For many financial advisors, one of the most frustrating bottlenecks in the planning process is the data-gathering phase, where client procrastination frequently stalls progress before it even begins. Onboarding requires effort from clients themselves: locating documents, completing forms, and granting account access. This work is often tedious, emotionally charged, and unglamorous, which can cause even highly motivated clients to get stuck. However, these delays don’t necessarily reflect a lack of interest or commitment; clients can deeply value financial planning and still struggle to act on it.

The core challenge stems from what behavioral psychologists call the “value-action gap”: the disconnect between what people say they want and what they actually do. Clients often defer onboarding tasks not because they doubt the advisor’s value, but because the tasks feel overwhelming or uncomfortable. This behavior isn’t unique to financial planning; people procrastinate things they care about all the time, from exercise to decluttering. At the heart of this struggle is a concept called “momentary distress tolerance” – the ability to endure short-term discomfort in service of a longer-term goal. While some advisors aim to work around this with synchronous “Get Organized” meetings or similar solutions, it’s difficult to eliminate client ‘homework’ entirely. And when motivation falters, discomfort often wins out, leading to stagnation.

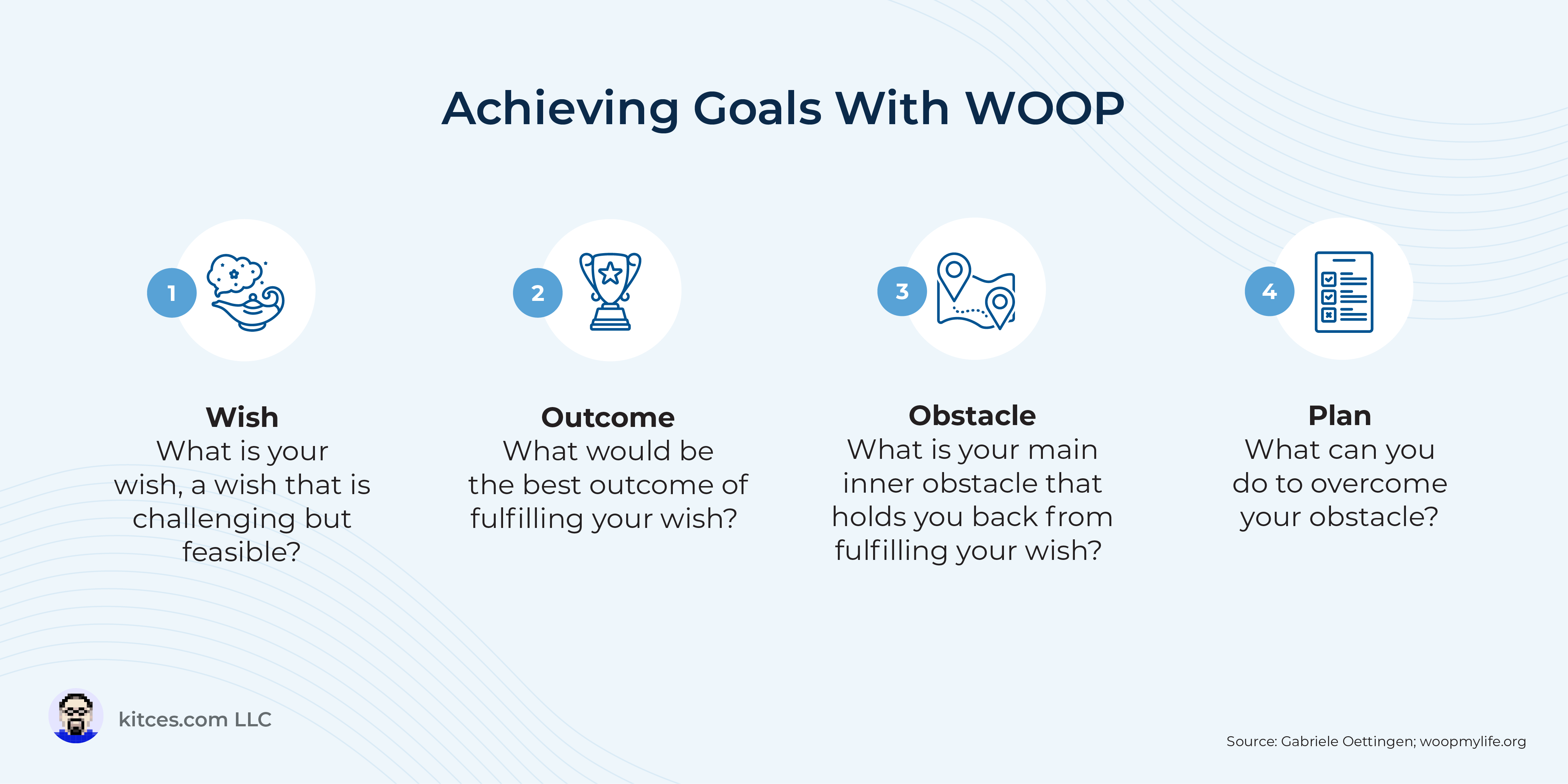

Traditional motivation strategies – like emphasizing the benefits of completing onboarding – often fall flat because clients are already convinced of financial planning’s value. In many cases, the barrier is more often an issue of bandwidth, not desire. Gabriele Oettingen’s WOOP framework (Wish, Outcome, Obstacle, Plan) offers a practical, research-backed strategy to bridge the gap between intention and action. WOOP encourages clients to articulate not only their goals but also the internal and external obstacles likely to impede them – and to create if/then plans for overcoming those obstacles. For example: “If I get bored looking for paperwork, then I’ll set a 20-minute timer to stay focused.”

The real power of WOOP lies in its simplicity and adaptability: it doesn’t require worksheets or a rigid script – just a natural conversation about the client’s goal, why they want it, what might stand in their way, and how to get around it. Advisors can guide clients through this mental exercise informally in meetings, particularly when assigning tedious or low-reward tasks like gathering account statements or completing estate planning documents. By helping clients visualize potential friction points and prepare responses in advance, advisors make it more likely that clients will follow through and avoid the limbo of incomplete onboarding. Over time, this practice builds more client self-awareness while reinforcing the advisor’s role as a thinking partner – not just a taskmaster.

Ultimately, when clients are supported in identifying their own motivational roadblocks and equipped with strategies to overcome them, they’re more likely to stay engaged, follow through, and experience the true benefits of financial planning. This allows advisors to spend less time chasing paperwork and more time delivering meaningful, high-impact advice to their new clients!

Read More…