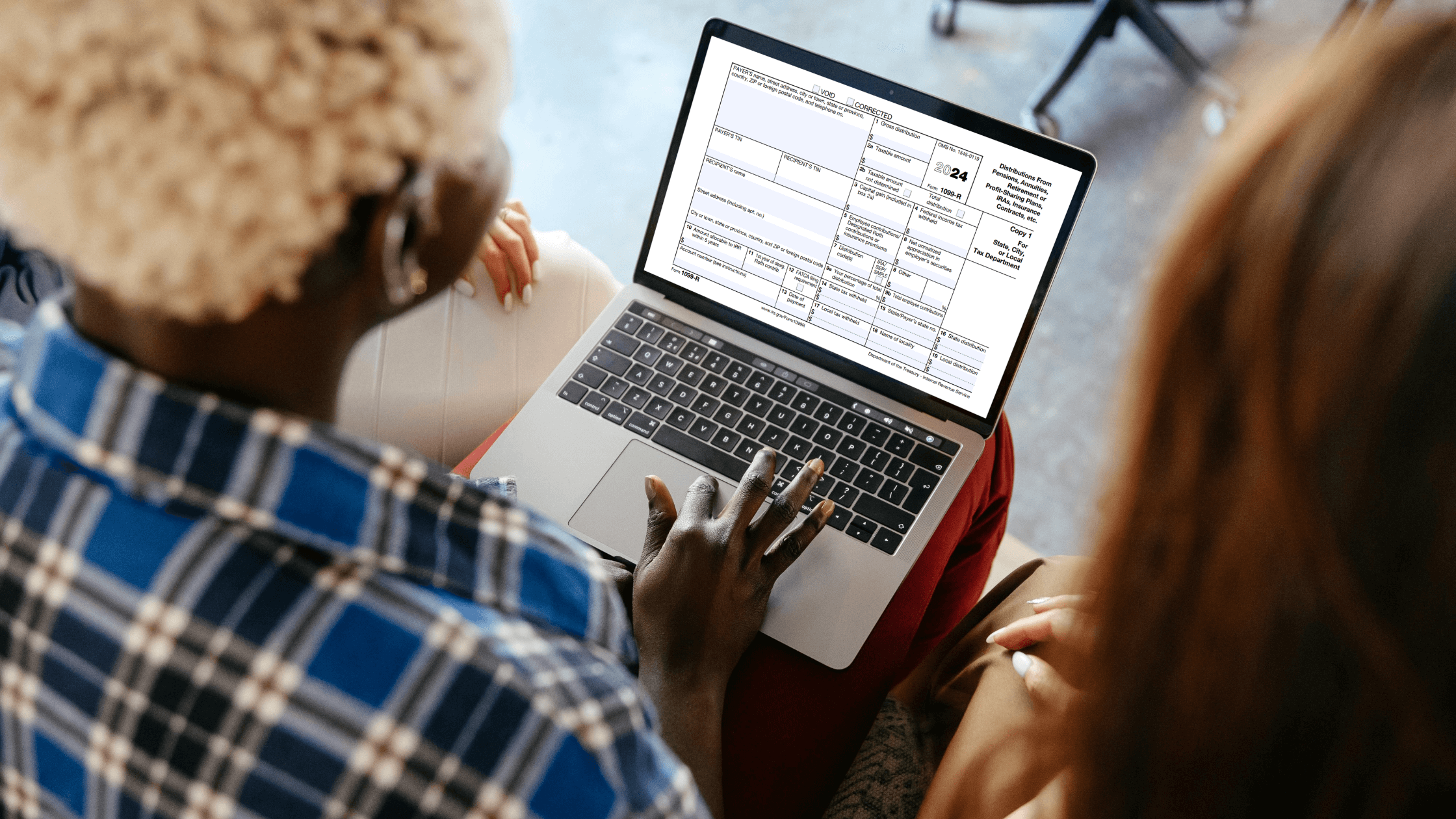

During tax season, one form you might come across is the 1099-R. This form is required for anyone who has received distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, or survivor income benefit plans. Let’s break down what the 1099-R is, why it’s important, and how to handle it.

