On 11 March 2026, Chile will inaugurate its new president, José Antonio Kast. During his campaign, both he and his opponent, Evelyn Matthei, endorsed reducing the country’s corporate tax rate from 27 percent to 23 percent to boost economic growth.

Corporate income taxes are among the most harmful taxes to economic growth. However, a closer look at the Chilean taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system reveals more serious issues than the country’s headline rate. Chilean companies face the worst capital allowances in the developed world and are subject to one of the last remaining worldwide tax systems. This raises the cost of capital investment and puts Chilean companies at a systematic disadvantage relative to their competitors when operating abroad.

Principled corporate tax reform can strengthen Chile’s economic growth at a minimal revenue cost by reinstating full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. and adopting a territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base. to align its cross-border rules with the international standard.

Despite Inflation IndexingInflation indexing refers to automatic cost-of-living adjustments built into tax provisions to keep pace with inflation. Absent these adjustments, income taxes are subject to “bracket creep” and stealth increases on taxpayers, while excise taxes are vulnerable to erosion as taxes expressed in nominal dollars, rather than rates, slowly lose value., Chile’s Capital Allowances Rank Last

Chile’s 27 percent headline corporate tax rate is about 3 percentage points higher than the Organisation for Economic Co-operation and Development (OECD) average of 24.2 percent in 2025. Corporate income taxes harm economic growth because they reduce the capital investment required to keep up an economy’s productive capital stock, a key determinant of a country’s productivity and prosperity. Cutting the headline tax rate can reduce those distortions because they become less significant at a lower rate. However, lawmakers generally have more cost-effective policy tools to reduce distortions by improving the structure of corporate taxation.

A key design feature that directly affects businesses’ cost of capital—and, consequently, their incentive to invest—is capital cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions.: the ability of businesses to deduct their investment costs from taxable corporate income. Ideally, businesses should be allowed to deduct their entire investment cost in real terms. However, when long depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and disco schedules stretch the cost that companies can deduct over longer periods, the real value of those deductions erodes via inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spendin and the time value of money.

