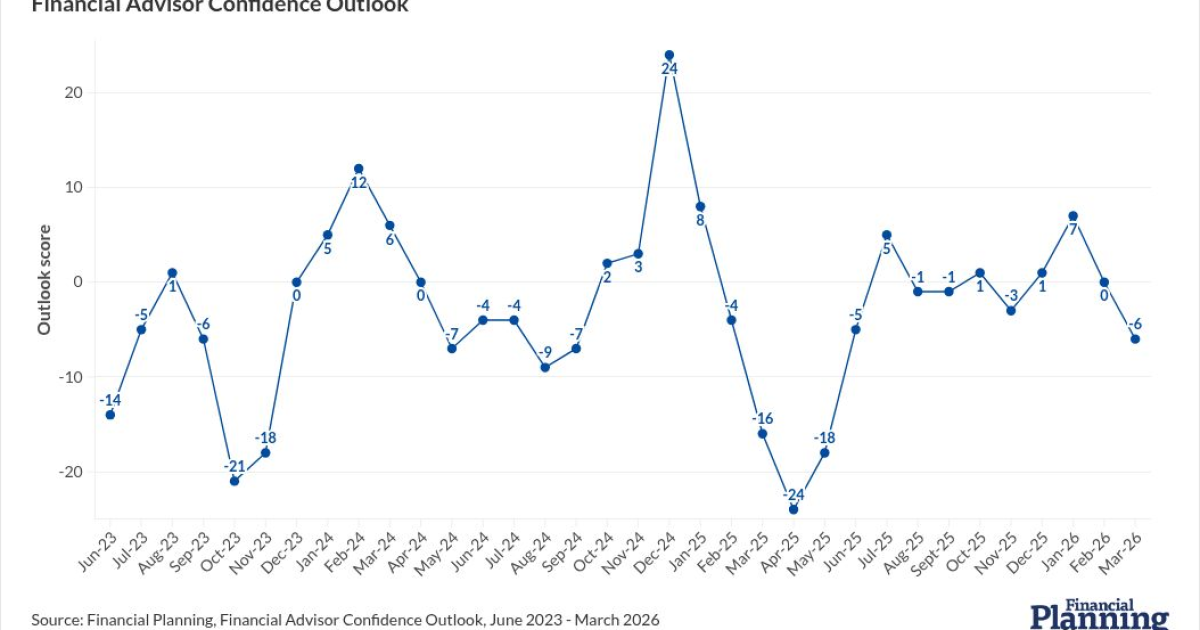

While estate planning has long been an integral part of the financial planning process, most advisors’ roles have historically been limited to identifying the need for documents and referring clients to attorneys. New technologies, however, are transforming how advisors approach estate planning by allowing them to go deeper—both through enhanced visualization and modeling tools and, more recently, through document preparation platforms that enable clients to complete core legal documents within an advisor-supported environment. Kitces Research projects that by 2026, nearly half of advisors will employ technology to support their estate planning.

Between 2024 and 2026, 1 in 10 advisors are projected to incorporate tech to support estate planning for the first time. As advisors expand their involvement, many face questions about whether to charge for these services – and if so, how to structure those fees.

Some firms may choose not to charge, integrating estate planning into their existing service offerings as a value-add to increase client loyalty, strengthen multi-generational relationships, or differentiate themselves in the marketplace. For firms intent on charging, concerns typically center on avoiding the Unauthorized Practice of Law (UPL), justifying fees to regulators and clients, and uncertainty about how much to charge. Each of these concerns, however, is surmountable. Advisors can generally avoid UPL by refraining from drafting documents or giving dispositive legal recommendations, and instead focus on providing education, modeling, and facilitating client-directed document creation via third-party tools. These platforms often include built-in guardrails that prevent advisors from crossing into legal advice while still delivering meaningful client value to justify a fee.

