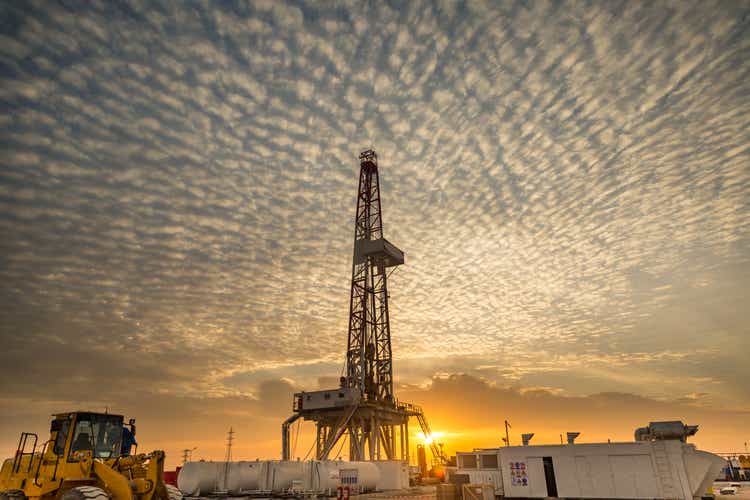

sasacvetkovic33/E+ via Getty Images

Diamondback Energy (NASDAQ:FANG) +9.7% in Monday’s trading to its highest level in nearly four months following news of its $26B cash and stock deal for Endeavor Energy Partners that would make the combined company the third-largest oil and gas producer in the Permian Basin, behind only Exxon and Chevron.

Bank of America upgraded Diamondback (FANG) to Neutral from Underperform with a $170 price target, saying the acquisition’s “compelling” strategic logic propels the company to the ranks of the “rate of change” plays among U.S. oil plays.

Endeavor is “one of the most highly sought after deals remaining in the Permian Basin, so this is a bit of a coup” for Diamondback (FANG), Roth MKM’s Leo Mariani wrote.

The merger has “industrial logic,” and a “reasonably priced acquisition could support current FANG valuations and merit another upward re-rate,” KeyBanc’s Tim Revzan said, according to Bloomberg.

“While FANG’s price paid is towards the high end of deals we have seen in the recent past, we believe FANG will be able to build upside through its suggested $550M annual synergies forecast,” Truist Securities analysts said.

“The quality of the inventory that Diamondback will have is extremely high, [which] will make this a very attractive investment on Wall Street,” Enverus analyst Andrew Dittmar told Reuters.