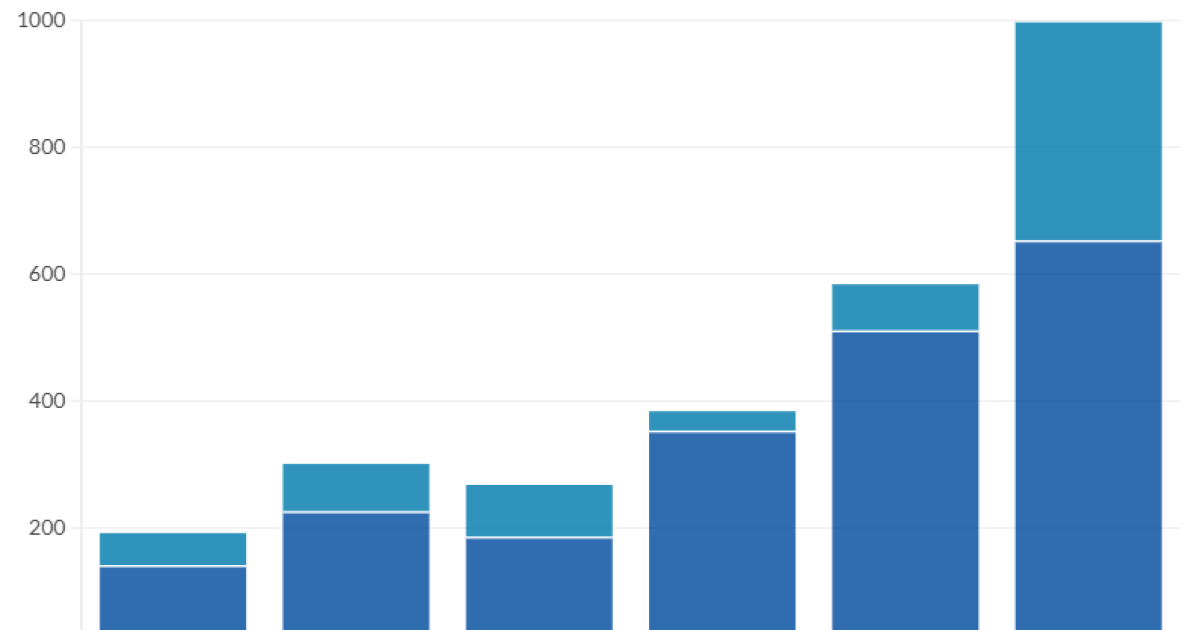

Even though Chile already indexes its capital allowances for inflation, Chilean companies still face the worst capital cost recovery provisions in the OECD, allowing them to only deduct 70.6 percent of their investment costs in machinery and 42.3 percent in industrial buildings, lower than the OECD average of 85.7 percent and 49.9 percent, respectively. Further, Chile is the only OECD country that does not let businesses deduct the cost of purchasing intangible assets such as patents or other immaterial rights, whereas, on average, OECD countries can deduct 76.7 percent in real terms.

Returning to the previous system of full expensing for all assets, which Chile had in place from 2020 to 2022, would allow companies to write off the entire cost in the year of investment, moving the country from the worst to one of the best capital cost recovery regimes in the OECD again.

To allow companies with temporary losses to take full advantage of the measure, policymakers could also extend the policy of inflation indexing by adding a real return on capital (e.g., indexed to a safe bond rate). This policy of neutral cost recovery would lower the cost to businesses caused by missed investment opportunities due to delayed tax depreciation of their investments.

These reforms—returning to full expensing and extending Chile’s inflation indexing policy to neutral cost recovery by adding a real return on capital—would be more cost-effective than cutting the headline tax rate, as better capital cost recovery directly lowers the tax cost of investment without reducing revenue from the return on existing assets.

Chilean Companies Face Systematic Disadvantages in Foreign Markets

Another dimension on which Chile’s corporate taxation is an unfortunate outlier is its cross-border rules: Chile remains one of the last OECD countries to operate a worldwide corporate tax system, which leaves Chilean companies at a disadvantage when competing in foreign markets.

A worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income of domestic corporations in the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. of their home jurisdiction. Almost all OECD countries have transitioned to a territorial or hybrid tax system by enacting participation exemptions for foreign income earned abroad and repatriated as dividends or capital gains. Besides Chile, Colombia and Mexico are the only other OECD countries still operating a worldwide corporate tax system.

This puts Chilean companies at a disadvantage when operating and competing in foreign markets, where they face either the same or a higher rate than their competitors abroad. The subsidiaries of Chilean companies in countries with a tax rate of at least 27 percent receive full credit for taxes paid in the foreign jurisdiction and pay the same tax rate as their local competitors. Meanwhile, the subsidiaries of Chilean companies operating in jurisdictions with a corporate tax rate below 27 percent—including most of the developed world—are still subject to the higher 27 percent tax rate, while their local competitors can operate at lower tax costs.

Enacting a participation exemption that excludes business income earned abroad from the domestic tax base would end this competitive disadvantage by allowing the subsidiaries of Chilean companies in foreign jurisdictions to compete under the same tax rules as companies headquartered in other countries.

Opportunities for the Incoming Administration

Chile’s incoming administration has an opportunity to pursue corporate tax reform that is both more conducive to growth and more revenue-efficient than a simple rate cut. While lowering the headline corporate tax rate from 27 to 23 percent would reduce some investment distortions, Chile’s true competitiveness problem lies in its exceptionally weak depreciation allowances and its outdated worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation..

Restoring the Chilean system of full expensing for all assets and transforming inflation indexing for delayed deductions into neutral cost recovery would be the most effective ways to reduce the tax cost of capital and spur domestic investment. Enacting a participation exemption for the business income earned by Chilean companies abroad would enable them to expand worldwide.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share this article