If Form 1099-SA showed up in your mailbox or inbox this year, don’t let it scare you. In this guide, we’ll break down what a 1099-SA form is, why you got it, and what you need to do next. By the end, you’ll know exactly how to report it on your income tax return and have one less thing to worry about on Tax Day.

At a glance:

Form 1099-SA reports distributions from health savings accounts and medical savings accounts.

Withdrawals from these accounts are tax-free if used for qualified expenses.

Nonqualified expenses are subject to income tax plus additional tax.

What is a 1099-SA form?

The Internal Revenue Service (IRS) officially calls Form 1099-SA Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. Basically, the agency uses this form to track distributions made from your health savings account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage Medical Savings Account (MA MSA).

HSAs and MSAs explained

HSAs and MSAs are tax-advantaged accounts designed to help Americans covered under a High Deductible Health Plan (HDHP) pay for qualified medical expenses. Contributions to these accounts are tax-deductible and can be invested, but there are contribution limits to how much money you can add each year. Unspent contributions roll over from year to year until you need them. Sometimes, your employer may contribute to these accounts as well. When you pull money from your HSA or MSA to cover healthcare expenses, the IRS wants to know about it.

Here’s why it matters: If you used the distribution money for qualified medical expenses, you’re in the clear — no taxes, no penalties. But if you used it for a nonqualified expense, that money is subject to income taxes plus an additional penalty.

IRS Form 1099-SA example

Form 1099-SA looks like this:

On the left of the form, you’ll find the contact information of the financial institution (payer) and their taxpayer identification number (TIN). As the account holder, you’ll also see your info, account number, and TIN.

Now, let’s break down the key parts of this form and what each box means:

Box 1: Gross distribution – This is the total distribution amount you took from your HSA or MSA during the year. All distributions are reported here, even if you used the funds for qualified medical expenses.

Box 2: Earnings on excess contributions – If you contributed more than the allowable limit to your HSA or MSA, any earnings on those excess contributions are reported here.

Box 3: Distribution code – This number indicates the type of distribution — whether it was for a qualified medical expense, a non-medical expense, or another reason entirely (retirement, death, disability, etc.). You can view the full list of codes on the IRS website. The code tells the IRS how to tax your distributions (if at all).

Box 4: FMV on date of death – This box only applies if you are a beneficiary of the HSA or MSA account and is mostly for informational purposes. It shows the fair market value (FMV) of your account on the day the account holder died.

Box 5: Type of account – This checkbox tells you whether the distribution came from an HSA, Archer MSA, or Medicare Advantage MSA.

Form 1099-SA instructions

Okay, so now you know what’s on the form. But what do you actually do with it?

First, take a deep breath. If you withdrew money for qualified medical expenses, you shouldn’t have to pay taxes on it — but you do need to report it. Here’s how to handle it:

Check your records: Compare the amount in Box 1 with your own records. Make sure the distribution matches what you took out. If you notice an error, contact your plan administrator right away to get it corrected.

Report the distribution on your tax return: Taxable HSA distributions are reported on Form 8889, while taxable MSA distributions are reported on Form 8853. You should report distributions from these accounts even if they aren’t taxable. When you e-file with TaxAct®, we help you fill out these forms by asking questions about your 1099-SA.

Non-qualified distributions: If you used the funds for non-medical expenses, the distribution will be taxed, and you’ll owe an additional 20% penalty. Our software can help calculate this, too, if needed.

E-file your return: Once you’ve filled out the proper forms, TaxAct can help you e-file everything electronically with our tax preparation software. E-filing is fast, secure, and ensures the IRS gets your info quickly.

