2025 was nothing if not eventful, and financial advisors say they’re expecting more of the same in 2026. With potential cuts to consumer protections and new rules around artificial intelligence on the horizon, advisors say sweeping regulatory changes could reshape how wealth management firms operate and serve clients.

Processing Content

Financial Planning surveyed over 200 advisors across the industry to capture their policy predictions for the year ahead. In line with findings from FP’s monthly FACO survey, tariff-induced volatility and federal interest rate cuts remain top of mind moving into 2026.

A vast majority of advisors — nearly 90% — said that volatility in tariffs will “definitely” or “probably” continue in the coming year. Similarly, most advisors are also anticipating continued interest rate cuts from the Federal Reserve in 2026.

Advisors are split on policy changes affecting Social Security and Medicare. Nearly half of those surveyed expect the FICA cap to rise significantly in 2026, while just under a third say it could be eliminated altogether.

Opinions are equally divided on Medicare’s benefits and funding, though advisors warn that cuts to the program would pose a major risk to their business, second only to tariff volatility.

It’s not all doom and gloom. Many advisors expect a lighter regulatory landscape in 2026 and believe it poses little to no risk to their business. For clients, a plurality of advisors say fewer regulations could be a net positive in the months ahead.

But beyond interest rate and regulatory changes, advisors say most scenarios — such as raising the retirement age, cutting Medicare benefits or increasing the FICA cap — would generally hurt their clients.

A new regulatory environment

Advisors largely agree that the wealth management industry will see a reduction in regulations over the coming year, but exactly which regulations will be impacted remains a point of debate.

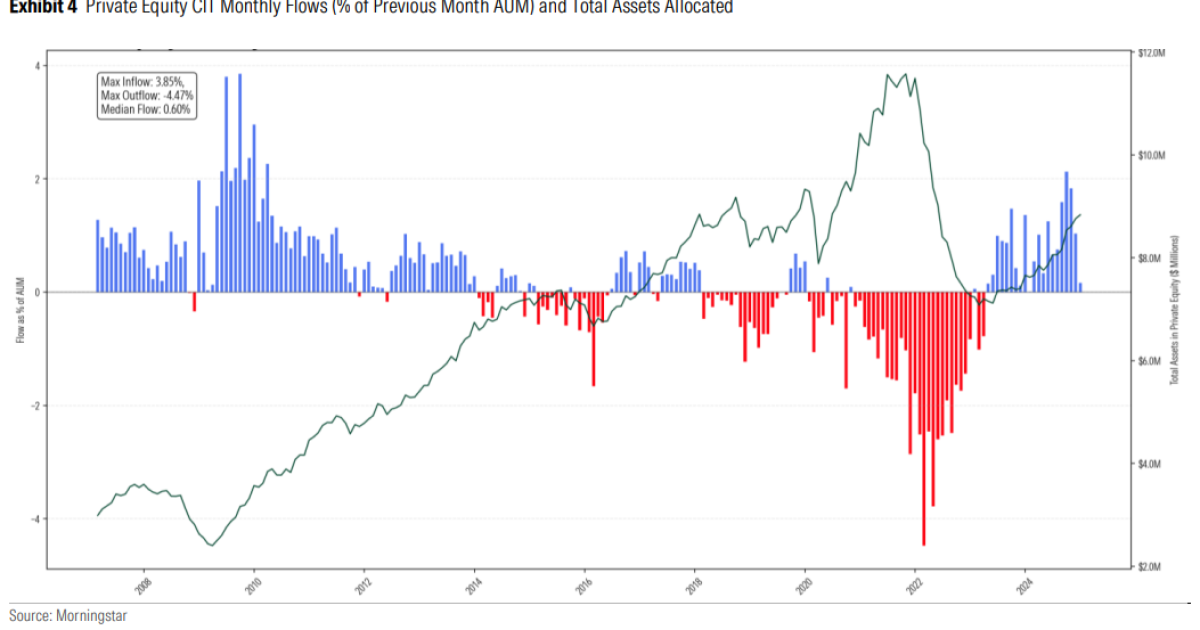

A vast majority of respondents (78%) believe rules granting retail access to private markets are likely to pass, making it the most anticipated change.

Regulatory clarity on digital assets and AI also ranks high, with 75% predicting changes to stablecoin regulations and 72% forecasting new governance for AI in investment recommendations.

One advisor in the survey suggested that the current regulatory focus will shift in 2026 from “fiduciary duty” to “AI diligence.”

While a majority (60%) also foresee a general loosening of enforcement and consumer protections, advisors largely dismissed the prospect of ending quarterly public company reporting, with 70% categorizing it as unlikely.

In September, President Trump proposed moving to semiannual reporting in a post on Truth Social, saying it would ‘save money and allow managers to focus on properly running their companies.’ SEC Chair Paul Atkins expressed support in October, telling CNBC that a rule proposal was in the works. So far, no changes have been implemented.

An industry split on regulatory outlook

Advisors at RIAs, wirehouses and broker-dealers often hold markedly different outlooks on key regulatory issues within the wealth management industry, according to survey data.

RIAs, in particular, forecast a significantly more permissive environment than their peers. While 89% of RIAs expect regulators to grant retail investors greater access to private markets, only 67% of advisors at banks and wirehouses agree.

The divide is most acute regarding government oversight: 80% of RIAs predict a “major relaxation” of consumer protection efforts, nearly double the 45% of broker-dealer advisors who share that view. And 76% anticipate fewer enforcement actions, compared to just 47% of bank advisors.

Consensus only emerges regarding digital assets, where clear majorities across all channels (ranging from 67% to 76%) expect new regulations or clarification on stablecoins.

Whether such regulatory changes actually materialize remains to be seen. But with tariff volatility, potential FICA changes and new rules for AI and crypto all on the table, advisors across the board are preparing for a major shake-up in how they do business in 2026.