Texas Pacific Land Corporation (TPL) is based in Dallas, Texas, with its crown jewel resting in the Permian Basin. The company holds vast tracts of land, monetizing them through leases, sales, and easements that allow pipelines and utilities to carve their way through.

Add to that a water services arm that supplies, treats, and disposes of water for energy operators, and the business has carved out a powerful niche. With a market capitalization of nearly $21.5 billion, TPL comfortably sits in the “large-cap” club, a space reserved for players valued at $10 billion and above.

Yet for all its scale and pedigree, the stock has been on a bruising ride. Shares of TPL have tumbled 47.2% from the 52-week high of $1,769.14 seen in November 2024. The bleeding has not stopped there.

Over the past three months alone, the stock is down 11.8%, while the Dow Jones Industrial Average ($DOWI) rose 7% in the same stretch. Investors watching that divergence can almost feel the sting.

Stepping back further, the picture grows even more telling. Across the past 52 weeks, TPL’s shares marginally slipped further into the red. In 2025 alone, the decline has sharpened to 15.5%. Putting that against the Dow’s 9.3% rise over the year and an 8.4% gain year-to-date, the underperformance lays bare.

Traders have taken note. Since early June, the stock has lingered below both the 50-day and 200-day moving averages, a classic marker of bearish momentum. Only very recently has TPL clawed its way above the 50-day average of $925.18, though it still sits well below the 200-day average of $1,172.60.

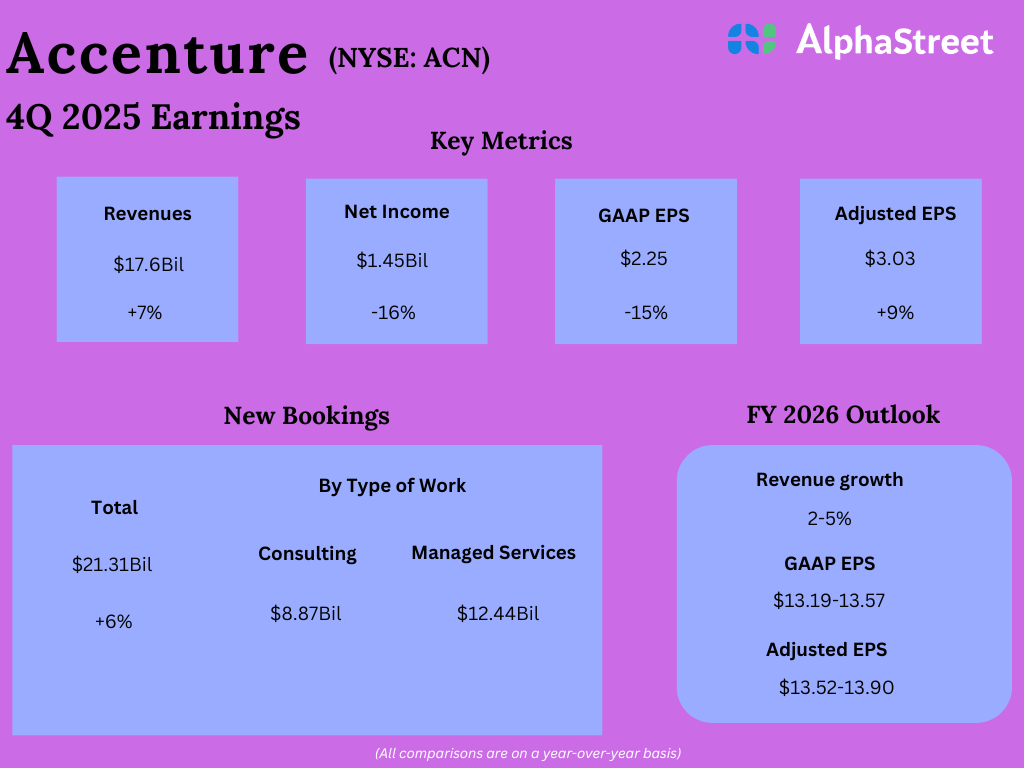

But there is more. On August 6, the stock slid, only to plunge another 8.8% the following day as the Q2 2025 earnings call played out. Revenue grew 8.8% year over year to $187.54 million, but missed the analysts’ expectations of $198 million. EPS offered little comfort. At $5.05, EPS showed growth of 1.4% from the prior year but still fell short of the $5.48 estimate.

Ironically, the quarter also held bright spots that went largely overshadowed. Production averaged 33.2 thousand barrels of oil equivalent per day, easement revenue came in at $36.2 million, and net income reached $116.1 million. On their own, these would be numbers to celebrate. But when paired with missed top and bottom lines, they only deepened the sense that the engine was revving without enough forward thrust.