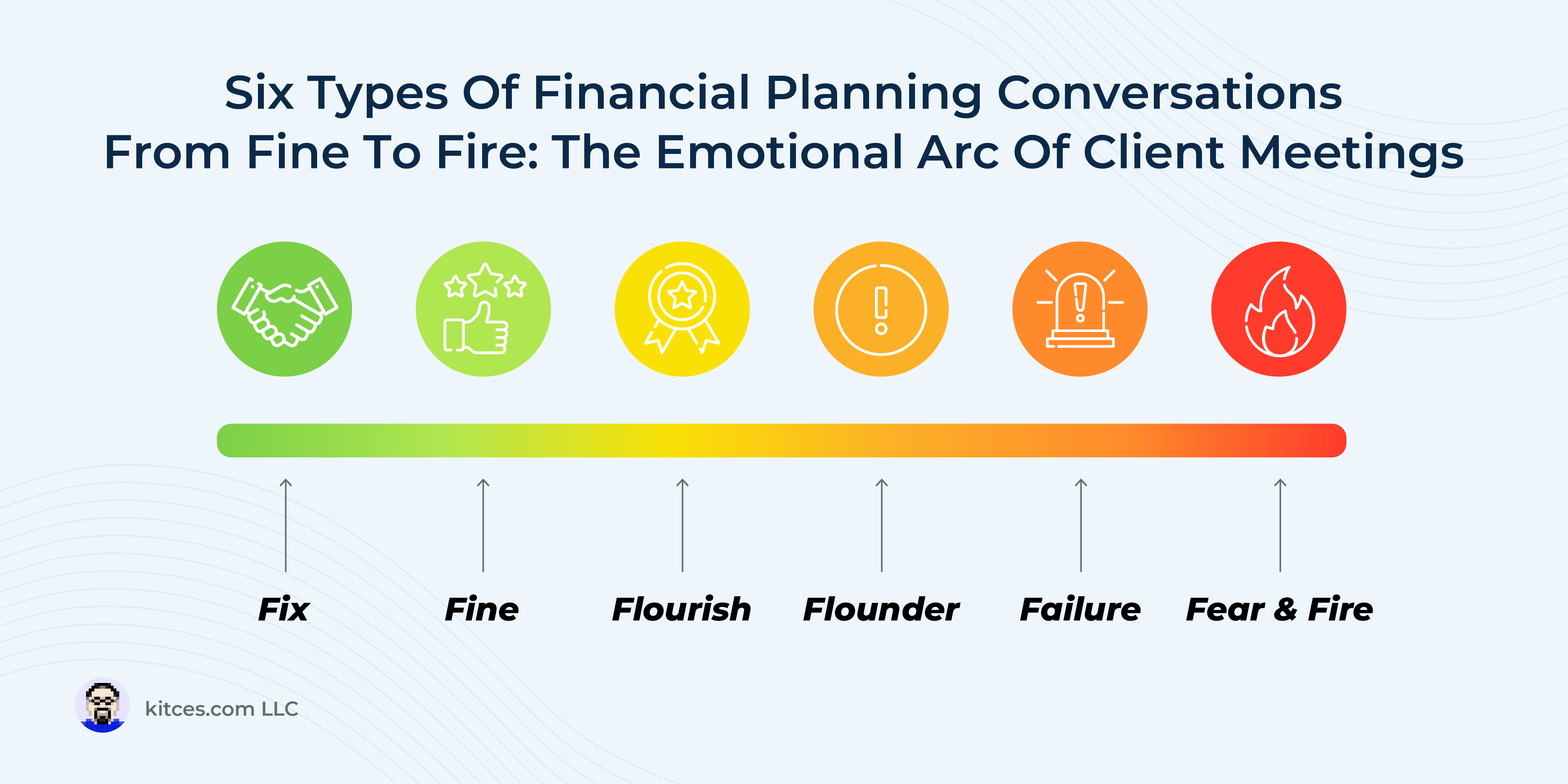

Financial planning meetings often fall into categories like “Fix Meetings” (where there is an urgent problem that both the advisor and client want to address), ‘Fine Meetings’ (where everything is on track and the advisor provides reinforcement), or ‘Flourish Meetings’ (where clients are thriving and the focus is on expanding possibilities). However, another type of meeting occurs when the client isn’t in crisis but has clearly drifted off track (e.g., spending more than planned, which could lead to long-term consequences for their financial plan). These Flounder Meetings can be particularly challenging, as the client may not feel the same urgency as the advisor to address the issue. Advisors often recognize the risks ahead and feel a strong responsibility to intervene, but without shared motivation, even well-intentioned conversations can feel stuck or strained.

In these situations, it can be tempting for the advisor to jump into problem-solving mode, telling the client how their current trajectory is unsustainable and recommending changes to get things back on track. But this directive approach can backfire if the client feels judged, causing them to disengage and leaving everyone frustrated. Because even technically sound advice may be ignored if the client doesn’t feel respected or involved in the process.

An alternative approach is to make Flounder Meetings more collaborative than corrective. When clients are invited to actively participate in the conversation – instead of passively receive recommendations – they’re more likely to engage. Rather than starting the conversation by pointing out the problem, an advisor might begin by encouraging the client to imagine what their life could look like 10 years from now if they continue on their current path. This encourages awareness without assigning blame and creates room for the client to articulate the issue in their own words. Once the situation is collaboratively explored and the problem defined, the advisor can help reframe potential adjustments as meaningful opportunities. For example, rather than warning, “You’re on track to run out of money”, the advisor might ask, “How could we think about this as a shift that gives you more options, not fewer?”

Guiding a client through a Flounder Meeting often means helping them visualize where their current path is leading, reflect on the trade-offs of staying the course, and reframe adjustments as opportunities for growth. And by framing potential next steps as short-term ‘experiments’ (e.g., cutting spending by $400 for three months) rather than permanent commitments, the conversation can reduce fear and unlock the momentum needed to take action, all in a natural, supportive way.

Ultimately, the key point is that an effective Flounder Meeting can help clients move from passive acknowledgment to active engagement, building both the desire for change and the confidence to pursue it. It also offers a moment to slow down, reset, and reimagine the future – because a shifting financial life tends to call for renewed alignment, agency, and resilience. These moments when clients felt heard, supported, and empowered to move forward are often the ones they remember most – and when they most recognize the value of having an advisor as a trusted, collaborative partner!

Read More…