Did you receive Form 1099-Q this tax year? The Internal Revenue Service (IRS) requires payers to send you this tax form if you took distributions from a tax-advantaged education investment account such as a 529 plan or Coverdell education savings account (ESA). Whether you’re a parent or a student, we’re here to help you understand this tax form, why you got it, and whether you need to report it on your income tax return.

At a glance:

Form 1099-Q reports distributions from qualified education programs like a 529 plan or Coverdell ESA.

Distributions are not taxable if used to pay for qualified education expenses.

You may owe taxes and penalties on your earnings if you use the distributions for nonqualified

What is a 1099-Q form?

Form 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530), reports distributions from qualified education programs, including 529 plans and Coverdell education savings accounts (Coverdell ESAs or CESAs). If you’ve been saving for education in one of these accounts and take money out, this form tells you and the IRS how much you withdrew.

529 plans and Coverdell ESAs explained

CESAs and 529 plans (also called qualified tuition programs or QTPs) are tax-advantaged investment accounts intended to help Americans pay for qualified education expenses from kindergarten through university. Often, a parent or other relative opens one of these accounts for their child, who is the designated beneficiary.

CESAs and QTPs have different rules for contributions and beneficiaries, but the tax treatment is the same for both. Receiving Form 1099-Q does not automatically mean your distributions are taxable. You can withdraw funds tax-free to pay for qualified education expenses like tuition, books, or sometimes room and board costs. However, you may owe taxes and penalties if your distributions exceed your qualified education costs or if you spend them on nonqualified expenses.

Example of Form 1099-Q

Let’s take a closer look at a 1099-Q example. This is what the form looks like:

The form has a few boxes that contain key information for taxpayers. Here’s a quick breakdown:

First, you’ll see the payer’s name, address, phone number, and tax identification number (TIN). You’ll also see your information, including your account number.

Box 1: Gross distribution – This is the total distribution you received in the past year from your CESA or QTP in the form of cash, tuition credits or certificates, waivers, vouchers, etc.

Box 2: Earnings – This is the portion of the distribution that shows how much money you made from your invested contributions.

Box 3: Basis – This is your basis in the gross distribution, or how much you contributed to the account, minus your earnings (Box 1 – Box 2 = Box 3).

Box 4: Trustee-to-trustee transfer – This box is checked if the funds were rolled over or transferred directly between qualified programs. For example, a QTP to QTP, CESA to CESA, CESA to QTP, or even a QTP to an ABLE account.

Box 5: This box shows the type of account from which the distribution came (QTP or CESA).

Box 6: If this box is checked, it means the distribution was made to a person other than the designated beneficiary, such as the account owner. For example, a parent who withdrew funds to spend for their child’s education.

The key boxes to focus on are 1, 2, and 3. These boxes show you how much was taken out, how much of that is earnings (potentially taxable), and how much your initial investment was.

Instructions for Form 1099-Q

Got your 1099-Q form in hand? Here’s what you should do with it:

Verify the numbers: First, make sure the information is correct. Check the distribution amount and double-check that the form matches what you know you withdrew. If something looks off, contact the plan administrator for clarification.

Determine if the distribution is taxable: You do not owe tax on the amount you used for qualified education expenses. But if you used the distribution for nonqualified expenses or it exceeded your qualified expenses, the earnings portion (Box 2) is subject to income tax and likely a 10% penalty.

Report it on your tax return: If any part of the distribution is taxable, you must report it as “other income” on your federal tax return. TaxAct® can guide you through this process if you e-file with us.

FAQs about Form 1099-Q

How to file Form 1099-Q with TaxAct

Reporting your 1099-Q form doesn’t have to be a headache. Here’s how to input this form when using our tax preparation software:

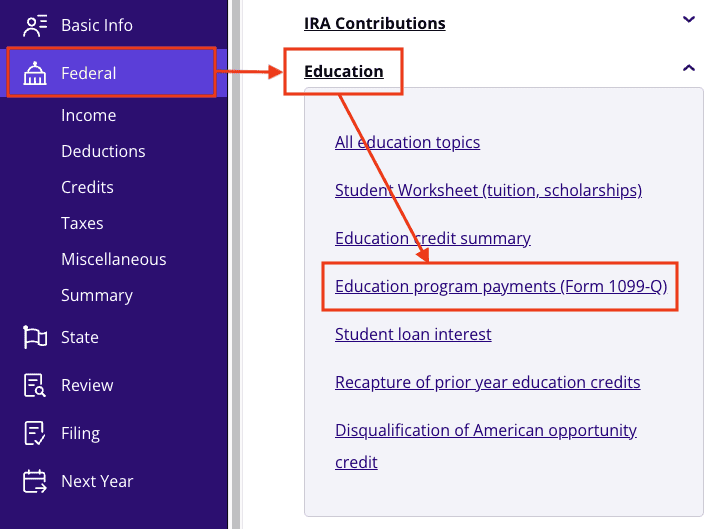

From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

Click the Education dropdown, then click Education program payments (Form 1099-Q), as shown below.

3. Click + Add Form 1099-Q to create a new copy of the form or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

Easy, right? Taxes might not be the most exciting thing on your to-do list, but with TaxAct, they don’t have to be the hardest either.

The bottom line

Form 1099-Q can seem complex initially, but with some background knowledge, it’s not that different from a simple W-2 form. Whether you’re a parent or student, understanding the IRS 1099-Q requirements and knowing what’s taxable and what isn’t will help ensure a smooth tax filing process this season. And don’t forget — TaxAct can help guide you through the 1099-Q reporting process.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.