Nasdaq 100 futures are flat this morning, premarket, after the tech-heavy index rose a solid 1.3% yesterday, nearing its record high. By contrast, the broader S&P 500 index rose “only” 1%. The Nasdaq is up 20% year to date (the S&P is up 14.5%).

Yet on Wall Street, analysts are increasingly asking whether tech stocks are in a bubble, and one crucial stat keeps coming up: About 40% of the companies in the small-cap Russell 2000 index have no earnings or negative earnings, according to Apollo Management chief economist Torsten Slok. “Something remarkable is going on in the equity market. Stock prices of companies with negative earnings have in recent months outperformed stock prices of companies with positive earnings,” he said on his blog.

Most of those unprofitable companies are tech companies, he told Fortune.

This quirk was also noticed by Morgan Stanley chief investment officer Lisa Shalett. “More than a third of the Russell 2000 remains unprofitable … [and] small-cap companies’ cost of capital is well above their return on assets,” she said in her most recent weekly note.

Savita Subramanian and her colleagues at Bank of America are also concerned. They said stocks were “frothy to bubbly” in a recent note because the S&P 500 is now “richer” than it was in the year of the 2000 dotcom bust on nine of 20 metrics they use to gauge whether stocks are in bubble territory.

“Of 20 valuation metrics we regularly track, the S&P 500’s Market Cap to GDP, Price to Book, Price to Operating Cash Flow and Enterprise Value to Sales have hit new records,” they said. “The index eclipses its March 2000 metrics on five others: Price to GAAP EPS, Median PE, EV/EBITDA, S&P v. WTI and S&P v. Russell 2000.”

However, context is important, they said: “Historical comparisons are problematic, as today’s S&P is higher quality, asset light, less levered, etc. But risks are mounting and the valuation floor for the S&P 500 is likely lower than today’s levels.”

So are tech stocks going to crash?

Not if, as is expected, the U.S. Federal Reserve continues to make new cash cheaper to obtain via its program of interest rate cuts. That’s likely to fuel further capital expenditure in tech, particularly as dealmaking in the AI sector remains fierce. (It’s worth asking questions about the quality of that dealmaking: As the Wall Street Journal notes today, AI revenue does not exceed AI capex.)

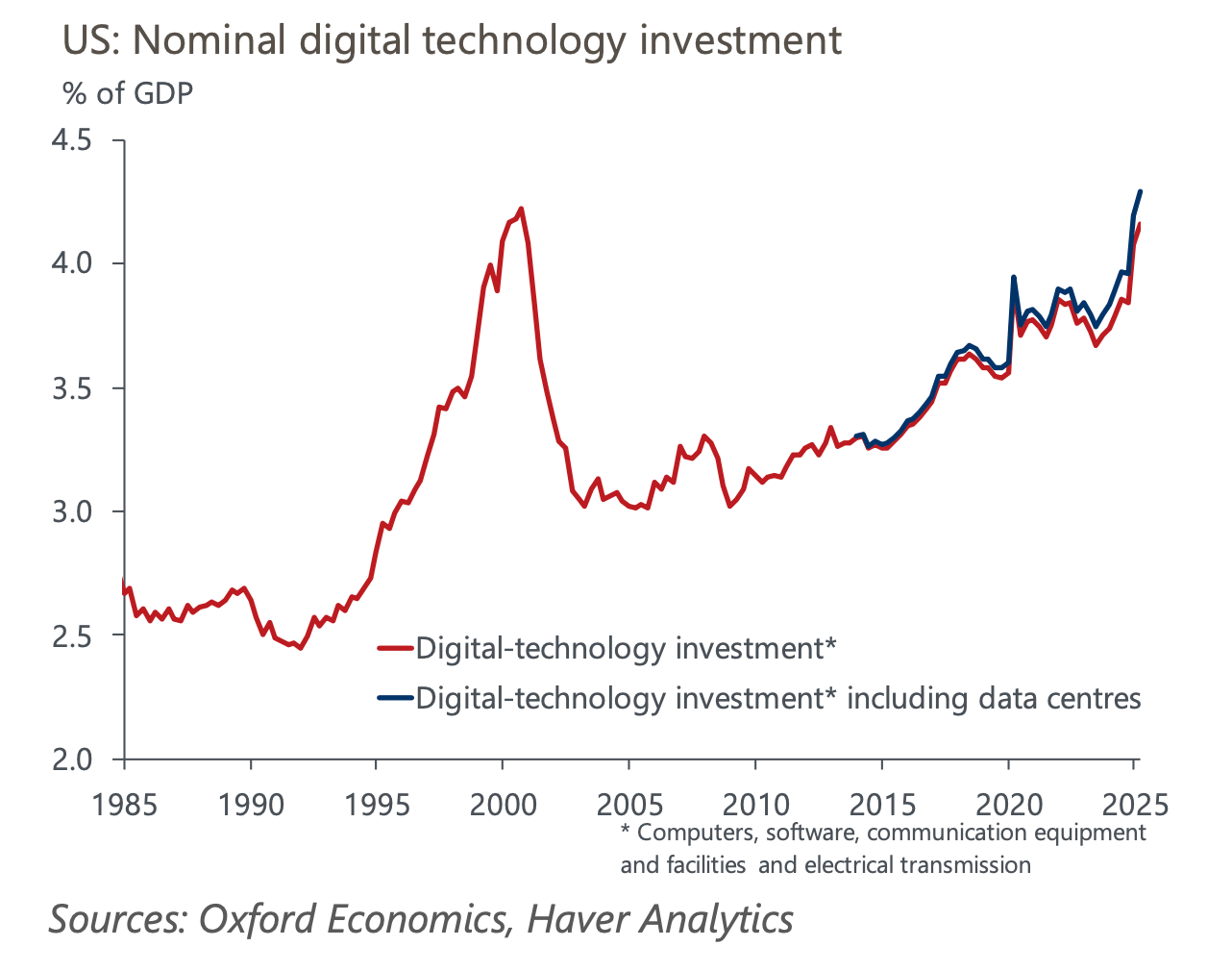

“Our US GDP growth forecast of 2.3% for 2026 significantly exceeds the consensus estimate of 1.7%. However, we assume digital tech investment as a share of GDP won’t increase further. If digital tech investment does increase, then US GDP growth could be almost double the consensus expectation and far surpass growth rates of other advanced economies,” Ben May of Oxford Economics said in a research note. He believes that if tech capex continues to grow, U.S. GDP could hit 3% next year.

That doesn’t mean that the stock market is partying like it’s 1999, he wrote. “Due to significant structural shifts over the past three and a half decades, the recent increase in tech investment began from a much higher point than in the early 1990s As a result, there’s no clear reason why surpassing the late 1990s peak in the ratio should indicate that AI investment is in a bubble. Even if it were, the bubble could continue to inflate.”

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

S&P 500 futures were down marginally this morning. The index closed up 1.07% in its last session.

STOXX Europe 600 was up flat in early trading.

The U.K.’s FTSE 100 was up 0.22% in early trading.

Japan’s Nikkei 225 was up 0.27%.

China’s CSI 300 was up 1.53%.

The South Korea KOSPI was up 0.24%.

India’s Nifty 50 was up 0.098% before the end of the session.

Bitcoin was down to $108K.