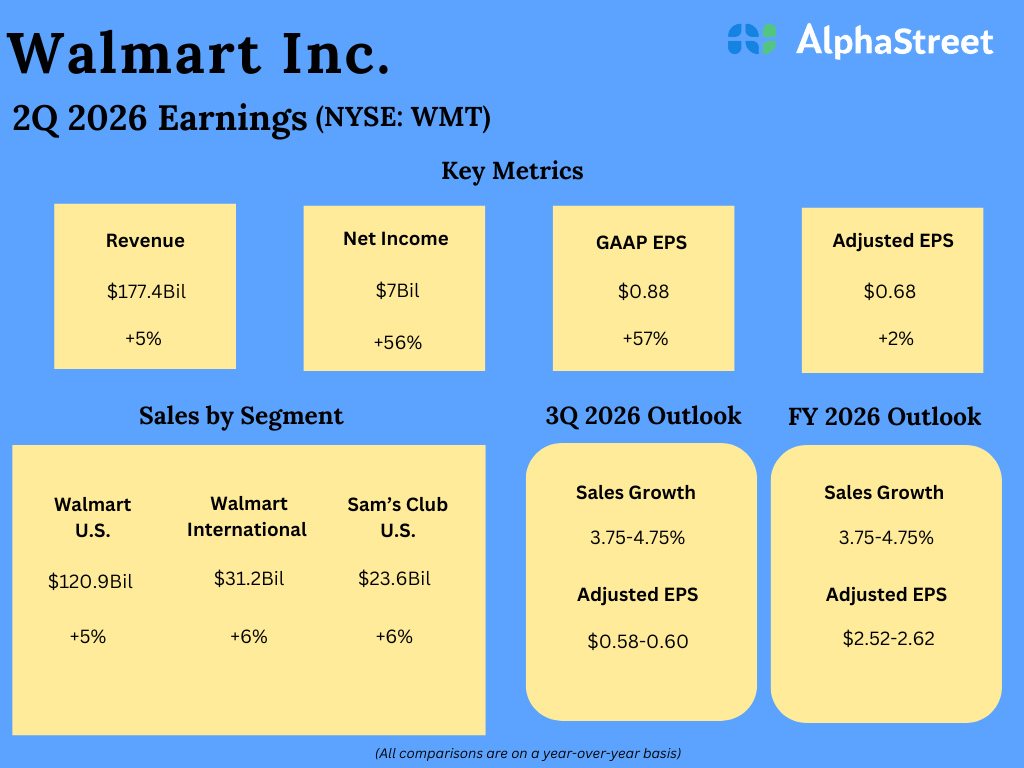

A new report from the Institute for Policy Studies reveals that executive compensation at the country’s 100 largest low-wage employers—dubbed the “Low-Wage 100”—has reached unprecedented heights, with CEOs taking home astronomical pay packages while typical workers’ wages stagnate or even decline. This annual “Executive Excess” analysis scrutinizes six years of pay and investment trends at major publicly traded companies, including household names like Starbucks, Walmart, Home Depot, and Amazon.

Key findings

CEO compensation vs. worker pay: From 2019 to 2024, average CEO pay at Low-Wage 100 firms climbed 34.7%, compared to just a 16.3% rise for their average median worker pay—less than the cumulative 22.6% U.S. inflation over the same period. The average CEO now earns $17.2 million, while the typical worker receives only $35,570 a year. At 22 of these companies, even nominal median pay dropped over six years.

Widening pay gaps: The CEO-to-worker pay ratio ballooned 12.9%, from 560:1 in 2019 to 632:1 in 2024—more than double the S&P 500 average. Starbucks set a new record with a staggering 6,666:1 ratio last year, reflecting CEO Brian Niccol’s $95.8 million pay package versus $14,674 for the median employee.

Stock buybacks over investment: These 100 companies spent $644 billion on stock buybacks between 2019 and 2024. A majority, 56 firms, invested more in buybacks than in long-term capital improvements, with Lowe’s and Home Depot leading the pack. Lowe’s alone spent $46.6 billion—enough for an annual $28,456 bonus for every employee over six years.

Billionaire fortunes: At least 32 U.S. billionaires owe their wealth to these companies, with a combined net worth of $827 billion.

Policy solutions and public support: The report outlines numerous policy reforms to rein in excessive executive pay and buybacks, including higher corporate taxes for outsized pay gaps—a proposal supported by 80% of likely voters in a 2024 survey. Other measures include boosting the federal stock buyback excise tax, restricting buybacks for companies accepting government contracts or subsidies, and tying pay ratio benchmarks to federal procurement.

Case studies: stark examples

Starbucks: Its median worker pay rose just 4.2% in real terms over six years amid mounting unionization drives. The company spent $18.2 billion on buybacks, far outpacing capital investment. Nearly half its employees eligible for 401(k) plans in 2023 had zero savings.

Ulta Beauty: The cosmetics retailer saw median pay plummet 46% (to $11,078), as its workforce shifted toward part-time employment. CEO pay surged 45%—now 1,130 times the median. Ulta spent three times as much on buybacks as capital improvements.

The wider context

The CEO-worker pay gap is an issue beyond the Low-Wage 100. Among a broad sample of 50 public companies with revenues over $1 billion, a March 2025 study from Compensation Advisory Partners found a widening split between actual company performance and CEO pay. Median revenue growth collapsed on a year-over-year basis from 3.7% to 1.6% and earnings per share growth dropped from 0.3 to basically zero among the 50 firms, but the companies still issued bumper bonuses to their leaders. The significant boosts averaged a whopping 280% increase, and bonuses were still up by 45% at other firms, Fortune reported.

Two leading academics, Claudio Fernández-Aráoz and Greg Nagel, argued in the pages of Fortune in April that the data is daming. Back in 1965, CEOs earned 21 times more than the average worker; by 2023, this ratio had escalated to 290x. For 100 of the S&P 500 corporations, they noted, this ratio climbed to 603x in 2022. Adjusted for inflation, they found, CEO compensation in large firms increased by 878% from 1978 to 2022, whereas real worker compensation only by 4.5%.

It’s part of a wider story of wealth inequality, certainly in the United States, where the Congressional Budget Office found in late 2024 that the top 10% wealthiest Americans own the majority of assets, and the top 1% controls nearly a third.

There’s a bit of a “perfect storm” in the confluence of shareholder primacy, stock buybacks, and falling corporate tax rates by which “companies have gotten bigger, corporate power is on the rise, and the benefits that they’ve accrued in profit they are funneling to a smaller number of people,” Irit Tamir, senior director of Oxfam America’s private sector department, told Fortune in October 2024.

Legislative action

The IPS report catalogs a sweeping set of reforms already on the legislative agenda in Congress and in cities such as Portland and San Francisco. Proposals range from taxes and contract restrictions for excessive CEO-worker pay gaps to strengthening board accountability, corporate transparency, and shareholder powers. Many measures have drawn strong bipartisan as well as public support.

Ultimately, the Institute for Policy Studies warns that without decisive reform, America’s largest corporations will regret this. The report cited Drew Hambly, the investment director at the country’s largest public penson fund CalPERS, warning of the harmful effects of this imbalance at an SEC roundtable on executive compensation. CalPERS research, he said, finds high levels of worker unrest at low-wage corporations where median worker pay has either remained flat or declined over the past five years. “I want corporate boards to think more about the bottom 50% of people who work for them,” he told the roundtable. “Because when I go into a business, I’m probably interacting with a lower-wage worker. And if you’re going to drive value over time, that’s the face of your company.”

Starbucks, Lowe’s and Ulta Beauty did not respond to requests for comment.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.