FAQs about Form 1099-SA

How to file Form 1099-SA with TaxAct

TaxAct’s intuitive software takes the guesswork out of tax filing, so you can confidently report your 1099-SA with ease. Depending on the type of account you have, you can report your 1099-SA distributions in three ways:

HSA distributions

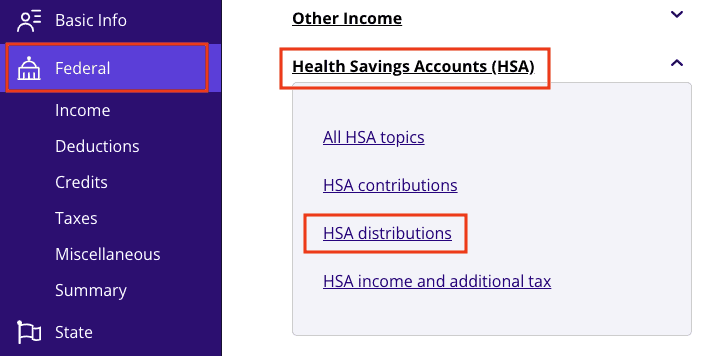

From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

Click the Health Savings Accounts (HSA) dropdown as shown below, then click HSA distributions.

3. Continue with the interview process until you reach the screen titled Form 1099-SA – Type of Account, then click the circle next to HSA.

Archer MSA distributions

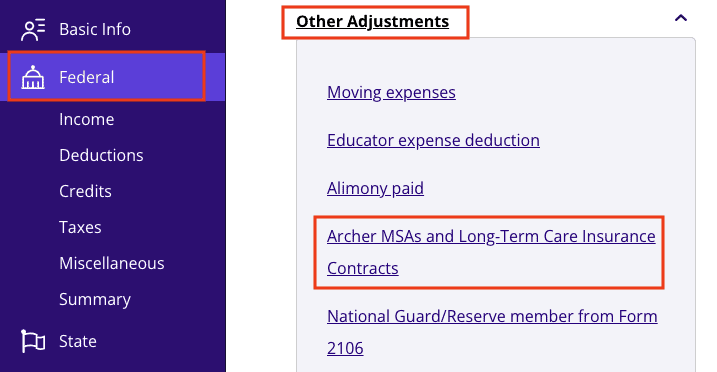

From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

Click the Other Adjustments dropdown as shown below, then click Archer MSAs and Long-Term Care Insurance Contracts.

3. Click MSA Distributions and continue with the interview process to enter your information.

Medicare Advantage MSA distributions

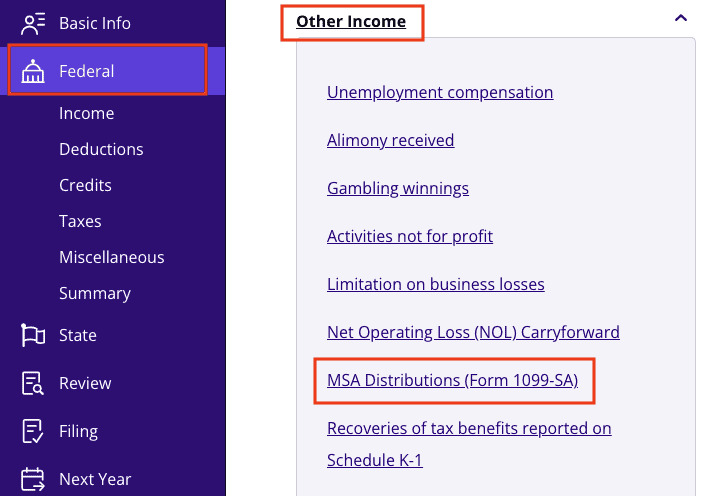

From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

Click the Other Income dropdown as shown below, then click MSA Distributions (Form 1099-SA).

3. Click + Add Form 1099-SA to create a new copy of the form or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

The bottom line

If you took distributions from an HSA or MSA during the tax year, expect to receive Form 1099-SA this season. Whether you used your distribution for qualified medical expenses or non-medical purposes, TaxAct will help you report it properly so you can rest easy knowing your taxes are squared away. Let TaxAct handle the details, and your taxes will be over with before you know it!

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, sponsored by, or sponsors of TaxAct, Inc.