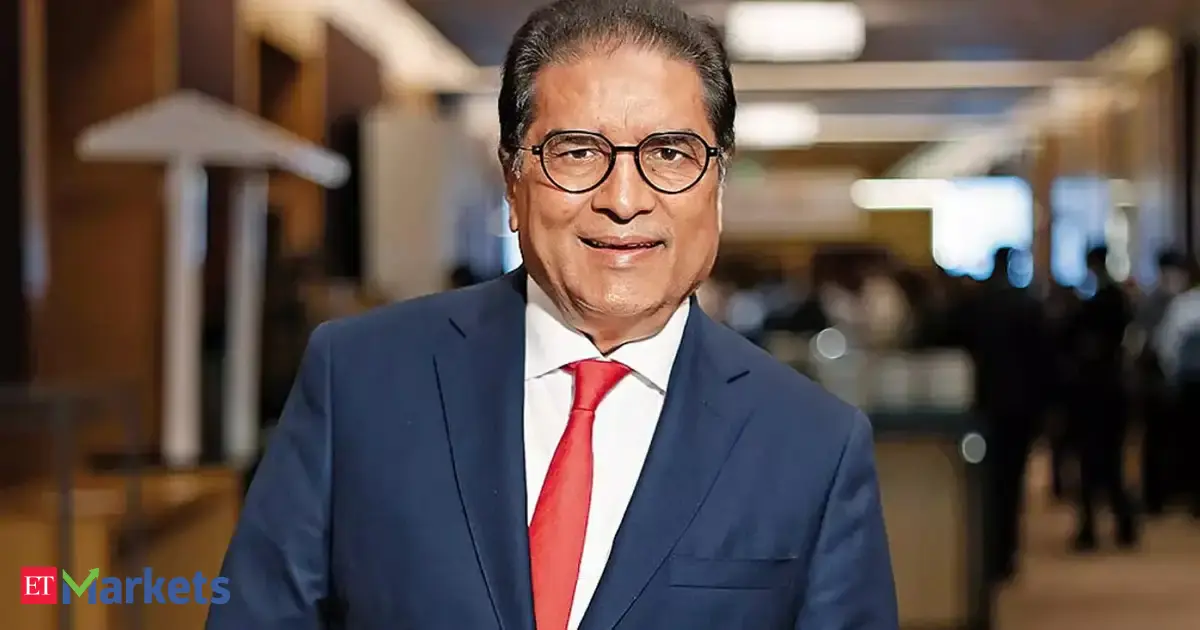

Speaking to ET Now, Nayak said that the treatment of buybacks under capital gains tax, instead of being deemed as dividends, has improved the post-tax outcome for minority shareholders.

“In fact, I believe it is a contrary because from a minority shareholder perspective earlier the buybacks used to be deemed dividend. So, this was taxed at more or less the marginal tax rate. But now being considered as capital gains, you will be basically taxing it at 12.5% or 20% depending upon the long-term or the short-term capital gains tax,” Nayak said.

He added that cash-rich IT companies are therefore likely to continue using buybacks as a capital return tool.

“So, the guys who have significant cash in their books and given the macro environment, I believe someone like a Wipro, LTIM, TCS they may continue to do buybacks. In fact, I believe that we will see a slew of buybacks going forward because post the earlier norms of starting October 24 the buybacks have just slowed down because of the tax inefficiencies. I think that has been a fantastic step which has been taken by the government to basically bring it under the ambit of capital gains tax,” he said.

From a promoter’s perspective too, Nayak said buybacks still remain more tax-efficient than dividends in many cases.“As far as your question on the promoter bit is concerned, see, the way it works is from a promoter perspective if they apply for a buyback, a domestic corporate will be subjected to 22% and anyone else will be subject to 30%. So, even if I compare it vis-à-vis let us say if you give it as a dividend, then I will be again subject to my marginal tax rate which will be higher than the 30% in the worst case possible scenario. From that perspective, buyback is the way to go rather than dividends is my submission here,” Nayak said.Addressing concerns that companies should prioritise long-term investments in emerging technologies such as artificial intelligence, Nayak said IT services firms have limited scope to directly participate in deep tech development.

“At the end of the day, the focus is on execution and the AI trade is another trade altogether but from an IT perspective where exactly can we add value in the value chain. At the end of the day, 80% to 90% is capex related and 10% will be where IT services folks will be able to add value,” he said.

He added that Indian IT firms are more likely to benefit as implementation and modernisation partners rather than as core AI technology developers.

“We end up becoming implementation partners for someone like a Snowflake or a Databricks and possibly we help in the cloud modernisation, data modernisation, so on and so forth. I believe getting into deep tech or AI is not something that is a core competency of the IT sector,” Nayak said.

On the question of whether promoter structures could influence buyback decisions, Nayak pointed out that companies with corporate promoters may find buybacks more attractive than those with individual promoters.

“So, just to give you an example like let us say LTIMindtree. L&T would be the primary shareholder. Someone like an Infosys, I completely agree with you there the individuals are there but at the end of the day Infosys has already gone for the buyback,” he said.

He added that while Infosys may not rush into another buyback immediately, buybacks remain a viable option for firms with strong balance sheets.

“If I look at a TCS, it is Tata Sons so they will also want to go for a buyback but presently their focus from a capital allocation perspective is on the data centre part of the business, so that is where the capex will increase rather than going for a buyback,” Nayak said.

However, he noted that several IT companies are sitting on large cash reserves, which could support future buybacks, especially if business visibility remains weak.

“If you look at, let us say, an LTIM, it is almost $1.5 billion. If you say Wipro, it is $5 billion of cash is what they have in their books. And given that their Q4 guidance has not been that great and buyback norms will be effective from 1st April, so I believe that is someone which may be ripe for doing a buyback, someone like an LTIM also is what I believe,” he said.

Nayak added that HCLTech, which has been active on the mergers and acquisitions front, may consider buybacks once its acquisition strategy stabilises.

“HCL Tech has been doing a lot of M&As, so this is something that they may consider over a period of time after they are done with the M&A focus as such, that is the way I would look at it,” he said.