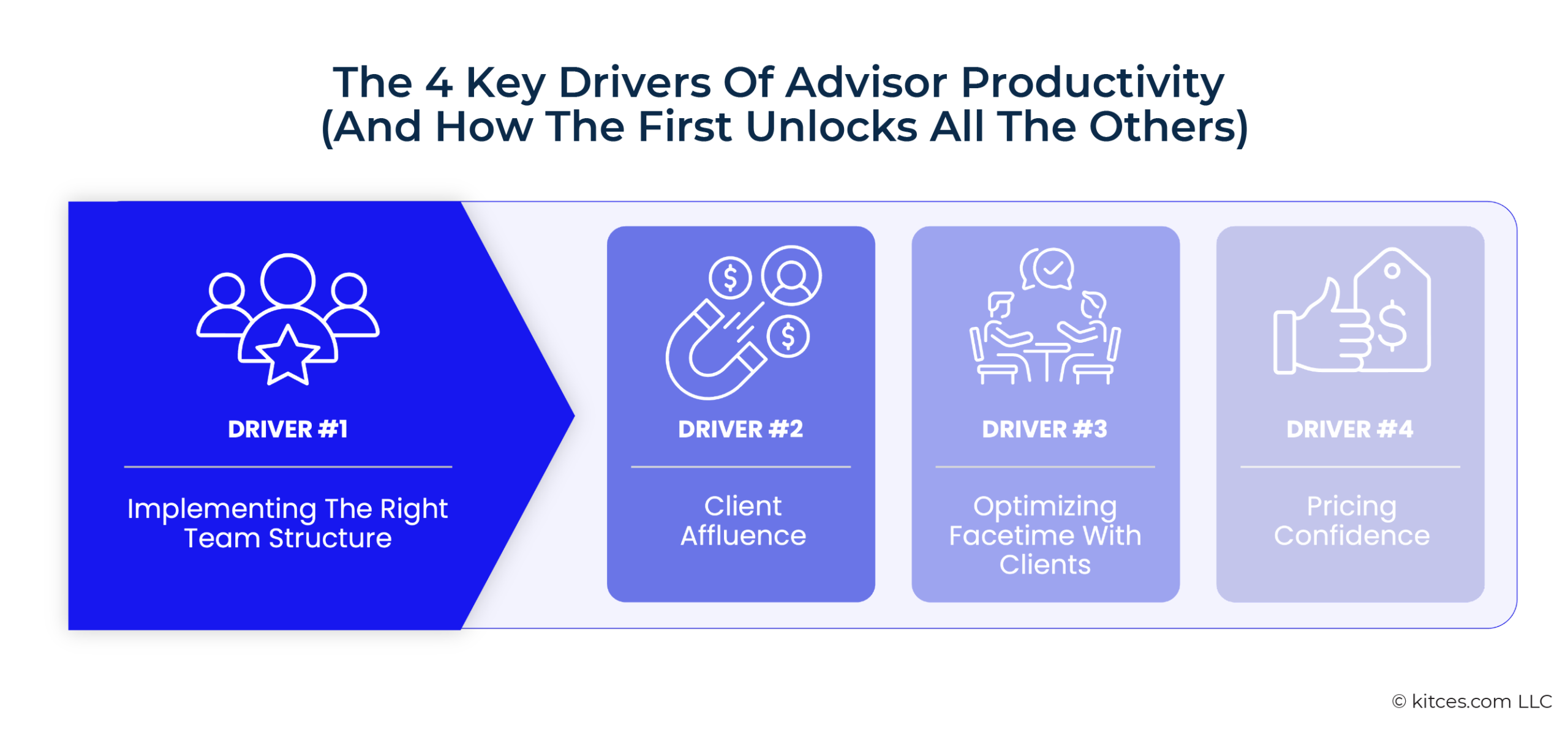

Most advisors actively seek to become more productive – that is, to generate more revenue for every person on their team, even when that ‘team’ is just a solo advisor in business for themselves. For many, improving productivity is often equated with working longer hours, adopting better technology, or earning another advanced designation. However, according to the latest Kitces Research report on Advisor Productivity, none of these rank among the four key drivers of advisor productivity identified in the research. In this article, Kitces Director of Advisor Research Mark Tenenbaum outlines these four drivers – implementing the right team structure, client affluence, optimizing face time with clients, and pricing confidence – and explains the significance of each for success.

Notably, these four drivers are not equally important. The single most critical driver of advisor productivity is implementing the right team structure. This starts with simply having a team at all – evident in the fact that the median unsupported solo advisor generates 64% less revenue than solo advisors with support. The most successful configuration is the three-person ‘Triangle Team’, consisting of a Senior Advisor supported by an Associate Advisor and a Client Service Associate (CSA). Triangle Teams generate the highest revenue per advisor and per employee, providing Senior Advisors with the leverage to grow while avoiding the inefficiencies common in larger teams.

Implementing the right team structure – having a team and ensuring the right mix of roles – is the most important driver because it is the foundation that enables success across the other three key drivers. This can be seen with the second driver – client affluence – when considering how higher-net-worth clients typically have more complex financial needs – such as estate planning and charitable giving structures – and the willingness and financial resources to hire advisors capable of managing that complexity. However, as client affluence increases, advisors struggle to scale their services alone; multi-member teams become essential for delivering the depth of service these clients expect.

A similar dynamic is also present for the third driver – optimizing client face time. Top-performing advisors spend about 24% of their time in client meetings, compared to just 17% for their typical peers. The importance of client meetings in driving productivity is unsurprising, as this is where prospects become clients, existing clients reveal new needs (such as navigating a divorce or managing an inheritance), ongoing interaction reinforces the client’s sense of being valued, and referrals often arise through conversations like, “I have a friend who’s anxious about retirement—can I tell her to reach out to you?” Support staff free advisors to spend more time with clients and focus on client engagement without compromising quality or risking burnout.

The fourth driver is pricing confidence – the ability to set and enforce appropriate fees and minimums. Firms that implement AUM minimums or confidently charge fees aligned with their value consistently outperform those that don’t. While this may seem separate from team support, it ultimately ties back to it: Pricing confidence depends on delivering a premium service promise. This involves not only offering comprehensive financial planning but doing so with consistency, thoroughness, and responsiveness – all of which depend on a well-coordinated team.

Ultimately, the key point is that while technology, credentials, and individual effort will always contribute to a successful advisory practice, the most important factor is deliberately structuring teams so advisors can focus their energy where it matters most – serving clients, deepening relationships, and driving the firm forward. Put simply, the most productive firms are those that build the right teams so their advisors can truly focus on being advisors!

Read More…