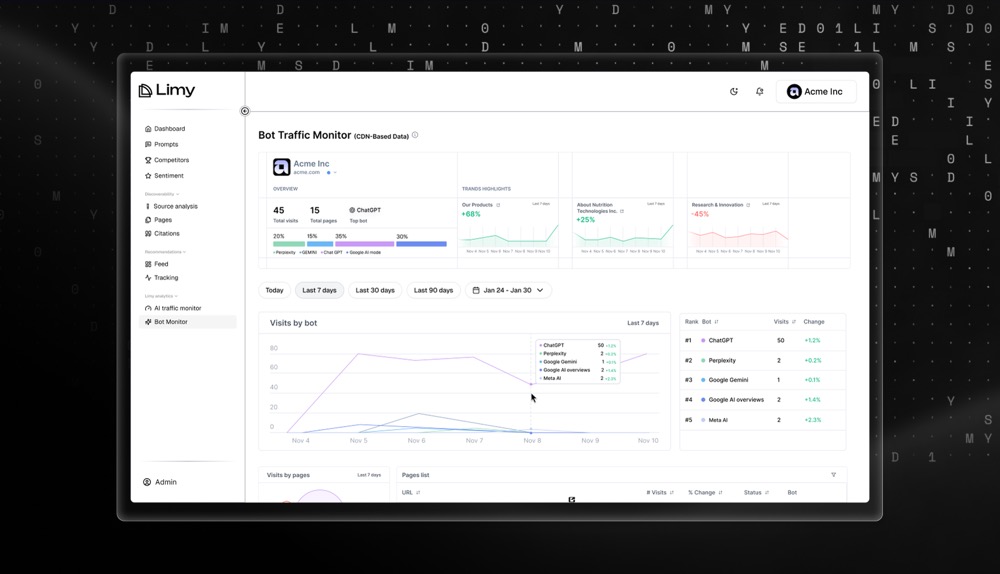

The web’s fundamental architecture is undergoing a historic shift as AI agents increasingly replace human users as the primary consumers of online information. While traditional marketing and SEO focused on influencing human behavior through search rankings and ad placements, AI-powered shopping assistants and research tools now make purchasing decisions and product recommendations by analyzing websites through bot interactions rather than user clicks. This transition from user-driven to agent-driven commerce has left brands blind to a critical question: when an AI recommends a competitor’s product over yours, what information drove that decision? Limy addresses this gap by operating at the infrastructure layer between a brand’s domain and the internet, identifying and decoding every agent and bot interaction to reveal exactly which prompts drive conversions and which information agents extract when making recommendations. The platform’s attribution model tracks the entire customer journey initiated by AI, connecting specific prompts to actual revenue and enabling brands to optimize their presence in AI-mediated discovery. With Fortune 100 companies including AstraZeneca, Samsung, and KIA already using the platform, some attributing 10% of their revenue to Limy’s insights, the company demonstrates that agentic commerce is no longer theoretical but a measurable channel for growth.

AlleyWatch sat down with Limy CEO and cofounder Aviv Shamny to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

$10M Seed funding led by Flybridge with participation from a16z speedrun. Other investors include Axiom, Clarim, Communitas, JRV, & AnD.

Tell us about the product or service that Limy offers.

As the web shifts to AI agents, our infrastructure platform provides brands control over visibility, influence, and conversions to drive revenue in the Agentic Web.

Our platform produces insights to help companies better understand how AI agents decide which brands and products to recommend to their users.

What inspired the start of Limy?Limy started from a personal moment. I saw my mom asking an LLM for medical advice, and it confidently recommended products with ingredients that weren’t actually the right ones. That was a wake-up call – I realized this is a ticking time bomb, and as more people rely on AI for decisions, someone has to make sure the information brands show up with is accurate, safe, and measurable.

How is Limy different?

