If you work at home, you’ve probably heard about the home office deduction and its many tax benefits. But who exactly qualifies for this deduction, and how does it work? In this comprehensive guide, we’ll walk you through the intricacies of calculating the home office deduction, help you navigate the eligibility criteria, and give you tips on how to successfully claim this tax break.

Understanding the home office tax deduction

First, let’s go over the basics of the home office deduction and what it entails.

What is the home office deduction?

The home office deduction allows self-employed people to deduct expenses related to the business use of their home. Typical W-2 employees who work remotely are not eligible to claim the home office deduction. To qualify for this tax deduction, you must use a portion of your home exclusively for your business. In other words, setting up a temporary workspace on your dining table won’t qualify you for this tax break.

Business use of your home for tax purposes

When claiming this deduction, you need to understand the IRS guidelines for determining if your home office qualifies. To qualify for the home office deduction, you must meet one of the following criteria from the IRS:

You must use your home office regularly and exclusively for your trade or business.

You must use your home office exclusively to meet or deal with your patients, clients, or customers on a regular basis.

You conduct work in a separate structure unattached from your home and use this area exclusively and regularly for business purposes.

As you can see, the main factors the IRS looks at are the regular and exclusive use of a specific area in your home for your business. To meet the exclusive use test, your home office or studio needs to be your principal place of business — not a mix of personal and business activities. And to meet the regular use test, you must regularly use your home office space for business purposes. If you only conduct business from home occasionally, it doesn’t count in the eyes of the IRS.

Exclusive rules exceptions

However, there are some exceptions to the exclusive use rules mentioned above. You don’t have to use your home office exclusively for business purposes if you fall into either of the following categories:

You use part of your home to regularly store product samples or inventory used in your trade or business, and your home is your only fixed business location.

You use part of your home as a daycare facility.

To qualify for the storage of inventory exclusion, you have to meet several IRS tests. The same goes for daycare facilities.

The IRS also considers the nature of your business activities and whether your home office is essential to conducting those activities. If your home office is an integral and necessary part of keeping your business running, you should have no problem claiming the home office deduction. Just be sure to keep good records of your home office expenses and any supporting documentation in case they’re needed.

Calculating the home office deduction

To calculate the home office deduction, you first need to determine which business expenses you can write off. There are two categories home office expenses can fall into:

Direct expenses are used solely for your home office, such as equipment, repairs, and maintenance specific to that area. Direct expenses are fully deductible.

Indirect expenses are related to your entire home, but you can deduct a percentage of these costs based on the size of your home office. Indirect expenses include mortgage interest, property taxes, utilities, and homeowners insurance to name a few.

The size of your home also plays a significant role in determining your deduction amount, so make sure you know the square footage of your home office to make your calculations.

You have two options for deducting your direct and indirect expenses: calculating your actual expenses or using the simplified method.

The actual expenses method (regular method)

If you’re comfortable doing some math, you can calculate your actual expenses to come up with a more precise home office deduction. This method allows you to fully deduct your direct expenses and manually calculate the deductible percentage of your indirect expenses, giving you a more accurate reflection of the actual costs associated with your home office.

Direct expenses = fully deductible

Remember, direct expenses are only used for your home office. They directly benefit your business and are easily identifiable as related to your business activities. Examples of direct expenses include:

Office supplies

Furniture and equipment (computer, printer, desk, etc.)

Repairs and maintenance specific to your home office

Indirect expenses = partially deductible

On the other hand, indirect expenses are costs related to your entire home. You can partially deduct these costs based on the percentage of space used for your business. Examples of indirect expenses include:

Mortgage interest or rent payments

Property taxes

Homeowners insurance

Utilities (including internet and phone bills)

To calculate the deductible percentage of your indirect expenses, follow these steps:

Determine the square footage of your home office space and the total square footage of your home.

Divide your home office’s square footage by your home’s total square footage to get the percentage of space used for your business.

Apply this percentage to your indirect expenses to determine the deductible amount.

