, capital flows and market sentiments are mixed. Higher US rates could lead to foreign capital outflows from Indian markets, whereas lower rates could encourage inflows. Additionally, US economic uncertainty could contribute to market volatility. However, a stronger dollar could influence global commodity prices and since India is a major oil importer, this could positively impact Indian stock markets.

Which sectors do you believe hold the most promise for long-term investors, and why?

The next phase of the market rally is likely to be led by the IT and banking sectors, supported by their strong Q3 performance and favourable valuations. The Federal Reserve’s decision to maintain the interest rates within the 4.25%-4.50% range is expected to provide further stability.

The banking sector, in particular, stands to benefit from a positive Union budget for FY26 and the Reserve Bank of India’s recent easing of loan requirements after three years. This move signals strengthening financial sector stocks.

How do you approach asset allocation in a volatile market scenario to ensure consistent returns for policyholders?

In a volatile market, effective asset allocation is critical for ensuring consistent returns for policyholders. A diversified portfolio across equities, debt, and commodities, helps mitigate risks associated with downturns in any single asset class.

Implementing dynamic rebalancing allows for adjustments in asset proportions based on market conditions, optimizing returns while maintaining a long-term focus. It’s important to avoid market timing strategies, as they can lead to poor investment decisions; instead, a consistent investment strategy emphasizing long term market participation is preferable.

Risk management is critical, involving the construction of an inflation-resistant portfolio and maintaining liquidity to manage potential risks effectively. Additionally, mitigating concentration risk by diversifying across industries and geographic regions enhances portfolio resilience against sector-specific downturns. Setting realistic expectations and avoiding herd behavior are keys to managing volatility.

What are your expectations from the Q4 earnings season? Do you believe the worst of the downgrades is behind us, and are we now entering a phase of gradual earnings recovery and growth?

We anticipate a strong Q4 earnings season, driven by a rebound in rural demand, increased government spending, and a potential recovery in urban demand. The urban demand is expected to benefit from income tax relief in the Union Budget, monetary easing by the RBI, and a moderation in food inflation.

While these factors suggest a positive outlook for corporate earnings, certain risks remain. Geopolitical shocks, such as international conflicts or trade tensions, could disrupt global markets and impact earnings. Additionally, shifts in global policies, such as changes in interest rates or fiscal policies, could have unforeseen consequences on business performance. Additionally, unforeseen earnings downgrades could dampen investor sentiment. Overall, we expect a gradual earnings recovery, supported by domestic consumption and fiscal measures.

As we step into FY26, do you think that consumption could be the biggest theme given lowering of interest rates and income tax rate cut. FIIs have been selling across sectors, including consumption. Is that an opportunity for domestic investors?

Lower interest rates and income tax cuts typically boost the consumption sector by increasing disposable income and encouraging spending. With lower interest rates, borrowing becomes cheaper, prompting consumers to take out loans for big-ticket items, while tax cuts directly raise disposable income, which encourages people to spend more on goods and services.

It may take a few quarters for the effects to be reflected in the numbers, and while the consumption sector has already seen a correction, valuations still appear high. However, strong growth is expected moving forward. Given these factors, the consumption sector seems to be one of the few themes with potential for strong performance in the coming quarters. Domestic investors could start considering this sector for investment.

Do you think that investor opinion towards quick commerce companies can also turn more positive in FY26 as cash burn and competitive intensity slows down?

Quick commerce is an emerging segment, it is capital-intensive, driven by aggressive customer acquisition strategies, high operational costs, and intense competition. They are aggressively acquiring customers through steep discounts and promotional offers which have significantly contributed to cash burn, while maintaining dark stores and ensuring ultra-fast deliveries further added financial burden.

In the December quarter, Swiggy Instamart reported an adjusted EBITDA loss of ₹578 crore, compared to ₹358 crore in Q2 of this fiscal. Blinkit posted an adjusted EBITDA loss of ₹103 crore against ₹8 crore in July-September quarter. Meanwhile, Zepto’s loss for FY24 remained flat at ₹1,248 crore, against ₹ 1,272 crore in FY23.

Currently quick commerce is prioritizing growth over profitability. However, as competition eases and cash burns moderate, the sector could become an attractive investment opportunity for investors.