It’s that time of year when people are looking to improve their finances as part of their upcoming New Year’s resolutions. One way that many decide to do this is through the 52-week money challenge. However, this doesn’t work for everyone, so instead, here are 10 great 52-week money challenge alternatives.

How the 52 Week Money Challenge Works

The challenge is a simple and effective way to save money. All you have to do is save $1 corresponding to the week of the year. For example, during week one, you would save $1. During week two, you would save $2, and during week three, you would save $3. You continue this every week of the year until the last week, when you would save $52. By doing this each week, at the end of the year, you will save $1,378.

The challenge is here if you want to give it a try.

Limitations of the Challenge

While the classic challenge can help a lot of people save money, there are some limitations to it. The challenge doesn’t always fit everyone’s financial situation. Because of this, there are numerous alternatives to this challenge – one of which is likely to fit nicely with your current finances and financial goals. Below you’ll find ten alternatives to the 52-week money challenge to consider.

1) Modified 52 Week Money Challenge

The modified 52-week money challenge allows you to choose how much you save each week from $1 to $52. Instead of going in order from $1 to $52, you can choose any amount left on your challenge chart. Since it’s difficult to predict when you will have a week where you can’t save as much as you had hoped, this modified challenge gives you more flexibility to succeed. The goals should always be to save the highest amount on your chart, but if you can’t for whatever reason, you can substitute it for a smaller amount.

2) 26 Bi-Weekly Money Challenge

Some people get paid bi-weekly and find it easier to save the money for the challenge when they get paid, rather than each week. They find that when it comes to week two, after they have been paid, they may not have the money left to save. For them, it’s easier to pay the money for the two weeks as soon as they get paid and they have it available. You can also try the twice-a-month money challenge if you get paid this way rather than bi-weekly.

3) Monthly Money Challenge

Much like the issue that people who get paid bi-weekly have, those who get paid monthly also can find it difficult to save the money the week before they’re paid. Many find it easier to pay for the entire month when they get paid and have the money. It’s the classic “you don’t miss what you can’t see” philosophy behind pay yourself first.

4) Double 52 Week Money Challenge

For those who want a bit more of a challenge than simply $1 a week, they can try the 52-week double challenge. In this challenge, all the numbers are doubled, so at the end of the year, you end up with $2,756 instead of $1,378. It’s a great challenge for those who believe they can save a little more and want to challenge their savings a bit more.

5) Mega 52 Week Money Challenge

For those who are really looking to jumpstart their savings, the mega 52-week money challenge might be exactly what they’re looking for. Instead of $1 a week, the mega challenge shoots for $5 a week. For those able to complete the mega challenge, they will find an extra $6,890 in their bank account at the end of the year.

6) 52 Week Mini Money Challenge

Also called the 52-week half challenge, this one uses $0.50 each week instead of $1. This makes it easier to save the money, but it also means you’ll end up with half as much at the end of the year ($674 instead of $1,378). For those who want to take the challenge but start a bit slower, this can be the perfect alternative.

7) 52 Week Coin Challenge

On the opposite end of the double and mega challenges is the 52-week change challenge. In this challenge, you simply save the number of coins for each week of the year. In week one, you save a single coin, while in week fifty-two, you save 52 coins. The amount you save will depend on the value of the coins you save each week. Another option is to save specific coins during the year, such as a 52-week challenge for pennies, nickels, dimes, and quarters.

8) 52 Week Bill Challenge

The 52-week bill challenge is like the coin challenge, but uses bills instead. In the first week, you save a single bill (it could be a $1, $2, $5, $10, $20, $50, or $100 bill), in week two, 2 bills, and in week 52, 52 different bills. In this challenge, you would save a minimum of $1,378 (if you only used $1 bills), but it could be much more depending on the bill denominations you save each week.

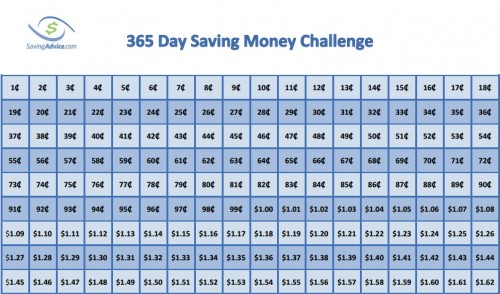

9) 365 Day Money Challenge

Some people find that in order to save money, they need to do it on a daily rather than a weekly basis. For those who want to make sure saving money becomes a habit this year, the 365-day money challenge can be a great alternative. In this challenge, you begin with a penny on day one and end with $3.65 on day 365.

10) Create Your Own 52 Week Money Challenge

None of the above money challenges exactly meet what you’re looking for? That isn’t a problem. You can simply create your own 52-week challenge, which meets the exact specifications and needs you want. You know yourself better than anyone else, so creating your own specific challenge will give you the best chance of completing it.

Consider Automating Your Savings

The 52-week savings challenge and its alternatives are ways of actively managing your savings. If you are hardcore about saving money and want both an active approach and a passive approach, do two things. First, select one of the challenges here, and second, supplement your savings with a “fire and forget” automated approach. Here are some great budgeting apps that can make stacking your savings even easier.

Rocket Money

Quicken Simplifi

You Need A Budget (YNAB)

Wallethub

Origin

Automating things will help you not only know where your money is going, but can assist you in growing your savings in 2026. So, what are you waiting for? Which challenge is most appealing to you? Which are you going to commit to trying? Let us know in the comments. We’d love to follow along with your journey.

What to Read Next

The 365 Day Money Challenge – The Classic Article That Started It All

Take The 365 Day Dime Challenge – And Save $6,679.50

Money Challenges For Kids Are A Thing Also

The Best New Year’s Deals and Freebies You Won’t Want to Miss

5 Social Security Calculations That Change After New Year’s

This post includes affiliate links. If you purchase anything through these affiliated links, the author/website may earn a commission.