Imagine you’re planning to get a new credit card and you’re weighing two similar options. Both offer comparable benefits and charge the same annual fee. But one card offers a welcome bonus of 80,000 points, while the other offers a welcome bonus of 100,000 points. Based on those bonuses, which card would you choose?

The card that comes with more points may seem like the obvious answer, but the reality is that you’re missing a crucial piece of information: You can’t tell which bonus is better without knowing how much the respective points are worth. Depending on the value of the points each card earns, the smaller welcome bonus could actually be worth more.

Knowing the value of points and miles is a vital step toward using them wisely, which is why NerdWallet publishes valuations of popular airline, hotel and credit card rewards. Here’s how you can use those valuations to your benefit.

How to use valuations for award travel

Knowing the value of your currency is essential in any transaction. Here’s how points and miles valuations can assist you in booking travel.

Decide whether to book with points or cash

Award travel creates opportunities to save money, but just because you can book a trip with points or miles doesn’t mean you should. Some award redemptions are phenomenal and some are dismal, with a lot of territory in between. Valuations are the key to figuring out where a given award lies on that spectrum.

You can use our flight calculator to figure out whether to book flights in points or cash. Or you can do the calculation yourself: (Cash price – fees when booking with points)/number of points.

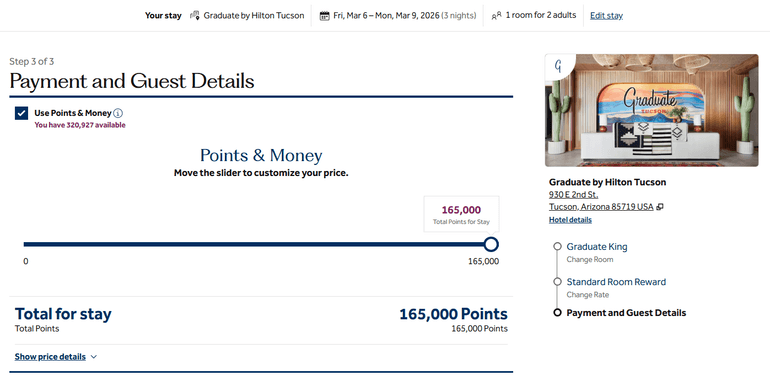

Suppose you’re booking a long weekend visit to the University of Arizona in March of 2026. You want to be close to campus, so you decide on the Graduate by Hilton Tucson hotel. After taxes, the total cost for three nights in a 1 King Bed room is $1,319.27.

However, you have a stash of Hilton Honors points, so you check the award rate and see that you could instead book the same stay (with a comparable cancellation policy) for 165,000 points.

Dividing the cash price by the award price yields a redemption value of just under 0.8 cents per point. NerdWallet’s valuation for Hilton Honors is 0.6 cent per point; by that metric, booking an award provides better than expected value in this case.

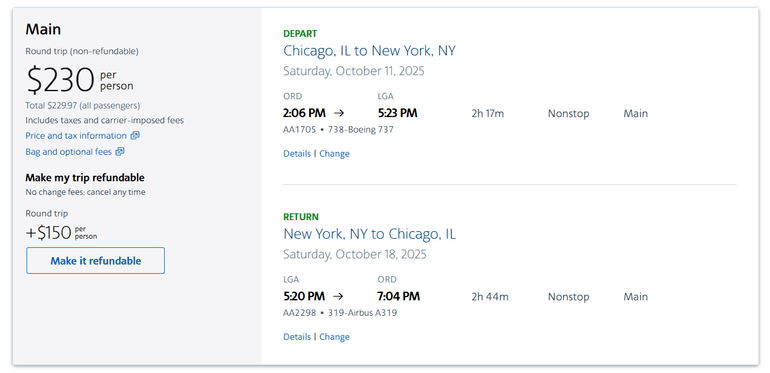

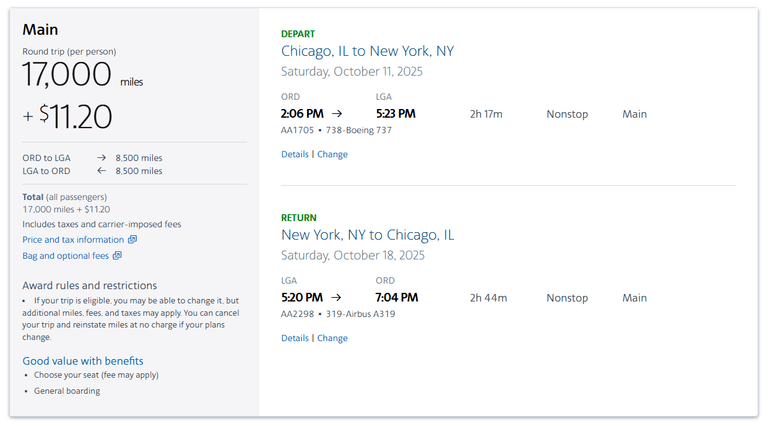

For another example, consider an American Airlines economy flight from Chicago to New York LaGuardia in October 2025. This nonstop itinerary is available for $229.97 round-trip.