Example calculation

For example, if your home office is 200 square feet and your home is 2,000 square feet in total, your business use percentage would be 10%. This means you can deduct 10% of your indirect expenses. So, if your annual property tax bill is $5,000, you could deduct $500 (10% of $5,000) as a business expense related to your home office.

The simplified home office deduction (simplified method)

The simplified method is a more streamlined approach to calculating the home office deduction. If you’re someone who finds calculating actual expenses to be too time-consuming or challenging, the simplified method is for you.

The simplified method allows you to multiply the square footage of your home office space (up to 300 square feet) by a flat $5 rate. The IRS created this straightforward calculation to make it easier for the self-employed to determine their home office deduction.

One of the significant advantages of the simplified method is its simplicity and ease of use. Instead of tracking and allocating specific expenses related to your home office, you can use a standard rate per square foot, saving you time and effort. This is especially beneficial if you’re a small business owner who doesn’t have the time or expertise to commit to more complex tax calculations.

Another advantage is that the simplified method reduces the risk of errors or discrepancies when calculating the home office deduction. A standardized rate means there is less room for mistakes when determining the deductible portion of your indirect expenses.

Examples and limitations

That being said, the simplified option also has limitations and may not always result in the highest deduction compared to the actual expense method. Depending on the square footage of your home office, a flat-rate deduction may not accurately reflect the actual expenses you paid.

For example, the IRS limits the simplified method to 300 square feet, making the maximum home office deduction $1,500 when using the simplified method. If your actual expenses exceed $1,500, the regular method should result in a bigger tax break. It never hurts to calculate the home office deduction using both methods to determine which option is more beneficial in your situation.

Regardless of your chosen method, it’s still crucial to keep detailed records of your direct and indirect expenses to support your home office deduction claims. Keep receipts, bills, invoices, and any other relevant documents in case the IRS ever asks for them. Good recordkeeping will also help you make accurate calculations to maximize your tax benefits.

Self-employment and home office expenses FAQs

Navigating tax forms for the home office deduction

You need to be aware of several tax forms when it comes to the home office deduction. We cover each of them in more detail below.

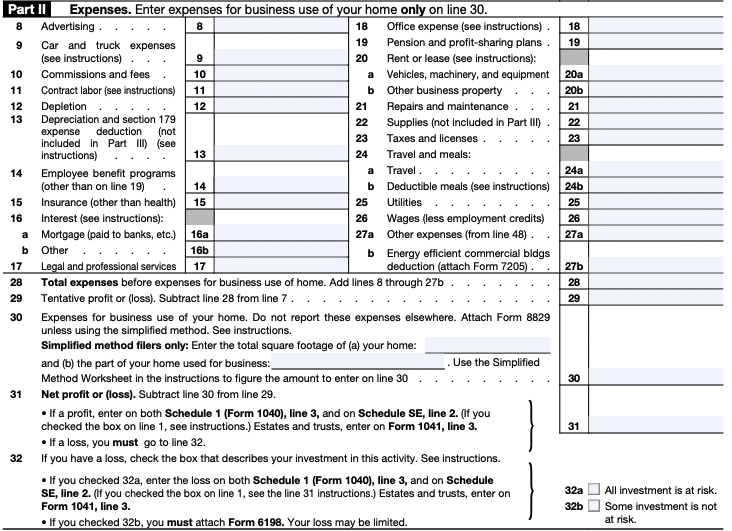

About Form 8829

IRS Form 8829, Expenses for Business Use of Your Home, is designed for those who plan to claim the home office deduction. This form will help you calculate and report your eligible home office expenses, which you will transfer to Schedule C to determine your taxable income.

Completing Form 8829 accurately requires careful attention to detail and understanding the IRS guidelines on home office deductions. Here is a step-by-step guide to help you navigate Form 8829 effectively:

For Part I, you will need to know the following:

The square footage of your home office.

The total square footage of your home.

The days you used your house for daycare, if applicable.

The business percentage of your indirect expenses.

