We’re joined by two tax professionals to discuss staffing issues, technology adoption, and strategic planning ahead of the next busy season.

Highlights:

Staffing shortages are pushing firms to embrace automation

Firms should plan to implement new solutions in the fall, ahead of busy season pressure

Law changes and uncertainty have clients seeking additional tax guidance

Tax season challenges have existed ever since the April 15 deadline was established. But the types of challenges that tax professionals face are always evolving. We wanted to forecast what types of tax industry trends will define 2026 and how professionals can prepare. So, we gathered a panel of experts to share their perspectives:

Bob LeMay, Principal and President, LeMay & Company

Here are some highlights from our extended discussion on tax industry trends, preparation for 2026, and the benefits and challenges of implementing technology in Q4.

Jump to ↓

What types of changes have you seen over the past year? How do you expect them to impact this upcoming tax season?

Bob: Certainly we’ve seen law changes, and that uncertainty has caused some anxiety with our clients. That puts more stress on us to guide them through the mire of what we’re seeing in the tax world. People are thinking more long term. Not just what today’s return is looking like.

Keestan: Obviously AI is at the forefront of everyone’s mind. But I think one other thing that’s stood out to us is just talent. These past couple years, it’s been harder and harder for us to hire people. Less people are going into accounting and we’re just trying to figure out how it will go moving forward.

I think seasonal help is especially harder to find. We used to hire 3-4 seasonal interns and in past years we’ve had very few candidates. This last tax season was our first where we didn’t have to hire seasonal help. We focused more on software and automation.

Resource hub

Prepare your firm for busy season with these exclusive insights

Check it out ↗

As tax season approaches, what steps should professionals take to prepare?

Keestan: For us, this is the time of year that we look at our software, our processes. We’re actually making some software changes and working to implement those. We have a little bit of downtime since November-December are typically some of our slower months.

Bob: We do a complete evaluation of our systems, and we ask: “How we can do this better?” Which includes a big evaluation of our software. You don’t want to be trying to implement something in January. It’s too late.

What is your firm doing to set itself up for success next year?

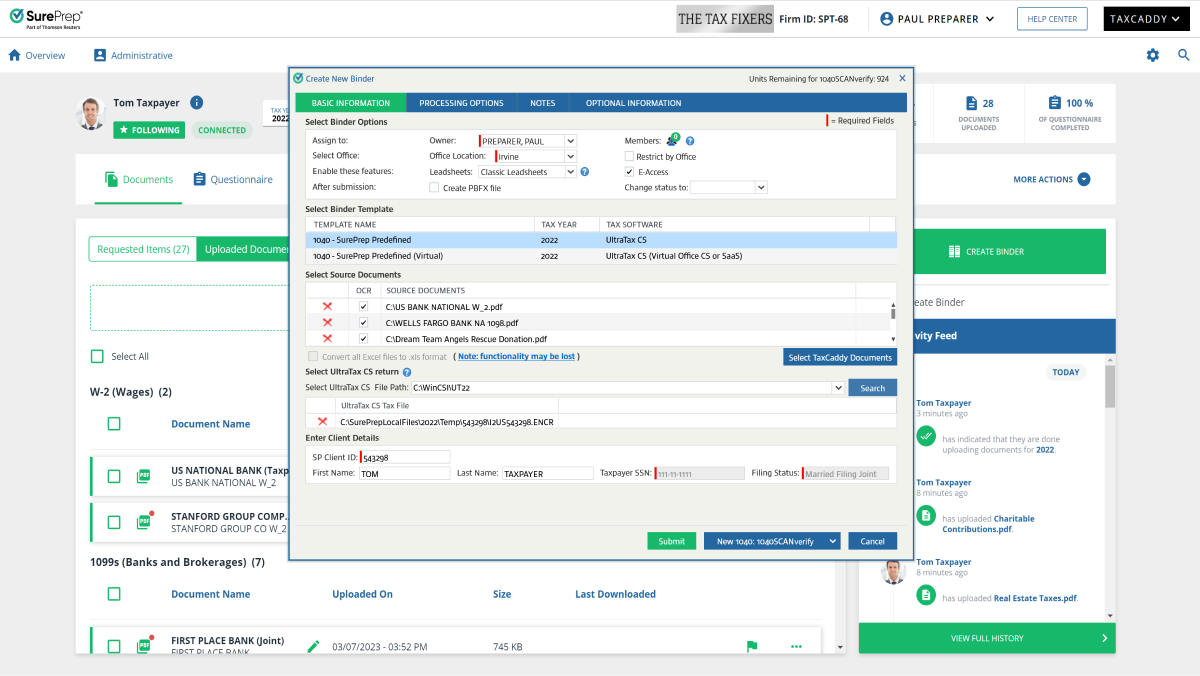

Bob: We’ve brought on a lot of software in partnering with [Thomson Reuters], from SurePrep to SafeSend. We can now do more with less staff, and the work we’re doing is higher value work. When we started moving in this direction, one of my staff members was like, “Wow, I can actually start doing what I really enjoy instead of this manual stuff.”

Keestan: We’re adopting the Gather AI portion of SafeSend. I think it’s always good to test out new software during extension season when you have less volume, that way you know what hiccups are going to come.

Want to save over 90 minutes per 1040 return?

Find out how SurePrep streamlines tax preparation

See for yourself ↗

When should a firm start thinking about switching software? Are there any telltale signs?

Bob: I’m a big believer in sooner rather than later … Usually fall is a really good time. You want to do it when you have an opportunity to evaluate. When you talk about telltale signs, you have to look at your workflow. What are the bottlenecks? Talk to your friend in the office. What are their struggles? Is there a better way of doing that?

Keestan: Prior to the 2021 tax year, we changed our tax software, our document software, and our signing software all in one tax year and it was a rough tax season … Now we always test things out in extension season … Your team has to get used to it. You might have to change your process. There might be a lot of questions. The more time you give yourself before you get to busy season, the better.

Amanda: You don’t have to switch everything all at once. There is support there for you. As a Thomson Reuters Sales Executive, that’s what our jobs are … We’ll help you develop that game plan and say: “Here’s where we recommend which solutions to implement at which stage.”

How does Thomson Reuters support your firm in and out of tax season?

Bob: I lean on the Sales team to really evaluate where we are as a firm … The main reason I made the switch was the customer service. It’s not a vendor. It’s truly a partnership. I feel that [Thomson Reuters] is invested in me as much as I’m invested in my business.

Keestan: I think one thing that’s really great about the Thomson Reuters reps is that you can have open, honest conversations. We’ll do a demo on a software and I’ll lay out: “These are all the pain points I see in my process with this software. How is this going to fit for us?” And they get me answers. They will kind of go to the end of the earth to get you all the information you need to make those decisions.

What these tax industry trends mean for your team

Like Bob and Keestan discovered, staffing challenges and workflow hurdles don’t have to be constants at your firm. With the right technology partner guiding the way, your practice can create a multi-year roadmap toward end-to-end automation. And with more regulatory challenges on the horizon, it’s never been more important to minimize preparation burdens so your team has the capacity to maximize its expertise.

Want to hear more from this conversation? Watch a recording of the full webinar for additional tax industry trends and implementation tips that can set your firm up for success in 2026 and beyond.