Alternatively, you could book the same flights for 17,000 AAdvantage miles plus $11.20 in fees.

This award offers a return of approximately 1.3 cents per mile, whereas NerdWallet’s valuation for AAdvantage miles is 1.6 cents apiece. That means the award provides lower than expected value, so if your decision rests solely on that valuation, then paying cash is the better option.

But valuations don’t exist in a vacuum, and there are other factors to consider when assessing the value of an award. In the case of booking the American flight, redeeming miles provides a more flexible cancellation policy. You can cancel and get a full refund so long as you do so before the first flight departs. You can also cancel the cash fare, but you’ll be refunded in American Airlines credit that expires after a year. That distinction makes the award flight more enticing, especially if your plans are tentative.

Apart from a more favorable cancellation policy, you might also prefer to book an award if you’re worried about points expiring or you’re looking to keep cash costs down.

On the other hand, you might lean toward paying cash if:

You’re conserving points for a more valuable future award.

You won’t get a good return because the points price comes with paying hefty award surcharges.

Choose between award booking options

Valuations can help you determine not only whether to book an award, but also which type of award to book and which loyalty program you should use to book it.

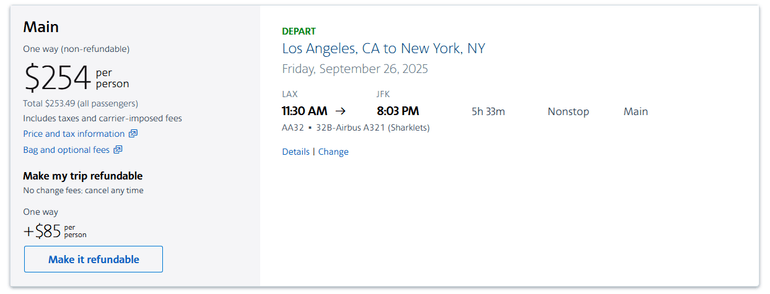

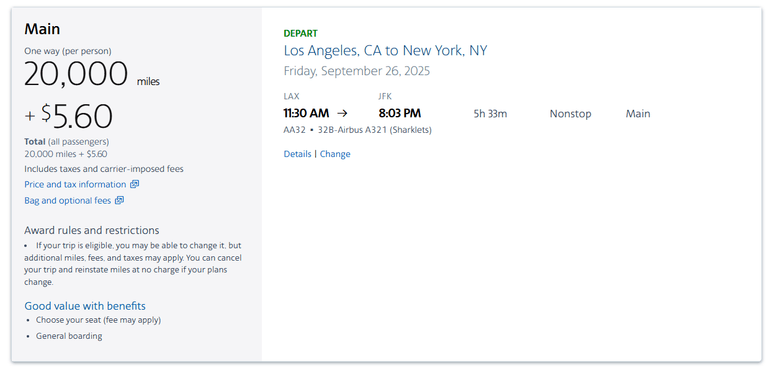

For example, imagine you’re booking a one-way flight from Los Angeles to New York in late September, and you have reserves of both American Airlines AAdvantage miles and Alaska Airlines Mileage Plan miles. You don’t mind paying cash, but you’re happy to use miles if you’re getting a good deal.

Checking award rates, you see the same flight available for 20,000 AAdvantage miles plus $5.60 in fees. That yields a redemption value of 1.2 cents per mile, which is well under NerdWallet’s valuation of 1.6 cents per mile, indicating a subpar return on your miles.