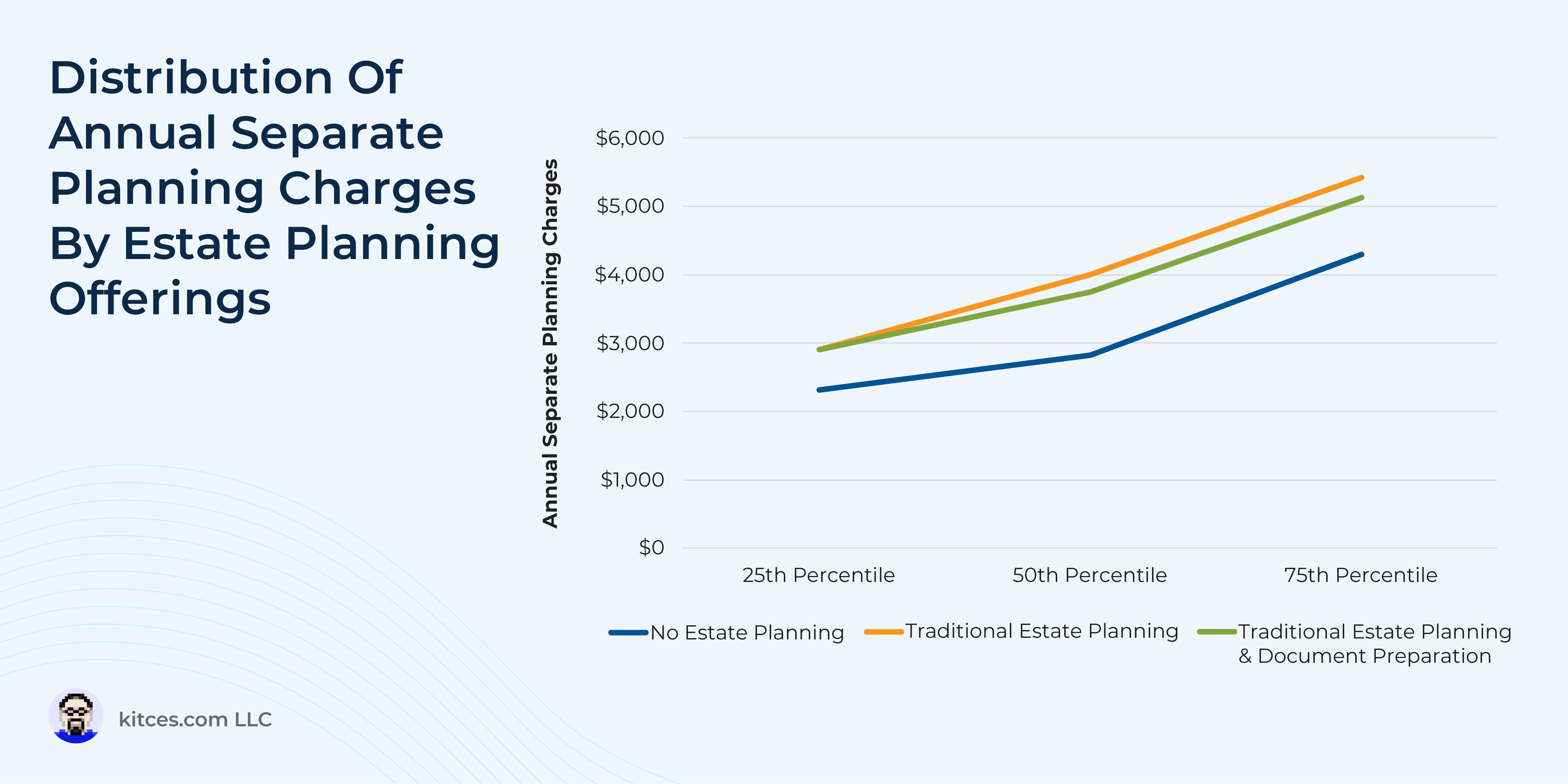

Advisors who do choose to charge for estate planning typically follow one of four approaches: 1) bundling it into AUM fees; 2) bundling it into existing planning fees, 3) adding a dedicated estate planning tier to their fee schedules, or 4) charging a flat estate planning fee. The most appropriate pricing method depends on whether estate planning is positioned as a core service for all clients or as an optional offering for a select group. Broad integration often supports modest, across-the-board increases in AUM or planning fees, while limited use is better aligned with tiered or flat-fee models, in which increased fees apply only to clients using these services. For advisors uncertain about how much to charge, benchmarking data is offered for each of these pricing structures.

Crucially, advisors adding estate planning services must also communicate the change effectively to clients. When estate planning is introduced as a value-add within an existing service offering, messaging can be straightforward and positive, emphasizing the new offering. If estate planning is offered as part of a separate tier or standalone fee, the tone can be more invitational, putting the decision in the clients’ hands and clarifying that they pay only if they choose to use the service. Finally, for advisors implementing estate planning across their entire client base and raising fees as a result, a value-centric approach works best, focusing on the additional benefits clients will receive.

Ultimately, the key point is that estate planning services – whether traditional scenario modeling or technology-supported document preparation – can provide meaningful value sufficient to justify a fee. By determining the right pricing structure and communicating changes clearly and empathetically, advisors can deliver added value, ensure they’re fairly compensated for the additional work involved, and confidently provide these services within regulatory boundaries – helping clients build clarity, confidence, and peace of mind!

Read More…