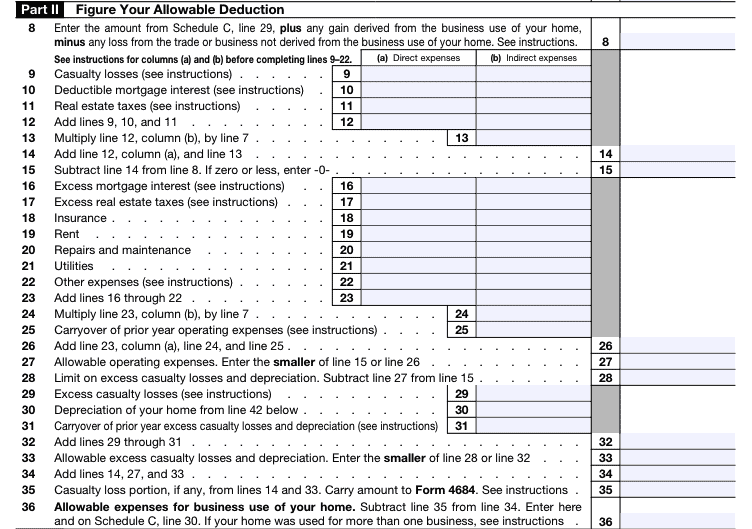

Part II is where you will figure out your allowable deduction. You will need to detail the following expenses:

Casualty losses

Deductible mortgage interest

Real estate taxes

Insurance

Rent

Repairs and maintenance

Utilities

Any other expenses

Part III calculates the depreciation of your home. You’ll need to calculate:

Your home’s adjusted basis or fair market value (whichever is lower)

The value of the land included in the cost of your home

Your depreciation percentage

Part IV allows you to carry over any unallowed expenses to the next tax year.

After completing Form 8829, you’ll transfer all your allowable expenses to Schedule C (Form 1040). If you file with us at TaxAct®, we make this process easy by asking you detailed interview questions and using your answers to fill out the applicable tax forms.

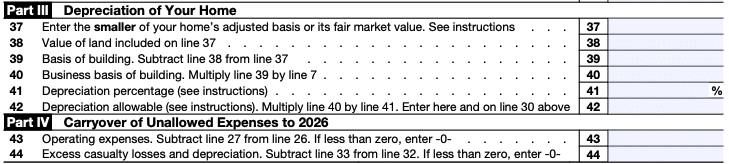

Understanding Form 4562: Depreciation and amortization

Another tax document you may need is Form 4562, Depreciation and Amortization. This form is used to depreciate any qualifying home office expenses, meaning you spread the deduction out over multiple tax years instead of deducting the total cost in the year you got it. Assets lose value over time and become outdated; depreciation helps you recover their costs.

You can use Parts II and III of Form 4562 to claim depreciation on home office assets like equipment, furniture, or computers. Just make sure anything you are depreciating is used for business purposes.

To determine which assets are eligible for depreciation, you need to consider the following:

Asset type: Tangible assets that have a useful life beyond one year and are used for business purposes are generally eligible for depreciation. Intangible assets such as software, patents, and copyrights may also qualify.

Business use percentage: Depreciation is limited to the percentage of time you use an asset for business activities. For example, if you use your computer 80% of the time for business and 20% for personal use, you can only depreciate 80% of its cost. To depreciate an asset, you must use it more than 50% of the time for business purposes.

Useful life: The IRS assigns an estimated useful life for each asset. The useful life is the period over which the asset’s cost can be depreciated. For instance, office furniture could have a useful life of seven years, while computers might have a useful life of five years.

Depreciation method: There are different depreciation methods allowed by the IRS, such as the straight line method, accelerated depreciation, and section 179 deduction. Your chosen method affects how much depreciation expense you can claim each year.

Form 4562 allows you to input all your depreciation information to calculate the depreciation deduction for each eligible asset. This is another area where meticulous recordkeeping and intuitive tax software with TaxAct come in handy.

