So, you just received Form 1099-MISC for the tax year, and you’re wondering what on earth miscellaneous income is. We get it — let’s break down what this form means, why you received it, the filing requirements, and how to report it on your federal income tax return.

At a glance:

Form 1099-MISC reports miscellaneous compensation like rent, prizes, awards, and more.

As of 2020, this form no longer reports nonemployee compensation.

Payments on Form 1099-MISC need to be reported when filing your income tax return.

What is the 1099-MISC form?

Form 1099-MISC, Miscellaneous Information, is one of many forms the Internal Revenue Service (IRS) uses to keep track of income that doesn’t come from a traditional employer. The IRS uses several different types of 1099 forms, also called information returns, to report additional income. IRS Form 1099-MISC is an interesting one because it’s essentially a catch-all to report certain kinds of “miscellaneous compensation” that doesn’t quite fit into other 1099 categories.

Who gets a 1099-MISC form?

If you received a 1099-MISC form this tax season, it means you received miscellaneous payments above a certain amount. This can include rents, royalties, prizes, awards, and more — see the next section for examples of all the different types of payments reported on Form 1099-MISC.

Before 2020, Form 1099-MISC was also used to report nonemployee compensation for independent contractors, freelancers, and other self-employed individuals. However, the IRS now uses Form 1099-NEC to report this type of income instead of 1099-MISC.

You may also receive Form 1099-MISC if you were subject to backup withholding or if you purchased at least $5,000 of consumer products for resale outside a permanent retail establishment.

Example of Form 1099-MISC

Here is a 1099-MISC example so you can see what’s on this important tax form. As the payee, you’ll receive Copy B:

On the form, you’ll see the payer’s information, including their address, phone number, and taxpayer identification number (TIN). Your contact information is also there — you’ll see your recipient’s name and TIN (typically your Social Security number). Your account number may also be on the form.

To properly read Form 1099-MISC, it’s important to understand that each box represents a different payment type. Click on the payment types below for more information about what it means and how to report it:

Boxes 2 and 8: These boxes report at least $10 in royalties (Box 2) or broker payments in lieu of dividends or tax-exempt interest (Box 8).

Other boxes report payments of at least $600 in:

Form 1099-MISC instructions

Now that you have your 1099-MISC form in hand and know what it’s for, what should you do with it? Follow these steps to help streamline the tax filing process:

Check for accuracy: Before you dive in, carefully review the information on your form. Double-check the amounts in each box for discrepancies. If you notice an error, contact the issuer to get a corrected form ASAP.

Determine where to report the income: The type of income you’ve received dictates where it goes on your tax return. TaxAct® makes this step easy — if you e-file with us, we’ll ask you detailed questions about your 1099-MISC income and pull all the necessary tax forms to report it accurately.

Keep a copy for your records: Once you’ve filed your tax return, hang on to your 1099-MISC form and any related tax documents for at least three years. You’ll need them for your records in case the IRS has any follow-up questions.

FAQs about Form 1099-MISC

How to file Form 1099-MISC online with TaxAct

Now it’s time to file your 1099-MISC. Thankfully, this step is easy if you file with TaxAct — we strive to make the e-filing process smooth and straightforward for filers.

To report Form 1099-MISC with TaxAct:

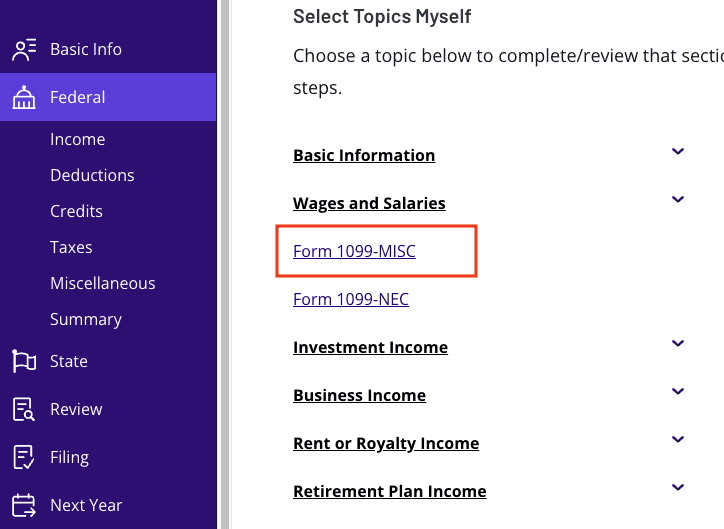

From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

Click Form 1099-MISC, as shown below:

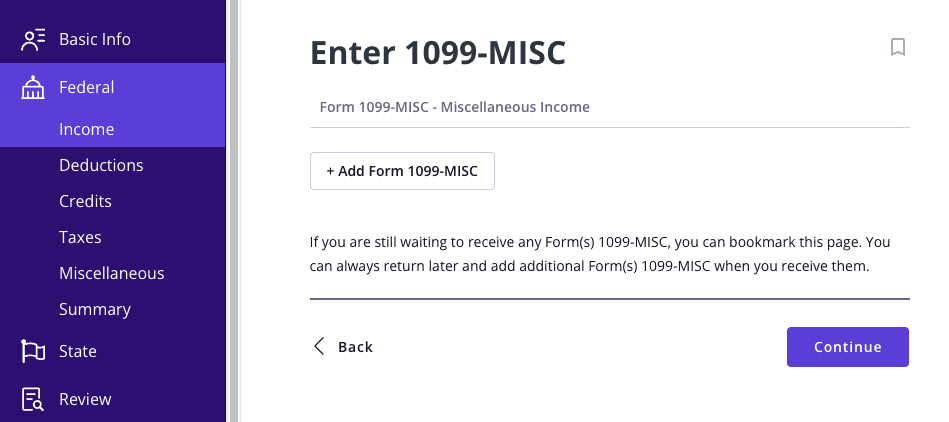

3. Click + Add Form 1099-MISC as shown below to create a new copy of the form, or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

Check out our FAQ page for additional tips on how to enter your 1099-MISC information in the TaxAct program.

The bottom line

Receiving a 1099-MISC form doesn’t have to be confusing! Payers use this form to report different types of miscellaneous compensation like prizes, awards, rent, and healthcare payments. You need to report these on your tax return, but don’t sweat it — TaxAct is here to walk you through it.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.