What is a 1099-R?

The 1099-R is a tax form used to report distributions of $10 or more from retirement accounts and other qualified plans. The IRS uses this form to track the money you receive and ensure it’s properly reported on your tax return.

Distributions reported on a 1099-R can include:

Regular retirement paymentsEarly withdrawalsRolloversLoans treated as taxable distributions

The form is issued by the financial institution or plan administrator that made the distribution. Failing to report the income shown on a 1099-R can lead to penalties and additional taxes.

Key Information on a 1099-R

The 1099-R form contains several important pieces of information:

Payer’s Information: Who sent you the money. Recipient’s Information: Your name and Social Security number. Gross Distribution: Total amount paid out. Taxable Amount: How much of that is taxable. Federal Income Tax Withheld: Any taxes already taken out. Distribution Codes: Codes that explain what kind of payment it was and if special tax rules apply.

How to Handle a 1099-R

1. Review the Form: Check all the information for accuracy. Ensure your personal details and the amounts reported are correct.

2. Report the Income: Include the taxable amount from your 1099-R on your tax return. This is typically done on Form 1040.

3. Consider Tax Implications: Depending on the type of distribution, you may owe additional taxes or penalties. For example, early withdrawals from an IRA may incur a 10% penalty.

4. Seek Professional Help: If you’re not sure how to report your 1099-R, talk to a tax professional.

Why Did You Get a 1099-R?

You will receive a 1099-R if you took $10 or more from a retirement account during the tax year. Certain retirement plan loans that become taxable may also trigger a 1099-R.

Here are common situations that result in a 1099-R:

Hardship Withdrawals: Hardship Withdrawals are taken from your retirement plan to meet an immediate and heavy financial need, such as medical expenses, tuition, or to prevent eviction or foreclosure on your home. This is reported on a 1099-R form and separate forms are issued for Roth vs. non-Roth funds.

Taxable: Generally subject to income tax.Penalty: May incur a 10% early withdrawal penalty if under age 59½.

Outstanding 401(k) Loan After Leaving a Job: If you take a loan from your 401(k) and repay it according to the terms, it is not considered a taxable distribution. However, if you do not repay the loan or leave your job with an outstanding loan balance, the unpaid amount is treated as a distribution. This means it becomes taxable, and you will receive a 1099-R form showing the amount of the loan that is now considered a distribution.

Taxable: Included in taxable income.Penalty: 10% early withdrawal penalty may apply if under age 59½.

401(k) Rollovers: Direct rollovers from one qualified retirement plan to another or to an IRA are generally not taxed if done as a direct transfer. However, you will still receive a 1099-R form for the original distribution. This form is used to report the movement of funds to the IRS. As long as the rollover is done correctly, the distribution amount should not be included in your taxable income.

Early Distributions: Early distributions are withdrawals taken from your retirement account before you reach the age of 59½. The 1099-R form will report the amount of the early distribution.

Box 7 will include a code indicating that it is an early distribution. Penalty: 10% early withdrawal penalty may apply if under age 59½. It’s important to plan for the tax implications and potential penalties when considering an early withdrawal.

Excess Contributions: If you contribute more to your retirement plan than the annual limit allows, the excess contributions must be withdrawn. These distributions are taxable in the year they are distributed, and you will receive a 1099-R form reporting the amount of the excess contribution. This form helps ensure that the excess contributions are included in your taxable income for the year.

Excess contributions to Roth accounts are handled differently and may not be taxable.

Special Consideration: 401(k) Automatic Enrollment

Starting January 1, 2025, many employees we’re automatically enrolled in their company’s 401(k) plan. If you are impacted by automatic enrollment and choose to opt out after the first deferral is withheld from your paycheck, you will need to complete a 1099-R form in the next tax season for the withdrawal. This is because the initial deferral is considered a distribution, and the IRS requires it to be reported.

If you are affected by automatic enrollment but plan to opt-out, make sure to do so before deferrals begin.

Staying Prepared

The 1099-R is an important form for anyone receiving payments from retirement accounts. Understanding how to handle it you can file your taxes correctly and avoid problems with the IRS. Staying informed helps make tax season simpler and less stressful.