Other players in this space are focused on what users are entering into LLMs, i.e. user data but in the Agentic Web, agents’ actions are much more important and that’s where Limy operates, giving us a clear advantage. Our technology is uniquely positioned at the intersection of a brand’s web domain and the internet, where data and traffic converge. The platform identifies and decodes every agent and bot interaction that takes place within a site, detecting what information is being fetched and what action is or isn’t being taken. This creates a direct, measurable link between prompts, agent behavior, and business impact. Limy produces its own proprietary data based on these agent interactions, generating specific insights for brands to win AI visibility as the LLM answer. Moreover, by operating directly at the infrastructure web layer, Limy has developed an attribution model based on its distinct ability to track and value the entire customer journey via AI and assign prompts to revenue. Limy is the first platform to connect AI agents to real user outcomes, revealing why, how and what value was generated from AI traffic.

What market does Limy target and how big is it?

We serve brands located anywhere in the world across ecommerce, retail, media, travel, finance, and B2B SaaS.

Limy caters to businesses of all sizes. Marketers can start via Limy’s self-serve dashboard, while enterprises and agencies can gain access to custom deployments with deeper integrations and more powerful features and performance.

What’s your business model?

A tiered subscription model based on a company’s size and the capabilities required.

How are you preparing for a potential economic slowdown?

We believe an economic slowdown makes our product even more essential. When budgets tighten, brands can’t afford wasted spend or missed demand – they need to maximize every high-intent customer interaction. That’s exactly where we sit: at the moment of search and decision-making inside LLMs. We’re helping brands ensure they show up accurately and competitively in AI-driven search, so they can capture demand more efficiently and protect growth even in a tougher macro environment.

What was the funding process like?It was surprisingly fast and smooth. We had around 3x more demand than we needed – technically we could have raised a much larger seed, even something like a $30M round. But we made a deliberate decision to stay disciplined and grow sustainably. We wanted the right partners and the right pace, not just the biggest number.

What are the biggest challenges that you faced while raising capital?

One of the biggest challenges was that we’re essentially creating a new category. We’re building for a need that wasn’t obvious to many people yet, especially early on. The AI landscape is evolving literally day by day, and not everyone is able to track the pace or fully understand how quickly consumer behavior is shifting toward LLM-based discovery. That meant we often had to operate in “educator mode” with investors: explaining the problem, why it matters now, and why it will become mission-critical for brands. Once investors truly understood the shift, the conversations became much easier.

What factors about your business led your investors to write the check?

A key factor was that we’re the only player in the market building real attribution for LLM-driven discovery. While others focus on visibility or monitoring, we’re the only ones who can quantify impact – we can tell brands exactly how much revenue and how many deals each prompt is worth to them. That ability to connect AI search behavior directly to business outcomes makes the category measurable, budgetable, and scalable – and that’s what ultimately gave investors confidence to write the check.

What are the milestones you plan to achieve in the next six months?Over the next six months, our focus is on scaling what we’ve proven post-seed. That means expanding our customer base with iconic global brands – including names like IKEA and McDonald’s – and continuing to deepen our attribution layer so brands can measure ROI from every LLM prompt. On the business side, we’ll also be building the momentum and metrics needed to position the company for the next stages of growth, including future Series A and beyond.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

First, focus relentlessly on fundamentals: cash, runway, and revenue. In this environment, efficiency matters more than hype – get extremely clear on what drives growth and cut anything that doesn’t. Second, talk to customers constantly and prioritize fast feedback loops; the companies that survive are the ones that stay closest to the market. Third, build a distribution advantage – especially in New York where competition is intense. If you can’t outspend, you need to out-execute on go-to-market. And finally, don’t be afraid to simplify: a smaller team with clear priorities and high velocity will beat a bigger team with noise.

Where do you see the company going now over the near term?

Looking to grow our team to 120 by the end of the year. We’re at 25 employees currently.

What’s your favorite winter destination in and around the city?Honestly? Staying home in New York.