New Year’s resolutions offer a natural reset for anyone hoping to change their habits, and for many, money goals are often at the top of the list. The real test, of course, is following through.

Nearly three-quarters of Americans missed their saving and spending goals in 2025, yet many say they’re confident 2026 will bring a “resolution rebound,” according to a new Vanguard survey.

The survey, which includes responses from just over 1,000 U.S. adults, found that more than 8 in 10 Americans have set financial resolutions for 2026. Among respondents, the top priorities were to build an emergency fund and to use a high-yield account for short-term savings.

Most respondents — 82% — say they feel at least somewhat confident they can hit those goals next year, but the obstacles vary by generation. Boomers worry most about unexpected expenses (29%), millennials point to insufficient income (22%) and Gen Z is the group most likely to overspend (15%).

Across all age groups, the biggest concern is the same: how economic uncertainty (22%) could derail their saving and spending plans.

“Americans are focused on building emergency funds and saving for short-term goals, and they need information and tools to make smarter savings decisions so they don’t fall short of their resolutions,” said Matt Benchener, managing director of Vanguard’s personal investor business. “Use the end of the year as a time to reset. Americans should take a close look at where they save to ensure they are earning the returns they deserve.”

A recent Wells Fargo survey underscored the prominence of financial goals among New Year’s resolutions in 2026. The survey, which included U.S. adults 25 and older with household incomes under $100,000, found that nearly all respondents (97%) have already set or are considering financial resolutions for the year.

Among those planning resolutions, the top goal is saving more money, cited by 70% of participants. Roughly half (49%) aim to spend less or reduce expenses, while about 2 in 5 are focused on improving their credit score (39%), paying off debt (38%), or starting a side hustle or additional income stream (35%).

New year’s resolutions help drive financial advisor interest

Americans are divided on whether they can achieve their 2026 financial goals, with confidence (18%) and uncertainty (16%) among the strongest emotions.

Still, many remain determined to improve their financial health. Their top motivators, including keeping up with rising living costs (26%) and preparing for unexpected expenses (24%), are also prompting more people to turn to financial advisors as the new year nears.

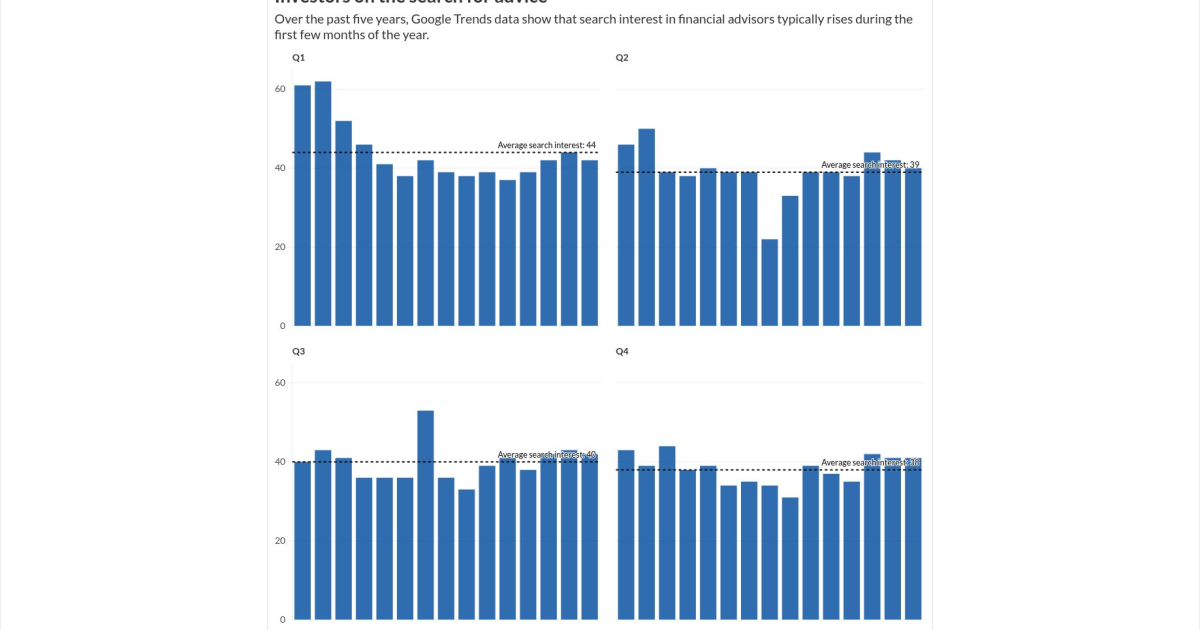

Searches for financial advisors tend to fluctuate from one season to the next, with the first months of a new year drawing the greatest web traffic, Google Trends data shows.

The resolution-driven bump in search interest can be helpful for advisors looking to attract new clients, but planners say the seasonal interest in financial resolutions can be helpful when working with their current clients as well.

“These discussions come up because I’ll use the start of the year as an opening — excuse — to revisit items that have been pushed off to the side that deserve another look,” said Noah Damsky, principal at Marina Wealth Advisors in Los Angeles. “Labeling a painful goal or task — such as getting an estate plan completed — with a label such as a resolution gives everyone a good reason to revisit a topic that is low on their list of priorities.”

Resolutions are an invitation for advisors

It’s easy to dismiss New Year’s resolutions — the vast majority are abandoned in just the first couple of months — but advisors say that’s a mistake when it comes to financial resolutions.

“A big part of an advisor’s job is to initiate discussions and encourage clients to take action,” Damsky said. “A surge in interest is a clue for us to start a discussion. It’s a slight opening in the door. We need to stick our foot in the door to start a discussion to see if there’s anything behind the door that’s worth unpacking.”

“Perhaps it leads to some sort of action, or maybe it just serves as a trust-building conversation that helps clients move closer to taking action on something in the future,” he added.