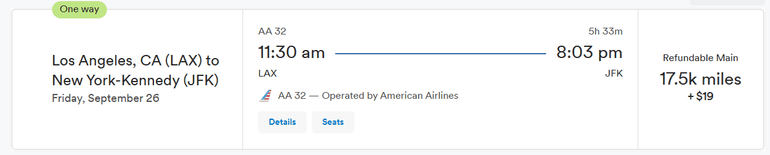

However, since American Airlines and Alaska Airlines are both Oneworld alliance members, you can redeem Alaska Mileage Plan miles to book American Airlines flights. In this case, you can book the exact same flight through Alaska Airlines for 17,500 Mileage Plan miles plus $19 in fees, yielding a redemption value of 1.4 cents per mile. NerdWallet’s valuation for Mileage Plan miles is 1.3 cents per mile, making this award a fair return of value.

This example illustrates how redeeming points is not only about the number of points or miles you use, but also what you think those points or miles are worth.

Booking this flight with AAdvantage miles isn’t a good deal. But assuming you agree with NerdWallet’s valuation, booking the exact same flight through Mileage Plan is a good deal because those miles aren’t worth as much.

There’s usually more than one way to book award travel. Knowing your options and their relative values will help you identify good redemption opportunities and reject bad ones.

Maximize spending

In addition to helping you redeem rewards, points and miles valuations can help you identify your best options for earning them.

The Chase Sapphire Preferred® Card earns 3 Chase Ultimate Rewards® points per dollar on dining worldwide. You could transfer those points at a 1:1 ratio to World of Hyatt points, which NerdWallet values at 2.2 cents each. Multiplying those two numbers yields a return of 6.6 cents per dollar spent on dining, so using your Chase Sapphire Preferred® Card could earn you $6.60 worth of rewards for your $100 dining purchase.

In contrast, the Hilton Honors American Express Surpass® Card earns 6 points per dollar on eligible U.S. restaurants (see rates and fees). However, NerdWallet’s valuations list Hilton Honors points at just 0.6 cent apiece, yielding a return of 3.6 cents per dollar on dining or $3.60 on a $100 purchase. Even though the card earns twice as many points, the return on spending at restaurants is lower because Hilton points are less valuable than Chase Ultimate Rewards® points.

Evaluate other offers

You can use valuations to assess the return you’ll get from other earning opportunities, such as credit card welcome bonuses and spending bonuses, retention offers, loyalty program promotions, compensation for overbooked flights and more.

For example, imagine a hotel loyalty program is running a promotion offering 2,000 bonus points per night (on top of what you’d already earn). If the program in question is IHG Rewards, then the promotion would earn you an extra $10 of value per night, since NerdWallet values those points at 0.5 cent apiece.

That’s less likely to move the needle than if the same promotion came from World of Hyatt; NerdWallet values Hyatt points at 2.2 cents apiece, so in that case you’d be getting $44 of extra value each night.

How not to use points and miles valuations

Here are a few pitfalls to avoid when applying valuations to your own award redemptions.

Don’t treat valuations like gospel

NerdWallet’s valuations are the product of real-world data, but they’re not universal. Even though NerdWallet may put Hyatt points at a higher value, it’s possible that you could find an award stay with another hotel brand at an even higher valuation. With most programs using dynamic pricing, there are usually plenty of award redemptions that fall above or below NerdWallet’s numbers.

Consider how much you’ll use a reward currency

No matter what the valuation of a travel rewards currency is, rewards are only valuable if you actually use them. When you’re deciding which type of points or miles to collect, consider your personal preferences. Does a certain airline offer more flights from your home airport? Do you prefer to redeem points for a certain type of award travel, such as business class flights or all-inclusive resorts?

For example, you’re more likely to find uses for Alaska Mileage Plan miles in Seattle than in Miami. You might not want to collect Hyatt points if there aren’t any Hyatt properties at your usual vacation destinations.

Don’t confuse valuations for return on spending

To maximize your return on spending, you have to consider both the value of the points you’re earning and the rate at which you’re earning them.

For example, NerdWallet values Marriott Bonvoy points at 0.9 cent each and JetBlue TrueBlue points at 1.5 cents each. If you face a choice between earning 2 Marriott points per dollar or 1 JetBlue point per dollar, the higher earning rate means your total return from the Marriott points will be higher even though those points have a lower valuation individually.

Don’t over-maximize

Valuations can help you decide whether booking an award makes sense, but you shouldn’t let valuations do the deciding for you. The best awards are the ones that take you where you want to go at a price you can afford; if that means redeeming points for less than the valuations say they’re worth, that’s okay!

Similarly, there’s no virtue in getting a high redemption value purely for its own sake. You might get a great return from using points to book first class flights or stays in overwater bungalows, but the redemption value is only meaningful if you actually want to book those awards. In short, don’t let metrics dictate how you travel.