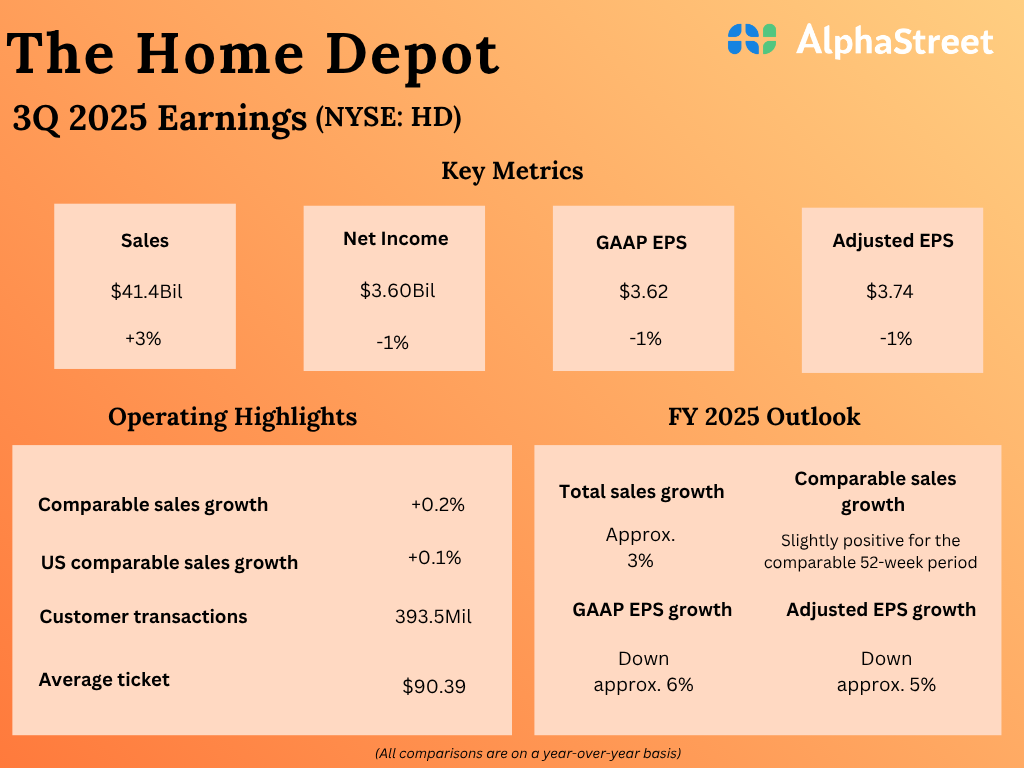

Shares of The Home Depot (NYSE: HD) stayed red on Wednesday. The stock has dropped 16% over the past three months. The company’s results for the third quarter of 2025 were a mixed bag, with growth in sales and a drop in profits. Net sales of $41.4 billion were up 2.8% from the prior-year quarter and included approx. $900 million from the GMS acquisition. Comparable sales rose just 0.2%, with comps in the US up 0.1%. Earnings, on an adjusted basis, decreased 1.1% year-over-year to $3.74 per share. Here are three factors that impacted the Q3 results:

Lack of storm-related demand

Home Depot saw a slowdown in comparable sales during the third quarter, mainly caused by a lack of storm activity, which led to greater-than-anticipated pressure in certain categories. Last year, the company had benefited from higher demand and sales due to rebuild and repair activity in the aftermath of storms, which did not recur this year. The impact of this was most pronounced in October, during which comps turned negative.

This pressure is expected to continue into the fourth quarter of 2025 as the current period has not seen the storm-related demand that was present in the fourth quarter of last year.

Consumer uncertainty and housing pressure

The second factor that weighed on Q3 results was the ongoing consumer uncertainty and pressure in housing. As mentioned on the quarterly conference call, although there was a drop in interest and mortgage rates, the continued economic uncertainty and housing market pressure continued to impact demand for home improvement.

The three main demand drivers – home price appreciation, household formation, and housing turnover remain pressured. Housing activity is at 40-year lows as a percentage of housing stock. Higher living costs and concerns over job security continue to loom. Normal repair and remodel activity in the US is estimated to be down by as much as $50 billion. These pressures are anticipated to continue in the near term.

Big project fatigue

In the third quarter, HD saw positive comps across most of its categories. Comp average ticket rose 1.8%, reflecting a greater mix of higher ticket items, customers trading up for new and innovative products, and modest price increases.

Pro and DIY comp sales were positive and relatively in line with each other. In Pro, categories like insulation and plumbing remained strong while in DIY, seasonal product offerings like hardscapes and garden products saw strength.

Big ticket comp transactions, or those over $1,000, were positive 2.3%, but this was mostly driven by the Pro segment. The company continues to see softness in larger discretionary projects. It is seeing some fatigue in taking on bigger projects and some softening in larger project backlog for Pros.

Revised outlook

The home improvement retailer revised its guidance for fiscal year 2025 to reflect its Q3 performance, continued pressure in Q4 from lack of storm activity, consumer uncertainty and housing pressure, and the inclusion of GMS. Total sales are now expected to grow around 3%, with around $2 billion in incremental sales expected from GMS. Comparable sales growth is expected to be slightly positive. Adjusted EPS is now expected to decline approx. 5% versus the previous expectation of around 2%.