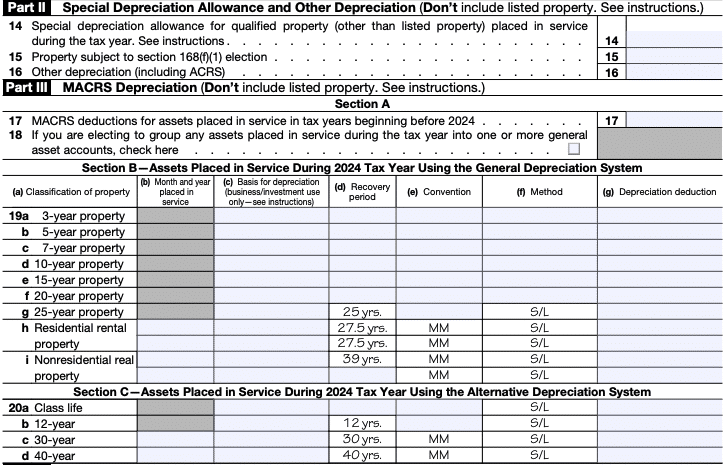

Completing Schedule C for home office deduction

Schedule C is where you’ll report all your business income and expenses to the IRS. This form helps you determine your deductible expenses, which ultimately impact your taxable income. It helps calculate your net profit or loss from your business activities, which flows into your overall tax return, Form 1040.

Tax Tip: If you use your home office for multiple unrelated businesses, you must file a separate Schedule C for each.

To enter accurate and complete home office expenses on Schedule C, follow these step-by-step instructions:

Enter business income: Enter your total business income earned during the tax year in Part I of Schedule C.

Calculate cost of goods sold (if applicable): If your business involves selling products, you may need to calculate and enter the cost of goods sold in Schedule C.

Deduct expenses: In Part II of Schedule C, deduct your business expenses, including those related to your home office. This is where you’ll include the costs calculated on Form 8829.

Complete home office expenses: In Schedule C, you’ll find a line item for Utilities (Line 25) and Other Expenses (Line 27). Here, you will enter the appropriate portion of your home office utilities and other deductible expenses based on your calculations from Form 8829.

Enter depreciation: If you claimed depreciation on assets related to your home office, you must also enter the depreciation expense in the appropriate section of Schedule C.

Calculate net profit or loss: After deducting all allowable expenses, calculate your net profit or loss for the business in Part II of Schedule C.

Transfer to Form 1040: Once you’ve completed Schedule C, the net profit or loss from your business will transfer to your Form 1040, where it contributes to determining your overall taxable income.

Tips for claiming the home office deduction

Now that you know how the home office deduction works and how to claim it, let’s review some tips to make the most of this tax break:

Know if you qualify: To qualify for the home office deduction, you must use a part of your home exclusively and regularly for business purposes. Make sure to keep detailed records to support your business use claim.

Keep careful records: The most important step when preparing to claim the home office deduction is to keep detailed records of all related expenses, including receipts, bills, invoices, and documentation supporting your deductions. Organizing your records makes it easier to report accurately and provides evidence in case of IRS inquiries.

Check your math: Calculate your home office deduction using your preferred method. Compare the regular and simplified methods to determine which one yields a higher deduction. Take particular care when using actual expenses to ensure your numbers are correct.

Be realistic: Understand that the home office deduction doesn’t always result in a substantial tax reduction. Before filing, make sure you set realistic expectations about the impact of the deduction on your overall tax liability.

Use tax software or consult a tax professional: Tax software like TaxAct can guide you through claiming the home office deduction and help ensure you don’t miss any eligible expenses. Alternatively, a tax professional can provide you with personalized advice and help you navigate your small business tax filing if needed.

Stay informed: Stay updated with IRS guidelines and any changes related to the home office deduction. Tax preparation software like TaxAct can be useful in this area. If the tax code changes, we update our product accordingly to ensure accurate income tax filing for our customers.

Be honest and transparent: Accurately reporting your home office expenses and following all the IRS guidelines will help you avoid penalties and delays. Remember, honesty is always the best policy when claiming a tax deduction.

The bottom line

The home office deduction can be a valuable tax-saving opportunity if you are an eligible self-employed taxpayer. To take advantage of this deduction, it is important to understand the associated rules, keep good records, and use helpful tax software such as TaxAct to your advantage. These proactive steps will help ensure that you maximize your tax benefits while complying with IRS regulations this tax season.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.