For the first time, a registered investment advisory firm requires at least $10 billion in assets under management to make the list of the 20 largest fee-only firms in the U.S.

In fact, Chicago-based Gresham Partners — No. 20 in the rankings below from data partner Comply for Financial Planning’s 2025 RIA Leaders study — has more than $11.6 billion in AUM. The top three spots this year went to St. Louis-based Moneta Group Investment Advisors ($42.8 billion in AUM); Bethesda, Maryland-based Chevy Chase Trust Company ($40.3 billion); and Torrance, California-based EP Wealth Advisors ($35.6 billion). Together, the top 20 firms in the 2025 ranking have nearly $424 billion in combined AUM.

As much as those eye-popping AUM figures reflect the sheer size of some fee-only RIAs, they also indicate accelerating consolidation.

The need for succession planning, capital to drive scale, organic growth, new lines of business and talent in the form of financial advisors, specialists and executives is driving that consolidation at the top of the channel, according to Brandon Kawal, a partner with consulting and transaction advisory firm Advisor Growth Strategies. M&A deals have proven “a good venue” for RIAs to pursue advisors and other professionals with solid track records, he said.

“As these larger platforms seek to drive increasing levels of value for their shareholders — whether individual or institutional — the most valuable aspect of any of these platforms is the ability to grow organically,” Kawal said. “Where they’re very accretive is where those acquisitions or mergers can come in and be part of a more holistic growth story.”

Eventually, the largest RIA aggregators could begin to see some advisors “splinter off” toward more independence out of companies that have become “a large national or international enterprise,” said David Grau, CEO of consulting firm Succession Resource Group. For now, movement into those firms and out of the wirehouses and other brokerages is feeding into the biggest RIAs, as are two other trends: teaming and companies offering advisors many essential services in one place.

“They’re able to compete on price, scale and service level. It’s really hard to compete with them, and, so, if you can’t beat ’em, join ’em,” Grau said. “The aggregation is at a really good inflection point for our industry. We’ve got large enough firms that can now focus on mentoring and training the next generation, not buying a book.”

Over the past decade, RIAs have expanded at an 11% compound annual growth rate due to asset appreciation and advisors’ gravitation toward them, research firm Cerulli Associates found in a study released earlier this month. At the same time, more than two-thirds of RIA executives with billion-dollar firms said organic growth is a strategic priority, and 83% said advisors’ lack of available time to focus on that is constraining their efforts around that goal. Regardless, the firms with at least $5 billion are vacuuming up the RIA channel. In the past five years, their client assets jumped at an average annual rate 21% and their advisor headcounts surged by 19% while their share of the channel’s assets soared by 18 percentage points.

“RIAs are still growing not only in real terms, but in terms of their marketshare of the wealth management industry,” Cerulli’s report said. “Almost all of this growth is now happening at firms with at least $5 billion in AUM, a group that has become increasingly acquisitive. RIA growth should not be taken for granted, as obstacles like talent shortage still need to be overcome.”

Scroll down the slideshow below to see the rankings of the 20 largest fee-only RIAs that provide financial planning services to clients. The ranking of the top 150 firms is available in printable PDF format. To read the RIA Leaders feature story, “The oldest RIAs are 85. How did they become a $144T industry?,” click here. For last year’s top 20 rankings, follow this link.

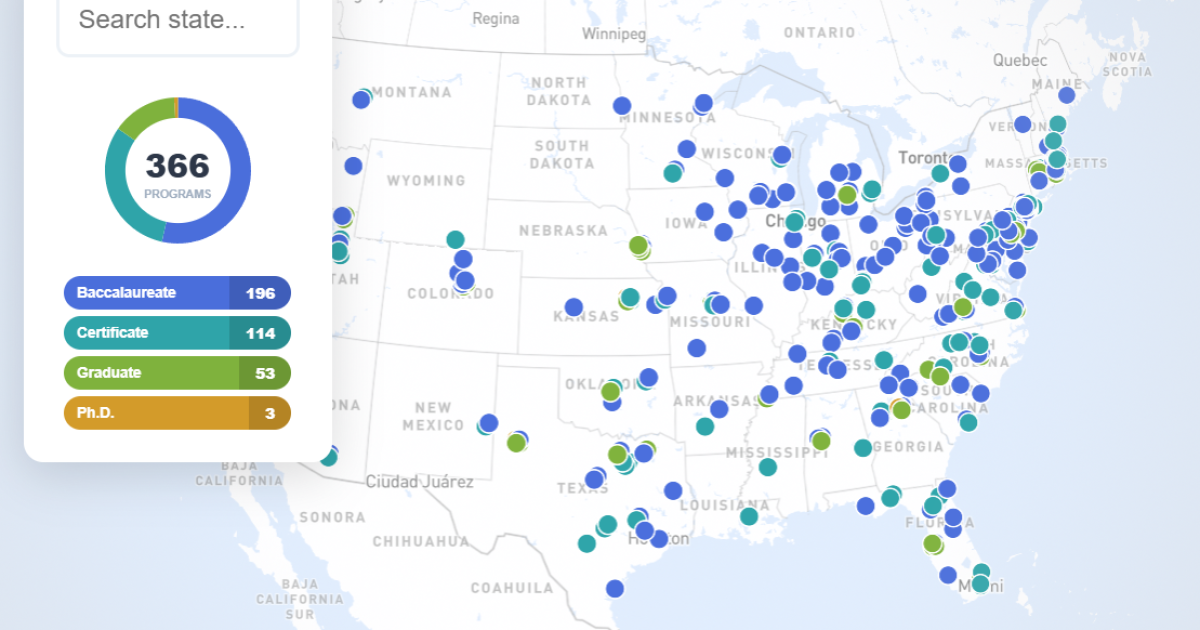

Notes: FP’s data partner for the RIA Leaders feature, Comply, produced the below rankings by applying the following six criteria to firms’ required SEC Form ADV filings on May 1, 2025:

Firms must have zero registered representatives of a broker-dealer.At least 50% of the firm’s clients must be individuals or high net worth individuals.Firms must not list commissions as a compensation arrangement.Firms must have more than zero financial planning clients.Firms must not list commission-taking businesses in “other business activities.”Firms cannot be affiliated under common ownership with commission-taking businesses.

In the absence of an official regulatory classification and definition for the titles “financial planner” or “financial advisor,” FP is using the closest available figure available through Form ADV requiring firms to state the number of employees “registered with one or more state securities authorities as investment adviser representatives.”